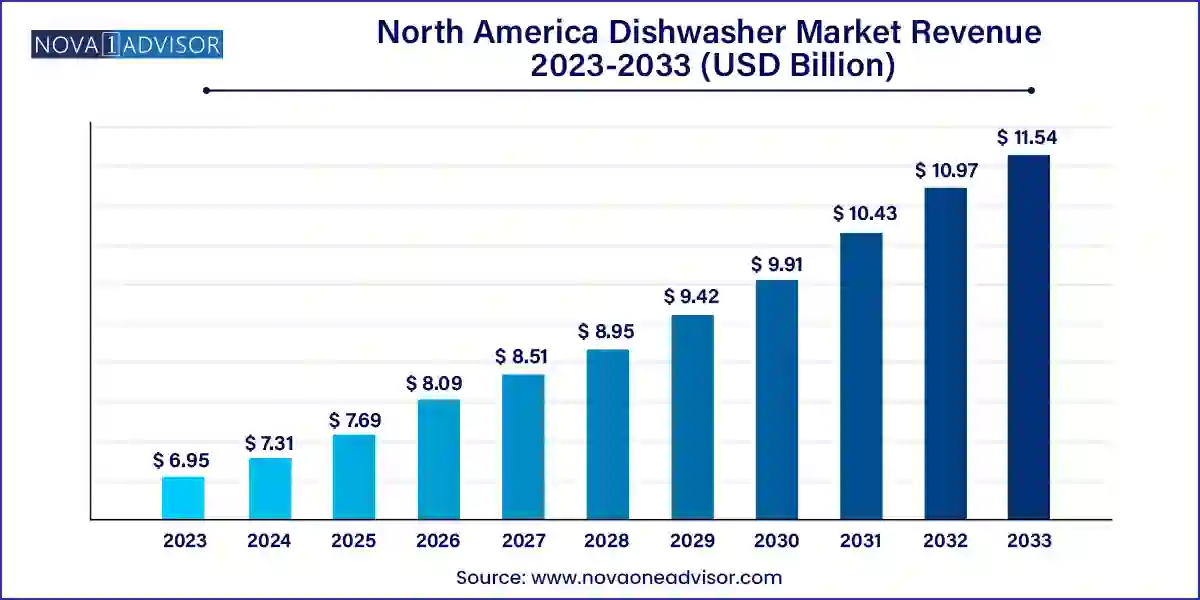

The North America dishwasher market size was exhibited at USD 7.31 billion in 2023 and is projected to hit around USD 11.54 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

The North America dishwasher market is a mature yet rapidly evolving segment of the broader home appliances industry, shaped by rising consumer expectations, energy efficiency norms, and smart home integration. Dishwashers, once considered a luxury in many households, have become a staple appliance in modern North American kitchens, particularly in urban and suburban homes. With time-pressed lifestyles, increasing dual-income families, and heightened focus on hygiene and water conservation, dishwashers are now perceived as essential tools for convenience, cleanliness, and sustainability.

The market consists primarily of two major product categories: freestanding and built-in dishwashers, with several sub-categories based on size, tub configuration, and price range. Product innovation continues to dominate, with leading brands introducing energy-efficient motors, noise reduction technologies, app-based remote monitoring, modular racks, and eco-friendly cycles. Consumers are increasingly selecting models based not only on performance but also on aesthetics, smart connectivity, and integration with modular kitchen cabinetry.

In North America, dishwasher demand is driven both by replacement cycles and new household formation. The rise in housing renovations, home improvement spending, and rental property upgrades have significantly influenced dishwasher installations. Moreover, the growth of compact and portable dishwashers caters to urban dwellers, millennials, and renters who may not have access to standard kitchen configurations. As sustainability and smart living gain momentum, manufacturers are adapting to these themes with product lines that are smarter, quieter, and more energy efficient.

Integration of Smart Technology: Dishwashers are now equipped with Wi-Fi connectivity, voice control, and app-based diagnostics for remote operation and performance monitoring.

Rising Demand for Tall and Deep Tub Models: Consumers are opting for larger internal spaces to handle increased dishwashing loads, especially in larger households or during holidays.

Premiumization of Kitchen Appliances: High-end dishwashers featuring stainless steel interiors, customizable exteriors, and advanced cleaning modes are gaining popularity.

Sustainability and Energy Efficiency: Compliance with ENERGY STAR ratings and water-saving technologies are becoming standard expectations among eco-conscious buyers.

Growth of Compact Dishwashers: Smaller models are in demand in urban condos and rental units, supporting space-constrained customers and single-person households.

Design-Centric Appliances: Built-in dishwashers that blend seamlessly with cabinetry or feature panel-ready exteriors are becoming more common in new home constructions.

Shift to Direct-to-Consumer Sales: Online platforms and brand-owned e-commerce stores are gaining traction, especially among younger consumers preferring digital-first shopping experiences.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.31 Billion |

| Market Size by 2033 | USD 11.54 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Size (Width), Tub Type, Price Range, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S, Canada |

| Key Companies Profiled | Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Frigidaire (Electrolux Inc.); Kenmore (Transform Holdco LLC); General Electric Company (Haier Company); AGA Rangemaster Limited; Miele; ASKO |

One of the most significant drivers of the North American dishwasher market is the increasing investment in residential remodeling and the adoption of smart kitchens. Post-pandemic shifts toward home-centric lifestyles have spurred a wave of kitchen upgrades, particularly in the U.S. and Canada, where homeownership remains a cultural priority. As families spend more time cooking and entertaining at home, the demand for high-performance, hygienic, and quiet kitchen appliances has surged.

Moreover, the desire for smart home ecosystems has driven dishwasher adoption as part of integrated appliance networks. Dishwashers now interact with mobile apps to notify users of cycle completion, water consumption, or maintenance needs. These features, paired with sleek design and modular installation options, appeal to both high-end consumers and tech-savvy millennials. The integration of dishwashers into home renovation plans, particularly in open-concept kitchens, continues to propel market expansion.

A major restraint in the market is the high initial cost of premium dishwashers and the rising price of post-purchase services. While entry-level models may retail under $500, advanced units with smart capabilities, noise-reduction features, and premium design aesthetics can exceed $1,500–$2,000. This price gap deters budget-conscious customers or renters who are reluctant to invest in built-in models for temporary residences.

Additionally, consumers often express concerns about the long-term maintenance and repair costs associated with high-end dishwashers, especially when dealing with imported or proprietary parts. The shortage of qualified appliance technicians in rural areas and lengthy service lead times further impact user satisfaction. These cost-related barriers, particularly in the lower-income and student demographic, may slow market growth in specific segments.

A major growth opportunity lies in the expansion of energy- and water-efficient dishwashers, especially in response to environmental concerns and regulatory mandates. Increasing awareness about water conservation—particularly in drought-prone regions of the U.S. and Canada—has led to consumer preference for dishwashers over handwashing, which can use up to 10 times more water.

Manufacturers have a clear opportunity to develop dishwashers with enhanced filtration, variable-speed pumps, and soil sensors that adjust cycle lengths automatically. New ENERGY STAR regulations and government rebate programs can further incentivize adoption. Consumers are increasingly choosing eco-cycles, half-load options, and quick-dry settings, creating a niche market for sustainable dishwashing solutions. Additionally, the integration of AI to optimize water and detergent usage based on load type may drive the next phase of innovation.

Built-in dishwashers dominate the North America market due to their widespread integration in both new homes and kitchen remodeling projects. These models are favored for their seamless design, space efficiency, and noise insulation, which makes them ideal for open-plan homes. Built-ins offer superior performance in terms of cycle options, tub size, and drying features, appealing to large households and premium buyers. Most home builders in the U.S. and Canada include a built-in dishwasher as a standard kitchen appliance, further cementing its market leadership.

However, freestanding dishwashers are growing at a faster pace, driven by increasing demand from renters, students, and space-constrained households. Portable units, countertop dishwashers, and compact freestanding models are increasingly available through online platforms. These are easy to install and don’t require custom cabinetry, making them appealing for temporary or secondary kitchens such as in basements or guesthouses. The combination of flexibility, affordability, and evolving design has spurred rapid adoption, especially in urban areas and among millennials.

Standard-size dishwashers (24 inches) hold the largest share of the North American market due to their compatibility with most residential kitchens. These units accommodate up to 12–14 place settings per cycle, making them suitable for families, entertainers, and multi-generational households. Most appliance brands have built extensive product portfolios around this size standard, offering variations in wash cycles, rack configurations, and tub finishes.

Compact-size dishwashers (18 inches) are experiencing rapid growth, primarily in metropolitan areas where small apartments and condominiums dominate. These models are also popular among aging populations or empty-nesters with reduced dishwashing loads. Compact dishwashers are ideal for households of 1–2 individuals and are often purchased as secondary appliances in offices or break rooms. Increasing design flexibility, water savings, and enhanced performance features are making compact models more attractive to a broader consumer base.

Standard tubs dominate due to their historical availability, ease of installation, and compatibility with most dishwasher cabinet spaces. These tubs, typically made of stainless steel or plastic, provide enough space for typical family needs. Many budget and mid-range dishwashers still come with standard tubs, appealing to cost-conscious homeowners and landlords seeking durability at a reasonable price.

Conversely, tall & deep tub dishwashers are growing fastest due to their enhanced loading capacity and ability to accommodate large cookware and bulkier items. These tubs often allow third racks, foldable tines, and bottle jets, addressing the diverse dishwashing needs of modern households. Families with children, home cooks, and entertainers prefer these configurations for their flexibility and performance. As kitchen designs become more open and multifunctional, these dishwashers align well with consumer preferences for fewer cycles and less frequent loading.

The USD 501 to USD 1,500 range dominates the market, encompassing a wide range of mid-range dishwashers that balance performance, design, and durability. Most ENERGY STAR-certified models, including those with smart technology, fall within this segment. Buyers in this range typically seek quiet operation, adjustable racks, stainless steel interiors, and digital touch controls. Brands like Whirlpool, GE, Samsung, and LG have focused heavily on this segment with consistent feature updates and customer support.

On the other hand, models priced up to USD 500 are growing rapidly, especially as entry-level consumers, first-time renters, or small households enter the market. These models are primarily freestanding or compact and are available across major online and offline retailers. Despite fewer features, advancements in motor design, detergent efficiency, and energy use have improved the value proposition of budget models. During economic uncertainty or in response to promotional campaigns, this segment sees spikes in volume-driven sales.

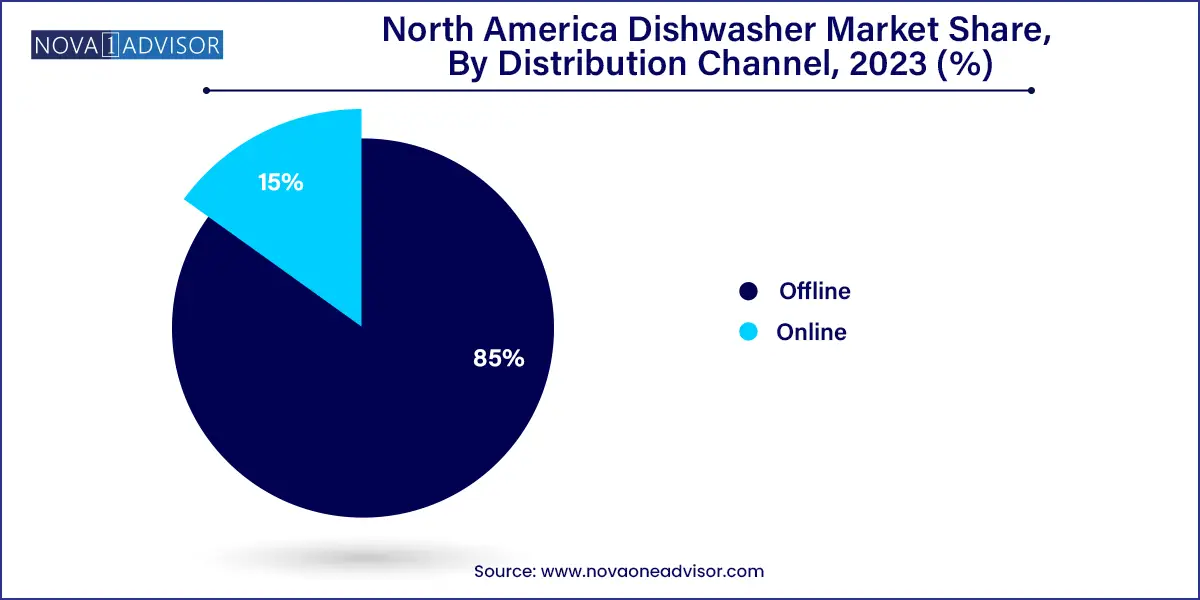

Offline retail, including home improvement chains like Home Depot, Lowe’s, and Best Buy, leads the dishwasher market, offering in-person demonstrations, same-day pickup, and installation support. Many consumers prefer viewing the product physically before purchasing, especially for built-in units requiring precise measurements. In-store promotions, seasonal discounts, and bundled appliance packages also contribute to higher conversion rates.

However, online channels are growing the fastest, accelerated by the digital transformation of retail, mobile app adoption, and pandemic-induced e-commerce boom. E-commerce platforms offer extensive product comparisons, customer reviews, installation videos, and AI-powered recommendation tools. Online sales are particularly strong in portable and compact dishwasher categories, where consumers are more comfortable buying without inspection. Retailers like Amazon, Wayfair, and brand-owned sites (e.g., Bosch, LG) are optimizing their supply chains to enhance last-mile delivery and after-sales service.

The U.S. dominates the North American dishwasher market, with the highest number of annual installations and replacements. The country’s strong housing market, high homeownership rates, and widespread kitchen appliance integration contribute to robust demand. Built-in dishwashers are considered standard in most homes, with replacement cycles driven by lifestyle upgrades and energy savings. U.S. consumers show a strong preference for ENERGY STAR-rated models and brands with local service networks.

The rise in kitchen remodeling, growing DIY culture, and focus on smart home ecosystems continue to influence U.S. buying behavior. Premium models with smart features, stainless steel exteriors, and whisper-quiet operation are gaining popularity among tech-savvy buyers.

Canada’s market is defined by high energy efficiency awareness and cold-weather utility. Canadian consumers favor stainless steel interiors and winter-proof installations with anti-freeze features. Urban centers like Toronto, Vancouver, and Montreal show strong demand for compact and stylish built-in models. Canada’s smaller yet steady market is shaped by eco-friendly preferences and support for local distributors.

Bosch Home Appliances (March 2024): Launched its Series 800 smart dishwasher in North America, featuring AI-driven soil sensing, Home Connect app integration, and ultra-quiet operation.

LG Electronics (February 2024): Introduced a new QuadWash Pro system in its dishwashers, offering faster wash cycles and dynamic spray arms, aimed at time-sensitive users.

Samsung (January 2024): Rolled out the Bespoke line of dishwashers with customizable panels and SmartThings connectivity, catering to premium and design-oriented consumers.

Whirlpool Corporation (December 2023): Partnered with Lowe’s to offer exclusive bundled kitchen appliance packages featuring eco-friendly dishwashers under $700.

GE Appliances (November 2023): Expanded its production facility in Kentucky to increase domestic supply of ENERGY STAR-certified dishwashers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America dishwasher market

Product

Size (Width)

Tub Type

Price Range

Distribution Channel

Country