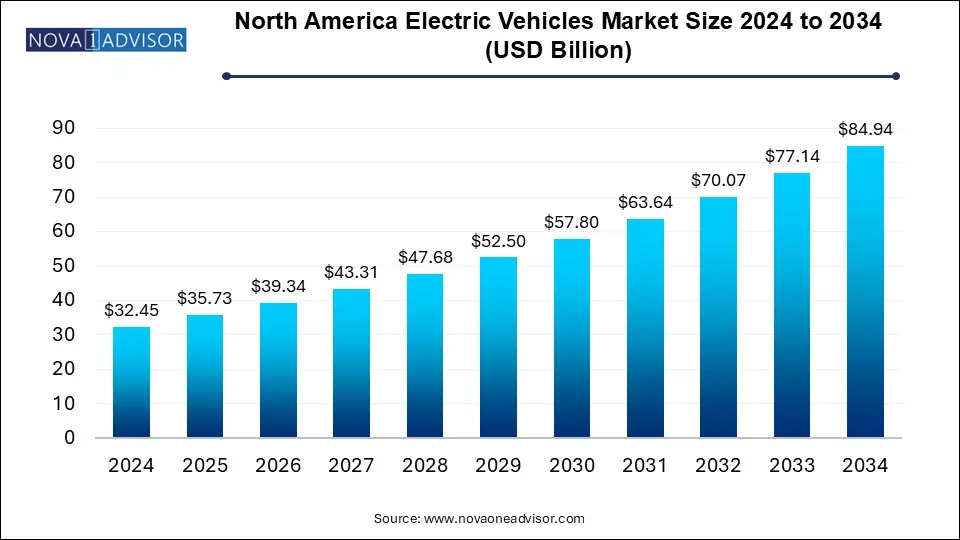

The North America electric vehicles market size was exhibited at USD 32.45 billion in 2024 and is projected to hit around USD 84.94 billion by 2034, growing at a CAGR of 10.1% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 35.73 Billion |

| Market Size by 2034 | USD 84.94 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Vehicle, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | BYD Motors Inc.; Daimler Truck AG; Ford Motor Company; General Motors; Lucid; MITSUBISHI MOTORS CORPORATION; Nissan Motor Co., Ltd.; Tesla; TOYOTA MOTOR CORPORATION; Volkswagen Group |

This growth can be attributed to supportive government policies and incentives promoting the adoption of electric vehicles (EVs). The U.S. government has implemented various initiatives, such as tax credits and rebates, to make EVs more affordable for consumers. In addition, ambitious targets such as having 50% of all new vehicle sales be zero-emission vehicles (ZEV) by 2030 further underscore the commitment to transitioning toward electric mobility. These policies encourage consumers to consider EVs while driving manufacturers to invest in EV technology and infrastructure.

Advancements in battery technology are another key factor propelling the North America electric vehicles industry. The continuous reduction in battery costs and improvements in energy density have made EVs more accessible and practical for a wider audience. Moreover, as battery prices are projected to decline significantly in the coming years, manufacturers can offer EVs at competitive prices while enhancing their performance and range. This technological progress alleviates consumer concerns about range anxiety and charging times, making EVs more attractive than traditional internal combustion engine vehicles.

Consumer demand for sustainable transportation is also driving the growth of the North America electric vehicles industry. Increasing awareness of environmental issues and the desire for cleaner alternatives to fossil fuel-powered vehicles are prompting consumers to shift toward electric mobility. Furthermore, rising gasoline prices and the potential for long-term cost savings associated with lower operating and maintenance expenses further incentivize this transition. The expansion of charging infrastructure across urban and suburban areas addresses accessibility concerns, making it easier for consumers to adopt EVs as their primary mode of transportation.

Hence, the North America electric vehicles industry is set for robust growth due to a combination of supportive government policies, advancements in battery technology, and rising consumer demand for sustainable transportation options. These factors create a conducive environment for the widespread adoption of EVs, positioning the market for significant expansion in the coming years as consumers and manufacturers embrace the shift toward electrification in mobility.

The battery electric vehicles (BEVs) segment dominated the North America electric vehicle market with a revenue share of 75.5% in 2024. This dominance can be attributed to the increasing consumer preference for ZEVs driven by heightened environmental awareness. In addition, advancements in battery technology have improved the range and affordability of BEVs, making them more appealing to a broader audience. Furthermore, the expansion of charging infrastructure across urban and rural areas has alleviated concerns about charging accessibility. The growing availability of government incentives has also significantly encouraged consumers to choose EVs.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is anticipated to experience the highest CAGR. This growth can be attributed to increasing consumer demand for vehicles that offer both electric and gasoline power, providing flexibility for longer trips. Moreover, advancements in battery technology are enhancing the performance and efficiency of PHEVs, making them more appealing to a broader audience. In addition, government incentives and environmental concerns are further propelling the adoption of PHEVs as a sustainable transportation option.

The Passenger Cars and Light Trucks (PCLT) segment dominated the market with the largest share of 98.0% in 2024. This growth can be attributed to growing consumer inclination toward practical vehicles, especially SUVs and pickup trucks, which have seen a rise in demand. While passenger cars remain important, their sales have decreased as more consumers choose light trucks for enhanced utility and space. In addition, technological advancements and features in these vehicles improve their appeal. Hence, the PCLT segment is set to maintain its dominance in the evolving North America electric vehicles industry.

The commercial vehicle segment is anticipated to experience the fastest CAGR over the forecast period. This growth is attributable to increasing demand for electric trucks and vans in the logistics and transportation sectors. In addition, government regulations aimed at reducing emissions encourage businesses to adopt electric commercial vehicles. Moreover, advancements in battery technology are enhancing the viability of electric options for commercial use, further supporting market expansion.

U.S. Electric Vehicles Market Trends

The U.S. electric vehicles market accounted for an 81.9% revenue share as of 2024. This dominance can be attributed to several factors, such as government incentives, expanding EV infrastructure, and growing consumer demand for sustainable transportation solutions. The country’s well-established automotive industry has embraced innovation, with leading manufacturers and startups producing various EV models to cater to diverse consumer needs. In addition, federal- and state-level tax credits and subsidies have accelerated EV adoption. Moreover, the government’s focus on reducing carbon emissions and promoting clean energy further boosts the EV market. As advancements in battery technology continue to enhance vehicle performance and affordability, the U.S. market is expected to experience significant growth.

Canada Electric Vehicles Market Trends

The Canada electric vehicles market is anticipated to grow at the highest CAGR over the forecast period, driven by increasing government incentives and rising consumer interest in sustainable transportation. Canada’s EV adoption is gaining momentum, supported by federal programs such as the ZEV initiative, which offers rebates for EV purchases. For instance, in 2023, EV registrations in Canada increased by 18.3% compared to the previous year, reflecting growing consumer confidence and expanding infrastructure. The development of nationwide charging networks and investments in clean energy sources further support this growth. With automakers introducing new models tailored to Canadian driving conditions and policies encouraging long-term adoption, the EV market in Canada is expected to witness significant expansion in the coming years.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America electric vehicles market

By Product

By Vehicle

By Country