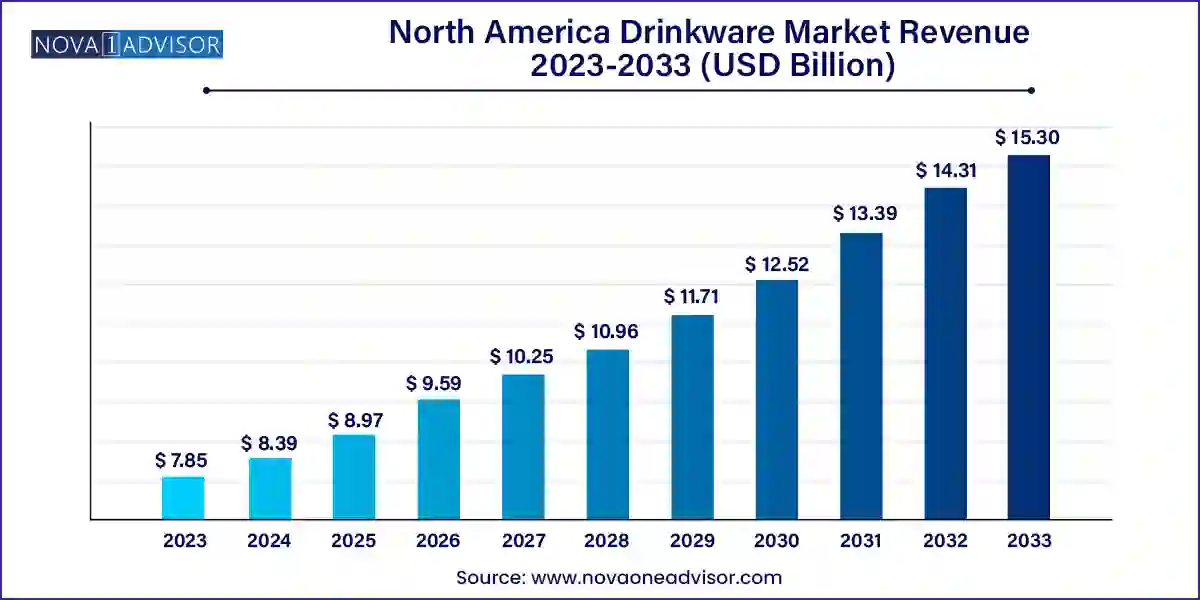

The North America drinkware market size was exhibited at USD 7.85 billion in 2023 and is projected to hit around USD 15.30 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2024 to 2033.

The North America drinkware market is a thriving and diverse consumer products segment that has witnessed significant evolution over the past decade. No longer just a category for basic hydration, drinkware in this region has become a fusion of function, fashion, sustainability, and personalization. The market encompasses a wide array of vessels including stainless steel water bottles, tumblers, mugs, tritan bottles, and specialty containers used for everything from coffee and cocktails to smoothies and protein shakes.

A key driver of this growth is the cultural shift toward reusable and eco-conscious consumption. As consumers increasingly seek alternatives to single-use plastic, brands have capitalized on this trend by launching stylish, ergonomic, and durable drinkware made from sustainable materials. Furthermore, drinkware is now an essential component of the lifestyle accessories market, promoted heavily by social media influencers, fitness advocates, outdoor enthusiasts, and eco-conscious celebrities.

Functionality has also taken center stage, with consumers demanding features such as double-wall vacuum insulation, leak-proof lids, modular attachments, and dishwasher-safe designs. Product customization—through engraving, color combinations, and graphic prints—has enabled personal expression and corporate branding. Drinkware has also become a popular gift item, promotional product, and status symbol, evident in the widespread popularity of brands like Yeti, Hydro Flask, and Stanley.

The North American market is supported by a strong e-commerce infrastructure, established retail chains, and growing demand across demographic segments—from school-age children to corporate professionals. With increasing health consciousness, outdoor recreation, and sustainability initiatives, the drinkware market is well-positioned for continued growth and innovation over the next decade.

Sustainability-Driven Product Innovation: Brands are moving toward recyclable, BPA-free, and biodegradable materials in response to environmental concerns.

Custom and Personal Branding: Engraving, logos, team colors, and personalized patterns are driving premium sales, especially for gifting and promotional use.

Hybrid and Multi-Functional Designs: Drinkware now includes features like built-in straws, smart temperature control, and interchangeable lids for different beverages.

Rise of Aesthetic and Lifestyle Drinkware: Design-driven models are becoming fashion accessories, with matte finishes, pastel tones, and artist collaborations gaining popularity.

Health and Fitness Integration: Drinkware for protein shakes, electrolyte beverages, and infused water is rising, often bundled with fitness gear.

Online Subscription and DTC Models: Startups and DTC brands are offering curated drinkware collections and seasonal designs via online subscriptions.

Celebrity and Influencer-Driven Brand Popularity: Influencers are promoting specific brands that align with personal wellness and sustainable values, often leading to viral demand spikes.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.39 Billion |

| Market Size by 2033 | USD 15.30 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Capacity, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S; Canada; Mexico |

| Key Companies Profiled | Yeti Coolers, LLC ; STANLEY; Starbucks Coffee Company; Helen of Troy Limited (Hydro Flask); Simple Modern; Contigo Brands; Thermos L.L.C.; CamelBak Products, LLC; Reduce Everyday; Thermo Fisher Scientific Inc. (Nalgene): Trove Brands, LLC (Owala); Klean Kanteen; Takeya USA Corporation; Leapfrog Brands (Ello Products) |

A dominant driver of growth in the North America drinkware market is the escalating consumer demand for reusable and eco-friendly beverage containers, propelled by both environmental awareness and regulatory actions against single-use plastics. Cities like San Francisco, Vancouver, and New York have introduced legislation to reduce plastic waste, prompting a cultural shift toward personal responsibility in waste management.

Consumers are actively choosing stainless steel bottles, tumblers, and BPA-free tritan containers as part of their everyday routine, whether at home, at work, or on the go. Millennials and Gen Z in particular favor sustainable options and are willing to pay a premium for environmentally responsible products. Companies that emphasize circular economy principles, such as using recycled materials or offering product take-back programs, are gaining significant market traction.

Despite the positive trajectory, a significant restraint is consumer price sensitivity and competition from low-cost imports or generic alternatives. While premium drinkware brands boast advanced features, durability, and aesthetic appeal, their products often come with higher price tags—ranging from $25 to over $60 per item.

In contrast, discount retailers, supermarkets, and online marketplaces offer cheaper versions that visually mimic branded products but lack the same quality or functionality. This flood of low-cost options—often manufactured in regions with low production standards—can undermine consumer loyalty, especially during economic downturns. For value-driven households or budget-conscious students, the initial cost of premium drinkware can be a deterrent despite long-term savings over disposable options.

A promising opportunity in the market lies in the emergence of smart drinkware, offering digitally integrated solutions that combine hydration with technology. These products include smart bottles that remind users to drink water, monitor fluid intake, or even measure beverage temperature. This trend is gaining momentum among tech-savvy consumers, athletes, and health-conscious professionals who prioritize hydration tracking as part of their wellness routine.

Startups and tech-focused brands are exploring app-connected drinkware with Bluetooth functionality and built-in sensors. Integration with health apps like Apple Health and Fitbit could unlock new subscription-based revenue models or personalized product bundles. The fusion of wellness, tech, and convenience presents a significant opportunity for differentiation in an otherwise saturated market.

Tumblers and mugs dominate the North America drinkware market due to their versatility, aesthetic value, and suitability for both hot and cold beverages. These products are widely used in office settings, coffee shops, households, and travel contexts. Their cylindrical shape, customizable exterior, and thermal insulation make them ideal for retaining the temperature of beverages like coffee, tea, and smoothies. Tumblers are also popular promotional merchandise, gifted at events, or used for brand engagement. The growing café culture in urban North America supports consistent demand across retail and foodservice channels.

In contrast, stainless steel water bottles are the fastest-growing segment, fueled by health and eco-conscious consumers seeking long-term, reusable hydration solutions. These bottles are favored for their durability, insulation properties, and compatibility with cold and hot drinks. Recent product launches feature ergonomic grips, sleek finishes, and modular lids for different use cases—such as wide-mouth for smoothies or straw tops for workouts. Brands like Hydro Flask, S'well, and Yeti have successfully turned stainless steel drinkware into a lifestyle accessory. Their use spans school campuses, corporate environments, gyms, hiking trails, and airports, showcasing cross-demographic appeal.

Drinkware between 16oz and 32oz dominates the North American market, representing the standard sizing for daily hydration. This capacity range is ideal for a single serving of coffee, water, juice, or protein shake, and fits comfortably in car cupholders, backpacks, and workspaces. It also offers enough volume for meal-time beverages without excessive bulk. Tumblers, sports bottles, and infuser bottles in this range are common among commuters, fitness enthusiasts, and office workers. These sizes are frequently used by restaurants for refills or by food delivery services for customized beverage packaging.

However, below 16oz capacity products are growing fastest, particularly among specialty users such as children, espresso drinkers, and minimalist consumers. Compact and lightweight, these drinkware items are easier to carry, clean, and store. They’re ideal for short commutes, airplane travel, and pairing with espresso machines. Additionally, personalization and gift-oriented marketing (e.g., monogrammed mugs or bridal party favors) often target smaller-capacity items. Growth is also supported by wellness trends promoting frequent, smaller sips of hydration and by high school and college students preferring lightweight options.

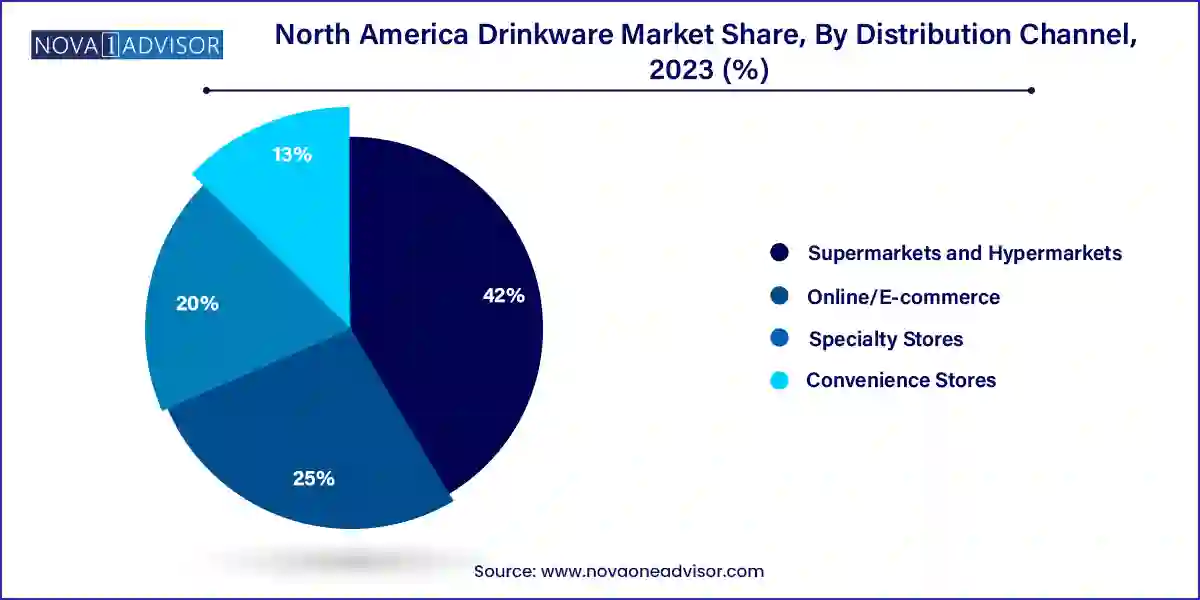

Supermarkets and hypermarkets remain the dominant distribution channel, owing to their accessibility, wide product range, and convenience. Retail giants such as Walmart, Target, and Costco prominently feature drinkware displays in both houseware and seasonal gift sections. These stores also attract bulk buyers, offering multi-packs of mugs or promotional pricing on popular water bottle brands. The visibility and immediate availability of products encourage impulse buying, especially during holidays, back-to-school season, or health-focused promotional weeks..

Yet, online and e-commerce platforms are experiencing the fastest growth, reshaping consumer purchasing behavior. Amazon, Etsy, and brand-specific online stores allow users to filter by capacity, color, brand, material, and price. Many online channels also provide engraving services, exclusive editions, or product bundles that are unavailable offline. The rise of influencer marketing, affiliate programs, and subscription boxes is enhancing visibility for direct-to-consumer drinkware startups. Consumers are increasingly drawn to convenience, reviews, and customization—all of which favor online shopping.

The United States leads the North American drinkware market, driven by a large population, strong purchasing power, and deeply entrenched coffee, tea, and fitness cultures. Urban centers such as New York, Los Angeles, and Chicago see high demand for insulated tumblers and customizable mugs, while outdoor and wellness-centric regions like Colorado, Oregon, and Utah favor stainless steel water bottles. Reusable drinkware is frequently marketed through sustainability campaigns, university initiatives, and workplace wellness programs.

The U.S. is also a hub for innovation, home to globally recognized brands like Hydro Flask (Oregon), Yeti (Texas), and Contigo (Illinois). Consumer behavior in the country is heavily influenced by social media, subscription services, and personalization trends. With a large market for corporate gifting, promotional items, and influencer merchandise, drinkware often extends beyond utility into fashion and branding.

Canada represents a growing and eco-conscious market, particularly in provinces like British Columbia and Ontario. National policies targeting single-use plastics, along with robust outdoor recreational culture, have fueled drinkware adoption. Consumers value insulated bottles for cold winters and seek ergonomic, compact designs for transit and commuting. Local retailers like Canadian Tire and Mountain Equipment Co-op (MEC) are popular sources for performance drinkware, while e-commerce is steadily gaining traction.

Mexico, while relatively smaller in volume, is becoming an attractive market due to rising health awareness, urbanization, and international brand penetration. Reusable water bottles are increasingly adopted in educational institutions and gyms, while mid-tier brands gain shelf space in department stores and supermarkets. The growing middle class and expanding e-commerce sector offer long-term growth potential, especially for affordable, durable, and branded drinkware.

Stanley (March 2024): Released a new range of pastel-colored Adventure Quencher tumblers targeting younger consumers through TikTok-driven campaigns, following viral success in 2023.

Yeti (February 2024): Opened a flagship store in Toronto, marking its official Canadian retail expansion and launching exclusive Maple Leaf Red editions of its popular bottles.

Hydro Flask (January 2024): Introduced the “Refill For Good” campaign in U.S. schools to promote the use of refillable water bottles, with proceeds from sales funding clean water initiatives.

Corkcicle (December 2023): Partnered with Marvel Studios to release a limited-edition drinkware series featuring characters from the Avengers franchise, appealing to collectors and fans.

Ello Products (November 2023): Launched a BPA-free, tritan-based bottle line in partnership with Whole Foods Market, focusing on clean aesthetics and eco-friendly messaging.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America drinkware market

Product

Capacity

Distribution Channel

Country