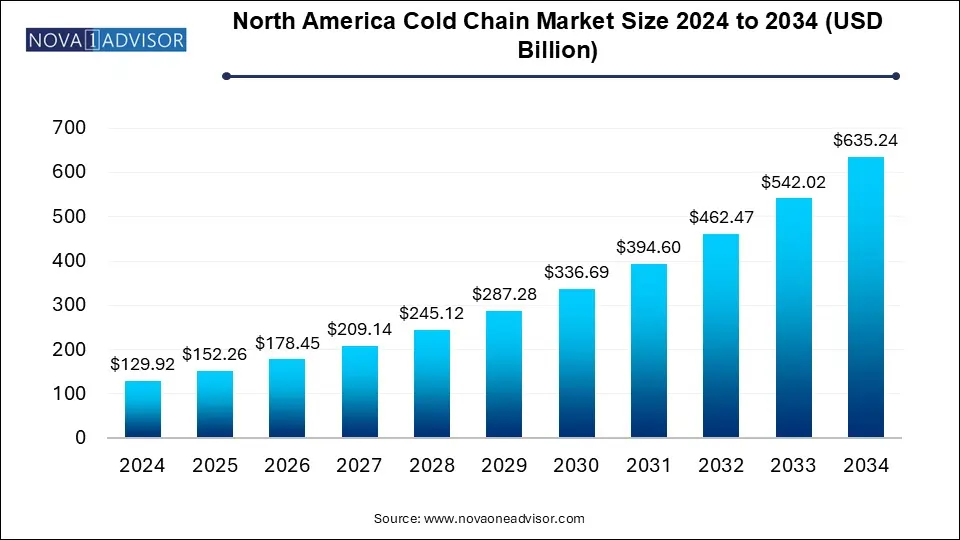

The North America cold chain market size was exhibited at USD 129.92 billion in 2024 and is projected to hit around USD 635.24 billion by 2034, growing at a CAGR of 17.2% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 152.26 Billion |

| Market Size by 2034 | USD 635.24 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 17.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Packaging, Equipment, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Americold Logistics, Inc.; Burris Logistics; LINEAGE LOGISTICS HOLDING, LLC; Wabash National Corporation; United States Refrigerated Storage; Tippmann Group; NFI Industries; Penske; Seafrigo Group; NewCold; CONESTOGA REFRIGERATED STORAGE; Sonoco ThermoSafe (Sonoco Products Company) |

The growth is driven by various factors, including changing consumer preferences, increasing demand for fresh and frozen foods, and the growth of e-commerce. In addition, the growing number of automated refrigerated warehouses further fuels growth. Moreover, the growing penetration of connected devices and automation of refrigerated warehouses across the globe is anticipated to spur industry growth during the forecast period. An increasing number of organized retail stores in emerging economies are leading to increased demand for cold chain solutions.

Increasing IT spending in refrigerated storage logistics to facilitate better inventory management and improve the overall efficiency of cold chain supply systems is propelling the market growth. By investing in advanced technologies such as cloud computing, IoT, and RFID, refrigerated storage operators can track and monitor their inventory in real-time, reducing the risk of food waste, spoilage, and product recalls.

In addition, IT investments in cold chains enable companies to control their energy consumption better and reduce their carbon footprint. For example, using smart sensors and real-time monitoring systems can help companies optimize temperature settings and minimize energy waste. This can result in cost savings, improved operational efficiency, and reduced environmental impact of operations.

Moreover, trade liberalization, government efforts to reduce food waste, and the expansion of retail chains by multinational companies are expected to boost industry growth. The World Trade Organization (WTO) and bilateral free trade agreements, such as the European Union Free Trade Agreement (FTA) and the North America Free Trade Agreement (NAFTA), have created opportunities for exporters in the U.S. and Europe to increase trade for perishable foods in a manner that is free of import duties.

In recent years, the cold chain industry in the North American market has witnessed significant investments from both private and public sectors. The cold chain industry is focused on developing and expanding refrigerated storage facilities, transportation networks, and logistics services. The increasing demand for temperature-sensitive products, such as perishable food items and pharmaceuticals, both domestically and globally, is one of the reasons driving the investments.

As these products require specialized temperature-controlled storage and transportation, the demand for chill chain logistics services is increasing. This has prompted companies to invest in developing refrigerated storage facilities and transportation networks that can meet the growing demand for temperature-controlled logistics.

Additionally, technological advancements have played a significant role in driving investments in the cold chain industry. Real-time temperature monitoring and tracking systems and other cold chain technologies have improved the efficiency and safety of chill chain logistics, making it easier for companies to transport and store temperature-sensitive products.

Furthermore, the COVID-19 pandemic has further highlighted the importance of the cold chain industry, particularly in vaccine distribution. The increasing need for safe and effective vaccine distribution led to increased investments in developing refrigerated storage facilities and transportation networks to support vaccine distribution efforts.

The outbreak of the COVID-19 pandemic became a severe issue worldwide immediately. The coronavirus's epicenter shifted from China to Europe and the U.S., making it the worst-hit country, globally. The pandemic led to lockdowns and travel restrictions in many parts of the world, impacting the supply chains of various businesses.

The North American cold chain market was affected positively to a significant extent by the pandemic. On the supply side, the production of pharmaceutical drugs and supply of raw materials for clinical trials of vaccines increased owing to the significant increase in the total number of active cases worldwide in Q2 and Q3 of 2020. Initially, the stringent lockdown and social distancing regulations imposed by the local and federal governments disrupted the overall supply chain logistics industry and led to a temporary shutdown of several manufacturing facilities across the region.

However, the supply of essential products such as food & beverages and pharmaceutical products was allowed while adhering to stringent norms such as social distancing and a limited workforce in the supply chain process. These stringent norms for supply chain logistics led to increased overall logistics costs in the region.

Another major trend witnessed after the onset of the pandemic was a significant rise in the number of e-commerce purchases, including the purchase of perishable products such as dairy, fruits & vegetables, meat, and pork. These products were required to be stored using refrigerated storage warehouses and distributed with thermally insulated packaging through refrigerated vehicles.

The pandemic had a positive impact on the cold chain business, driving the demand for cold chain warehouses, packaging, and distribution. The rising popularity of prepackaged food and beverage items is also contributing to the demand for cold chains in the food industry. As a result, food manufacturers were impelled to focus on goods as well as their storage to extend their shelf life, which contributed to the cold chain market growth.

These trends highlight the need for the food value chain to transition from public marketplaces to a cold chain system that helps store perishable goods for extended durations. These factors are expected to boost the demand for cold chains, subsequently driving the North American cold chain industry growth.

Based on type, the market is segmented into storage, transportation, and monitoring components. Among these, the storage segment dominated in 2024, gaining a market share of 61.7%. Refrigerated storage facilities are facilities used to store perishable items, such as fish, meat, dairy products, and fruits & vegetables, in a humid environment at optimal temperatures, primarily low temperatures, depending upon the item being stored.

Refrigerated storage systems may include warehouses, refrigerated containers, and blast chillers & freezers. According to the USDA National Agricultural Statistics Service January 2024 report, 904 refrigerated warehouses were aggregating to a gross refrigerated storage capacity of 3.73 billion cubic feet in the U.S. as of October 2021. Several market players are providing refrigerated storage facilities across North America.

For instance, CONESTOGA REFRIGERATED STORAGE of Canada has five automated refrigerated storage warehouses offering a total refrigerated storage capacity of over 64 million cubic feet. In May 2021, Congebec of Canada announced the expansion of its refrigerated storage facility in Mississauga, Canada, from 170,000 square feet to 232,600 square feet as part of the company’s efforts to strengthen its presence in the region.

The monitoring components segment is anticipated to witness the fastest growth, growing at a CAGR of 19.9% throughout the forecast period. Monitoring components are used to monitor temperature-sensitive products, such as food & beverage items and pharmaceuticals, for various parameters, including temperature, during transit and in storage in real-time and initiate corrective actions if required.

Cold chain monitoring has benefits, such as provisioning a single technology platform to detect temperature breaches and mitigate any potential damages by initiating corrective actions. It can also help in improving predictive maintenance through sensor data analytics. Monitoring devices can help in tracking various parameters of temperature-sensitive goods, including temperature, condition, and location.

ORBCOMM of the U.S. offers cold chain monitoring solutions. The company’s reefer monitoring portfolio includes door sensors, tractor ID sensors, and telematics solutions, which support remote commands for changing temperature, accessing temperature charts, and tracking cargo status using a cargo camera sensor.

Based on packaging, the market is bifurcated into products and materials. The product segment dominated the overall market, gaining a revenue share of 68.0% in 2024. It is expected to witness a CAGR of 18.2% during the forecast period. Cold chain packaging products include crates, cold packs, insulated containers & boxes, temperature-controlled pallet shippers, and labels. Some factors considered while choosing a cold chain packaging product include cost-efficiency and the material of the packaging product.

Renewable materials are widely preferred owing to growing environmental awareness. Depending on requirements such as volume and the type of temperature-sensitive product, businesses can select a particular cold chain packaging product type. Companies are introducing sustainable shipping products to address growing environmental concerns. For instance, in January 2024, U.S.-based Packaging Technology Group announced the launch of a new recyclable thermal shipper under its TRUEtemp NATURALS line. It maintains a temperature range between 2°C and 8°C for 72 hours.

The materials segment is anticipated to witness a faster CAGR of 19.7% throughout the forecast period. A cold chain involves storing and shipping temperature-sensitive products such as fruits & vegetables, meat, seafood, and dairy products. Businesses dealing with these products are required to carefully select the materials, such as insulated materials used for making cold chain products such as crates and cold packs for packaging or materials such as refrigerants used in refrigeration units, to ensure the quality of the cold chain products is maintained.

Many companies in the U.S. and Canada provide packaging products made of different insulation materials. For instance, Cold Chain Science Enterprises, a Canada-based company, offers insulated containers made of Expanded Polystyrene (EPS). Nordic Cold Chain Solutions, a U.S.-based subsidiary of Temperatsure, LLC., provides cooler boxes made of Polyurethane (PUR).

Based on application, the market is classified into fruits & vegetables, dairy products, processed food, fruit & pulp concentrates, fish, meat & seafood, pharmaceuticals, bakery & confectionaries, and others. The fish, meat & seafood segment dominated the market, gaining a revenue share of 20.5% in 2024. It is projected to register a CAGR of 14.4% during the forecast period.

The refrigerated storage of fish, meat, and seafood is crucial as harmful bacteria can grow on the meat when the animal is slaughtered. Food, meat, and seafood are among the high-risk products in terms of food poisoning. Hence, refrigerated storage solutions are vital to maintaining their quality and shelf life. Bacteria can multiply rapidly in meat when stored between 5°C and 63°C. The optimal temperature to store fish, meat, and seafood products is between 0°C and 5°C.

The processed food segment is anticipated to witness the fastest CAGR of 19.2% throughout the forecast period. Processed foods are food items that have undergone various chemical or mechanical processes from their raw agricultural state, such as heating, cooking, canning, and dehydrating. They include ready-to-eat meals, frozen pizzas, and foods with added ingredients such as spices, oils, and sweeteners, among others. According to the U.S. Department of Agriculture and Foreign Agricultural Service (FAS), the total U.S. processed food export was valued at USD 34.24 billion in 2021. Cold chain solutions help maintain the quality of processed foods and increase their shelf life.

The U.S. cold chain market dominated in 2024, gaining a revenue share of 71.1%. It is expected to grow at a CAGR of 15.8% throughout the forecast period. The U.S. cold chain industry includes transporting, storing, and distributing temperature-sensitive products, including food and beverages, pharmaceuticals, and other perishable products. The growth is driven by various factors, including changing consumer preferences, increasing demand for fresh and frozen foods, and the growth of e-commerce.

One of the major drivers is the increasing demand for fresh and frozen foods. Consumers are increasingly seeking fresh, healthy, and locally sourced foods and are willing to pay a premium price for high-quality products. This has increased the demand for chill chain logistics services as companies seek to ensure that their products are delivered to consumers in optimal conditions.

The other factor driving the growth of the U.S. cold chain market is the growth of the e-commerce marketplace. The demand for chill chain logistics services has increased as many consumers are shifting to online shopping and companies are focusing on ensuring that their products are delivered to customers efficiently and timely. This has led to an increase in temperature-controlled warehouses, vehicles, and other infrastructure to support the delivery of temperature-sensitive products.

Moreover, the increasing focus on healthcare and the growing demand for temperature-sensitive pharmaceuticals and other healthcare products has also contributed to the growth of the U.S. cold chain market. The stringent regulatory requirements for the storage and distribution of these products require specialized infrastructure and logistics capabilities, which has increased the demand for chill chain logistics services.

The Canadian cold chain market is anticipated to witness the fastest CAGR of 20.0% throughout the forecast period. The growth is driven by multiple factors, including growing exports, technological advancements, and changing demographics across the country. The export market for Canadian temperature-sensitive products, such as seafood and meat, has witnessed growth in recent years. This has led to an increase in the demand for chill chain logistics services capable of handling the complex requirements of international shipping.

The other factor responsible for the growth includes technological advancements in the cold chain industry, such as real-time monitoring and tracking systems, which have improved the efficiency and safety of chill chain logistics. Such technologies have made it easier for companies to transport and store temperature-sensitive products and have contributed to the growth of the Canadian cold chain market.

The changing demographics in Canada, including an aging population and an increase in single-person households, are driving changes in consumer preferences as well as the demand for certain temperature-sensitive products, such as ready-to-eat meals and chocolate and confectionery products. This is creating new opportunities for companies operating in the Canadian cold chain market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America cold chain market

By Type

By Packaging

By Equipment

By Application

By Country