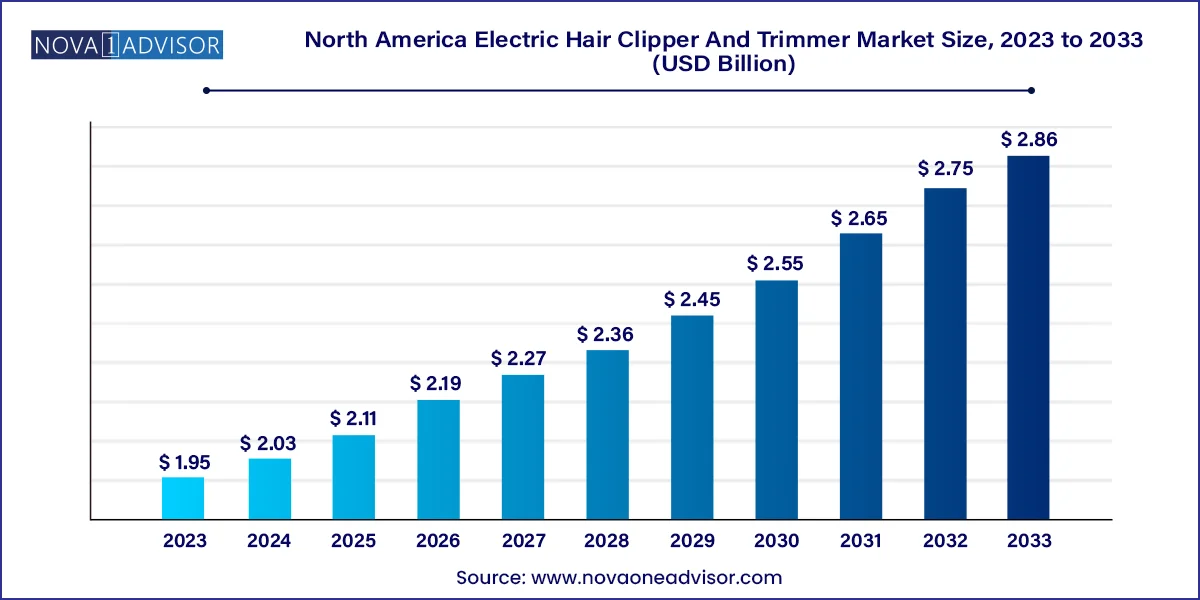

The North America electric hair clipper & trimmer market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 2.86 billion by 2033, growing at a CAGR of 3.9% during the forecast period 2024 to 2033.

The North America electric hair clipper and trimmer market is witnessing remarkable growth, underpinned by the increasing emphasis on personal grooming, convenience-driven lifestyle shifts, and rising disposable incomes. The evolution of grooming preferences, driven by cultural influences and media portrayal of style trends, has significantly increased the adoption of electric grooming devices in both professional and domestic settings. With the proliferation of grooming salons, pet care centers, and do-it-yourself (DIY) haircare trends post-pandemic, electric hair clippers and trimmers have become indispensable tools in households and professional environments alike.

Hair grooming is no longer perceived as a luxury but a daily necessity. From barbershops to high-end salons and pet grooming centers to home users, electric clippers and trimmers have democratized grooming services. Moreover, North American consumers show high receptivity to technologically enhanced grooming products such as cordless trimmers, waterproof designs, and precision-controlled cutting mechanisms. This has pushed manufacturers to innovate and release feature-rich devices that align with user preferences for portability, comfort, and durability.

According to various consumer behavior insights, the U.S. market particularly favors value-for-money grooming kits with multifunctional heads, while the Canadian demographic leans toward environmentally conscious, rechargeable, and ergonomic designs. This trend has driven companies like Wahl Clipper Corporation, Philips Norelco, and Andis Company to strategically launch targeted product variants across these nations. The market outlook remains optimistic as home grooming and self-care continue to thrive in the post-pandemic era.

Technological Integration in Grooming Devices: Smart trimmers with digital displays, adjustable motor speeds, and memory settings are gaining attention in the consumer segment.

Rise of Cordless and Rechargeable Products: Battery-powered devices with quick charging and long runtime are rapidly replacing corded models.

Pet Grooming Boom: An increase in pet ownership and spending on pet care has accelerated demand for pet-specific grooming tools.

Eco-Friendly Design Preferences: A growing trend toward sustainable grooming tools with recyclable materials and energy-efficient batteries.

Customization & Precision Cutting: The demand for personalized grooming and fading designs has popularized products with multiple blade attachments and trimming lengths.

Growth of E-commerce Sales Channels: The preference for online platforms, especially Amazon, Walmart, and company websites, has surged owing to convenience and discounts.

Increased Male Grooming Awareness: A significant shift has been observed in male grooming habits, spurred by social media influencers and skincare campaigns.

Ergonomically Designed Grooming Devices: Lightweight, compact, and user-friendly products are witnessing increased adoption, especially among the aging population and first-time users.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.03 Billion |

| Market Size by 2033 | USD 2.86 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Type, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada |

| Key Companies Profiled | Wahl Clipper Corporation; Andis Company, Inc.; Conair LLC (BaBylissPRO); Oster Professional Products (Sunbeam Products, Inc.); Koninklijke Philips N.V.; Panasonic Corporation; Remington Products (Spectrum Brands, Inc.); Oneisall, Inc.; Skull Shaver, LLC; Supreme Trimmer. |

One of the key drivers propelling the North American electric hair clipper and trimmer market is the growing awareness and acceptance of male grooming routines. Over the past decade, the perception of masculinity has undergone a transformation, with self-care becoming a central component. From beard styling to intricate hair fading, the modern man has embraced grooming as a part of his daily regimen. This change has been fueled by aggressive marketing by grooming brands, celebrity endorsements, influencer campaigns on social media, and the normalization of aesthetic maintenance among men.

Brands like Philips and Wahl have tapped into this demographic by offering grooming kits specifically designed for male users, often bundling them with beard combs, ear and nose trimmers, and skin-friendly blades. According to surveys, men aged 20-40 across urban U.S. cities spend more than ever on grooming tools, and this has directly contributed to the rise in sales of electric clippers and trimmers. As male grooming continues to break stereotypes and evolve, the market is likely to benefit from sustained growth in demand.

Despite the robust market growth, price sensitivity remains a significant restraint for the North American electric hair clipper and trimmer industry. Many consumers, especially in the lower-income segment or first-time users, are hesitant to invest in premium grooming devices that often cost upwards of $100. This hesitation is particularly observed in semi-urban and rural populations, where cheaper manual razors or low-cost alternatives are still in use. Additionally, the influx of unbranded or counterfeit products in online marketplaces has also eroded the trust of some consumers, affecting the credibility and pricing strategies of established brands.

Furthermore, the high frequency of technological upgrades prompts some users to delay purchases in anticipation of better models at similar prices. This price-value evaluation often affects the buying decision, especially among younger consumers who weigh brand credibility against affordability. For market players to address this challenge, tiered pricing strategies and value-based offerings are essential.

The burgeoning pet grooming sector presents a lucrative opportunity for the electric clipper and trimmer market in North America. The U.S. and Canada are home to a massive pet population, with dogs and cats being the most common. According to the American Pet Products Association, U.S. pet owners spent over $10 billion on pet grooming and boarding services in 2024, reflecting the growing focus on pet hygiene and aesthetics. Electric clippers designed specifically for pet fur—featuring low noise operation, hypoallergenic blades, and comfort-focused designs—have become highly sought after.

Major brands such as Andis and Wahl have introduced dedicated product lines for pet grooming, with features tailored for different coat types, lengths, and pet sizes. For example, in February 2024, Wahl launched a new “Pet Pro Clipper Kit” designed for at-home pet grooming, receiving positive consumer reviews for affordability and performance. The increasing trend of pet humanization and DIY grooming at home further accelerates this market opportunity. With pet owners keen on ensuring comfort and care for their furry companions, the pet grooming segment is anticipated to become a substantial contributor to the overall electric clipper and trimmer market in North America.

The electric hair clippers segment held the largest revenue share of 54.6% in 2023. Hair clippers, with their robust motor capacity and wide blade attachments, are ideal for bulk hair removal and basic trimming, making them a staple tool for professional stylists and at-home users alike. The demand for clippers surged during the COVID-19 pandemic when salons were closed and self-grooming became the norm. Manufacturers such as Wahl, Oster, and Panasonic have capitalized on this surge by launching user-friendly clipper kits with tutorials and guides.

On the other hand, hair trimmers are anticipated to be the fastest-growing segment, driven by their versatility and precision. Trimmers are lightweight, offer better control for facial grooming, and are ideal for maintaining detailed styles like beard contours, mustaches, and sideburns. The popularity of beards and short stubble styles has made electric trimmers a must-have grooming tool. The ability to use them on-the-go, coupled with features such as USB charging, waterproof casing, and titanium blades, has positioned trimmers as the grooming tool of choice among millennials and Gen Z consumers.

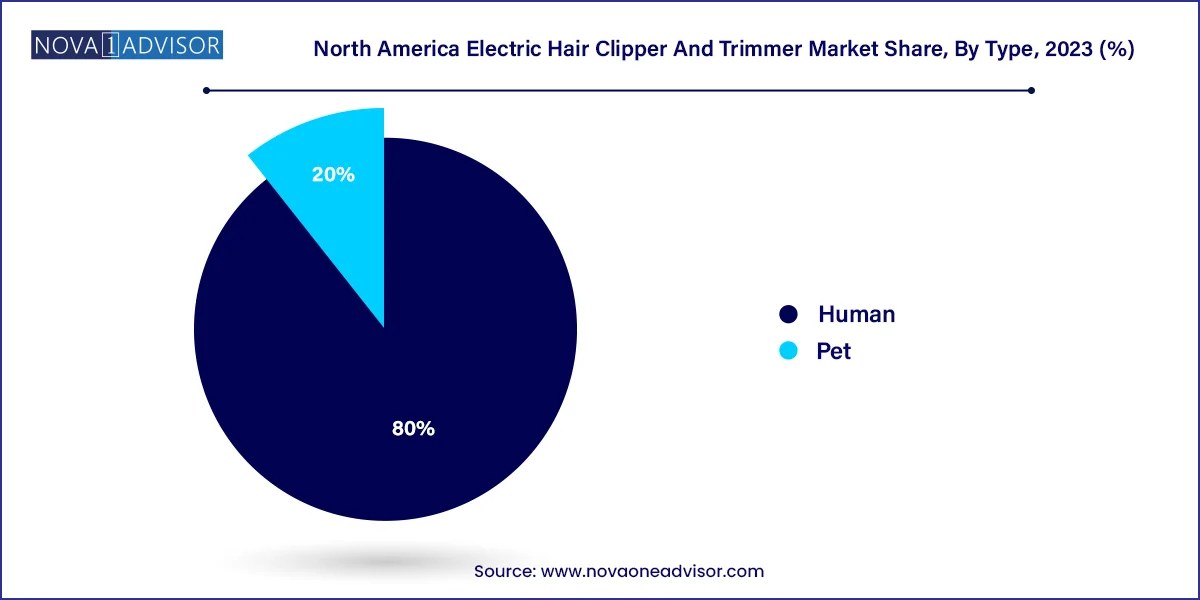

Based on type, the human electric hair clipper & trimmer segment accounted for the largest share 80.0% in 2023. Most of the product development, marketing strategies, and retail sales have been historically aligned with human grooming needs. From buzz cuts to detailed trims, the demand for reliable, precise, and durable tools continues to grow. Brands heavily invest in creating ergonomic designs, hypoallergenic blades, and skin-friendly materials for human application, contributing to this segment's dominance.

Conversely, the pet segment is poised to be the fastest-growing, supported by the increasing rate of pet adoption and awareness of pet hygiene. Dog and cat owners have become more conscious of fur management and the need for frequent grooming, especially during seasonal shedding. Pet grooming salons, mobile grooming vans, and DIY grooming kits have contributed to this trend. With low-noise motors and pet-safe blades, grooming brands have effectively targeted this rising demand. The trend is especially prominent in urban households in the U.S., where pets are considered part of the family and receive similar grooming attention as humans.

Sales through retail channels accounted for the largest market share in 2023. Consumers prefer in-store purchases for grooming products due to the ability to physically test products, seek expert advice, and evaluate build quality. Retailers like Target, Walmart, and Best Buy offer a wide variety of electric trimmers and clippers, often bundled with grooming kits and discounts. Specialty grooming outlets also offer curated selections for professionals, which has maintained the retail segment's stronghold.

However, online distribution is emerging as the fastest-growing segment, propelled by changing consumer behavior and convenience. Online platforms like Amazon, eBay, and company-specific websites have made a wide variety of products accessible with competitive pricing, user reviews, and doorstep delivery. Subscription-based models, virtual try-ons, and influencer-led promotions have further accelerated online adoption. With high internet penetration and growing trust in e-commerce, this channel is expected to outperform traditional retail in the coming years, especially for repeat and value-added purchases.

United States

The U.S. dominates the North American electric hair clipper and trimmer market, attributed to its large grooming-conscious population and well-established salon industry. Grooming is embedded in American culture, and with the surge of social media trends and YouTube tutorials, at-home grooming has received a significant push. Leading brands like Andis, Wahl, and Philips have dedicated product lines for the U.S. market, featuring rugged designs and multi-voltage adaptability. U.S. consumers prioritize features like cordless operation, waterproofing, and fast charging—preferences that have guided innovations in this region.

Additionally, the U.S. pet grooming market significantly contributes to the demand for clippers and trimmers. With rising pet ownership and demand for home grooming kits, companies have introduced dedicated SKUs for pets. The proliferation of barbershops, increasing demand for self-care products among men, and high digital penetration for e-commerce make the U.S. a hotspot for electric grooming product innovation and sales.

Canada

Canada presents a high-growth potential in the regional market, driven by an increasing focus on health, wellness, and self-presentation. Canadian consumers are particularly inclined toward eco-friendly and energy-efficient grooming devices. Urban areas like Toronto and Vancouver show high consumer interest in ergonomic, quiet-operation trimmers. Moreover, the bilingual packaging and marketing strategies (English and French) adopted by brands show their responsiveness to Canada's diverse consumer base.

Pet grooming is also gaining traction in Canada, with a notable rise in pet salons and mobile grooming services. Canadian consumers value quality and safety in grooming tools, and many are shifting towards premium grooming kits. The strong digital ecosystem has supported the expansion of online sales channels, giving brands an effective way to reach a wider consumer base.

February 2024 – Wahl Clipper Corporation launched its “Pet Pro Clipper Kit” designed for DIY home pet grooming, targeting U.S. and Canadian households with pets.

November 2023 – Philips Norelco announced its new “Multigroom 9000” series with self-sharpening stainless steel blades and advanced lithium-ion battery technology.

August 2023 – Andis Company unveiled the “reVITE Cordless Clipper” in North America, a lightweight clipper aimed at professionals, featuring a high-speed rotary motor and adjustable blades.

June 2023 – Conair’s BaBylissPRO line expanded its trimmer offerings with ergonomic designs specifically created for fade and detail work in professional salons.

April 2023 – Panasonic introduced a new line of beard trimmers with precision dial settings and waterproof build, focusing on the tech-savvy urban male demographic.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America electric hair clipper & trimmer market

Product

Type

Distribution Channel

Country