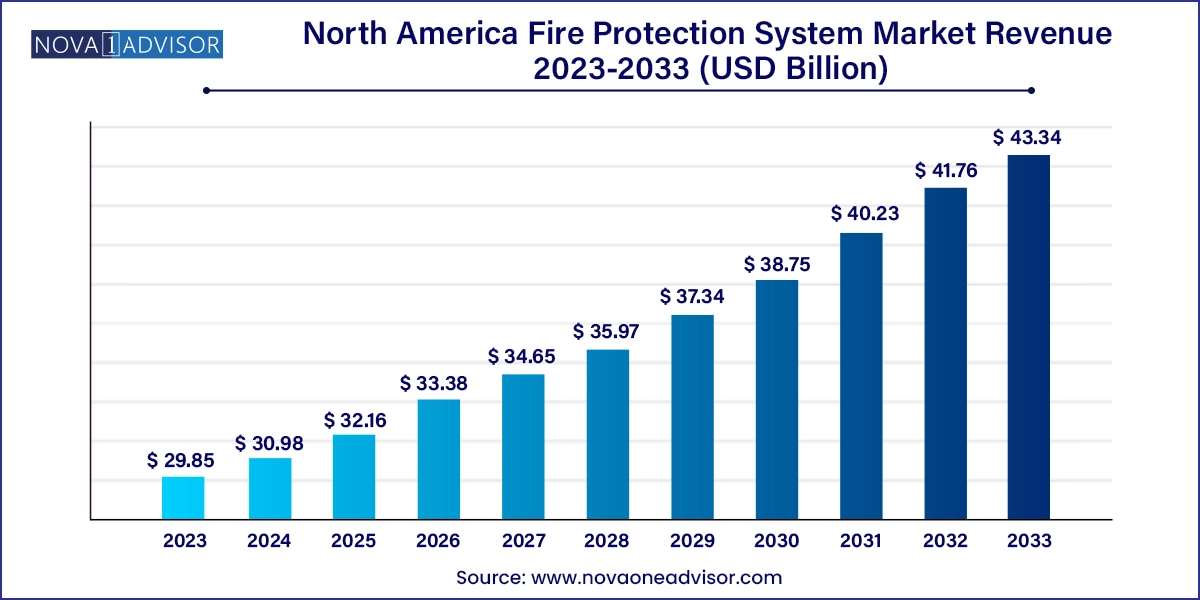

The North America fire protection system market size was exhibited at USD 29.85 billion in 2023 and is projected to hit around USD 43.34 billion by 2033, growing at a CAGR of 3.8% during the forecast period 2024 to 2033.

The North America fire protection system market has become a critical part of the region’s broader safety infrastructure, encompassing a wide array of technologies and services that detect, prevent, suppress, and respond to fire hazards. With urbanization, industrial expansion, and growing public and occupational safety expectations, the market has expanded beyond traditional fire suppression equipment to include intelligent fire detection systems, real-time data analytics, automated suppression systems, and comprehensive managed services.

Fire protection systems today are essential in residential, commercial, and industrial environments—ranging from smart homes and high-rise offices to manufacturing plants, oil refineries, and data centers. The stakes are high: fires in the U.S. alone cause thousands of deaths and billions of dollars in property damage annually, according to the National Fire Protection Association (NFPA). Governments, insurance bodies, and regulatory agencies across the region have responded by enacting rigorous fire safety codes and standards—such as the National Fire Alarm and Signaling Code (NFPA 72), and the International Building Code (IBC)—mandating implementation of certified fire protection systems in almost all built environments.

The evolution of fire protection systems is increasingly influenced by technology integration, such as IoT (Internet of Things), wireless communication, and AI-based analytics. These advancements allow systems to not only detect fires earlier but also to provide real-time alerts, dynamic risk assessments, and automated decision-making. As a result, businesses, property managers, and facility operators are investing more in holistic fire protection strategies that cover prevention, detection, suppression, and evacuation.

Integration of IoT and AI in Fire Safety: Smart sensors, real-time data analytics, and predictive maintenance capabilities are transforming fire detection and response systems.

Rise of Wireless and Networked Fire Detection Systems: Wireless systems are increasingly adopted in retrofits and heritage buildings due to ease of installation and scalability.

Cloud-Based Fire System Monitoring: Remote access and control of fire safety systems through cloud-based platforms are gaining momentum, especially in commercial infrastructure.

Increased Demand for Green and Waterless Suppression Systems: Eco-friendly solutions such as clean agent systems and water mist suppression are growing in popularity in data centers and high-value asset protection.

Building Information Modeling (BIM) for Fire System Design: BIM integration allows engineers to simulate fire risk and ensure system compatibility before installation.

Emphasis on Interoperable and Integrated Safety Systems: Fire protection systems are being integrated with security, HVAC, and lighting systems for unified building management.

Expansion of Fire Safety Regulations in Canada: The Canadian government is increasing investments in smart city fire safety and modernizing its National Building Code (NBC).

Growth in Retrofitting and Renovation Projects: Aging infrastructure and buildings are being retrofitted with modern fire protection systems to comply with updated fire codes.

| Report Coverage | Details |

| Market Size in 2024 | USD 30.98 Billion |

| Market Size by 2033 | USD 43.34 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Service, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada |

| Key Companies Profiled | Johnson Controls; Honeywell International, Inc.; Raytheon Technologies Corp.; Gentex Corp.; Siemens; Robert Bosch GmbH; Halma plc; Eaton; Hitachi, Ltd.; Iteris, Inc. |

One of the key drivers of the North America fire protection system market is the strong regulatory environment that compels compliance with detailed fire safety requirements. Agencies such as the NFPA, the International Code Council (ICC), and local building authorities mandate fire detection, suppression, and sprinkler systems in commercial and industrial buildings. For example, NFPA 13 governs the installation of fire sprinkler systems, while NFPA 72 standardizes fire alarm and signaling systems.

Such regulatory frameworks are not only enforced in new construction but also require ongoing inspections, maintenance, and, in some cases, retrofitting of outdated systems. The legal and financial risks associated with non-compliance—such as insurance denial, business interruption, and liability in case of fire events—make investment in fire protection systems a non-negotiable aspect of risk management. The increased focus on safety post-COVID-19, along with new environmental mandates on fire suppressant chemicals (like PFAS restrictions), has further strengthened this trend.

Despite the advantages, the market faces challenges related to the high initial costs and technical complexity of fire protection systems. Comprehensive solutions that include detection, suppression, response coordination, and cloud-based monitoring can be expensive, especially for small and mid-sized businesses. The cost of system design, permits, certified installation, periodic inspection, and potential disruption during installation (in the case of retrofits) can deter some building owners.

Furthermore, with growing system sophistication comes increased demand for trained personnel. Integration with building automation systems, cybersecurity protocols for IoT-connected devices, and adherence to evolving codes require continuous learning and resources. In regions with limited access to certified professionals or where budgets are constrained, adoption may lag despite regulatory pressure.

An emerging opportunity in the North America fire protection market lies in the growth of smart buildings and the broader trend of digital transformation in the built environment. Smart buildings integrate multiple systems—including lighting, HVAC, access control, and fire safety—into a unified platform managed by building management systems (BMS). In this context, fire protection systems are evolving from standalone safety mechanisms to data-generating, interconnected components of an intelligent infrastructure.

Opportunities abound in leveraging data from fire systems to predict failures, optimize maintenance schedules, and even proactively identify fire hazards before they escalate. Vendors that can offer interoperable, modular, and IoT-enabled fire systems with advanced analytics and remote diagnostics are poised to capture growing demand from facility managers, data center operators, hospitals, and smart cities across the U.S. and Canada.

Installation & design services dominate the fire protection services segment, accounting for the majority of project costs in both new builds and retrofit scenarios. Fire system designs must comply with local fire codes, NFPA standards, and insurance requirements. Proper installation, layout optimization, and interconnectivity with other building systems are critical to system efficacy. Installation and design services are in high demand, particularly as large commercial and industrial projects seek custom, compliant solutions.

Managed services are the fastest-growing, as more property owners shift toward outsourced fire system management. These services include remote monitoring, predictive maintenance, cloud analytics, and emergency response coordination. Subscription-based models offered by providers like Johnson Controls or Honeywell allow clients to maintain compliance and system performance without investing heavily in in-house expertise.

Commercial buildings lead in fire protection system adoption, supported by stringent codes for occupancy safety, business continuity, and insurance requirements. High-rise offices, malls, hotels, schools, and healthcare facilities are key verticals investing in advanced detection, suppression, and evacuation systems. With urban expansion and increasing public footfall, fire protection in commercial facilities remains a regulatory and operational priority.

The industrial segment is the fastest-growing, particularly in oil & gas, automotive manufacturing, chemical processing, and data center sectors. These environments pose higher fire risks due to flammable materials, complex machinery, and continuous operations. Suppression systems—such as foam-based, clean agent, and inert gas systems—alongside explosion-proof detectors, are being adopted to minimize fire-related downtime and safety hazards. North American industrial zones, especially in Texas, Alberta, and Ontario, are expanding fire protection investments to support operational safety.

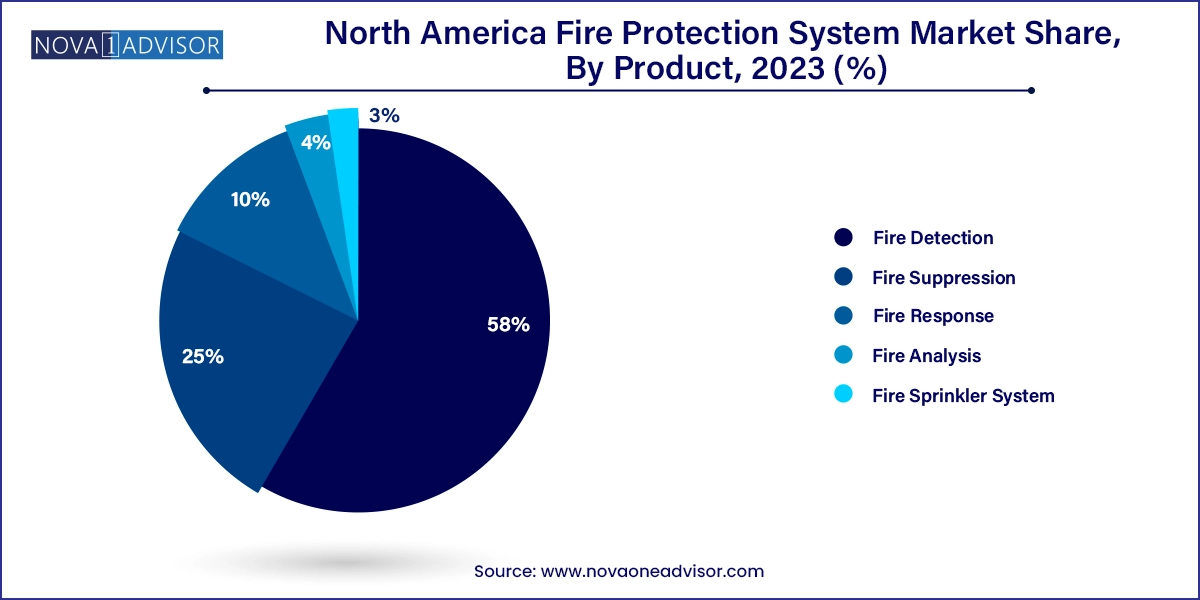

Fire detection systems dominated the market, owing to their foundational role in initiating the fire safety chain. Devices such as smoke detectors, heat sensors, gas sensors, and flame detectors are mandated in nearly all building types across North America. Technological innovation, including multi-sensor detection, addressable fire alarm panels, and AI-based pattern recognition, has enhanced the speed and accuracy of fire detection. Fire detection systems are the first line of defense and are installed in both high-risk industrial environments and low-risk residential settings, ensuring broad market penetration.

Fire analysis systems are the fastest-growing segment, driven by the increasing emphasis on data analytics and risk modeling. These systems collect and process incident data to understand the source and progression of fire events, aiding in root-cause analysis and system optimization. Fire analysis solutions are increasingly used in mission-critical environments such as oil refineries, transportation hubs, and power plants where real-time data is vital for proactive fire prevention and post-incident investigations.

The U.S. dominates the North America fire protection system market due to its robust infrastructure development, strict safety regulations, and early adoption of smart technologies. The presence of key industry players such as Honeywell, Johnson Controls, and Raytheon Technologies, coupled with a strong construction pipeline in commercial and industrial sectors, drives market leadership. The U.S. also leads in the retrofitting of aging infrastructure to comply with NFPA and IBC standards. High fire-related losses and strong insurance influence push property managers to maintain state-of-the-art systems. Urban areas like New York City, Chicago, and Los Angeles represent high-demand zones for integrated, high-end fire safety solutions.

Canada is experiencing significant growth in fire protection, driven by regulatory reforms and increasing investment in smart cities and industrial zones. The Canadian Building Code is continuously evolving, incorporating newer fire safety mandates, especially in provinces like British Columbia and Ontario. Government programs promoting resilient infrastructure and renewable energy facilities are also fueling demand for advanced fire detection and suppression systems. Additionally, the rise of modular construction and urban densification has led to wider implementation of wireless and scalable fire safety systems in residential and mixed-use buildings.

April 2024 – Honeywell launched its next-generation NOTIFIER® N16 fire alarm control panel series in North America, offering cloud-based monitoring, AI-enabled detection, and cybersecurity features for commercial applications.

February 2024 – Johnson Controls announced a $100 million investment in its new smart fire suppression R&D center in Milwaukee, focusing on eco-friendly agents and integrated platform development for industrial applications.

January 2024 – Siemens USA debuted its Cerberus® PRO wireless fire detection system at the NFPA Conference, designed for high-rise and retrofit markets with robust mesh connectivity and long battery life.

November 2023 – Halma’s subsidiary Apollo Fire Detectors partnered with a Canadian university to test AI-driven smoke detector algorithms for faster identification of slow-burning fires in healthcare facilities.

October 2023 – Minimax Viking launched an environmentally sustainable water mist system in partnership with a data center operator in Texas, designed to protect critical servers without collateral water damage.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America fire protection system market

Product

Service

Application

Country