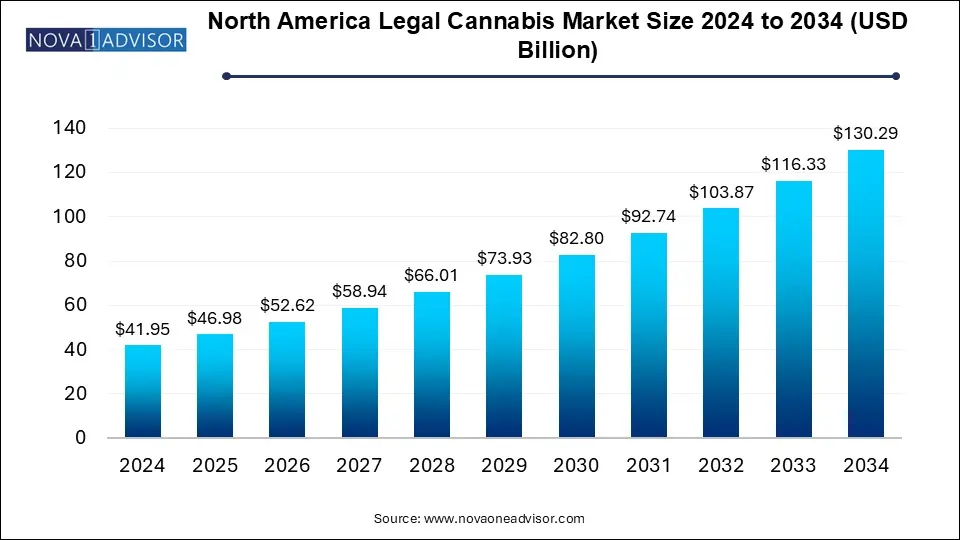

The North America legal cannabis market size was exhibited at USD 41.95 billion in 2024 and is projected to hit around USD 130.29 billion by 2034, growing at a CAGR of 12.0% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 46.98 Billion |

| Market Size by 2034 | USD 130.29 Million |

| Growth Rate From 2025 to 2034 | CAGR of 12.0% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Source, Derivatives, Cultivation, End use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America |

| Key Companies Profiled | Canopy Growth Corporation, Charlotte's Web, Inc., Aurora Cannabis Inc., Tilray Brands, The Cronos Group, Jazz Pharmaceuticals, Inc., Sundial Growers, Medipharm Labs, NuLeaf Naturals, LLC, Irwin Naturals |

Growing legalization and rising awareness with respect to health benefits provided by consumption of cannabis are some of the major factors driving the growth of the market. For instance, in May 2024, the Government of Minnesota legalized cannabis for recreational use and became the 23rd state in the U.S. to legalize adult-use cannabis. Moreover, Kentucky’s General Assembly passed a law legalizing medical cannabis for residents, which is effective from January 2025.

The growing need for remedies regarding pain management amongst the patient population is propelling the market growth. Moreover, the increasing number of patients suffering from chronic pain are the other factors anticipated to fuel the demand for cannabis for medical purposes over the forecast period. For instance, according to data published by the U.S. Pain Foundation in August 2024, 17.1 million individuals are suffering from high-impact chronic pain, and over 51.6 million individuals are living with chronic pain in the U.S. In addition, according to a study published in the JAMA Network Open in January 2024, almost one-third (1/3) of patients reported using cannabis to manage chronic pain.

Favorable government initiatives and rising investments by public and private companies propelling market growth. For instance, in April 2024, Alberta's government introduced the Sustainable Canadian Agricultural Partnership (Sustainable CAP) Program. Under this program, cannabis growers and processors in Canada are eligible to apply for USD 2.6 billion (3.5 billion Canadian dollars) in funding. The Ministry of Agriculture and Irrigation governs the program.

Furthermore, the positive consumer attitude towards cannabis, the expansion of cannabis market players, and the growing number of companies entering the North American region to cater to the growing demand for cannabis support the market growth. For instance, The Cannabist Company, a New York-based cannabis company, expanded its retail footprint by launching adult-use sales of cannabis in New Jersey, Maryland, and Virginia in July 2024. The company already has its operations in 16 states in the U.S.

Moreover, the rising utilization of cannabis for medical and non-medical purposes and ongoing research activities boost the market growth. For instance, in the last five years, federal funding has varied from USD 5,368.9, allocated to Ricci Cannabis for the development of a “wine style” non-alcoholic cannabis drinks through the National Research Council of Canada’s Industrial Research Assistance Program, to a significant USD 3.92 million granted to Pbg Biopharm a through the government’s Regional Economic Growth through Innovation program.

Furthermore, various cannabis companies invest in R&D to incorporate AI in their cannabis cultivation process and launch an AI-based platform. For instance, in April 2024, Barky AI and Highten introduced Canna-GPT, a cannabis AI platform that makes cannabis education more accessible. Users can ask cannabis-related queries in the app to get the answers efficiently and quickly.

By source, the marijuana segment dominated the market in 2024 and is anticipated to witness the fastest growth with a CAGR of 12.92% over the forecast period. This growth is attributed to the growing adoption of marijuana products along with increasing legalization of medical marijuana.

In addition, marijuana oil is used for the treatment of cancer & nausea and can also be used for the improvement of the sleep cycle and for alleviating stress, pain, & anxiety. It is mostly used by people who refrain from smoking buds due to their ill effects. The demand for marijuana oil is anticipated to increase over the forecast period, as there has been a substantial increase in the number of patients preferring oil as compared to buds.

The hemp segment held a significant share in 2024, owing to its applications in several sectors, including pharmaceuticals, cosmetics, nutraceuticals, and food & beverage. Moreover, many key players focus on numerous initiatives, such as distribution partnerships and product innovation, to maintain their position in the market. For instance, in October 2022, Charlotte's Web Holdings, Inc. partnered with Gopuff Retail Company for the distribution of its products through Gopuff Retail Company in the U.S. states such as Arizona, Illinois, California, and New York and is expected to continue to expand throughout 2022 and 2024.

By derivatives, the CBD segment dominated the market with a revenue share of 64.6% in 2024. Factors such as growing public awareness about CBD's health advantages, positive legislative policies, rising adoption of CBD-based cosmetics, and the increased use of CBD oil in multiple industries and its use in several medicines propel the market growth. Delush, Calyx Wellness, KaliKare, High On Love, Fitish, Birch + Beauty, Emprise Canada, and Love Necta are some of the CBD-based cosmetics brands available in North America.

However, other segment is expected to witness the fastest growth over the forecast period. This segment includes terpenes, flavonoids, and other minor cannabinoids. The growing popularity of terpenes and minor cannabinoids and new product launches are anticipated to boost the segment's growth. For instance, in January 2024, Texas Original, a medical cannabis company, introduced the Elevate beverage product, a medical cannabis product infused with cannabigerol (CBG). It offers uplifting, energizing relief for common symptoms associated with pain, anxiety, and inflammation.

By cultivation, the indoor cultivation segment held the largest market share of 54.5% in 2024 and is expected to witness fastest growth over the forecast period. The liberalization of laws and regulations associated with cannabis cultivation, particularly for hemp cultivation due to its low THC content, is further increasing its adoption. Moreover, the legalization of cannabis in various states in the U.S. and countries in North America and its rising adoption for medical purposes are factors driving the market for cannabis cultivation. For instance, 18 states and Washington, D.C. in the U.S. permit some form of at-home cannabis growing.

The outdoor cultivation segment is expected to grow lucratively over the forecast period. Outdoor cultivation eliminates the need for expensive growing equipment, lowering the overall cost of the operation due to the ready availability of a natural environment that provides the necessary factors for cannabis plants to grow, driving the number of outdoor cultivation farms and aiding segment growth. Moreover, the introduction of new cannabis facilities boosts the market growth. For instance, in August 2019, MJ Holdings, Inc., a cannabis company in Nevada, launched an outdoor cannabis cultivation facility in the Amargosa Valley of Nevada.

By end use, the recreational use segment dominated the market with revenue share of 67.0% in 2024 and is anticipated to grow at a fastest CAGR over the forecast period. Factors such as the growing legalization of cannabis for adult use and the increasing adoption of cannabis vape pens are fueling the market's growth. According to Headset.io, Vape Pens are the second most popular category in the U.S. and third most popular in Canada, capturing 23.6% and 17.1% market share, respectively; furthermore, according to data published by Flowhub, Millennials, and Gen Z makeup 62.8% of all U.S. cannabis sales.

The medical use held a significant market share in 2024, owing to the rising trend in plant-based medicines, especially for pain management. Furthermore, the growing acceptance of cannabis for the treatment of various chronic conditions, such as cancer, diabetes, depression and anxiety, arthritis, and epilepsy, drives the segment's growth. For instance, Epidiolex (CBD oral solution) was approved by the U.S. FDA for the treatment of seizures associated with two forms of epilepsy such as Dravet syndrome and Lennox-Gastaut syndrome.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America legal cannabis market

By Sources

By Cultivation

By Derivatives

By End Use

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Segment scope

1.1.2. Regional scope

1.1.3. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. Research Assumptions

1.8. List of Secondary Sources

1.9. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Source outlook

2.2.2. Derivatives outlook

2.2.3. Cultivation outlook

2.2.4. End Use outlook

2.2.5. Regional outlook

2.3. Competitive Insights

Chapter 3. North America Legal Cannabis Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. North America Legal Cannabis: Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTLE Analysis

3.4. Regulatory Framework

Chapter 4. North America Legal Cannabis Market Segment Analysis, By Source, 2018 - 2030 (USD Million)

4.1. Definition and Scope

4.2. Product Market Share Analysis, 2023 & 2030

4.3. Segment Dashboard

4.4. North America Legal Cannabis market, by Source, 2018 to 2030

4.5. Marijuana

4.5.1. Marijuana market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2. Flowers

4.5.2.1. Flowers market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3. Oil and Tinctures

4.5.3.1. Oil and Tinctures market estimates and forecasts, 2018 to 2030 (USD Million)

4.6. Hemp

4.6.1. Hemp market estimates and forecasts, 2018 to 2030 (USD Million)

4.6.2. Hemp CBD

4.6.2.1. Hemp CBD market estimates and forecasts, 2018 to 2030 (USD Million)

4.6.3. Industrial Hemp

4.6.3.1. Industrial Hemp market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. North America Legal Cannabis Market Segment Analysis, By Derivatives, 2018 - 2030 (USD Million)

5.1. Definition and Scope

5.2. Derivatives Market Share Analysis, 2023 & 2030

5.3. Segment Dashboard

5.4. North America Legal Cannabis market, by Derivatives, 2018 to 2030

5.5. CBD

5.5.1. CBD market estimates and forecasts, 2018 to 2030 (USD Million)

5.6. THC

5.6.1. THC market estimates and forecasts, 2018 to 2030 (USD Million)

5.7. Other derivatives

5.7.1. Other derivatives market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. North America Legal Cannabis Market Segment Analysis, By Cultivation, 2018 - 2030 (USD Million)

6.1. Definition and Scope

6.2. Cultivation Market Share Analysis, 2023 & 2030

6.3. Segment Dashboard

6.4. North America Legal Cannabis market, by Cultivation, 2018 to 2030

6.5. Indoor Cultivation

6.5.1. Indoor Cultivation market estimates and forecasts, 2018 to 2030 (USD Million)

6.6. Greenhouse Cultivation

6.6.1. Greenhouse Cultivation market estimates and forecasts, 2018 to 2030 (USD Million)

6.7. Outdoor Cultivation

6.7.1. Outdoor Cultivation market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. North America Legal Cannabis Market Segment Analysis, By End Use, 2018 - 2030 (USD Million)

7.1. Definition and Scope

7.2. End Use Market Share Analysis, 2023 & 2030

7.3. Segment Dashboard

7.4. Global North America Legal Cannabis Market, by End Use, 2018 to 2030

7.5. Medical Use

7.5.1. Medical Use Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.2. Cancer

7.5.2.1. Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.3. Chronic Pain

7.5.3.1. Chronic Pain Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.4. Depression and Anxiety

7.5.4.1. Depression and Anxiety Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.5. Arthritis

7.5.5.1. Arthritis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.6. Diabetes

7.5.6.1. Diabetes Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.7. Glaucoma

7.5.7.1. Glaucoma Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.8. Migraine

7.5.8.1. Migraine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.9. Epilepsy

7.5.9.1. Epilepsy Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.10. Multiple Sclerosis

7.5.10.1. Multiple Sclerosis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.11. AIDS

7.5.11.1. AIDS Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.12. Amyotrophic Lateral Sclerosis

7.5.12.1. Amyotrophic Lateral Sclerosis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.13. Alzheimer's

7.5.13.1. Alzheimer's Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.14. Post Traumatic Stress Disorder (PTSD)

7.5.14.1. Post Traumatic Stress Disorder (PTSD) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.15. Parkinson's

7.5.15.1. Parkinson's Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.16. Tourette’s

7.5.16.1. Tourette’s Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.17. Others

7.5.17.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Recreational Use

7.6.1. Recreational Use Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Industrial Use

7.7.1. Industrial Use Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. North America Legal Cannabis Market Segment Analysis, By Region, By Product, By Material, By End Use, 2018- 2030 (USD Million)

8.1. Regional Market Share Analysis, 2023 & 2030

8.2. Regional Market Dashboard

8.3. Regional Market Snapshot

8.4. North America Legal Cannabis Market Share by Region, 2023 & 2030:

8.5. North America

8.5.1. North America Legal Cannabis market, 2018 - 2030 (USD Million)

8.5.2. U.S.

8.5.2.1. U.S. Legal Cannabis market, 2018 - 2030 (USD Million)

8.5.3. Canada

8.5.3.1. Canada Legal Cannabis market, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Company Profiles

9.3.1. Canopy Growth Corporation

9.3.1.1. Company overview

9.3.1.2. Financial performance

9.3.1.3. Product benchmarking

9.3.1.4. Strategic initiatives

9.3.2. Charlotte's Web, Inc.

9.3.2.1. Company overview

9.3.2.2. Financial performance

9.3.2.3. Product benchmarking

9.3.2.4. Strategic initiatives

9.3.3. Aurora Cannabis Inc.

9.3.3.1. Company overview

9.3.3.2. Financial performance

9.3.3.3. Product benchmarking

9.3.3.4. Strategic initiatives

9.3.4. Tilray Brands

9.3.4.1. Company overview

9.3.4.2. Financial performance

9.3.4.3. Product benchmarking

9.3.4.4. Strategic initiatives

9.3.5. The Cronos Group

9.3.5.1. Company overview

9.3.5.2. Financial performance

9.3.5.3. Product benchmarking

9.3.5.4. Strategic initiatives

9.3.6. Jazz Pharmaceuticals, Inc.

9.3.6.1. Company overview

9.3.6.2. Financial performance

9.3.6.3. Product benchmarking

9.3.6.4. Strategic initiatives

9.3.7. Sundial Growers

9.3.7.1. Company overview

9.3.7.2. Financial performance

9.3.7.3. Product benchmarking

9.3.7.4. Strategic initiatives

9.3.8. Medipharm Labs

9.3.8.1. Company overview

9.3.8.2. Financial performance

9.3.8.3. Product benchmarking

9.3.8.4. Strategic initiatives

9.3.9. NuLeaf Naturals, LLC

9.3.9.1. Company overview

9.3.9.2. Financial performance

9.3.9.3. Product benchmarking

9.3.9.4. Strategic initiatives

9.3.10. Irwin Naturals

9.3.10.1. Company overview

9.3.10.2. Financial performance

9.3.10.3. Product benchmarking

9.3.10.4. Strategic initiatives