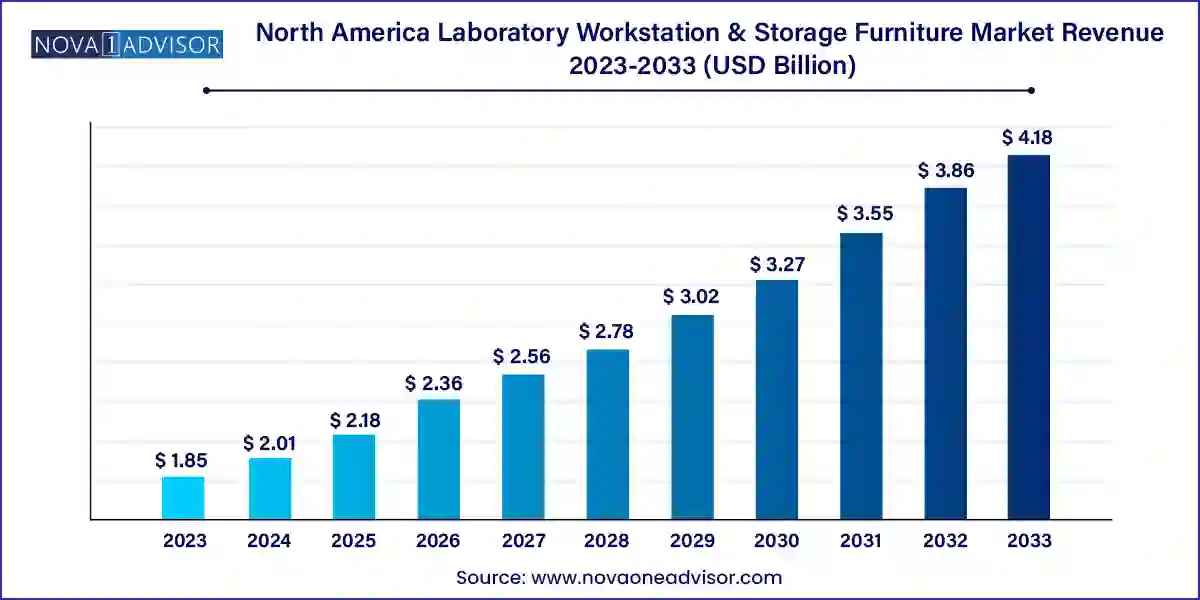

The North America laboratory workstation & storage furniture market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 4.18 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2024 to 2033.

The North America Laboratory Workstation & Storage Furniture Market is witnessing a steady and transformative evolution as the demand for advanced, ergonomic, and safe laboratory environments grows across a range of industries. Laboratories today are no longer static spaces—they are dynamic work zones that must accommodate interdisciplinary research, compliance with regulatory standards, and robust safety protocols. This shift is driving the need for intelligent workstation designs and high-performance storage solutions capable of enhancing workflow efficiency, comfort, and risk mitigation.

The demand for specialized furniture in laboratories spans a wide spectrum of end users including medical labs, industrial research centers, educational institutions, and government agencies. Increasing investments in R&D, particularly across sectors like pharmaceuticals, biotechnology, materials science, and environmental sciences, have prompted a reevaluation of how laboratories are physically structured. Lab managers are seeking customized furniture solutions that can withstand chemical exposure, offer modularity, and optimize available space. This market is defined not only by utility but also by innovation—new designs now incorporate features such as mobile workstations, integrated power supplies, ventilation systems, and height-adjustable workbenches.

North America, as a hub of scientific research and innovation, continues to lead global trends in laboratory modernization. The U.S., in particular, is home to numerous pharmaceutical giants, high-tech research parks, and university-affiliated labs that are actively investing in state-of-the-art infrastructure. Canada and Mexico are also seeing a surge in biotech investments and healthcare advancements that are catalyzing the need for improved laboratory environments. In such a climate, the demand for advanced laboratory furniture is not just growing—it is being redefined.

Ergonomic Design Adoption: There is a growing emphasis on reducing workplace injuries and enhancing researcher productivity through ergonomic workstations and adjustable lab furniture.

Customization & Modularity: Laboratories are increasingly seeking modular systems that can be reconfigured easily to adapt to changing research requirements and spatial constraints.

Chemical-Resistant Materials: Innovations in chemical-resistant laminates and powder-coated metal frames are being integrated into cabinet and workstation designs to meet safety regulations.

Integration of Smart Technology: Smart storage units with inventory tracking, RFID tagging, and environmental sensors are beginning to emerge in highly advanced labs.

Sustainable Materials & Green Lab Initiatives: Demand is rising for eco-friendly and recyclable materials, especially in university and government laboratories aligning with LEED standards.

Mobile Lab Solutions: Workstations with caster wheels and lightweight frames are enabling mobility within lab spaces, especially in field laboratories and temporary setups.

Growth of Online Distribution Channels: With digital procurement gaining traction, many manufacturers are expanding their online catalogs and offering 3D visualization tools for custom furniture orders.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.01 Billion |

| Market Size by 2033 | USD 4.18 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Kewaunee International Group; Hemco Corporation; Thermo Fisher Scientific Inc.; SteelSentry Inc.; Mott Manufacturing Ltd. & Mott Manufacturing LLC.; PSA Laboratory Furniture; Labconco Corporation |

A key driver propelling the laboratory furniture market in North America is the substantial rise in research and development investments across life sciences, pharmaceuticals, and academia. According to the National Science Foundation, the U.S. alone spent over $700 billion on R&D in 2023, with private companies contributing significantly. As new labs are being built and old ones refurbished, there is a strong emphasis on setting up flexible and future-ready lab environments.

This uptick in R&D activity is closely tied to increased demand for customized lab infrastructure, including furniture that supports multidisciplinary research. For instance, pharmaceutical companies are increasingly investing in personalized medicine and biotechnological research, both of which require specialized storage units and modular workstations for cleanroom compatibility. Universities and educational institutions are also upgrading their laboratory facilities to attract research grants and meet new STEM curriculum requirements. Consequently, furniture vendors are developing solutions tailored to these evolving scientific needs.

Despite the growing demand, the high upfront cost of specialized lab furniture remains a notable restraint. Laboratory workstations and storage units are typically built using high-grade materials such as stainless steel, chemical-resistant laminates, or epoxy resin tops—all of which contribute to elevated pricing. Additionally, the need for custom designs, utility integrations (such as plumbing and electricity), and compliance with OSHA or BSL guidelines further adds to the complexity and cost.

For smaller institutions or independent research facilities, these costs can become prohibitive, delaying or limiting the scope of laboratory upgrades. Moreover, the procurement process can be lengthy due to the need for architectural compatibility and space optimization, often requiring consultations with engineers and interior designers. These financial and logistical hurdles can slow down the adoption rate among price-sensitive buyers, especially in regions like Mexico where budget constraints are more pronounced.

A significant opportunity lies in the rising demand for modular and reconfigurable laboratory furniture. Research priorities are evolving rapidly due to technological innovation and the emergence of interdisciplinary studies. Laboratories must now support a range of activities—from wet chemistry and biosafety testing to computational modeling. In such scenarios, the ability to rearrange lab furniture without extensive renovation becomes invaluable.

Manufacturers are capitalizing on this by offering modular benching systems, mobile cabinets, adjustable shelving, and universal frames that can be adapted for different purposes. For instance, industrial R&D labs working on material synthesis can easily switch between chemical handling zones and clean spaces with the help of movable dividers and standalone cabinetry. Furthermore, schools and universities are favoring reconfigurable solutions for multipurpose labs that serve different departments. This shift in preference toward adaptability is expected to be a long-term driver for market growth.

Workstation/Workbench products dominated the market owing to their foundational role in all laboratory operations, from basic handling and documentation to advanced testing procedures. These units are the central component of lab interiors, designed to support various accessories, instruments, and tools. The demand for ergonomic, height-adjustable, and load-bearing workbenches with customizable configurations has surged. Workbenches now often include integrated power outlets, chemical-resistant countertops, and ventilation features. Labs across pharmaceutical, educational, and industrial sectors see these units as essential for maintaining workflow efficiency and safety.

In contrast, Chemical Storage Cabinets are emerging as the fastest-growing product segment. With increasing regulatory scrutiny around hazardous chemical handling, labs are investing heavily in secure, fire-resistant storage solutions. These cabinets are engineered with self-closing doors, spill containment trays, and clear labeling systems. As chemical research intensifies across life sciences, materials, and energy sectors, the need for compliant chemical storage solutions is growing rapidly. This trend is particularly noticeable in government and industrial labs dealing with sensitive or flammable substances.

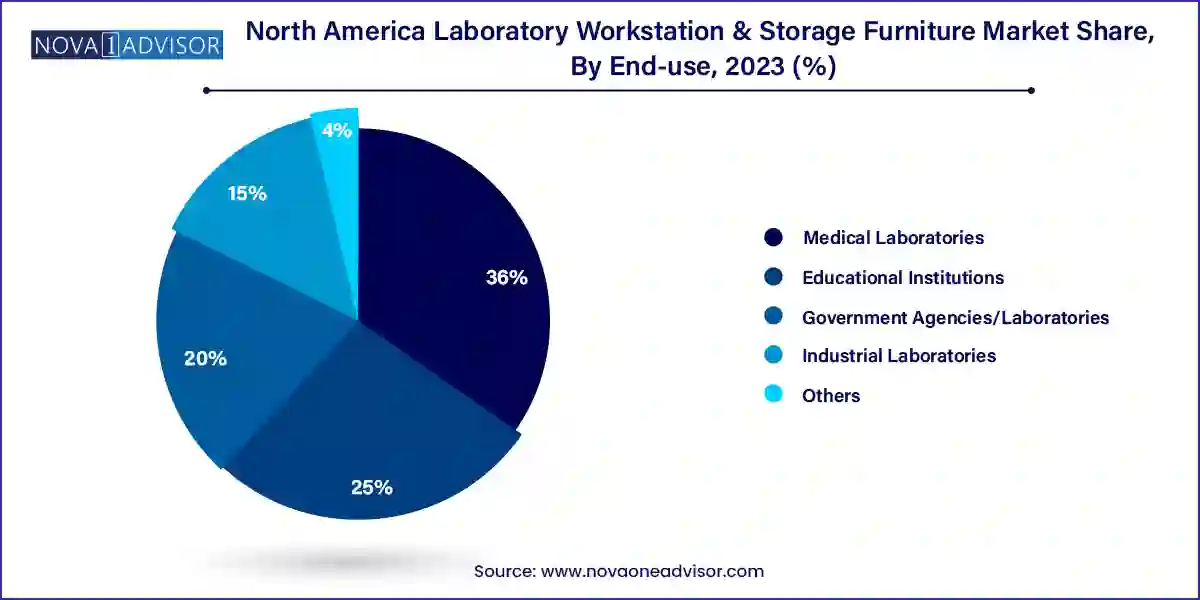

Medical laboratories remain the dominant end-use channel due to the rapid expansion of diagnostics, pathology, and clinical testing facilities. Hospitals, diagnostic labs, and biotechnology firms are constantly upgrading lab infrastructure to keep pace with advances in molecular diagnostics, virology, and genetic testing. The COVID-19 pandemic accelerated this trend, and it continues into the post-pandemic era with increased attention to laboratory automation, biosafety, and hygiene. As a result, the demand for modular furniture that supports autoclave setups, fume hoods, and biological safety cabinets is surging.

Meanwhile, Educational Institutions are witnessing the fastest growth, driven by government initiatives to boost STEM education across North America. Universities are remodeling older science labs and constructing new ones with interactive learning zones, shared research hubs, and multipurpose lab spaces. For example, Canada’s federal funding for research infrastructure through the CFI (Canada Foundation for Innovation) is enabling institutions to invest in modern lab setups. The increasing student intake in science and technology programs is also leading to larger, more flexible lab environments that demand scalable and durable furniture solutions.

Direct sales emerged as the leading distribution channel in this market, primarily due to the need for customized solutions, project-specific engineering, and after-sales support. Large laboratories typically engage directly with manufacturers to design and install tailored workstation layouts that comply with lab-specific protocols. Direct engagement also ensures transparency in pricing, installation timelines, and quality assurance. Major vendors like Labconco and Kewaunee often deploy dedicated consultants and engineers for such projects, which adds value beyond what general distributors can offer.

However, E-commerce is rapidly becoming the fastest-growing channel. With digital transformation affecting B2B purchasing behavior, more labs are sourcing pre-configured furniture and accessories via online platforms. Websites offering virtual configurators, 3D renderings, and digital catalogs have streamlined the procurement process. For example, companies like Global Industrial and Grainger have expanded their online offerings to include ergonomic lab chairs, adjustable shelving, and mobile benches. This channel is especially useful for educational institutions and small labs needing standard furniture with quick delivery.

The United States is the largest and most mature market in North America for laboratory workstation and storage furniture. With a vast concentration of pharmaceutical, biotech, and academic research facilities, demand is driven by innovation cycles and federal funding in science and technology. Institutes like the NIH, CDC, and major universities continuously invest in infrastructure upgrades, prompting high demand for modular and compliance-focused furniture. The U.S. is also a hub for companies such as Thermo Fisher Scientific, Labconco, and Kewaunee Scientific Corporation, which set industry benchmarks in both design and safety.

Canada is emerging as a strong growth market due to rising investments in healthcare and academic research. Public funding initiatives, such as the Canada Research Chairs program and the Innovation Superclusters Initiative, are encouraging lab modernization across provinces. Moreover, increased collaboration between academia and industry is leading to the creation of innovation centers and shared labs. Canadian labs place high emphasis on sustainability and ergonomic compliance, driving demand for green-certified and modular furniture systems.

Mexico is showing signs of accelerated growth in laboratory infrastructure, particularly in industrial zones and government-funded healthcare facilities. The expansion of pharmaceutical manufacturing in northern states, coupled with the establishment of quality control labs by multinational corporations, is pushing demand for robust and adaptable lab furniture. While pricing remains a challenge in some segments, government-backed education and public health reforms are gradually opening up new opportunities. Companies that can offer cost-effective, durable, and easy-to-install systems are finding a foothold in the Mexican market.

In March 2025, Kewaunee Scientific Corporation announced a strategic partnership with a Canadian healthcare design firm to provide laboratory solutions for a new series of public health testing labs across Ontario.

Labconco Corporation launched a new modular fume hood workstation in January 2025, which integrates overhead storage, real-time air quality sensors, and ergonomic design, aimed at high-containment biological labs.

In February 2025, Thermo Fisher Scientific revealed plans to upgrade its lab furniture division to support modular bio-labs as part of its rapid deployment solutions for pharmaceutical clients.

Diversified Spaces, a prominent manufacturer of lab and tech classroom furniture, expanded its e-commerce presence through partnerships with B2B platforms like Global Industrial in December 2024.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North Americ laboratory workstation & storage furniture market

Product

End-use Channel

Distribution Channel

Country