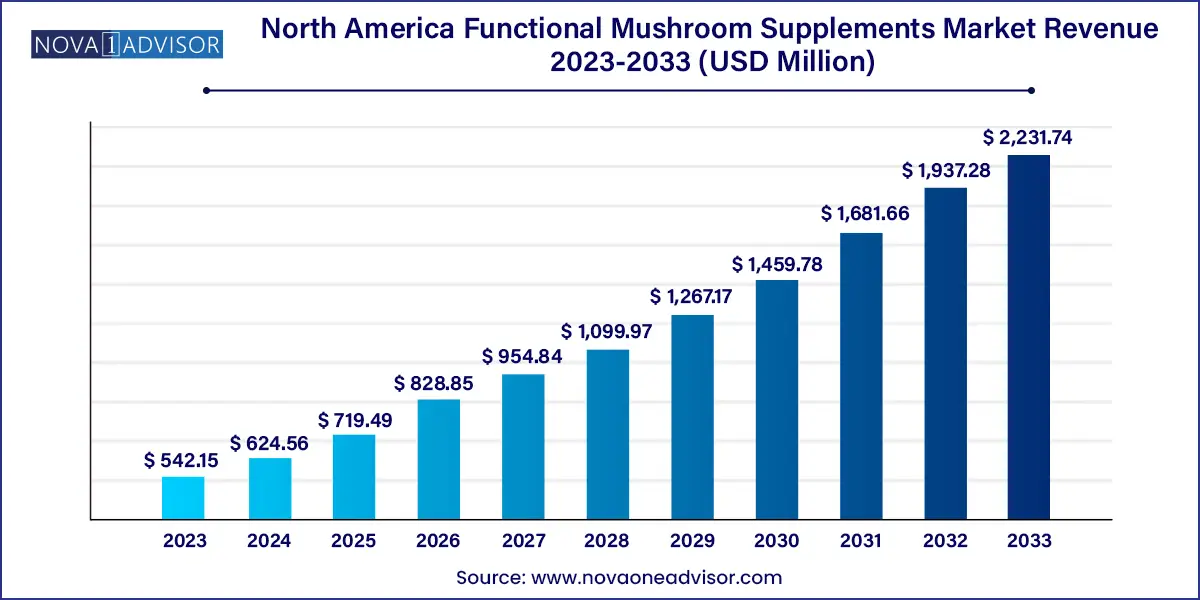

The North America functional mushroom supplements market size was exhibited at USD 542.15 million in 2023 and is projected to hit around USD 2,231.74 million by 2033, growing at a CAGR of 15.2% during the forecast period 2024 to 2033.

The North America functional mushroom supplements market is undergoing a remarkable transformation as consumers increasingly embrace holistic wellness and natural remedies. Functional mushrooms—species like Reishi, Chaga, Lion’s Mane, Cordyceps, and Turkey Tail—have entered the mainstream supplement space, driven by their wide-ranging health benefits, deep cultural histories, and growing scientific validation. These fungi are now being formulated into powders, capsules, extracts, gummies, and even ready-to-drink beverages to cater to modern consumer lifestyles and preferences.

Across the U.S., Canada, and Mexico, this once-niche market has evolved into a dynamic wellness segment, reflecting a broader shift toward plant-based, adaptogenic, and immunity-boosting alternatives. Functional mushroom supplements are marketed for their contributions to immune support, cognitive enhancement, stress relief, anti-inflammation, gut health, and even athletic performance. The popularity of nootropics and natural adaptogens has dovetailed with the functional mushroom movement, creating new demand channels across wellness, fitness, and mental health communities.

North America is uniquely positioned as a major consumer market for functional mushroom supplements due to its advanced dietary supplement ecosystem, high consumer health literacy, and growing interest in alternative medicine. Companies operating in this space range from long-standing herbal supplement manufacturers to new-age, digitally native wellness startups. Consumers are not just focused on efficacy—they are seeking transparency, clean-label ingredients, and personalized supplement experiences. As a result, the category has seen a proliferation of SKUs, including organic-certified powders, vegan gummies, liposomal sprays, and clinical-grade capsules.

Rise of Mushroom Nootropics: Cognitive enhancement through natural ingredients is pushing Lion’s Mane and Cordyceps into the spotlight as natural brain boosters and energy enhancers.

Increased Demand for Immune Support: Post-pandemic health consciousness has amplified interest in Reishi and Turkey Tail for their immunity-strengthening properties.

Clean Label and Organic Certification: Consumers prefer products with transparent sourcing, USDA organic certification, and no synthetic additives or binders.

Expansion of Functional Formats: Beyond capsules, the market is seeing growth in powders, liposomal sprays, and ready-to-mix single-serve sachets for convenience.

Celebrity and Influencer Advocacy: Functional mushroom brands are leveraging social media influencers, athletes, and wellness celebrities to reach a broader audience.

Mushroom Stacking and Synergistic Blends: Brands are combining different mushroom species or pairing them with other adaptogens (like ashwagandha or rhodiola) to target multiple health benefits.

E-commerce and D2C Boom: Online channels offer consumers easy access to niche brands, subscription-based delivery, and education-focused marketing.

Focus on Mental Health and Stress: As anxiety and burnout rise, mushroom-based stress-relief and mood-support formulations are gaining momentum.

| Report Coverage | Details |

| Market Size in 2024 | USD 624.56 Million |

| Market Size by 2033 | USD 2,231.74 Million |

| Growth Rate From 2024 to 2033 | CAGR of 15.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Form, Type, Function, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Four Sigmatic; Fungi Perfecti - Host Defence; Om Mushroom Superfood; Swanson; Mushroom Wisdom; Real Mushrooms; LifeCykel; New Chapter, Inc.; DIRTEA; Pure Essence Labs; Sun Potion |

The primary driver of the North America functional mushroom supplements market is the surge in consumer interest in holistic wellness and immunity-focused health solutions. The COVID-19 pandemic significantly shifted public perception toward preventive healthcare, spotlighting natural and plant-based ingredients with immune-boosting properties. Mushrooms like Reishi, Chaga, and Turkey Tail have long been used in traditional medicine systems for their immunomodulating effects, and this wisdom is now resonating with modern consumers.

Additionally, with rising rates of chronic stress, cognitive fatigue, and burnout, consumers are seeking non-pharmaceutical solutions that support whole-body health without the side effects associated with synthetic compounds. Functional mushrooms, backed by centuries of use and emerging clinical research, are positioned as credible, natural tools for health optimization. The trend toward self-care and self-diagnosis, aided by online education and wellness communities, continues to fuel demand for these supplements across age groups and lifestyles.

Despite promising growth, the functional mushroom supplements market is constrained by regulatory ambiguity and the absence of standardized quality assurance protocols. Unlike pharmaceuticals, dietary supplements in North America are regulated post-market, allowing inconsistencies in label claims, potency, and ingredient purity. As a result, many mushroom-based products vary in the presence of active compounds like beta-glucans or triterpenes, leading to potential efficacy discrepancies.

The market also suffers from terminology confusion—some products labeled as “mushroom extract” may use only mycelium (the root system), while others contain the fruiting body, which typically holds more active compounds. For consumers and healthcare professionals alike, this lack of standardization makes it difficult to compare brands or trust claims. Regulatory oversight from the FDA and Health Canada remains limited, and this has created an environment where substandard or misleading products can temporarily thrive, hindering consumer trust.

One of the most compelling opportunities in the North America functional mushroom supplements market lies in expanding product formats that align with consumer lifestyles. As users become more sophisticated in their supplement routines, the demand for convenience, personalization, and taste appeal is growing. This paves the way for novel delivery forms such as functional coffees infused with Lion’s Mane, pre-workout mushroom shots, calming nighttime Reishi teas, and gummies targeted at sleep or mood support.

Innovations in liposomal delivery and nanoencapsulation offer superior absorption and allow brands to offer clinical-grade performance in lifestyle-friendly formats. Furthermore, companies that integrate functional mushrooms into existing health rituals—such as breakfast smoothies, daily coffee, or evening wind-down routines—can embed their products into long-term behavior. This opens avenues for customer loyalty, subscription models, and cross-sell opportunities with other wellness products. Functional mushroom supplements are no longer limited to the health food aisle—they are making their way into mainstream kitchens and daily routines.

Capsules & tablets dominated the product form segment, owing to their ease of use, accurate dosing, and broad market familiarity. Most consumers associate capsules with medicinal or therapeutic intent, which lends credibility to mushroom-based formulations. Capsules are also easy to transport, odorless, and suited for multi-mushroom stacks. Major players such as Host Defense and Gaia Herbs continue to offer standardized capsule lines that emphasize bioavailability, third-party testing, and traceability. These products are often preferred by older consumers or those with established supplement routines seeking clinical-grade support for immune health or cognition.

Gummies have emerged as the fastest-growing form, especially among younger demographics and new entrants to the supplement market. Functional mushroom gummies, particularly those offering calming or energy-boosting effects, appeal to consumers seeking convenience, flavor, and a non-pharmaceutical experience. Companies like Plant People and Troop have launched mushroom gummy lines targeting mood, focus, and immunity. Gummies also support branding opportunities through creative shapes, packaging, and messaging that resonate with millennial and Gen Z buyers. Their palatable nature makes them suitable for daily use and helps brands establish habitual consumption patterns.

Reishi mushrooms dominated the type segment, widely recognized for their adaptogenic, calming, and immune-modulating effects. Used in both traditional Chinese and Japanese medicine, Reishi (Ganoderma lucidum) is considered the "mushroom of immortality" and continues to be popular in supplements designed for stress relief, sleep support, and long-term immunity. Reishi’s anti-inflammatory and antioxidant properties also make it a staple in anti-aging and detox formulations. Brands often position Reishi in nighttime formulas, combining it with herbs like valerian or chamomile to enhance rest and recovery.

Lion’s Mane is the fastest-growing mushroom type, due to its nootropic benefits and rising popularity among consumers interested in mental performance and neuroprotection. Lion’s Mane contains compounds like hericenones and erinacines, believed to stimulate nerve growth factor (NGF) production, enhancing cognitive clarity and memory. This mushroom is often featured in supplements targeting students, professionals, and aging populations concerned with brain health. Functional beverage brands such as Four Sigmatic and MUD\WTR have popularized Lion’s Mane in coffee and hot cocoa blends, driving widespread awareness and adoption.

Immune support dominated the function category, largely due to the historic use of mushrooms like Reishi, Turkey Tail, and Chaga in boosting immune resilience. Following the COVID-19 pandemic, there was a significant uptick in demand for supplements that could bolster the body’s natural defenses, particularly among vulnerable populations. Products focused on immunity often combine multiple mushrooms with vitamin C, zinc, and echinacea to offer multi-pathway support. This segment benefits from strong consumer intent, seasonal demand spikes, and cross-functionality with respiratory and anti-inflammatory health.

Cognitive health is the fastest-growing function, driven by the wellness community’s growing interest in mental clarity, productivity, and long-term neuroprotection. Lion’s Mane is the hero ingredient in this segment, often paired with adaptogens and amino acids in supplements that target mental fog, memory lapses, or focus challenges. With the rise of remote work, digital fatigue, and performance anxiety, consumers are turning to natural nootropics as alternatives to caffeine and stimulants. These products are especially popular in the U.S. tech hubs and startup communities, where performance optimization is a cultural norm.

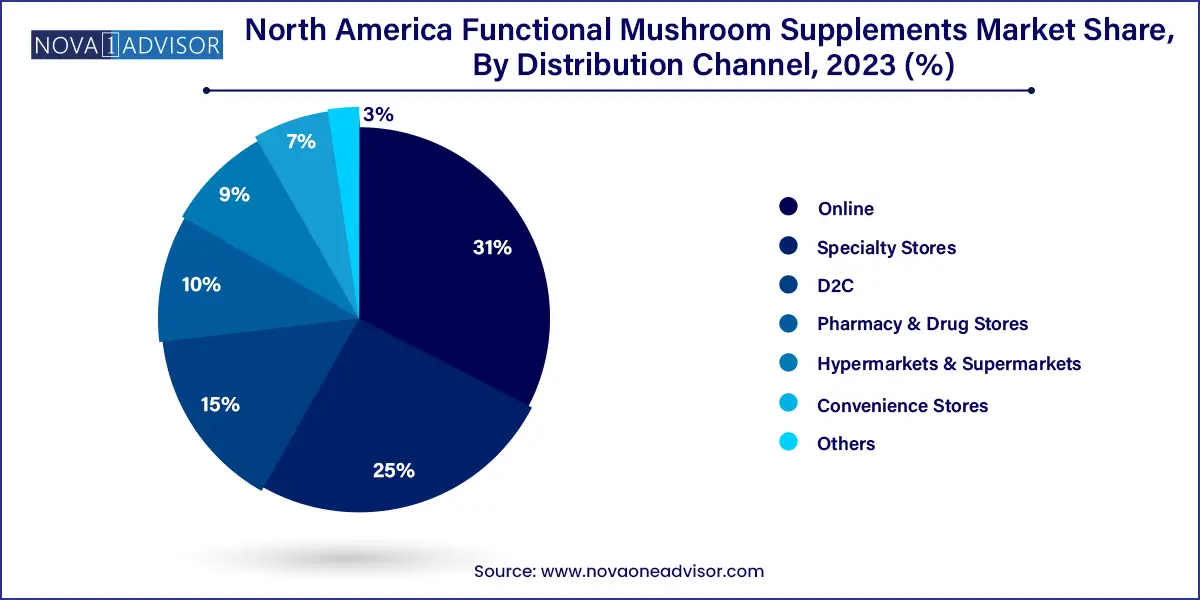

Specialty stores dominated the distribution segment, particularly natural health retailers, holistic pharmacies, and supplement boutiques. These outlets attract wellness-focused consumers seeking personalized guidance, curated selections, and product transparency. Brands often leverage in-store education tools and sampling stations to engage customers. Chains like Whole Foods, Sprouts Farmers Market, and local apothecaries remain critical points of sale for premium mushroom supplements, especially those with organic or vegan claims.

D2C (Direct-to-Consumer) and online sales are the fastest-growing channels, reflecting the shift toward digital health retail. Brands like Rainbo, FreshCap, and Earth & Star are leveraging e-commerce to deliver education, personalization, and community engagement. Subscription services, loyalty programs, and influencer partnerships allow these brands to bypass traditional retail and build direct relationships with their customers. Digital platforms also enable transparency through lab test disclosures, ingredient sourcing maps, and usage guides—empowering consumers to make informed decisions.

The U.S. is the largest market for functional mushroom supplements in North America, supported by high consumer awareness, strong e-commerce infrastructure, and a culture of preventive healthcare. The wellness industry’s growth has paralleled the rise of adaptogenic ingredients, making functional mushrooms a natural fit. Urban centers like Los Angeles, New York, and Austin have become testing grounds for new product formats and marketing approaches. The U.S. also has a mature regulatory framework for supplements, allowing innovation while maintaining safety standards. Education through wellness podcasts, social media, and holistic practitioners continues to drive market expansion.

Canada follows closely behind the U.S. in adoption, with high trust in natural health products and a strong tradition of herbal medicine. Canadian consumers are particularly receptive to organic, vegan, and sustainability-certified mushroom products. Regulatory frameworks under Health Canada ensure quality and standardization, bolstering consumer confidence. The presence of homegrown supplement companies and government-supported innovation funds also fuels market growth. Canadians are increasingly purchasing mushroom supplements both through specialty health stores and digital wellness marketplaces.

Mexico is an emerging market in this space, where traditional knowledge of medicinal mushrooms intersects with growing consumer interest in natural health solutions. While still developing in terms of retail infrastructure and brand variety, awareness is increasing, especially among middle- and upper-income consumers in urban regions. Online retailers and wellness influencers are helping bridge the information gap, and several international brands are entering the market through cross-border e-commerce. There is strong potential for localized product development, blending indigenous knowledge with modern delivery formats.

January 2025: Four Sigmatic launched a new Lion’s Mane Focus Shot, targeting professionals and students looking for caffeine-free cognitive support in a ready-to-drink format.

February 2025: Host Defense announced an expansion of its organic cultivation facility in Washington State, allowing for increased production of Reishi and Turkey Tail supplements.

March 2025: MUD\WTR introduced a nighttime mushroom blend with Reishi and Chamomile, marketed as a non-drowsy sleep aid for wellness-conscious consumers.

January 2025: FreshCap Mushrooms unveiled its liposomal delivery line, claiming superior absorption and shelf stability, focused on Chaga and Lion’s Mane extracts.

February 2025: Plant People partnered with Thrive Market to distribute its functional mushroom gummies through D2C and subscription-based wellness bundles.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America functional mushroom supplements market

Form

Type

Function

Distribution Channel

Regional