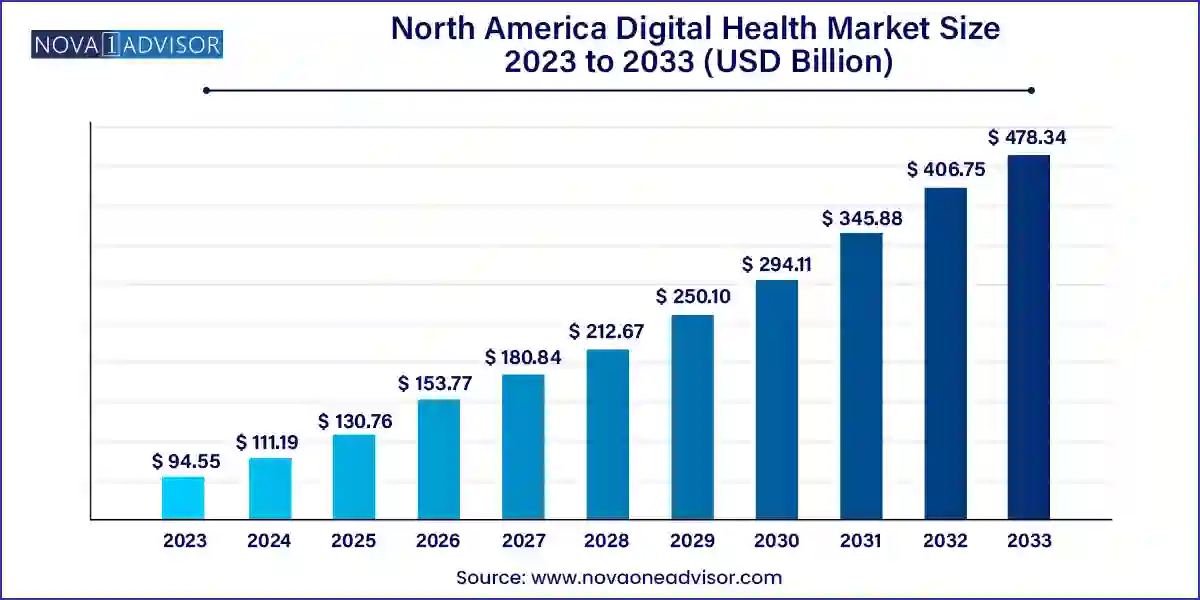

The North America digital health market size was exhibited at USD 94.55 billion in 2023 and is projected to hit around USD 478.34 billion by 2033, growing at a CAGR of 17.6% during the forecast period 2024 to 2033.

The North America Digital Health Market is at the forefront of a technological renaissance in healthcare, leveraging innovation to enhance patient outcomes, reduce operational inefficiencies, and transform care delivery. Digital health refers to the convergence of healthcare services with digital technologies such as mobile health (mHealth), telehealth, wearable devices, electronic health records (EHRs), healthcare analytics, and artificial intelligence. As the most mature market globally, North America especially the U.S. and Canada has been the breeding ground for a surge in digital health startups, government-backed initiatives, and massive investments from both healthcare and tech giants.

The COVID-19 pandemic acted as a springboard for the digital health ecosystem, rapidly accelerating adoption timelines by several years. Remote care, once considered optional or supplementary, quickly became a necessity. This scenario catalyzed widespread teleconsultations, e-prescriptions, remote monitoring, and mobile health apps to manage chronic and acute conditions alike. The post-pandemic environment now reflects a paradigm shift where hybrid models of care physical plus virtual are expected to persist long-term.

Major health systems, insurers, and tech companies in North America are investing heavily in digital infrastructure. Electronic Health Records (EHRs), once regarded as administrative burdens, are evolving into intelligent systems integrated with analytics and AI to support clinical decisions in real-time. Mobile applications tailored to specific conditions—from diabetes to mental health—are becoming a regular part of patient care pathways. Meanwhile, wearable devices are helping track patient vitals continuously, bridging the gap between hospital visits and home care.

Moreover, North American consumers are highly aware and receptive to digital health innovations. The penetration of smartphones and internet connectivity exceeds 90% in the region, enabling seamless use of mobile apps and remote health tools. At the same time, stringent regulatory frameworks ensure patient safety, data security, and software efficacy—thus driving both trust and reliability in digital health solutions.

Growth of Virtual Care Platforms: Telehealth and video consultations are becoming standard offerings across primary care and specialty services.

Expansion of Remote Patient Monitoring (RPM): RPM devices like glucose meters and pulse oximeters are increasingly used for chronic disease management.

Integration of AI and Machine Learning: Advanced analytics and AI-powered algorithms are enhancing diagnostics, personalized treatments, and administrative automation.

Rise of Condition-Specific Mobile Health Apps: Apps targeting mental health, fertility, cardiovascular health, and diabetes are seeing strong adoption.

Focus on Interoperability: There's a significant push to enable data sharing across platforms, providers, and payers through interoperable systems.

Hybrid Healthcare Models: A combination of in-person visits and virtual care is becoming the norm across practices and hospitals.

Health System Strengthening Initiatives: Digital solutions are being adopted to strengthen infrastructure, especially in rural or underserved areas.

Increased Role of Retail Health and Non-Traditional Players: Amazon, CVS, and Walmart are entering digital health via e-pharmacies, diagnostics, and virtual clinics.

| Report Coverage | Details |

| Market Size in 2024 | USD 111.19 Billion |

| Market Size by 2033 | USD 478.34 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 17.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Component, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America |

| Key Companies Profiled | Cerner Corp.; Allscripts; Apple Inc; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; Hims; Orange; Qualcomm Technologies, Inc; Softserve; MQure; Computer Programs and Systems, Inc; Vocera Communications; IBM Corp.; CISCO Systems, Inc. |

A major growth driver for the North America digital health market is the rising burden of chronic diseases such as diabetes, cardiovascular diseases, COPD, and obesity coupled with an aging demographic. According to the CDC, 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 have two or more. Similarly, Canada's senior population is expected to account for nearly 23% of the total population by 2030. These demographics place enormous pressure on traditional healthcare models.

Digital health tools offer scalable and cost-effective solutions for long-term monitoring, treatment adherence, and early intervention. For instance, remote patient monitoring devices allow physicians to continuously track blood pressure or glucose levels, reducing the frequency of hospital visits and improving patient outcomes. Virtual health platforms also enable elderly patients to consult specialists from their homes, reducing mobility burdens and healthcare costs. This combination of demographic necessity and technological capability makes digital health not just a convenience but a public health imperative.

While digital health offers transformative benefits, data privacy and security remain significant barriers to full-scale adoption. The healthcare industry is one of the most targeted sectors for cyberattacks due to the sensitivity and volume of personal health information (PHI). Data breaches can lead to identity theft, insurance fraud, and other malicious activities, eroding consumer trust.

In North America, stringent regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada govern digital health data. However, compliance with these laws involves complex processes, which can slow down innovation and increase operational costs. Additionally, smaller healthcare providers and startups may lack the resources to deploy enterprise-grade cybersecurity systems, leaving vulnerabilities. Balancing the demand for interoperability with data security continues to be a significant challenge for the digital health ecosystem.

One of the most promising opportunities in the North America digital health market lies in the expansion of predictive analytics and artificial intelligence (AI) across care delivery systems. AI can process massive volumes of data, identify hidden trends, and generate actionable insights far beyond human capability. Predictive models can anticipate disease progression, identify at-risk patients, and recommend proactive interventions.

For example, AI-enabled tools are being used to predict hospital readmission risks, optimize emergency room triage, and support radiologists in interpreting diagnostic imaging with high accuracy. IBM Watson Health and Google's DeepMind are prime examples of AI applications in drug discovery and diagnostics. As data volume grows through EHRs, wearables, and mobile apps, AI-driven healthcare will become an indispensable element of personalized and preventive medicine. Investment in this space is already surging, and as regulatory approvals become more streamlined, AI in digital health will create vast new revenue streams.

Tele-healthcare dominated the technology segment, primarily driven by the explosion of teleconsultations and virtual care during and after the COVID-19 pandemic. Video consultations, long-term care (LTC) monitoring, and remote medication management are now deeply embedded in many healthcare systems. Large health providers like Cleveland Clinic and Mayo Clinic offer teleconsultations across departments, while insurance companies have integrated telemedicine services into reimbursement models. Remote medication management has also gained traction, allowing doctors to adjust prescriptions based on real-time data, thereby minimizing side effects or drug interactions.

mHealth is the fastest-growing segment, with massive adoption of wearables and mobile health applications. Devices such as Apple Watches, Fitbits, and specialized monitors for blood pressure, glucose, and sleep apnea are now mainstream in personal health management. These devices sync with mobile apps that offer real-time feedback, wellness tracking, and physician dashboards. Medical and fitness apps are surging in popularity, offering everything from AI-powered symptom checkers to guided meditation sessions. With over 300,000 mobile health apps available and user engagement rates climbing, mHealth is emerging as a powerful vehicle for preventive care and patient empowerment.

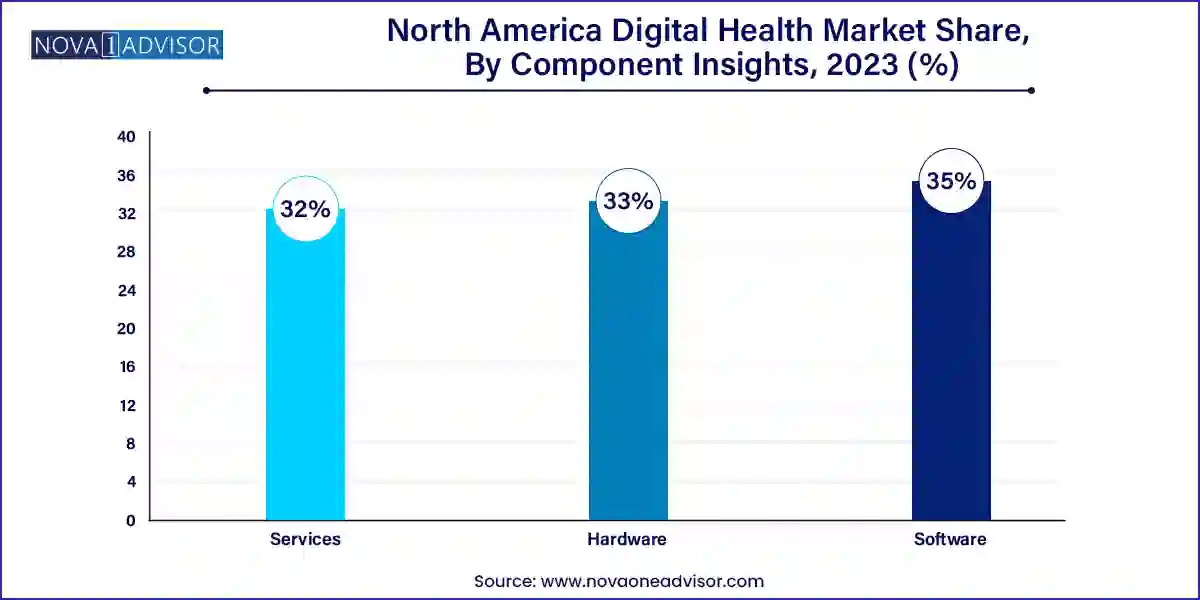

Software holds the dominant share in the component segment, owing to the vast deployment of digital platforms for EHRs, mobile applications, and healthcare analytics. Software solutions are the backbone of digital health infrastructure, enabling connectivity between stakeholders, managing patient records, and analyzing clinical data. From comprehensive hospital management systems to standalone diagnostic tools, software forms the digital interface between healthcare professionals and patients. Companies like Epic Systems, Allscripts, and Cerner lead this domain by providing scalable and customizable digital solutions to hospitals, clinics, and research centers across North America.

Services are growing at the fastest pace, fueled by the need for integration, training, and maintenance of complex digital systems. As healthcare organizations adopt more sophisticated technologies, the demand for consulting, onboarding, and technical support has grown exponentially. Services also include remote patient engagement, health coaching, and IT security consulting—essential for HIPAA-compliant system deployments. Moreover, value-added services like cloud storage, cybersecurity audits, and system upgrades are becoming recurring revenue streams for service providers. The growing complexity of healthcare IT ecosystems ensures that the services segment will continue to expand rapidly.

The U.S. commands the lion’s share of the North American digital health market, supported by strong infrastructure, proactive policy frameworks, and extensive private sector investment. Key initiatives like the 21st Century Cures Act have encouraged interoperability and data sharing. Companies such as Teladoc, Amwell, and Apple Health are based in the U.S., pioneering innovations in telehealth, wearables, and AI health tools. Insurance players like UnitedHealth and Cigna now include digital health services as part of their core offerings. The American consumer's comfort with technology, paired with increasing chronic disease prevalence, positions the U.S. as the global hub for digital healthcare innovation.

Canada is emerging as a significant player in digital health, particularly through public-private partnerships and provincial initiatives. Projects like Ontario Health Teams and British Columbia's digital strategy aim to unify healthcare systems using interoperable EHRs, telemedicine, and analytics platforms. The Canada Health Infoway has invested over CAD 2 billion in digital health systems since its inception. Startups such as Maple and WELL Health Technologies are transforming virtual care delivery. Moreover, the Canadian healthcare system’s universal nature allows large-scale testing of digital solutions across patient populations, offering a unique opportunity for rapid deployment and scalability.

February 2025 – Teladoc Health announced the launch of a new AI-driven mental health platform in the U.S., designed to personalize care plans and streamline provider matching based on patient profiles.

January 2025 – Apple Health introduced a new blood pressure monitoring feature integrated into the Apple Watch Series 9, aimed at supporting hypertensive patients through real-time alerts and syncing with EHR platforms.

March 2025 – WELL Health Technologies, a leading Canadian digital health provider, acquired Intrahealth Systems to expand its digital infrastructure capabilities across North America.

December 2024 – Epic Systems partnered with Amazon Web Services (AWS) to migrate its health records to the cloud, enhancing scalability, cybersecurity, and system uptime for thousands of hospital networks.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America digital health market

Technology

Component

Regional