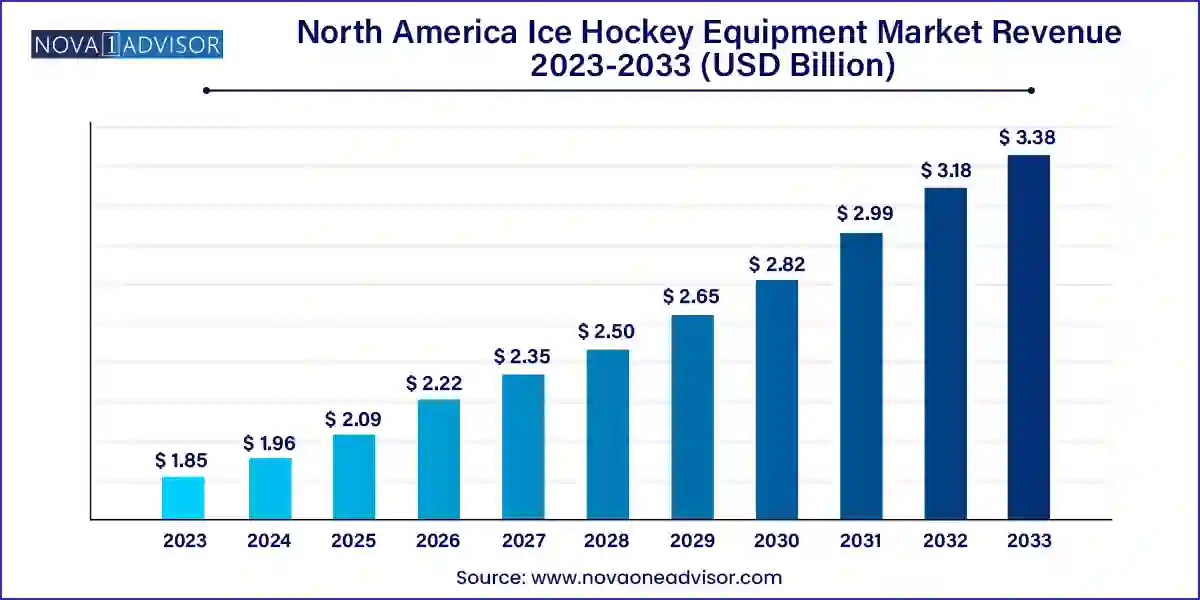

The North America ice hockey equipment market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 3.38 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2024 to 2033.

The North America ice hockey equipment market is a deeply embedded segment of the region’s sporting goods industry, reflecting both the cultural significance and professional popularity of the sport across the United States and Canada. Ice hockey is more than just a recreational activity; it is a cornerstone of sports identity in Canada and an increasingly prominent athletic discipline in several U.S. states. With the National Hockey League (NHL), collegiate leagues, youth development programs, and community rinks driving participation at all levels, demand for ice hockey gear continues to remain strong and diversified.

Ice hockey equipment includes an array of protective gear, sticks, skates, jerseys, and accessories, all designed to meet the safety, comfort, and performance needs of players. From casual players in youth leagues to elite professionals, equipment is continually being upgraded to reflect advances in material science, aerodynamics, and ergonomic design. Technological innovation is a hallmark of this market, with carbon fiber sticks, advanced foam padding, and thermoregulated skates pushing performance boundaries while enhancing player safety.

Additionally, the resurgence of youth sports post-pandemic, combined with increasing female participation, has created fresh momentum for the industry. Associations such as USA Hockey and Hockey Canada have launched grassroots programs aimed at expanding the player base, which directly influences equipment sales. As a result, the market is positioned for sustained growth over the next decade, supported by brand loyalty, e-commerce expansion, and continued investments by key manufacturers.

Technological Innovation in Protective Equipment: Use of lightweight, impact-absorbing materials like D3O foam and carbon composites is improving player safety and agility.

Customization and Personalization: Consumers are demanding custom-fit gear, especially skates and sticks, tailored to individual performance needs and aesthetics.

Sustainability in Manufacturing: Brands are incorporating recycled materials and eco-friendly manufacturing practices in response to environmental concerns.

Growth of Women’s and Youth Hockey: Increased participation by women and children is creating new demand segments for size- and gender-specific gear.

Direct-to-Consumer and Online Sales Expansion: Major brands are bypassing traditional retailers to sell directly via websites, offering exclusive products and customization tools.

Smart Gear and Sensor Integration: Development of gear embedded with sensors to track performance data such as shot speed, skating pace, and impact force is on the rise.

NHL-Driven Brand Partnerships and Endorsements: Equipment visibility in professional leagues influences buying behavior at amateur levels.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.96 Billion |

| Market Size by 2033 | USD 3.38 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada |

| Key Companies Profiled | Bauer (Peak Achievement Athletics Inc.); CCM (Birch Hill Equity Partners); SherWood (Canadian Tire Corp); Warrior Sports (New Balance); True Temper Sports; STX; Grafskates AG; Winnwell; Vaughn Hockey; ROCES SPORT S.R.L |

One of the most significant drivers of the North America ice hockey equipment market is the steady growth of amateur and youth hockey programs, particularly in non-traditional U.S. markets. Traditionally, hockey has been concentrated in Canada and northern U.S. states like Minnesota, Michigan, and Massachusetts. However, over the past decade, participation has grown substantially in states such as Texas, California, and Florida, driven by NHL expansion and targeted development programs.

Associations like USA Hockey have reported a consistent year-on-year increase in registered players, with the youth segment accounting for a large share. Initiatives such as "Try Hockey for Free Day" and school-linked developmental clinics have made the sport more accessible. This growing base of young players translates into regular demand for helmets, chest protectors, elbow pads, sticks, and skates, often replaced annually due to growth or wear. As families invest in high-quality gear to support their children’s safety and performance, brands benefit from strong recurring revenue streams.

Despite a growing interest in ice hockey, one of the key restraints limiting broader market expansion is the high cost associated with full equipment purchases, particularly for new or lower-income participants. A complete set of gear—including skates, stick, helmet, pads, gloves, and a bag—can cost upwards of $700 for youth and over $1,500 for adults when opting for mid-range to premium brands.

The sport's affordability barrier often leads to dropout among younger players and limits entry into the sport in lower-income communities. Equipment rental and resale options exist, but parents are often concerned about sizing, safety, and durability. This challenge is particularly significant in the U.S., where ice hockey competes with more affordable sports such as basketball, baseball, and soccer. Moreover, ice time and training costs compound the financial burden, creating regional disparities in participation that ultimately constrain equipment sales growth.

A substantial opportunity in the North American market lies in the increasing participation of women and girls in organized ice hockey, which is creating demand for gender-specific gear. Over the past decade, female enrollment in amateur leagues has surged, driven by Olympic visibility, professional women’s leagues, and grassroots efforts by organizations like the NHL and Hockey Canada to promote inclusivity.

Leading brands such as Bauer and CCM have begun producing gear tailored specifically for female athletes, including shoulder pads, pants, and gloves that account for anatomical differences. These designs offer improved fit, protection, and mobility, encouraging higher adoption rates and better retention in female hockey programs. As more schools and universities launch women’s teams and professional female leagues gain traction, this segment is expected to grow significantly, providing manufacturers a relatively untapped niche to expand into with customized offerings and marketing strategies.

Protective wear dominates the North America ice hockey equipment market due to its essential role in ensuring player safety during high-impact, high-speed gameplay. This category includes helmets, shoulder pads, shin guards, elbow pads, mouthguards, and neck guards—gear mandated by almost every organized league. Safety innovations and growing awareness of concussion prevention have also driven up investment in high-quality headgear and neck protection. Regulatory organizations like HECC (Hockey Equipment Certification Council) further ensure that safety standards are met, reinforcing the importance of this product segment. As participation increases across age groups, recurring purchases of protective gear remain a core revenue generator for brands.

Skates represent the fastest-growing segment, driven by continuous technological enhancements and player preference for speed and comfort. High-performance skates now feature carbon fiber outsoles, thermoformable boots, and moisture-wicking liners. These attributes, while previously reserved for professionals, are now being adopted in mid-tier models for youth and amateur players. Brands such as Bauer (with its Vapor and Supreme lines) and CCM (with its Jetspeed series) are focusing on innovation and customization, offering heat-moldable options and advanced blade holders. Rising sales in this category are also influenced by wear-and-tear, with players upgrading skates more frequently due to rigorous training schedules.

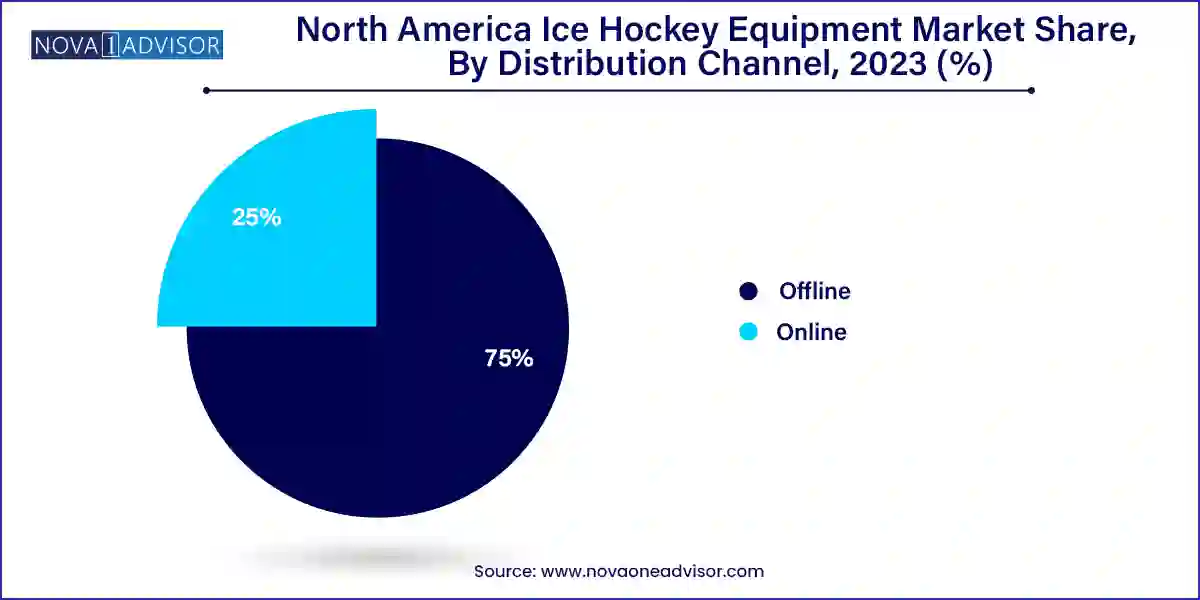

Offline retail channels dominate the North American ice hockey equipment market due to the experiential nature of the buying process. Specialty stores such as Pro Hockey Life, Pure Hockey, and Hockey Monkey offer players the ability to try on gear, test stick flex ratings, and custom-fit skates. These stores are often staffed by knowledgeable sales professionals who guide purchases based on player skill level, position, and league regulations. In addition, in-store services such as skate sharpening, repairs, and custom equipment fittings continue to make brick-and-mortar retail an essential part of the consumer journey.

Online sales channels are growing at the fastest pace, accelerated by e-commerce convenience, digital innovation, and expanded product availability. Manufacturers like Bauer and CCM now offer direct-to-consumer e-commerce platforms with options for customization, virtual fitting tools, and loyalty programs. E-commerce giants such as Amazon and HockeyMonkey.com are also gaining traction for their wide selections and efficient shipping. Especially during the COVID-19 pandemic, online retail served as the primary channel for hockey families to replace gear and accessories, prompting brands to invest further in digital storefronts and mobile commerce strategies.

The United States is the larger market in terms of absolute value, driven by a growing population base, increasing investment in youth hockey programs, and the commercial strength of the NHL. States like Minnesota, Massachusetts, Michigan, and Illinois are traditional hockey hotbeds, but newer markets such as California, Texas, and Arizona are expanding rapidly due to NHL team presence and grassroots initiatives. Organizations such as USA Hockey report rising registration figures year-over-year, and NHL initiatives like "Hockey is for Everyone" have further helped broaden access. American universities and colleges with NCAA programs also drive strong sales in protective wear and skates, making the U.S. a key revenue contributor.

While smaller in population, Canada is the spiritual and cultural epicenter of ice hockey, and its per capita participation far exceeds that of any other country. Ice hockey is embedded in school programs, community leagues, and professional pathways, leading to recurring and multigenerational purchases of equipment. The country has a deeply loyal consumer base for brands such as Bauer, CCM, and Warrior. Many families purchase new gear every season, contributing to robust sales volumes across all product categories. Additionally, Canada’s long winters and abundance of rinks make hockey a year-round pursuit in many provinces, ensuring consistent demand.

Bauer Hockey (March 2024): Launched its “Re-Akt 150Y” helmet series aimed specifically at youth players, featuring enhanced impact protection and sweat-resistant liners, reinforcing its leadership in safety innovation.

CCM Hockey (January 2024): Introduced a new custom skate fitting system using 3D foot scanning technology in partnership with select Canadian retailers, aimed at enhancing comfort and reducing injury risk.

Warrior Sports (December 2023): Announced the launch of the Alpha LX Pro 2 stick with upgraded carbon layering for improved puck control and increased durability, targeting competitive adult players in North America.

True Temper Hockey (November 2023): Released its Catalyst 9X3 skates and stick combo with upgraded thermoform features and customizable tongue options, receiving strong endorsements from NHL prospects.

Pure Hockey (October 2023): Expanded its U.S. footprint by acquiring regional hockey retailer Total Hockey Supply, adding ten new stores and boosting offline distribution capacity.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America ice hockey equipment market

Product

Distribution Channel

Country