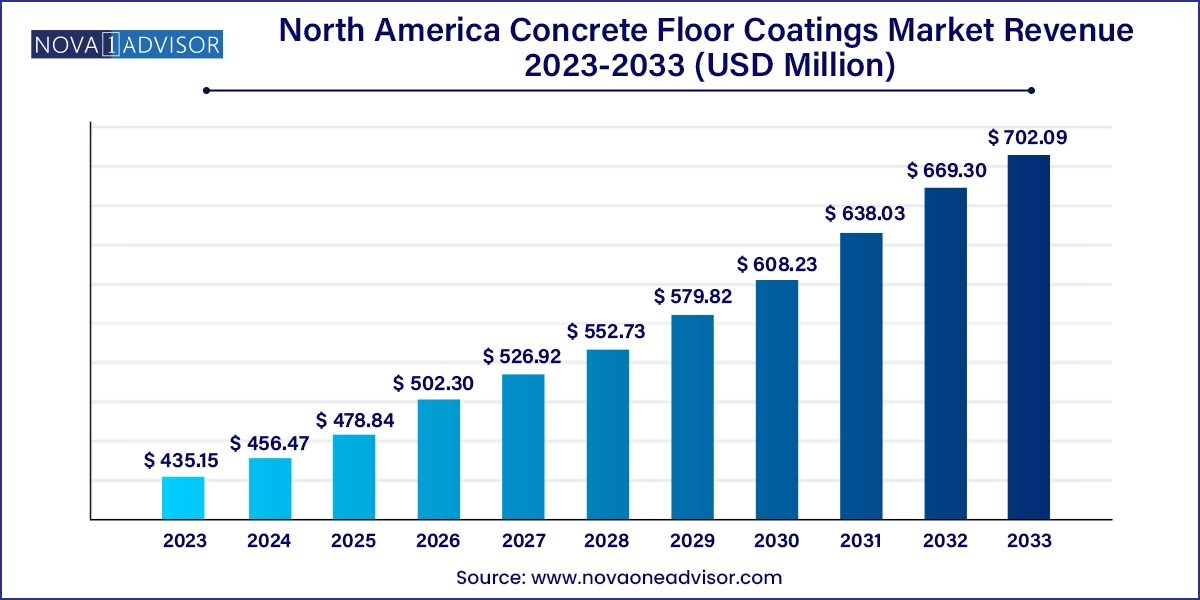

The North America concrete floor coatings market size was exhibited at USD 435.15 million in 2023 and is projected to hit around USD 702.09 million by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

The North America Concrete Floor Coatings Market is a thriving component of the region’s broader construction and building materials sector. It encompasses a diverse range of protective and aesthetic solutions applied to concrete surfaces, primarily in commercial, industrial, residential, and institutional spaces. These coatings not only extend the lifespan of concrete flooring but also offer benefits such as abrasion resistance, chemical shielding, surface sealing, decorative finishes, and easy maintenance.

In North America, the concrete floor coatings market is witnessing a strong uptick owing to rapid industrialization, urban redevelopment, renovation of aging infrastructure, and the rising emphasis on clean and safe workspaces. From warehouses and automotive service centers to hospitals, educational institutions, and residential garages, demand for durable, high-performance concrete coatings has escalated sharply.

Growth is also supported by the booming home improvement trend in the United States and Canada, where consumers are increasingly investing in aesthetic yet functional upgrades to basements, garages, and patios. Additionally, as environmental regulations and building standards tighten, demand is shifting towards low-VOC, sustainable, and LEED-compliant coating formulations.

Manufacturers in North America are focusing on offering innovative coating systems such as polyaspartic, fast-curing epoxies, and antimicrobial formulations that meet specific industry requirements. Furthermore, technological advancements like UV-stable coatings, moisture-tolerant primers, and decorative flake systems are expanding the scope of applications, driving both product differentiation and customer adoption across sectors.

Shift Toward Eco-Friendly and Low-VOC Coatings

Regulatory pressure and consumer demand for environmentally responsible building materials are accelerating the adoption of water-based and solvent-free coatings.

Rising Popularity of Polyaspartic and Fast-Cure Technologies

Polyaspartic coatings are gaining momentum for their quick curing times and superior UV resistance, ideal for time-sensitive commercial and outdoor applications.

Integration of Decorative and Functional Finishes

Flake systems, metallic pigments, and stained concrete coatings are blending aesthetics with durability, especially in showrooms and garages.

Expansion of DIY and Residential Applications

The rise in home improvement projects is creating a lucrative market for user-friendly floor coating kits, especially in the U.S.

Technological Enhancements in Surface Preparation Tools

Innovations in grinders, dust extractors, and shot blasters are making floor preparation more efficient and ensuring better coating adhesion.

Growing Demand for Antimicrobial Coatings in Healthcare and Food Facilities

Concrete coatings that inhibit bacterial growth are in demand for cleanrooms, medical facilities, and processing plants post-pandemic.

Increased Use of Concrete Coatings in Retail and Hospitality Renovations

Designers and facility managers are opting for polished concrete with coatings as a sleek, durable alternative to tile and carpet.

| Report Coverage | Details |

| Market Size in 2024 | USD 456.47 Million |

| Market Size by 2033 | USD 702.09 Million |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | TruCrete Surfacing Systems; The Sherwin-Williams Company; North American Coating Solution; Henkel AG & Co. KGaA; BASF SE; Vanguard Concrete Coating; Tennant Coatings; Jotun; Axalta Coating Systems; Elite Crete Systems; Stonhard; PPG Pittsburgh Paints; Key Resin Company; BEHR Process Corp.; EPMAR Corp.; Pratt & Lambert; Dex-O-Tex; Florock; Garland Industries, Inc.; Tnemec; Cornerstone Coatings; Westcoat Specialty Coating Systems |

A major driver behind the robust growth of the North America concrete floor coatings market is the expansion of industrial and commercial infrastructure, particularly across logistics, automotive, manufacturing, healthcare, and food sectors. These industries require high-durability flooring solutions capable of withstanding heavy foot traffic, chemical exposure, and mechanical abrasion.

In the United States, the boom in e-commerce warehouses and distribution centers has sparked significant demand for industrial-grade floor coatings. Facilities operated by giants like Amazon, Walmart, and FedEx require seamless, dust-proof flooring that can handle forklifts, pallet jacks, and automated machinery. Epoxy coatings, known for their toughness and chemical resistance, have become the standard for such environments.

Moreover, commercial real estate investment in the hospitality and retail sectors is also increasing, especially post-pandemic, where ease of sanitation, visual appeal, and fast refurbishment are critical. Polyurethane and polyaspartic coatings, which offer UV stability and faster return to service, are highly valued in these sectors. As investment in these infrastructure categories continues to rise, the market for concrete coatings grows in tandem.

One of the persistent challenges limiting the widespread adoption of concrete floor coatings is the high sensitivity of many formulations especially epoxy to substrate moisture levels and environmental conditions during application. Improper surface preparation or elevated moisture in the slab can lead to issues such as blistering, delamination, or improper curing, ultimately resulting in coating failure.

This concern is particularly prominent in older buildings undergoing refurbishment, where moisture vapor emissions or contamination from oils, chemicals, or prior coatings can compromise new coatings. Moreover, extreme temperature fluctuations common in North America especially in northern U.S. states and Canada further complicate outdoor applications, limiting the effective installation window.

Contractors and DIY users alike must invest in proper substrate testing, preparation equipment, moisture barriers, and primer systems, increasing both time and cost. While new formulations such as moisture-tolerant epoxies and breathable urethanes are emerging, awareness and training gaps still restrict their effective utilization, posing a restraint to mass-scale adoption.

One of the most promising opportunities in the North America concrete floor coatings market lies in residential applications, particularly for garage floors, patios, basements, and outdoor entertainment areas. The COVID-19 pandemic reshaped consumer behavior, prompting homeowners to re-evaluate and renovate underutilized spaces, especially garages and basements, for multi-functional use.

Today’s consumers view garages not just as car storage, but as workshops, fitness zones, or man-caves, demanding clean, stylish, and easy-to-maintain floors. This trend has fueled demand for decorative flake systems, metallic epoxy coatings, and water-based polyurethanes that are DIY-friendly and low-odor.

In parallel, the rise of outdoor living spaces in suburban homes has created new opportunities for coatings on patios, pool decks, and driveways. UV-resistant and slip-resistant coatings are now in demand for exterior applications where aesthetics and safety matter. Manufacturers offering easy-to-install kits with enhanced abrasion resistance and color variety are well-positioned to capitalize on this growing consumer interest.

Indoor applications dominate the market, reflecting strong demand from commercial and industrial sectors. These include warehouses, institutional buildings, basements, laboratories, and food processing plants. Indoors, concrete floor coatings serve a dual purpose enhancing durability while improving aesthetics and hygiene. Epoxy and polyurethane systems with antimicrobial or antistatic properties are often used in hospitals, cleanrooms, and pharmaceutical manufacturing. Decorative finishes such as terrazzo-style epoxies are also gaining traction in educational facilities and public buildings.

Outdoor applications are growing at a faster pace, driven by increased usage of decorative and protective coatings on patios, pool decks, sidewalks, and driveways. Outdoor areas are exposed to UV rays, temperature shifts, rain, and chemical spills (such as de-icing salts), requiring robust coatings that resist chalking, yellowing, and surface degradation. Polyurethane and polyaspartic coatings are preferred in these settings due to their UV resistance and flexibility. Stamped concrete overlays with acrylic topcoats are also widely adopted for decorative outdoor surfaces.

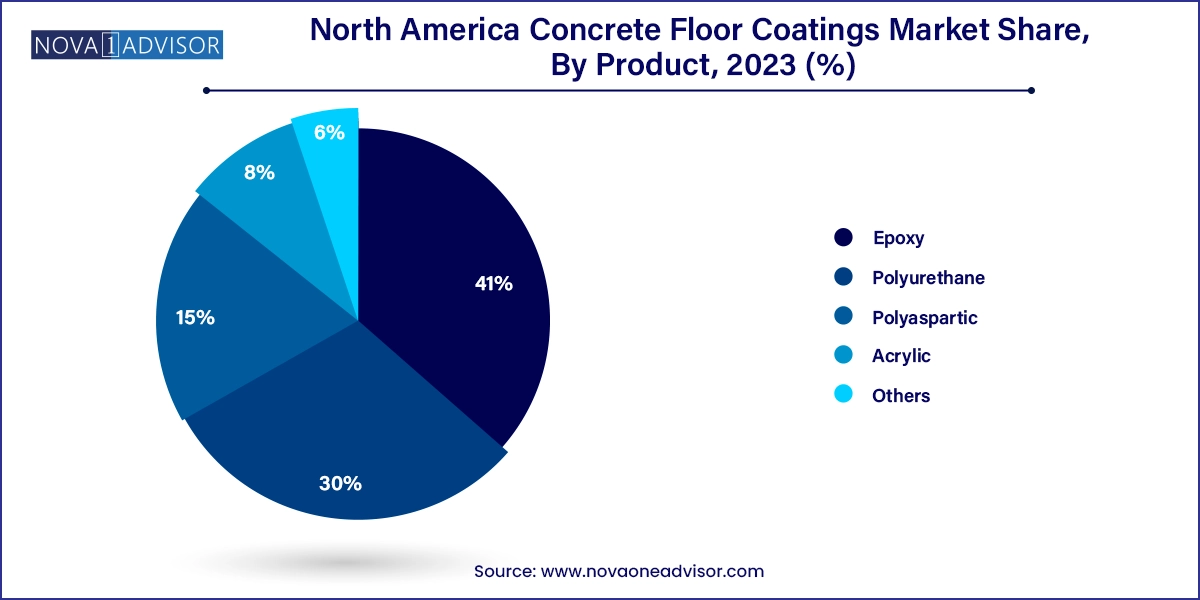

Epoxy coatings dominated the North America concrete floor coatings market, owing to their superior mechanical strength, chemical resistance, and cost-effectiveness. They are widely used in industrial and commercial settings such as warehouses, automotive service stations, and manufacturing floors. Their ability to bond strongly to concrete surfaces and protect against spills, abrasions, and thermal shocks makes them ideal for heavy-duty use. Epoxies also support decorative systems with flake or quartz embeds and are available in water-based, solvent-based, and 100% solids formulations to suit different site conditions.

Polyaspartic coatings are the fastest-growing product segment, particularly in commercial garages, showrooms, and time-sensitive applications. These fast-curing systems offer excellent UV stability, clarity, and resistance to chemical staining. Unlike traditional epoxies, polyaspartic coatings can be applied in a wider range of temperatures and have shorter return-to-service times, making them attractive for 24/7 operational environments. In residential markets, polyaspartic coatings are becoming increasingly popular for garages due to their glossy finish and ability to resist tire marks and hot-tire pickup.

United States

The United States dominates the North America concrete floor coatings market, driven by robust construction activity, high disposable income, and extensive adoption in residential, industrial, and commercial sectors. The U.S. has a mature coatings ecosystem, with a high penetration of decorative concrete coatings in garages, showrooms, and healthcare facilities. Leading home improvement retailers like Home Depot and Lowe’s offer DIY epoxy kits, reflecting growing consumer awareness.

Commercial redevelopment, including warehouse expansions and retail renovations, continues to spur demand. The U.S. Green Building Council’s LEED program has also influenced the adoption of low-VOC, environmentally friendly coating systems. Innovative startups and established players alike are offering customized solutions with anti-slip, antimicrobial, and decorative properties tailored for the U.S. market.

Canada

Canada is emerging as a steadily growing market, especially in the commercial and residential sectors. Harsh winters and freeze-thaw cycles necessitate coatings with superior flexibility and resistance to salt damage. Epoxies and urethanes are commonly used in commercial garages, parking decks, and basements. In cities like Toronto and Vancouver, increasing urbanization and high-rise construction have boosted demand for durable and aesthetic flooring solutions.

Canada also has a strong focus on sustainability and green building practices, with many developers preferring low-emission coating systems. However, climate conditions often limit the application window for certain coatings, especially outdoors, which manufacturers are addressing with fast-curing and all-season polyaspartic systems.

Mexico

Mexico represents an emerging opportunity in the North American market, with demand driven by urban development, industrial zone expansions, and manufacturing growth. The automotive, aerospace, and electronics sectors in Monterrey, Guadalajara, and Mexico City require factory floors that meet international durability and safety standards. Epoxy coatings dominate here due to their affordability and chemical resistance.

While decorative coatings are less common, interest is rising in polished concrete and colored finishes for malls, hotels, and government buildings. With rising foreign investment and infrastructure modernization, Mexico is poised to become a key growth driver in the North America concrete coatings landscape.

March 2025 – Sherwin-Williams launched a new polyaspartic floor coating system under its FasTop line, targeting the food and beverage manufacturing sector in the U.S., offering fast cure times and antimicrobial features.

January 2025 – PPG Industries expanded its concrete coatings portfolio with EcoTouch™, a low-VOC polyurethane product designed for high-traffic areas and LEED-compliant commercial projects across North America.

November 2024 – Rust-Oleum introduced a new line of DIY garage floor kits with integrated flake systems, targeting residential consumers via big-box retailers in the U.S. and Canada.

October 2024 – Sika Canada completed a regional expansion of its production facility in Quebec, increasing output capacity for floor coating resins and primers to meet rising demand in Eastern Canada.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America concrete floor coatings market

Product

Application

Country