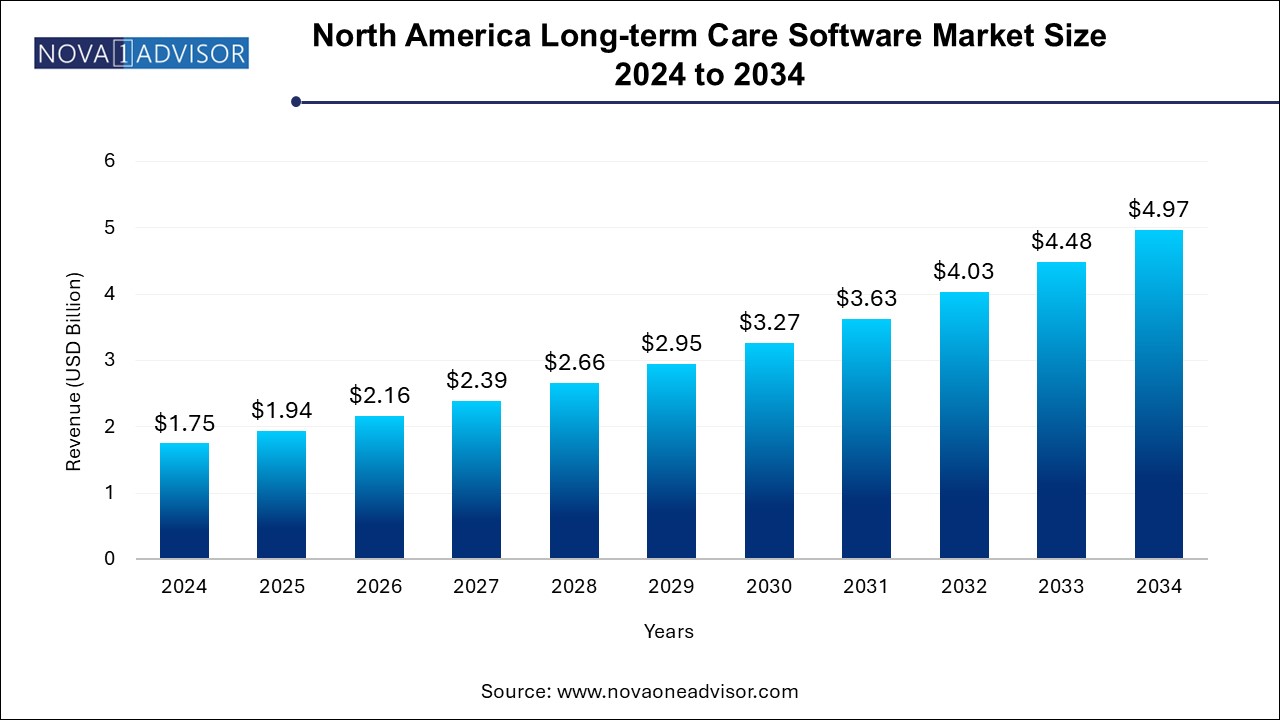

The North America long-term care software market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 4.97 billion by 2034, growing at a CAGR of 11.0% during the forecast period 2025 to 2034.

The North America Long-term Care Software Market is experiencing significant growth, driven by a confluence of demographic shifts, technological advancements, and a growing focus on improving healthcare delivery for aging populations. Long-term care software refers to digital platforms and applications designed to manage the clinical, financial, and administrative operations of long-term care facilities, such as nursing homes, assisted living centers, and home healthcare agencies. These systems offer a range of solutions, from Electronic Health Records (EHR) to staff management, enabling seamless care coordination, compliance tracking, and patient-centered services.

As the region grapples with a rapidly aging population — with estimates suggesting that over 80 million people in the U.S. will be aged 65 or older by 2040 — long-term care services are becoming increasingly essential. Facilities are under pressure to provide efficient, high-quality care while maintaining cost-effectiveness. This need has created a fertile environment for the adoption of innovative software tools that automate administrative workflows, enhance clinical decision-making, and ensure regulatory compliance.

In particular, the U.S. is leading the transformation with an early embrace of cloud-based solutions and robust federal initiatives supporting the adoption of health IT across healthcare ecosystems. Canada and Mexico, while following at different adoption rates, are also showing strong potential due to healthcare digitization policies and increased investments in long-term care infrastructure.

Integration of Artificial Intelligence (AI) and Predictive Analytics

AI-powered tools are being increasingly embedded into long-term care software platforms to analyze patient data, predict outcomes, and personalize care plans. Predictive analytics is helping facilities anticipate readmissions and manage chronic conditions proactively.

Growing Adoption of Cloud-based Solutions

With the need for scalability, data security, and remote access, cloud-based delivery models are becoming the preferred mode for most care facilities. These solutions enable real-time data sharing across care teams and reduce IT overhead.

Interoperability and Cross-platform Integration

Long-term care providers are investing in interoperable platforms that seamlessly integrate with other healthcare systems such as hospitals and insurance databases, improving care continuity.

Rise of Mobile Health Applications

Mobile-enabled solutions for caregivers and family members are gaining popularity, allowing better monitoring of residents and facilitating real-time updates and communication.

Emphasis on Patient-centric and Value-based Care Models

The focus is shifting from traditional fee-for-service models to outcome-driven approaches, requiring software that can track performance indicators, patient satisfaction, and health outcomes.

Compliance-driven Innovation

Regulatory demands, including the Health Insurance Portability and Accountability Act (HIPAA) and other state-specific guidelines, are pushing vendors to enhance data security, audit capabilities, and reporting functionalities.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.94 Billion |

| Market Size by 2033 | USD 4.97 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Mode of Delivery, End use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | U.S., Canada, Mexico |

| Key Companies Profiled | Veradigm LLC (Allscripts Healthcare), Cerner Corporation (Oracle Corporation), Netsmart Technologies, Inc., MatrixCare, McKesson Corporation, VITALS SOFTWARE, PointClickCare, Medtelligent, Inc., Omnicell, Inc., Genexod Technologies LLC |

One of the primary drivers of the North America long-term care software market is the rapidly aging population across the region, especially in the United States and Canada. According to the U.S. Census Bureau, by 2030, one in every five Americans will be of retirement age. This demographic trend is intensifying the demand for comprehensive long-term care solutions, which include assisted living, nursing homes, and in-home care services.

As aging populations typically face chronic conditions such as dementia, arthritis, and cardiovascular diseases, healthcare providers require software solutions capable of managing long-term treatment plans, monitoring vital signs, and maintaining accurate, up-to-date patient records. Long-term care software facilitates better management of these chronic conditions, reduces the risk of medication errors, and streamlines workflows for overstretched caregivers. Additionally, it ensures adherence to clinical pathways and enhances patient safety, making it indispensable in modern geriatric care.

Despite its advantages, the adoption of long-term care software is not without challenges. A significant restraint impacting the market is the concern over data privacy and cybersecurity. Long-term care facilities handle highly sensitive patient information, including medical histories, insurance records, and billing data. As these facilities digitize their records and move towards cloud-based platforms, they become increasingly vulnerable to data breaches and cyber threats.

In recent years, several high-profile cyberattacks targeting healthcare systems in North America have highlighted the urgency for stringent security measures. Many smaller care homes and assisted living facilities, particularly in Mexico and rural parts of Canada, lack the IT infrastructure and resources to implement advanced cybersecurity protocols. This vulnerability raises concerns among administrators and may delay software adoption or lead to resistance from stakeholders.

The growing preference for aging in place — where seniors receive care in the comfort of their own homes — presents a substantial opportunity for long-term care software providers. Especially in a post-pandemic world, home healthcare agencies are investing in technologies that allow for remote monitoring, virtual consultations, and digital documentation.

This trend is not only driven by patient preference but also by cost-effectiveness. Home care services are generally less expensive than institutional care, and governments across North America are encouraging this shift through funding programs and reimbursement incentives. Software platforms offering home care scheduling, telehealth capabilities, and mobile documentation tools are poised for significant growth. For example, in the U.S., companies like MatrixCare and Homecare Homebase are seeing rising demand for solutions that support hybrid care models.

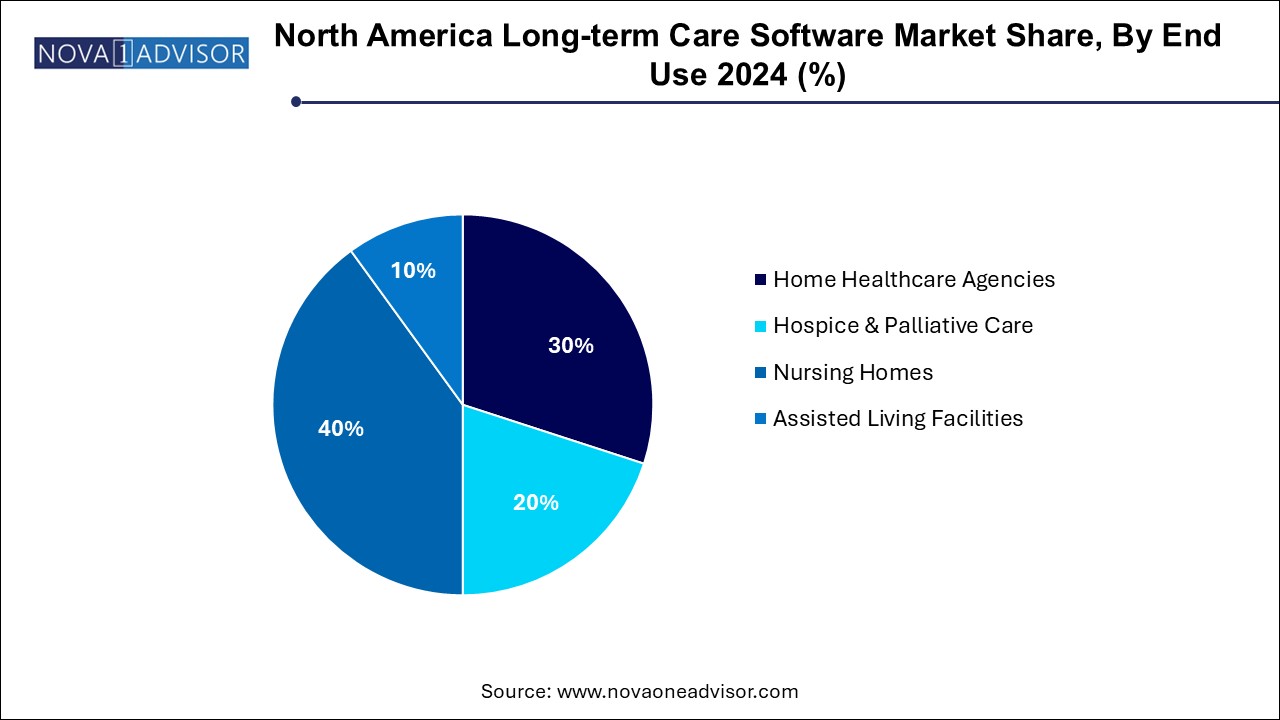

Electronic Health Records (EHRs) dominated with 32.6% of the market share in 2024 owing to the increasing demand for centralized and streamlined healthcare administration. EHRs are central to the functioning of long-term care facilities as they allow seamless access to patient information, promote continuity of care, and reduce administrative workload. Facilities across the U.S. and Canada are prioritizing the implementation of EHR systems to align with federal mandates and to avoid penalties linked to non-compliance. Furthermore, the push for interoperability with hospital systems and insurance platforms is enhancing the relevance of EHRs in long-term care settings.

The fastest-growing segment is Electronic Medication Administration Record (eMAR). As medication errors continue to be a significant concern in long-term care settings, eMAR systems are gaining traction for their ability to streamline drug administration, track dosages, and issue alerts for missed medications. These systems reduce the burden on nursing staff and improve patient safety, especially for residents with complex medication regimens. With the added benefit of integration with pharmacy systems, eMAR adoption is witnessing substantial momentum across nursing homes and assisted living centers.

The cloud based solutions segment dominated the market in 2024 owing to their cost-effectiveness. largely due to their flexibility, scalability, and cost-effectiveness. Long-term care providers, particularly in the U.S., are shifting from legacy systems to cloud platforms that allow real-time updates, data sharing, and remote access. These solutions reduce the need for on-premise IT infrastructure and enable better coordination among geographically dispersed teams. Moreover, cloud technology supports compliance through automatic updates, secure backups, and encrypted communication channels.

The web-based solutions segment is projected to grow at a CAGR of 11.4% during the forecast period. Propelled by smaller facilities and home care agencies looking for lightweight, browser-accessible systems. These platforms often serve as a cost-effective alternative to cloud or on-premise models, especially for organizations with limited IT capabilities. They provide essential functionality with simplified deployment and maintenance, making them ideal for facilities in rural or underserved areas.

The nursing care segment registered 40.0% of the market share in 2024 due to the increased number of patients with chronic illnesses. Accounting for the largest market share. This is primarily because nursing homes cater to patients with chronic illnesses and those requiring round-the-clock supervision. Software platforms enable these facilities to manage resident care plans, monitor vital signs, and coordinate with healthcare professionals. Integration of long-term care software enhances both clinical efficiency and regulatory compliance, which is critical in an environment that demands meticulous documentation and high standards of care.

The home healthcare segment is expected to grow at a CAGR of 12.4% during the forecast period owing to significant technological advancements. The increasing demand for remote patient monitoring, mobile care applications, and flexible care delivery models is prompting a surge in software adoption in this segment. These agencies require robust systems for scheduling, patient data entry, and caregiver communication. Given the rise in home-based care following the COVID-19 pandemic, long-term care software vendors are tailoring their products to meet the unique needs of this decentralized care model.

United States

The United States represents the largest market for long-term care software in North America, attributed to advanced healthcare infrastructure, robust government initiatives, and widespread adoption of digital health solutions. Federal programs like the Health Information Technology for Economic and Clinical Health (HITECH) Act and incentives under Medicare and Medicaid are supporting the implementation of health IT systems across the long-term care ecosystem. Additionally, partnerships between software providers and healthcare systems are boosting innovation in the space.

For instance, in 2023, the U.S. Department of Health and Human Services (HHS) launched initiatives to standardize data collection in long-term care settings, promoting software upgrades for better interoperability. Vendors such as MatrixCare, Netsmart, and PointClickCare have gained strong footholds through tailored solutions designed to meet regulatory and clinical requirements of U.S. facilities.

Canada

Canada’s market is growing steadily, supported by provincial digitization strategies and the rising demand for elder care services. The government’s investments in long-term care infrastructure, particularly following the COVID-19 pandemic, have accelerated the need for digital solutions. EHR and resident care applications are among the most sought-after segments in the Canadian market. However, privacy concerns and regulatory variability across provinces remain key challenges.

Mexico

Mexico represents a nascent but promising market for long-term care software. The growing awareness of elder care needs, along with efforts to modernize healthcare services, is driving the adoption of basic EHR systems and medication tracking tools. Public-private collaborations and investments in telehealth infrastructure are expected to support market expansion. However, economic constraints and a lack of digital literacy in rural areas continue to hinder large-scale deployment.

PointClickCare Technologies announced a strategic partnership with the American Health Care Association in February 2024, aimed at enhancing interoperability in skilled nursing facilities through data-sharing initiatives.

MatrixCare, a ResMed company, launched a new AI-driven analytics dashboard in October 2023 to help care managers identify at-risk residents and track quality metrics more effectively.

Netsmart Technologies collaborated with the National Association for Home Care & Hospice in September 2023 to provide integrated solutions for remote care management and improve staff scheduling in home-based care services.

AL Advantage, a prominent provider of assisted living software, introduced a web-based mobile platform for caregiver documentation in August 2023, enabling more efficient note-taking and patient updates in real time.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America long-term care software market

Application

Mode of Delivery

End Use

Country