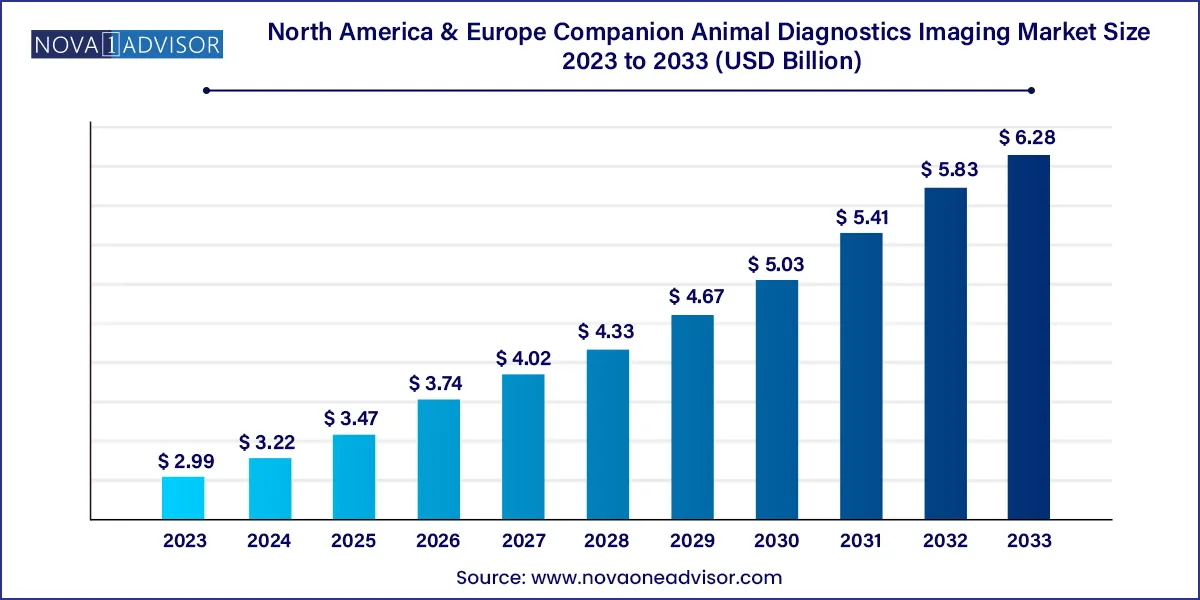

The North America & Europe companion animal diagnostics imaging market size was exhibited at USD 2.99 billion in 2023 and is projected to hit around USD 6.28 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2024 to 2033.

The North America and Europe companion animal diagnostic imaging market represents a rapidly evolving sector within veterinary healthcare. The increasing humanization of pets has dramatically influenced the demand for advanced diagnostic modalities to ensure better health outcomes for companion animals. Pet owners are no longer content with symptomatic treatments; instead, they demand precision diagnostics akin to human healthcare. This rising awareness and expectation have encouraged veterinary clinics and hospitals to adopt cutting-edge imaging technologies.

The market encompasses a wide array of diagnostic imaging solutions such as X-rays, ultrasound, MRI, CT, and ECG/EKG. These modalities help in accurately diagnosing conditions related to cardiology, orthopedics, oncology, and internal medicine. In both North America and Europe, governments and veterinary associations have actively promoted animal health, further driving the adoption of diagnostic imaging services. Additionally, the growing number of veterinary clinics, specialized hospitals, and academic research institutes focused on animal health contribute to market expansion.

Both continents are seeing increasing investments from imaging equipment manufacturers, software developers, and telemedicine providers. As pet insurance coverage rises and disposable income for pet care increases, the demand for better diagnostic outcomes propels the market forward. The integration of imaging with cloud-based PACS and teleconsultation services further enhances service accessibility and efficiency.

Expansion of Portable Imaging Devices: The rising demand for handheld and portable ultrasound and X-ray devices is reshaping field diagnostics and home-based veterinary services.

Telemedicine and Teleradiology Growth: Tele-imaging platforms that allow remote consultations and radiologic interpretations are increasingly favored, particularly in rural and underserved areas.

Rise in MRI and CT Adoption: Advanced imaging techniques like MRI and multi-slice CT are becoming more accessible in high-end veterinary centers.

Integration of AI in Diagnostic Imaging: Artificial Intelligence is being deployed for image analysis, anomaly detection, and diagnosis support, reducing human error and speeding up workflows.

Cloud-based PACS Proliferation: There is a significant shift toward cloud-enabled Picture Archiving and Communication Systems for data storage and sharing.

Training and Education Emphasis: Vendors and veterinary institutions are increasingly offering educational services to help professionals become proficient in advanced imaging technologies.

Increased Use of Diagnostic Imaging in Emergency and Critical Care: Vets are relying more on imaging modalities for quick decision-making in trauma and acute illness scenarios.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.22 Billion |

| Market Size by 2033 | USD 6.28 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Animal Type, Solutions, Application, End-use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America And Europe |

| Key Companies Profiled | IDEXX Laboratories, Inc.; SOUND; Heska Corp.; ESAOTE SPA; Canon Medical Systems Corp.; Siemens Healthcare Ltd.; FUJIFILM Holdings America Corp.; Hallmarq Veterinary Imaging; Carestream Health; Agfa-Gevaert Group |

One of the most compelling drivers in the North America and Europe companion animal diagnostic imaging market is the increasing humanization of pets. Pet owners increasingly view their animals as family members and are therefore more willing to spend on advanced diagnostics and treatments. According to the American Pet Products Association, U.S. pet care spending reached over $136 billion in 2024, with diagnostics and treatments forming a significant portion of this expenditure. Similarly, European countries like Germany and the UK have also seen a steady increase in veterinary healthcare investments. This trend has directly impacted the demand for diagnostic imaging, encouraging clinics to adopt sophisticated equipment like portable ultrasounds, digital X-rays, and MRI scanners to offer the best possible care.

Despite the promising growth trajectory, the market faces a significant restraint in the form of high capital and operational costs associated with diagnostic imaging equipment. Advanced imaging modalities such as MRI and CT scanners entail not only a high purchase cost but also substantial maintenance and operating expenses. Smaller clinics often find it financially unviable to invest in such equipment, limiting accessibility. Furthermore, pet owners without comprehensive insurance coverage may find diagnostic imaging prohibitively expensive, which can result in underutilization of available services. This cost barrier hinders widespread adoption, especially in rural or economically constrained regions within both continents.

The rapid evolution of veterinary telemedicine and teleradiology presents a remarkable growth opportunity. With the integration of digital imaging and cloud-based PACS, veterinarians can now transmit diagnostic images to specialists located remotely for prompt analysis and consultation. This is especially beneficial in areas where access to advanced veterinary services is limited. Companies like VetCT and Antech Imaging Services are pioneering these solutions, offering 24/7 radiologic interpretation services. Telemedicine not only reduces operational costs for clinics but also expands access to specialized expertise, enabling timely and effective treatments. The ongoing digital transformation in veterinary care is expected to continue driving demand for imaging services integrated with remote consultation features.

Dogs dominated the animal type segment, accounting for the highest number of diagnostic imaging procedures across North America and Europe. Dogs are more prone to orthopedic issues, cancers, and cardiovascular conditions, making them frequent subjects for imaging diagnostics. Their relatively higher ownership rates, coupled with increasing expenditure on pet wellness, contribute to their dominant position. For example, hip dysplasia and intervertebral disc disease are common among aging or large-breed dogs, necessitating repeated imaging over their lifetime. Additionally, many pet insurance plans in these regions offer better coverage for canine diagnostics, encouraging early and frequent imaging assessments.

Cats are anticipated to be the fastest-growing segment within the animal type category. While cats are often perceived as low-maintenance, awareness is rising about chronic diseases in felines that require diagnostic imaging, such as kidney disease, tumors, and dental disorders. Moreover, the growing trend of indoor cats has led to increased focus on early diagnosis and preventive care. Cat-specific imaging techniques and equipment tailored for their smaller anatomy have started to emerge, making diagnostics more accessible and less stressful for both pets and owners.

Equipment led the solutions segment, especially digital radiography and ultrasound systems. Fixed and mobile digital radiography systems are increasingly replacing conventional film-based X-rays due to their faster image acquisition, improved image quality, and ease of storage. Ultrasound, particularly handheld and portable units, has seen high adoption in both clinic and home-based settings. These systems are critical for non-invasive diagnosis of soft tissue, cardiac, and abdominal conditions. With companies like Mindray and Esaote launching vet-specific imaging devices, the equipment segment continues to thrive.

Services are projected to be the fastest-growing sub-segment, driven by the rise of teleradiology, support services, and diagnostic imaging as a service. Clinics with limited infrastructure now rely on outsourced imaging interpretation and mobile imaging units. Diagnostic imaging services allow smaller hospitals to offer high-end imaging without incurring large capital investments. Educational services, including certifications and hands-on workshops, are also expanding rapidly, contributing to improved skills and service offerings among veterinary professionals.

Orthopedics and Traumatology dominated the application segment, with a large number of diagnostic imaging procedures aimed at identifying fractures, joint issues, and skeletal abnormalities. Dogs and horses, in particular, are susceptible to musculoskeletal disorders requiring precise diagnosis through X-rays and CT scans. Orthopedic imaging also plays a vital role in pre-surgical planning and post-operative recovery assessments. This segment continues to expand with the adoption of 3D imaging and AI-based analysis.

Oncology is emerging as the fastest-growing application area in companion animal diagnostics. Rising cancer prevalence among pets and the increasing availability of advanced imaging modalities like MRI and CT have made oncology diagnostics more feasible. Early detection of tumors and metastasis has become a clinical priority, especially in aging pets. Veterinary oncologists increasingly use imaging to guide biopsy procedures, monitor treatment progress, and perform surgical mapping, fueling demand in this segment.

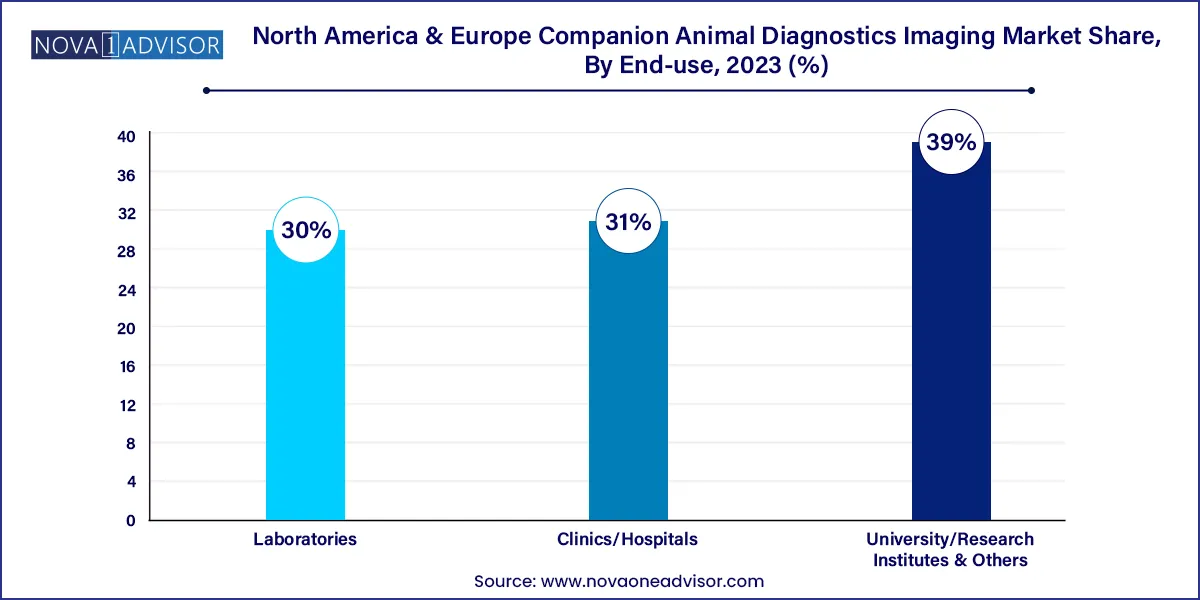

Clinics and Hospitals are the dominant end-users in this market, accounting for the bulk of imaging procedures. These settings typically have the infrastructure, skilled personnel, and equipment required for comprehensive diagnostic evaluations. Moreover, the trend of multi-specialty veterinary hospitals is gaining traction, offering a range of services from diagnostics to surgery and rehabilitation under one roof. Urban centers across North America and Europe have seen a proliferation of such facilities.

University and Research Institutes & Others are expected to be the fastest-growing end-use segment, driven by increased research on animal diseases and the development of new diagnostic technologies. Veterinary schools and academic hospitals are often the first to adopt high-end imaging modalities for educational and research purposes. These institutions play a crucial role in validating and standardizing imaging protocols, making them key contributors to the market's growth.

The U.S. remains the largest market in North America due to its advanced veterinary infrastructure and high pet ownership rates. Pet parents in the U.S. are highly invested in preventive care and early diagnosis, leading to widespread adoption of imaging services. Innovations such as mobile vet clinics and home-based diagnostics are increasingly popular, especially in suburban areas.

Canada is experiencing steady growth in companion animal diagnostics, driven by a robust network of veterinary professionals and increasing awareness among pet owners. Regulatory support for veterinary innovation and growing pet insurance penetration are additional factors bolstering the market.

Germany leads the European segment due to its dense network of veterinary clinics, high disposable income, and strong cultural emphasis on pet welfare. Many clinics in Germany offer advanced imaging technologies, including cone-beam CT and portable ultrasound.

The UK market is growing rapidly with increased adoption of digital solutions and AI-enhanced imaging tools. Initiatives by organizations such as the Royal College of Veterinary Surgeons have improved training and accessibility of advanced diagnostic tools.

France has seen growth through public-private partnerships in veterinary diagnostics. Several universities and research bodies have collaborated with industry leaders to promote advanced imaging research and service delivery.

March 2025: IDEXX Laboratories introduced a new AI-powered radiology suite for faster image interpretation and real-time anomaly detection, targeting clinics across North America and Europe.

February 2025: Esaote launched its Vet-MR Grande system tailored for small animal imaging, enhancing soft tissue resolution and ease of use in mid-sized clinics in Germany and the UK.

January 2025: VetCT expanded its tele-radiology services into France, offering 24/7 diagnostic imaging support to rural and suburban veterinary clinics.

December 2024: Mindray unveiled a new line of portable ultrasound devices with cloud integration capabilities for remote diagnostics and specialist collaboration.

November 2024: Antech Diagnostics opened its fifth veterinary imaging hub in Canada to cater to rising demand for MRI and CT imaging in pets.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America & Europe companion animal diagnostics imaging market

Animal Type

Solutions

Application

End-use

Regional