The North America contract furniture market size was exhibited at USD 39.15 billion in 2023 and is projected to hit around USD 60.80 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

The North America Contract Furniture Market has evolved into a pivotal sector within the broader commercial real estate and interior design industries. Characterized by demand from corporate offices, government institutions, healthcare facilities, hospitality venues, and educational institutions, the market thrives on its capacity to blend functionality with aesthetics, durability, and adaptability. Contract furniture differs from traditional residential furniture by virtue of its durability, ergonomic design, compliance with safety standards, and adaptability to professional environments.

As workspaces become more dynamic and the need for collaborative and agile environments intensifies, businesses across North America are turning to contract furniture to support productivity, health, and branding. Additionally, the surge in public infrastructure investments, coupled with institutional modernization initiatives, is further amplifying the need for contract-grade seating, workstations, storage units, and custom-designed furnishings. These pieces are designed to accommodate large-scale usage, frequent movement, and longer lifespans, often spanning up to a decade with minimal maintenance.

In particular, the post-pandemic era has ushered in a wave of workspace reinvention. Hybrid work models have led to the redesign of office layouts to support both solitary tasks and collaborative activities. Healthcare and education sectors are undergoing similar transformations with an emphasis on safety, mobility, and modularity. Contract furniture is seen as a foundational element of these transformations, contributing to user well-being and operational efficiency.

North America—comprising the U.S., Canada, and Mexico—is a leading market globally, driven by rapid urbanization, mature infrastructure, high commercial activity, and evolving aesthetics. In the U.S., furniture procurement has become a strategic tool for expressing corporate culture and environmental responsibility. In Canada and Mexico, the market is growing rapidly thanks to rising investments in smart cities, healthcare expansion, and hospitality infrastructure.

Hybrid Workspaces and Agile Layouts: Companies are investing in modular, mobile, and reconfigurable furniture to support evolving work habits like hot-desking, collaborative zones, and breakout spaces.

Sustainability and Circular Design: There is an increasing demand for environmentally sustainable furniture made from recycled materials and built to be reused or repurposed, aligning with ESG mandates.

Smart Furniture Integration: Integration of IoT-enabled desks, ergonomic chairs with sensors, and adjustable-height tables is becoming popular in tech-driven office spaces.

Hospitality-Inspired Workspaces: Offices and institutional settings are adopting hospitality-grade finishes and furniture to enhance comfort and aesthetic appeal, mirroring hotel lounge atmospheres.

Growth of E-commerce Procurement: Digital platforms offering 3D previews, bulk order customization, and installation services are reshaping how contract furniture is sourced and procured.

Increased Demand for Antimicrobial Surfaces: Especially in healthcare and educational settings, surfaces treated for antimicrobial resistance are becoming standard.

Design for Neurodiversity: Institutions and corporations are increasingly opting for furniture that supports sensory inclusion and flexible interaction, enhancing accessibility for neurodiverse users.

| Report Coverage | Details |

| Market Size in 2024 | USD 40.91 Billion |

| Market Size by 2033 | USD 60.80 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Haworth Inc.; MillerKnoll, Inc.; Kinnarps Group; Steelcase Inc.; HNI Corporation; KI; Global Furniture Group; and Teknion |

One of the most significant growth drivers for the North America contract furniture market is the expansion of commercial infrastructure and office renovations. In the wake of shifting work paradigms, organizations are overhauling their traditional office settings to accommodate collaborative zones, breakout spaces, and wellness-oriented layouts. The rise of coworking environments and hybrid schedules is forcing companies to rethink office furniture, emphasizing modularity, mobility, and ergonomic comfort.

For instance, major corporations like Google and Microsoft have redesigned their campuses to reflect these principles—fostering productivity through dynamic, employee-centric spaces. This is also reflected in the surge of office renovations across financial institutions and law firms seeking more open, flexible, and client-friendly spaces. Moreover, cities like New York, Toronto, and Mexico City are witnessing commercial real estate booms, with new office buildings incorporating contemporary contract furniture from the get-go. This infrastructure growth is fundamentally intertwined with furniture demand, as every new or revamped facility requires extensive fit-outs tailored to its operations and brand ethos.

A major restraint in the North America contract furniture market is the high cost of procurement and installation. Contract furniture typically involves custom specifications, premium materials, and compliance with building codes and occupational safety standards. These requirements drive up the base cost, making them significantly more expensive than consumer-grade furniture. The costs are further elevated by the inclusion of design consultations, CAD renderings, project management services, and on-site installation labor.

Organizations in the public sector, startups, and small institutions often struggle to meet these expenses, opting instead for budget solutions that may not offer the same durability or ergonomic quality. Additionally, the lead time for high-end contract furniture can extend from several weeks to months, which can disrupt operational timelines. Economic uncertainty and budget cuts—particularly in government and educational sectors—can further delay large-scale furniture investments, curbing overall market growth potential.

The integration of wellness-oriented and smart furniture solutions presents a compelling opportunity for the contract furniture market. Organizations are increasingly focusing on creating healthier and more productive environments for their employees and occupants. Height-adjustable desks, motion-sensor lighting integration, posture-correcting seating, and air-purifying materials are just some of the innovations being rolled out. This trend is particularly strong in North America, where companies are aligning their procurement strategies with workplace wellness certifications such as WELL and Fitwel.

Furniture with built-in sensors to monitor usage, occupancy, and ergonomics can not only enhance comfort but also provide actionable data for facilities management teams. For example, tech-enabled desks can prompt users to change posture or take breaks, reducing musculoskeletal strain. Moreover, in healthcare settings, smart recliners and beds that adapt to patient movements are becoming crucial in outpatient and inpatient environments. As organizations become more data-driven and human-centric, the demand for furniture that supports both these goals is expected to escalate rapidly.

The seating segment dominated the North America contract furniture market due to its ubiquity and versatility across all end-use environments. From ergonomic office chairs and task seating in corporate offices to recliners and patient chairs in healthcare settings, seating forms the core of user interaction. Companies such as Steelcase, Haworth, and Herman Miller have continually innovated this segment with features like lumbar support, smart adjustability, and antimicrobial fabrics. In educational institutions, stackable and mobile seating has gained prominence, allowing rooms to be repurposed quickly for lectures, workshops, or exams.

However, Storage Cabinets & Shelves represent the fastest-growing segment, driven by the dual need for organization and space optimization. With open office plans gaining popularity, the traditional use of personal desks and drawers is giving way to shared storage systems. Modular shelving and mobile storage carts that can be repositioned easily are in high demand in labs, offices, and classrooms alike. Healthcare facilities, in particular, are prioritizing secure, labeled, and compliant storage systems to house sensitive records and equipment. Furniture makers are responding with sleek, compact, and safety-certified storage solutions that blend with modern aesthetics.

Corporate offices hold the dominant share in the contract furniture market, propelled by the ongoing transformation of workplace culture across North America. The growing emphasis on employee well-being, creativity, and brand alignment has led to an overhaul of office environments. Employers are investing in open lounges, agile meeting zones, privacy pods, and high-design furnishings to reflect flexibility and innovation. This has significantly increased demand for collaborative seating, customizable desks, and acoustic panels.

Interestingly, Healthcare/Medical Facilities are emerging as the fastest-growing end-use segment, especially in the wake of healthcare reforms and facility expansions. Both inpatient and outpatient facilities are redesigning their interiors to enhance patient experience and infection control. Inpatient environments such as recovery rooms and long-term care units now demand comforting, home-like furniture. Meanwhile, outpatient clinics are being outfitted with ergonomic seating, easy-to-clean surfaces, and accessible examination furniture. As patient-centric care models gain ground, contract furniture tailored for medical usage is seeing robust uptake.

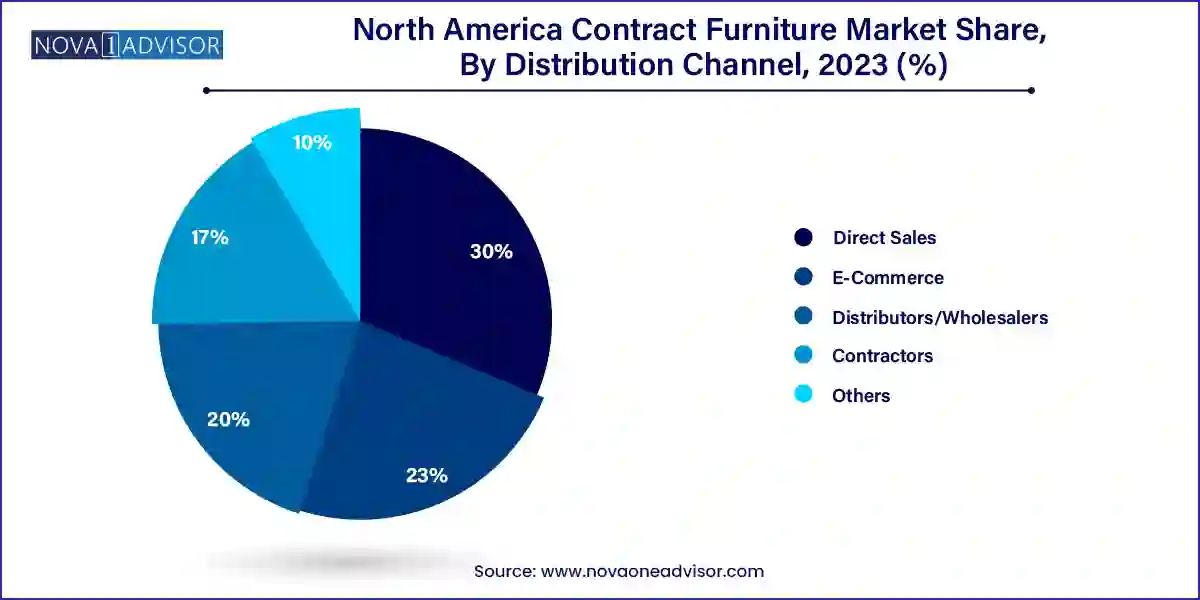

Direct sales dominate the contract furniture market, primarily due to the bespoke nature of projects and the long-term contracts involved. Institutions prefer dealing directly with manufacturers to ensure customization, consistency, and comprehensive post-installation services. This channel also facilitates early-stage collaboration between interior designers, project managers, and furniture suppliers, streamlining timelines and budgeting. Major players maintain dedicated business development teams to handle large contracts for universities, hospitals, and government complexes.

Meanwhile, E-commerce is rapidly gaining traction as the fastest-growing channel. As procurement departments become more digitally enabled, many buyers now prefer browsing product catalogs, accessing 3D visualizations, and placing bulk orders online. Platforms such as Wayfair Professional, Staples Business Advantage, and Uline have significantly expanded their B2B offerings, including delivery and assembly services. The COVID-19 pandemic accelerated this trend, and it is expected to continue as digital convenience becomes a priority in institutional procurement strategies.

The U.S. remains the dominant market in North America, accounting for the largest share due to a massive commercial real estate footprint and high R&D investments in workplace design. The presence of leading players such as Herman Miller, Knoll, and Steelcase ensures a strong manufacturing and innovation ecosystem. Government infrastructure projects, LEED-certified building renovations, and growing demand for smart offices continue to fuel market expansion. Additionally, the healthcare sector's focus on patient experience and safety is driving demand for purpose-built furnishings in hospitals and outpatient clinics.

Canada's contract furniture market is witnessing strong growth, driven by investments in public education, healthcare infrastructure, and urban renewal. Cities like Toronto, Vancouver, and Montreal are seeing significant institutional and commercial development, prompting demand for sustainable and adaptable furniture. Canadian manufacturers are increasingly adopting green practices, and government incentives for energy-efficient and eco-friendly procurement further support this trend. Furthermore, the country's growing tech and coworking ecosystem is driving innovation in design and flexibility.

Mexico is an emerging yet fast-growing market, supported by an expanding industrial base and rising investments in commercial and hospitality sectors. As multinational corporations expand operations in cities like Monterrey, Guadalajara, and Mexico City, demand for quality contract furniture is surging. Government efforts to enhance healthcare access and educational infrastructure are also contributing to market growth. Domestic manufacturers are gaining ground by offering cost-effective solutions tailored for institutional use, while international brands are partnering with local distributors for broader market access.

In February 2025, Herman Miller launched a new line of sustainable, ergonomic office seating under the “Re:Flex” brand, targeting hybrid work environments across North America.

Steelcase Inc. announced in January 2025 the acquisition of a Toronto-based smart furniture startup to bolster its IoT integration capabilities for office furniture.

Haworth Inc. expanded its Mexico operations in December 2024, opening a new logistics center in Monterrey to streamline delivery across Latin America.

In March 2025, Knoll Inc. revealed a collaboration with a prominent U.S.-based architecture firm to furnish several new federal government buildings in Washington, D.C.

Global Furniture Group introduced an antimicrobial healthcare furniture series in November 2024, aimed at outpatient facilities in the U.S. and Canada.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America contract furniture market

Product

End-use

Distribution Channel

Regional