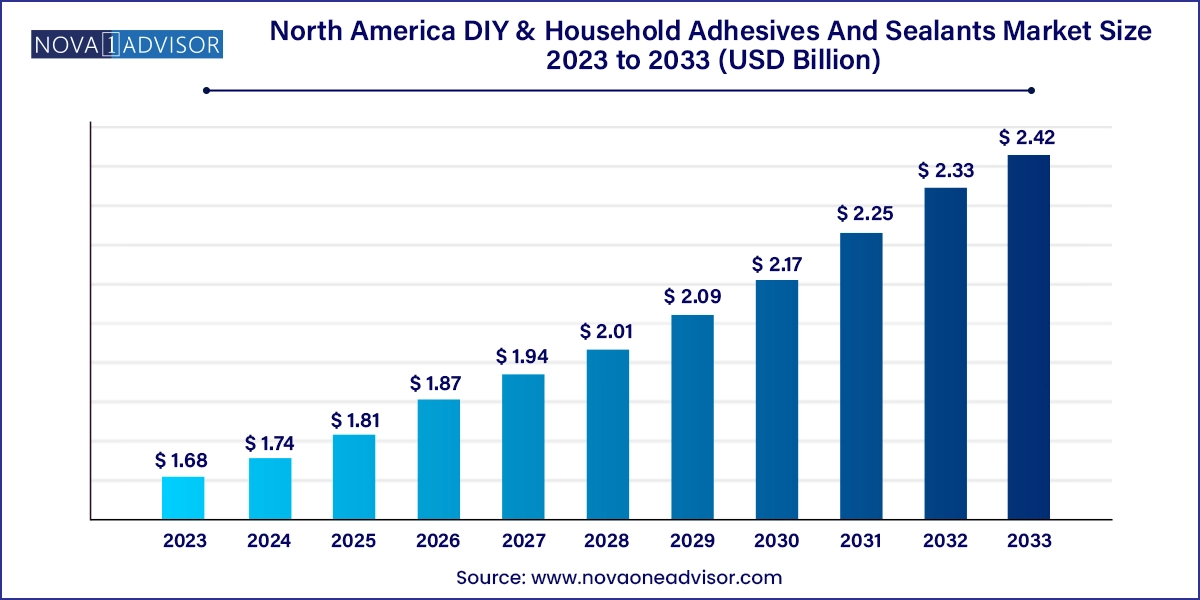

The North America DIY & household adhesives and sealants market size was exhibited at USD 1.68 billion in 2023 and is projected to hit around USD 2.42 billion by 2033, growing at a CAGR of 3.7% during the forecast period 2024 to 2033.

The North American market for DIY (Do-It-Yourself) and household adhesives and sealants has witnessed significant growth in recent years. This surge is attributed to the increasing trend of home improvement projects, rising consumer awareness about product availability, and the convenience of using adhesives and sealants for various household applications. The market encompasses a wide range of products, including epoxies, polyurethanes, silicones, acrylics, polyvinyl acetates, and latex-based adhesives and sealants. These products cater to diverse applications such as insulation, kitchen fixtures, waterproofing, surface bonding, and arts & crafts.

The growth trajectory of this market is influenced by factors such as technological advancements in adhesive formulations, the introduction of eco-friendly and sustainable products, and the increasing availability of these products through various distribution channels, including online platforms. Additionally, the rising popularity of DIY culture, fueled by social media platforms and home improvement shows, has further propelled the demand for household adhesives and sealants.

Eco-Friendly and Sustainable Products: Manufacturers are focusing on developing adhesives and sealants with low VOC (Volatile Organic Compounds) content to meet environmental regulations and cater to environmentally conscious consumers.

Technological Advancements: Innovations in adhesive technologies have led to the development of products with enhanced bonding strength, faster curing times, and improved resistance to environmental factors.

E-Commerce Growth: The proliferation of online retail platforms has made it easier for consumers to access a wide range of DIY and household adhesive and sealant products, contributing to market growth.

Customization and Specialty Products: There is a growing demand for adhesives and sealants tailored for specific applications, such as high-temperature resistance, flexibility, or compatibility with particular substrates.

Educational Initiatives: Companies are investing in educational campaigns and tutorials to inform consumers about the proper use of adhesives and sealants, thereby enhancing product adoption.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.74 Billion |

| Market Size by 2033 | USD 2.42 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product Categories, Technology, Surface Types, Packaging Types, Form Types, Application, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada. |

| Key Companies Profiled | Henkel AG & Co. KGaA.; RPM International Inc.; Gorilla Glue, Inc.; 3M; PPG Industries; DuPont; Sika AG; Franklin International; Dow; American Sealants Inc.; General Electric; Electric Products, LLC; MightyLoc; Bossil; Elmer’s; Flex Seal; Aleene’s; and J-B Weld |

The burgeoning DIY culture in North America serves as a significant driver for the adhesives and sealants market. Consumers are increasingly undertaking home improvement projects, ranging from simple repairs to complex renovations, driven by the desire for personalization, cost savings, and the satisfaction of self-accomplishment. This trend is further amplified by the availability of online tutorials, workshops, and DIY-focused television programs that empower individuals to tackle projects independently. Consequently, there is a heightened demand for user-friendly, versatile, and reliable adhesives and sealants that cater to a broad spectrum of household applications.

Despite the market's growth, health and safety concerns associated with certain adhesive and sealant products pose a restraint. Some formulations contain chemicals that emit VOCs, which can have adverse health effects and contribute to indoor air pollution. Additionally, improper handling or application of these products can lead to accidents or injuries. These concerns necessitate stringent regulatory oversight and compel manufacturers to invest in safer, non-toxic alternatives, which may increase production costs and impact profit margins.

The development of multi-functional adhesives and sealants presents a lucrative opportunity in the market. Consumers increasingly seek products that offer multiple benefits, such as bonding, sealing, insulation, and waterproofing, in a single application. Multi-functional products not only simplify the DIY process but also reduce the need for multiple purchases, offering cost and time savings. Manufacturers that innovate and introduce such versatile products can capture a broader customer base and enhance their market share.

Epoxy adhesives dominated the product category segment due to their superior bonding strength and chemical resistance, especially for surface bonding and waterproofing applications. Widely used in fixing metal, concrete, and wood surfaces, epoxy adhesives are preferred for their durability and long-lasting performance. Consumers undertaking DIY furniture repair, bathroom fixture installations, or kitchen upgrades often rely on epoxy products. Additionally, the rise in multipurpose household toolkits often includes epoxy adhesives for general-purpose use.

Silicone adhesives are projected to be the fastest-growing category, thanks to their flexibility, resistance to weathering, and excellent sealing properties. These features make them ideal for kitchen and bathroom applications where moisture resistance is crucial. Increasing awareness among consumers regarding mold-resistant, low-VOC silicone products has also fueled demand, particularly in caulking and fixture sealing tasks

Water-based adhesives lead the technology segment owing to their ease of use, environmental friendliness, and suitability for indoor applications. They have found widespread acceptance in arts and crafts, insulation, and surface bonding, particularly on porous materials like wood and paper. The demand is also fueled by their low odor and minimal health hazards, making them a family-friendly option for shared spaces and children's projects.

Reactive adhesives are expected to be the fastest-growing, driven by their high-performance attributes such as rapid curing time and excellent thermal resistance. These are especially favored in more complex or load-bearing DIY applications involving metals or ceramic tiles. Growth is supported by increasing innovation in one-component reactive technologies that reduce the need for mixing, simplifying consumer use.

Wood surface applications dominate this segment due to the widespread use of adhesives and sealants in furniture assembly, wall paneling, and decorative woodworks. The popularity of rustic and customized wood decor has enhanced the demand for wood bonding adhesives. These products are also essential for cabinetry, wooden doors, and skirting installations.

Metal surfaces are experiencing the fastest growth as consumers increasingly undertake projects involving garage doors, outdoor fencing, and furniture frames. Adhesives that eliminate the need for welding or mechanical fastening are particularly popular for achieving seamless finishes. The growing segment of metallic arts and crafts also adds to the traction.

Cartridges are the leading packaging format, especially for sealants and thick adhesives used in waterproofing and fixture installation. Their user-friendly design allows precise application and minimizes mess. These are frequently used in kitchen sinks, bathtubs, and sealing corners, making them a staple in household repair kits.

Tubes are growing fastest, propelled by their convenience and affordability. Used primarily for quick fixes and arts & crafts, tubes cater to casual DIYers who need minimal quantities. Single-use packaging is gaining favor for its hygienic appeal and low cost, further accelerating its uptake in this segment.

Liquid adhesives are the dominant form, as they provide excellent coverage and penetration into surfaces, making them highly effective for porous materials. They are versatile and used across multiple applications like insulation, surface bonding, and furniture repair. The strong demand from users preferring brush-on or pourable applications sustains their leadership.

Tapes are the fastest-growing form type, especially among beginners and hobbyists. Double-sided tapes, foam tapes, and decorative sealing tapes are easy to apply and remove, making them ideal for temporary applications or lightweight bonding. Their popularity in home décor and organization tasks like hanging frames or cable management supports rapid growth.

Surface bonding applications dominate, as a broad range of household tasks require joining surfaces for repairs, installations, or creative purposes. From repairing cracked items to assembling new furniture or installing tiles, adhesives are essential in ensuring long-term hold and finish.

Arts and crafts applications are growing fastest, thanks to rising interest in personalized décor, homemade gifts, and school projects. Online platforms like Etsy and Pinterest have created communities that encourage craft-related activities, boosting the demand for a variety of adhesives in this category.

The United States is the largest consumer within the North American DIY & Household Adhesives and Sealants Market. The nation's long-standing tradition of homeownership and the cultural inclination towards DIY renovations significantly contribute to market volume. According to the Home Improvement Research Institute, over 75% of U.S. homeowners engage in at least one DIY project annually. Adhesives and sealants are core products in these activities.

Retail giants such as Home Depot and Lowe's dominate distribution, while e-commerce continues to rise. In addition, U.S.-based innovations in low-VOC and eco-friendly formulations are setting the trend for the entire region. Regulatory standards by bodies such as the EPA (Environmental Protection Agency) ensure that products are increasingly sustainable.

Canada, though smaller in market size compared to the U.S., is exhibiting rapid growth fueled by increasing urbanization, rising homeownership, and the popularity of DIY culture. Canadian consumers value eco-conscious and safety-certified products, prompting growth in water-based and silicone adhesives.

Retailers such as Canadian Tire and RONA are playing a vital role in disseminating DIY solutions, often bundling adhesives with toolkits and renovation products. With government incentives on home retrofitting and energy efficiency, the insulation segment using adhesives and sealants is poised to see substantial growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America DIY & household adhesives and sealants market

Product Categories

Technology

Surface Types

Packaging Types

Form Types

Application

Country