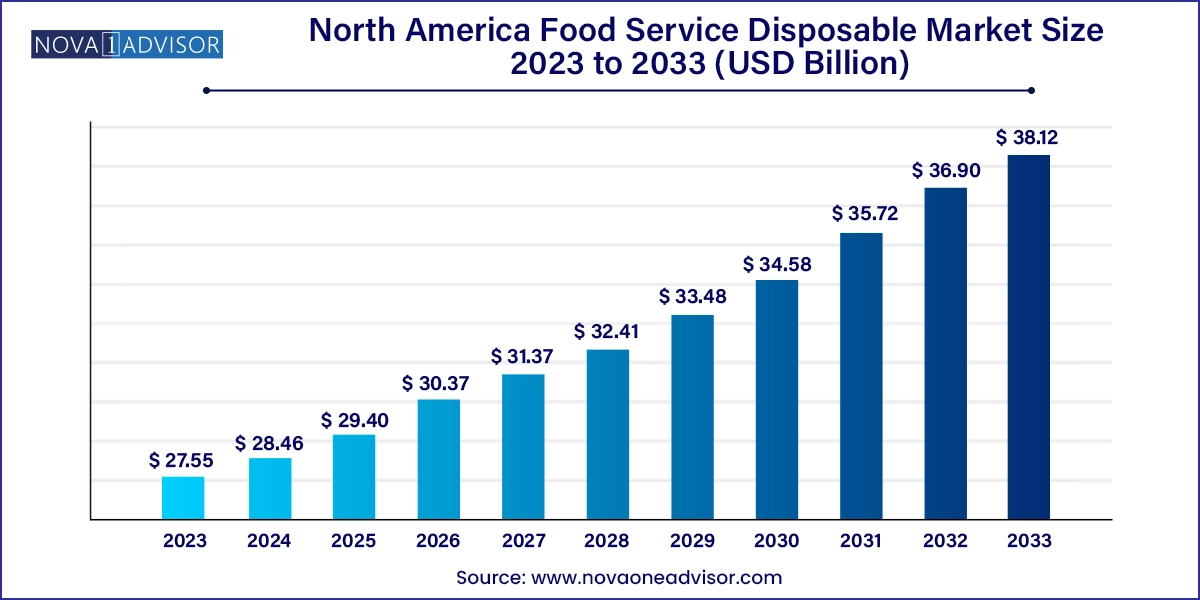

The North America food service disposable market size was exhibited at USD 27.55 billion in 2023 and is projected to hit around USD 38.12 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2024 to 2033.

The North America Food Service Disposable Market is a vital component of the region’s dynamic foodservice industry. This market includes a broad range of single-use tableware and packaging solutions such as plates, trays, containers, bowls, cutlery, and drinkware, typically made from materials like plastics, paperboard, fiber-based composites, and metals. These products are used extensively in various end-use sectors including quick-service restaurants (QSRs), full-service dining establishments, online food delivery platforms, and institutional cafeterias.

The demand for disposable foodservice products is largely driven by changing consumer eating habits, an increasing preference for convenience, and the expanding scope of online food delivery and takeout services. The COVID-19 pandemic further accelerated these trends, as hygiene and food safety became critical, pushing both consumers and businesses to favor individually packed, single-use items over reusable alternatives.

Moreover, eco-conscious consumer behavior, government regulations on plastic waste, and advancements in compostable materials have brought about a significant shift in the product mix. While plastic continues to dominate in terms of volume, alternatives such as fiber-based and biodegradable disposables are growing in popularity, reshaping procurement strategies and product innovation across the industry.

Rising Demand for Sustainable Packaging: Businesses are switching to biodegradable and compostable food service disposables to align with ESG goals and local plastic ban policies.

Growth of Online Food Delivery Ecosystem: Platforms such as Uber Eats, DoorDash, and Grubhub are fueling demand for durable, leak-resistant, and heat-retentive packaging solutions.

Innovation in Material Science: Manufacturers are investing in plant-based polymers, edible cutlery, and moldable fiber trays to create functional and eco-friendly alternatives.

Customization and Branding on Packaging: Restaurants and food service brands are increasingly personalizing disposables for brand visibility and customer engagement.

Shift Toward Lightweight and Stackable Designs: For operational efficiency and shipping cost reduction, many operators now prefer space-saving disposable products.

Regulatory Shifts Toward Plastic-Free Zones: Cities across the U.S. and Canada are implementing strict bans on EPS and single-use plastics, influencing material preferences.

Institutional Demand from Healthcare and Education Sectors: Schools, hospitals, and corporate cafeterias are increasingly adopting single-use packaging for safety and portion control.

| Report Coverage | Details |

| Market Size in 2024 | USD 28.46 Billion |

| Market Size by 2033 | USD 38.12 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Product, Application, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | Graphic Packaging International LLC; Sonoco Products Company; Sabert Corp.; Genpak LLC; Pactiv LLC; Inteplast Group; Anchor Packaging Inc.; Carlisle FoodService Products; GreenGood USA; Georgia-Pacific LLC; Amhil; Huhtamaki Oyj; Printpack; Dart Container Corp.; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc. |

A major driver propelling the North American food service disposable market is the explosive growth of food delivery and takeaway services. Changing urban lifestyles, increasing consumer preference for convenience, and the digitalization of food ordering platforms have significantly boosted the need for efficient, hygienic, and tamper-evident disposable packaging.

Platforms like DoorDash, Uber Eats, Postmates, and SkipTheDishes have enabled thousands of restaurants, including small and mid-sized establishments, to serve customers outside of physical premises. This shift has led to massive demand for microwave-safe containers, leak-proof bowls, double-walled cups, and biodegradable bags, especially in the U.S. and Canada where per capita online food ordering is among the highest globally.

Moreover, cloud kitchens and ghost restaurants that operate without dine-in facilities depend entirely on disposable packaging. As these models gain traction in urban hubs, they are likely to stimulate further innovation and volume growth in the disposables market.

Despite high demand, the market faces a significant restraint in the form of growing environmental scrutiny and evolving regulatory restrictions surrounding the use of non-biodegradable disposables, particularly those made of Expanded Polystyrene (EPS) and single-use plastics.

In North America, various jurisdictions including California, New York, British Columbia, and Montreal have introduced partial or complete bans on products like plastic straws, EPS containers, and polyethylene-lined cups. This patchwork of regulations increases complexity for manufacturers and distributors, who must adapt product offerings to comply with city- or state-specific bans.

Additionally, consumer pressure and brand sustainability pledges are pushing foodservice companies to phase out traditional disposables in favor of compostable alternatives. However, the higher cost of biodegradable and fiber-based materials, combined with limited composting infrastructure in many areas, poses a challenge for full-scale adoption.

A key opportunity lies in the development and adoption of fiber-based and compostable food service disposables, particularly in urban and environmentally conscious segments of the U.S. and Canada. With increased regulation of plastics and rising consumer preference for green alternatives, manufacturers can capitalize by offering certified compostable products that meet ASTM and BPI standards.

These alternatives include molded pulp trays, bamboo cutlery, sugarcane bagasse containers, and PLA-lined paper cups, which offer both functionality and eco-appeal. Quick-service giants like Chipotle, Starbucks, and McDonald’s are piloting these materials across North American locations, presenting huge opportunities for suppliers of biodegradable substrates.

Technological advances in barrier coatings, temperature resistance, and structural integrity are further reducing the performance gap between traditional plastics and fiber-based substitutes. Suppliers that can scale production while maintaining competitive pricing are well-positioned to thrive in this evolving landscape.

Plastic dominated the market, particularly variants like Polypropylene (PP), Polyethylene (PE), and Expanded Polystyrene (EPS), due to their affordability, durability, and moisture resistance. These materials have long been the go-to for fast food containers, drink cups, and cutlery in North America’s large QSR segment. PP and PE, known for their chemical resistance and light weight, are preferred in hot and cold beverage containers, while EPS remains widely used for foam cups and clamshells in regions without regulatory bans.

However, fiber-based materials are the fastest-growing segment, driven by mounting pressure to reduce single-use plastic pollution and improve compostability. Products made from sugarcane, cornstarch, and wheat fiber are gaining traction, especially for catering events, corporate cafeterias, and university dining services. Their natural texture and aesthetic appeal also align with the branding strategies of sustainable-focused food businesses.

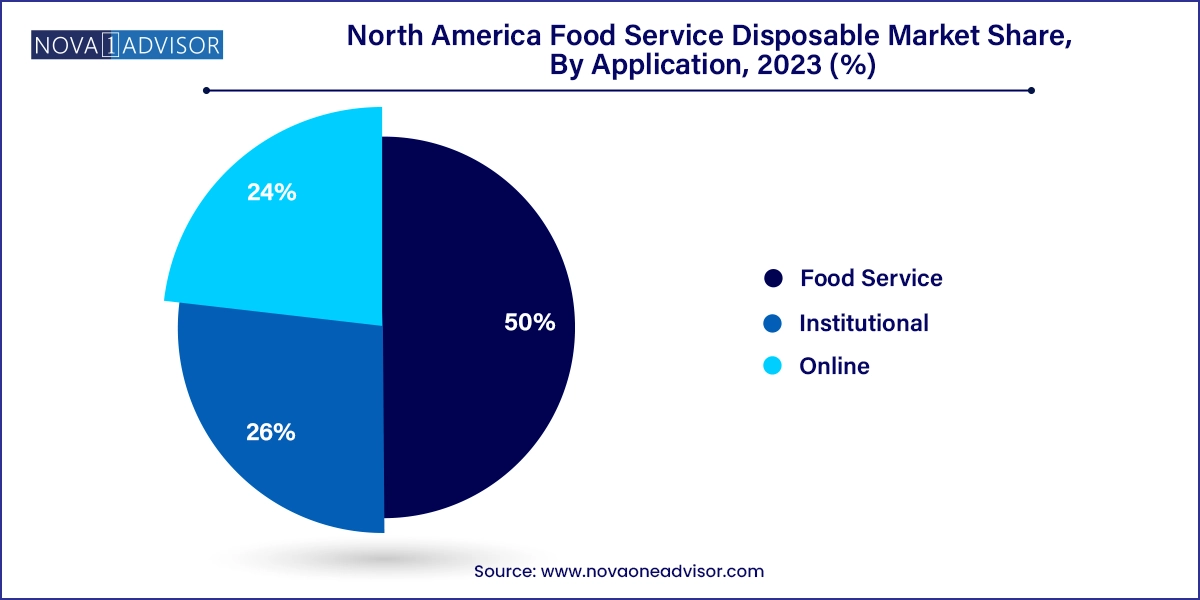

Quick service restaurants (QSRs) dominate the application segment, driven by volume sales, speed of service, and operational convenience. Chains like McDonald’s, Taco Bell, and Wendy’s rely heavily on disposable packaging for in-store and off-premise consumption. Their focus on throughput and cost efficiency ensures sustained demand for cutlery kits, paperboard cartons, and grease-resistant wraps.

Online food service is the fastest-growing segment, supported by third-party delivery platforms and the rise of ghost kitchens. This segment emphasizes packaging that maintains food temperature, resists leakage, and provides an unboxing experience that reflects brand identity. Tamper-proofing and sustainability certifications are also increasingly influencing packaging decisions in this space.

Cups and lids accounted for the largest share, owing to their ubiquitous use in cafes, fast food, and beverage outlets. From cold drink PET cups to insulated coffee cups with secure lids, this category sees massive daily consumption across North America. With the rise in mobile ordering and drive-thru culture, high-demand product innovation includes spill-resistant lids, sippy-style tops (to replace straws), and double-wall insulation designs.

Trays and containers are the fastest-growing product category, especially with the growth of delivery and takeaway services. Microwave-safe containers, tamper-proof packaging, and multi-compartment trays are in high demand, particularly among fast casual and ethnic food restaurants. In parallel, sushi, salad, and meal-prep containers are being redesigned using molded fiber and clear compostable PLA for transparency and aesthetics.

Corporate distributors lead the market, supplying large QSR chains, healthcare institutions, and retail foodservice providers with volume orders and customizable solutions. Their scale and logistics enable consistent pricing and compliance across multiple locations.

Direct distributors are the fastest-growing, particularly in the e-commerce space. Startups and local businesses prefer ordering directly from manufacturers or digital marketplaces for smaller, customized, or environmentally friendly batches. The rise of platforms like WebstaurantStore and Amazon Business is democratizing access to premium disposable options.

United States

The U.S. leads the North American food service disposable market, owing to its massive fast-food industry, deep penetration of delivery platforms, and large-scale institutional catering in schools, prisons, and military facilities. Regulatory movements such as California’s EPS ban and NYC’s plastic straw restrictions are reshaping product demand toward paper, bagasse, and bio-plastic alternatives. National chains are also centralizing procurement strategies to align with ESG commitments, boosting demand for certified compostable products.

Canada

Canada is seeing rapid change, particularly in British Columbia, Ontario, and Quebec, where bans on single-use plastics have taken effect. Many cities offer compost collection services, creating favorable conditions for paperboard and fiber-based packaging. The federal government's Zero Plastic Waste by 2030 initiative is prompting suppliers to accelerate R&D and reconfigure their material portfolios.

Mexico

In Mexico, demand is led by urban centers such as Mexico City, Monterrey, and Guadalajara, where food delivery apps and convenience dining are on the rise. Although environmental regulations are still evolving, local municipalities are beginning to implement bans on plastic bags and straws, creating market potential for economical fiber and paper-based disposables.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America food service disposable market

Material

Product

Application

Distribution Channel

Country