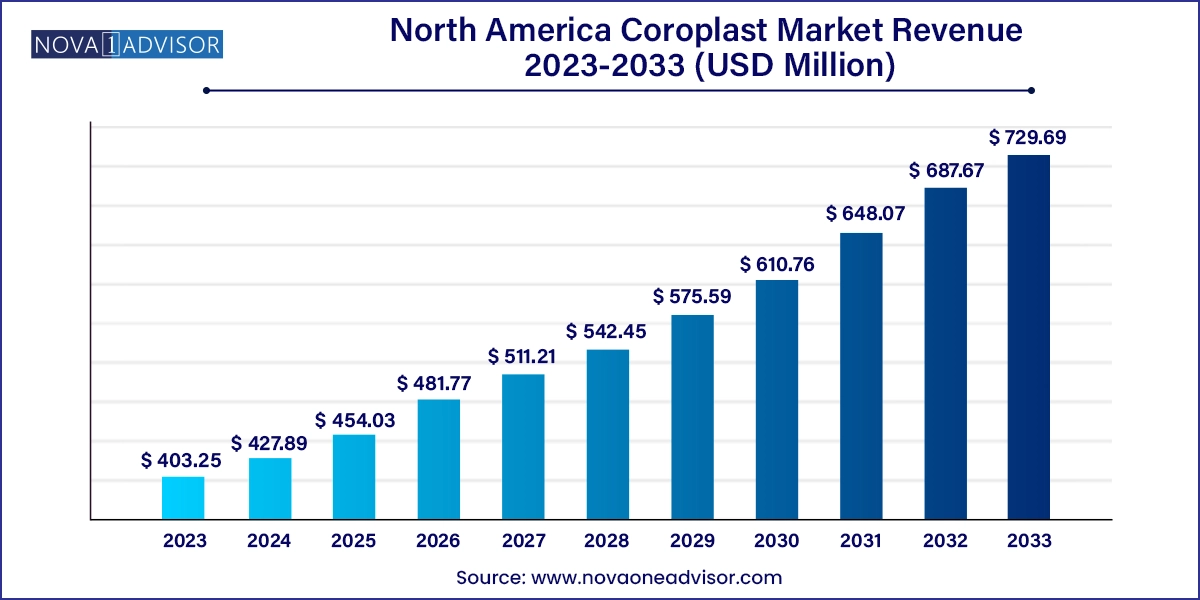

The North America coroplast market size was exhibited at USD 403.25 million in 2023 and is projected to hit around USD 729.69 billion by 2033, growing at a CAGR of 6.11% during the forecast period 2024 to 2033.

The North America Coroplast market, centered around the production and application of corrugated plastic sheets, is entering a phase of accelerated growth, innovation, and diversification. Coroplast, often made from polypropylene (PP) or polyethylene (PE), is a lightweight yet durable material widely used in applications such as signage, graphic displays, packaging, and construction. Its growing popularity across sectors is rooted in its resilience, weather resistance, recyclability, and cost-effectiveness compared to traditional materials like cardboard or plywood.

Across the United States, Canada, and Mexico, Coroplast has become synonymous with temporary outdoor advertising, point-of-purchase displays, election campaign boards, and packaging solutions. As North American industries emphasize sustainability, lightweight logistics, and visually dynamic branding, Coroplast has emerged as a preferred substrate. Additionally, the pandemic-induced acceleration of e-commerce and demand for protective barriers further amplified the role of corrugated plastics in the economy.

The U.S. dominates the market owing to its robust retail, political, and construction industries, while Canada and Mexico follow with increasing adoption driven by economic modernization and industrial output. Innovation in sheet printing technologies, automated cutting, and new color variations are also expanding the creative use cases for Coroplast. In the coming years, increased attention to reusable packaging, weather-resistant advertising, and affordable display materials will propel this market to new heights across the North American region.

Rising Use of Coroplast in Political and Event Signage: Election campaigns and public events continue to be major demand drivers, especially during election cycles and trade shows.

Growing Popularity of Recyclable and Reusable Signage Materials: Environmental awareness is pushing companies toward sustainable alternatives like PP-based Coroplast which is fully recyclable.

Expansion of Digital Printing Capabilities: Advanced flatbed UV printing technology allows high-resolution graphics directly on Coroplast sheets, boosting use in promotional and branding applications.

Customized Packaging and Logistics Solutions: Manufacturers are leveraging Coroplast for reusable packaging, crates, and dividers in industries like automotive and food distribution.

Increased Application in Construction Barriers and Safety Signage: Job sites increasingly use Coroplast for its weatherproof and durable nature in safety boards and temporary fencing.

Innovations in Surface Treatments: New coatings are being introduced to enhance ink adhesion, UV resistance, and anti-static properties for specialized applications.

Post-pandemic Demand for Hygienic and Protective Barriers: Coroplast dividers and shields used in schools, offices, and restaurants became prominent during COVID-19 and have found continuing demand.

| Report Coverage | Details |

| Market Size in 2024 | USD 427.89 Million |

| Market Size by 2033 | USD 729.69 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Coroplast (Inteplast Group); SABIC; Liberty Plastics Inc.; CoolSeal USA; Emco Industrial Plastics; Laminacorr Industries Inc.; New-Tech Packaging; Minnesota Diversified Industries (MDI); Commercial Plastics Depot; US Plast Inc.; Melmat, Inc.; All Weather Products LLC (AW Substrates); Primex Plastics Corporation; L-S Industries, Inc.; Ward & Kennedy Co.; Amatech Inc.; Matra Plast, Inc.; Mills Industries; VYCOM; Plaskolite; Con-Pearl North America Inc.; Plastic-Craft Products; SUREPAK INDUSTRIES; Palram Industries Ltd.; Lundell Plastics Corp.; Global Plastic Sheeting, Inc.; Polymershapes Mexico |

A key factor propelling the North American Coroplast market is the escalating demand from the signage and display industry. The material’s adaptability, cost-effectiveness, and weather-resistance make it ideal for both indoor and outdoor signage. It is particularly well-suited for short-term or medium-term applications such as promotional boards, real estate signs, event markers, and trade show displays. With its smooth surface, Coroplast is compatible with screen printing, digital printing, and vinyl application, which adds to its versatility for graphic designers and marketers.

This driver is particularly relevant in the U.S., where frequent political campaigns, seasonal sales promotions, and industrial trade shows generate enormous demand for cost-efficient display substrates. The material’s durability in outdoor conditions ensures that campaign signs can endure multiple weather cycles, while its lightweight profile makes installation and removal quick and economical. As small and large businesses invest more in eye-catching, localized advertising, Coroplast is poised to remain a go-to solution in the signage domain.

Despite its recyclability, Coroplast still faces scrutiny in the context of growing environmental concerns around plastic usage. Polypropylene and polyethylene, its two main raw materials, are petroleum-based plastics, and their use contributes to the global dependence on fossil fuels. Furthermore, if improperly disposed of, Coroplast sheets contribute to plastic pollution, especially in outdoor advertising where removal isn’t always adequately managed.

With increasing consumer and regulatory pressure on single-use plastics, organizations are being pushed to find greener alternatives. While Coroplast can be recycled, actual recycling rates vary widely across North American municipalities. The lack of standardized collection systems and consumer awareness regarding recycling can lead to improper disposal. As governments and industries push for circular economy models, Coroplast producers may face challenges unless they actively promote collection, reusability, and post-consumer recycling of their products.

An emerging opportunity in the North American Coroplast market lies in the growing adoption of reusable and sustainable packaging solutions. As companies across sectors—especially automotive, agriculture, and electronics—seek durable alternatives to cardboard and wooden crates, Coroplast is proving itself as a lightweight, moisture-resistant, and customizable option for transport packaging. Unlike traditional packaging, Coroplast boxes and dividers can withstand repeated handling and are resistant to chemicals and water, making them ideal for use in high-moisture or industrial environments.

Industries such as agriculture are exploring reusable Coroplast bins for transporting fruits and vegetables, reducing the need for disposable packaging. In warehousing and logistics, reusable layer pads and tote dividers made from Coroplast reduce material waste and overall packaging costs. With many large corporations pledging zero-waste goals and supply chain sustainability, the opportunity to position Coroplast as a key material in reusable packaging ecosystems is substantial. Manufacturers investing in modular, customizable designs tailored to specific industrial needs can tap into this fast-expanding segment.

Polypropylene (PP) dominated the North America Coroplast market owing to its superior strength, chemical resistance, and affordability. PP’s rigidity and light weight make it especially suitable for signage, packaging, and display applications. Its innate resistance to UV degradation and water damage enhances its utility for long-term outdoor applications. PP-based Coroplast also offers good compatibility with both screen and digital printing technologies. In the U.S. and Canada, where outdoor advertising remains a key medium for political, retail, and real estate sectors, PP has become the material of choice due to its cost-performance balance.

Additionally, PP’s environmental profile is improving with advancements in post-consumer recycling streams and growing awareness of circular plastics. Major producers are increasingly marketing their PP-based sheets as recyclable and are establishing take-back programs. As regulations evolve and environmental scrutiny grows, PP remains adaptable both in performance and eco-credentials, maintaining its lead in the segment.

Polyethylene (PE), while a smaller segment, is growing rapidly due to its enhanced flexibility and impact resistance. PE-based Coroplast sheets are particularly preferred for applications that require bending or shock absorption, such as protective packaging, flooring covers, and construction safety signs. Mexico has seen growing adoption of PE-based sheets in the manufacturing and logistics sectors, where toughness and resilience to stress are valued. PE also exhibits higher chemical resistance, making it suitable for use in harsh environments or chemical handling zones.

While slightly costlier and more prone to ink adhesion challenges, PE-based Coroplast is benefitting from innovations in surface treatment technologies that improve printability. As packaging and industrial applications expand in the region, PE’s role is expected to grow at a notable rate, carving a stronger niche in the market.

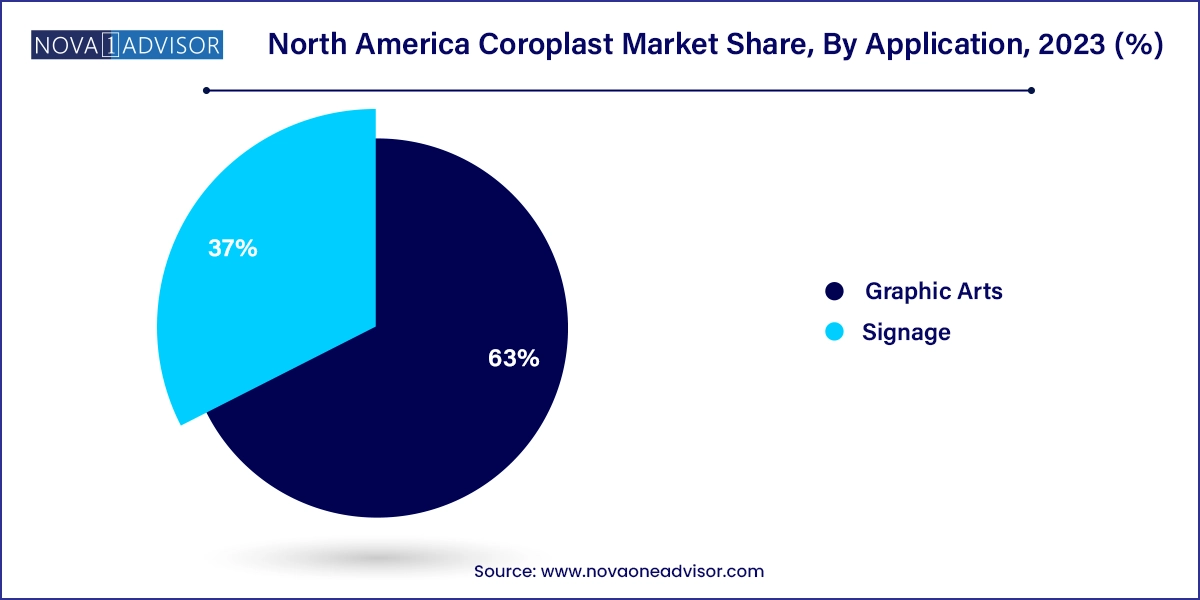

Signage was the dominant application segment, accounting for a significant share of Coroplast consumption across North America. The material’s inherent qualities—weather resistance, affordability, and printability—make it ideal for political signs, yard advertisements, store displays, and construction warnings. In the U.S., particularly during national and local elections, demand for Coroplast signage surges as campaigns deploy millions of temporary signs. Moreover, businesses across industries—from automotive dealers to fast food chains—leverage Coroplast for promotional displays due to its quick production cycle and ease of customization.

Canada also contributes significantly to signage demand, particularly in real estate and municipal services. Temporary wayfinding, construction zone notices, and safety signage all rely on Coroplast for its durability under varying weather conditions. The material's recyclability is becoming a promotional point for environmentally conscious municipalities.

Graphic arts emerged as the fastest-growing application segment, driven by increasing demand for visually striking, cost-effective, and easy-to-install materials in advertising and interior branding. With advancements in large-format digital printing, Coroplast is now used for decorative displays, point-of-purchase standees, exhibition booths, and even art installations. Print service providers across the region are expanding their Coroplast offerings to include matte, glossy, and textured finishes, enabling greater creativity.

Retail chains, event organizers, and marketing agencies are choosing Coroplast for its structural integrity combined with visual appeal. Mexico’s booming retail and trade show industry has especially contributed to the growth of this segment, where both affordability and presentation quality are key. The ability to print high-definition images directly onto Coroplast sheets makes them an ideal medium for quick-turnaround graphic displays.

The U.S. remains the dominant force in the North American Coroplast market, accounting for the majority of production, consumption, and innovation. The country’s vast retail infrastructure, frequent political activity, and vibrant advertising sector are key drivers. With a well-established printing industry and demand for cost-effective signage materials, Coroplast is a mainstay across small businesses, real estate firms, and political campaigns. Additionally, U.S.-based producers are at the forefront of developing UV-resistant and recyclable Coroplast variants.

The U.S. also leads in the application of Coroplast in packaging and industrial logistics. Reusable crates, dividers, and shelf liners made from Coroplast are used in industries from electronics to agriculture. The growth of e-commerce, warehouse automation, and modular storage solutions further fuel this segment.

Canada’s Coroplast market is growing steadily, particularly in construction, municipal services, and real estate. Due to varying climate conditions, materials used in signage must endure rain, snow, and extreme temperatures—making Coroplast a preferred choice. The country’s commitment to sustainable materials is also pushing demand for recyclable PP-based Coroplast sheets. Canadian retailers and event planners are adopting Coroplast for short-term displays, where visual quality and durability are essential.

Mexico represents a fast-growing market for Coroplast, spurred by rapid industrial development, expansion of retail infrastructure, and increased participation in international trade. Automotive and manufacturing hubs across the country use Coroplast for logistics packaging and temporary barriers in production lines. Additionally, political events and local advertising campaigns drive demand for low-cost signage. Mexican printing companies are increasingly investing in equipment capable of handling Coroplast, expanding local capacity for high-quality, printed display materials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America coroplast market

Material

Application

Country