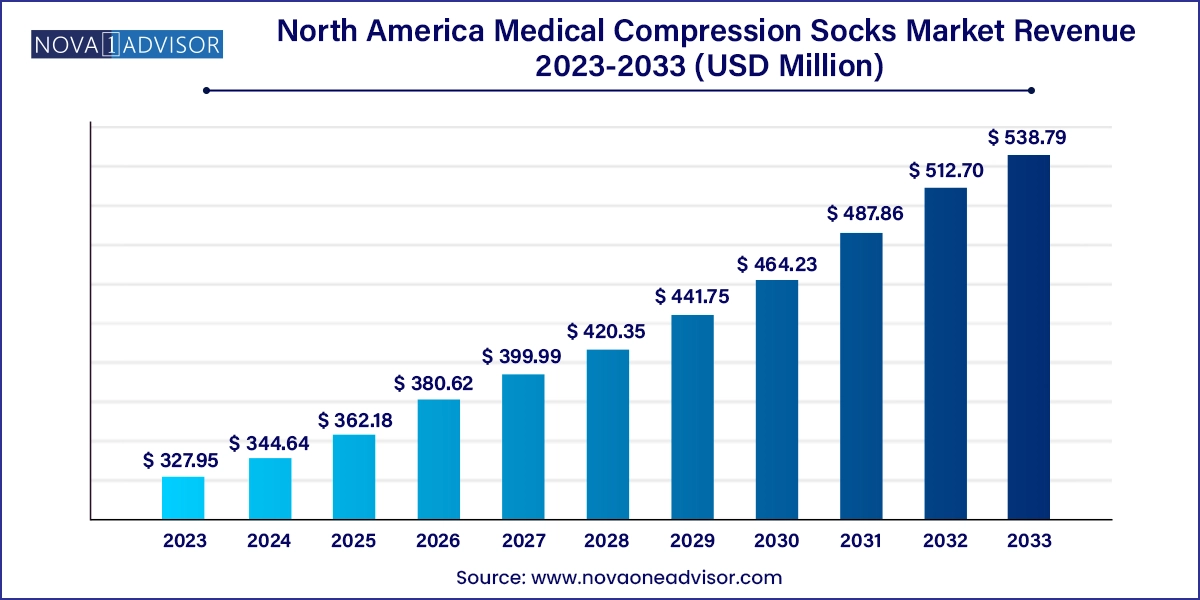

The North America medical compression socks market size was exhibited at USD 327.95 million in 2023 and is projected to hit around USD 538.79 million by 2033, growing at a CAGR of 5.09% during the forecast period 2024 to 2033.

The North America medical compression socks market has emerged as a dynamic and steadily expanding segment within the broader healthcare and wellness industry. These specialized garments are designed to apply graduated pressure to the lower limbs, enhancing venous blood flow, reducing swelling, and preventing venous disorders such as deep vein thrombosis (DVT), varicose veins, and chronic venous insufficiency. Once limited to post-operative or geriatric care, medical compression socks have evolved into essential lifestyle and preventive health products used by a diverse consumer base including athletes, pregnant women, travelers, and sedentary professionals.

The market's expansion in North America is driven by a confluence of medical, demographic, and behavioral factors. Rising awareness about circulatory health, the aging baby boomer population, the increasing incidence of lifestyle diseases such as obesity and diabetes, and prolonged sedentary work cultures are all contributing to the growing uptake of compression socks. Moreover, as the healthcare paradigm shifts from reactive treatment to preventive wellness, compression garments have gained traction as a non-invasive and cost-effective tool for managing early-stage venous diseases and maintaining circulatory health.

Technological advancements in textile engineering, product aesthetics, and breathable materials have transformed the perception of compression socks from clinical utilities to fashion-forward health accessories. Leading brands now offer performance-driven designs tailored for both medical efficacy and comfort, suitable for everyday use. Furthermore, e-commerce platforms, telehealth services, and direct-to-consumer models are reshaping the distribution landscape, improving access and patient compliance.

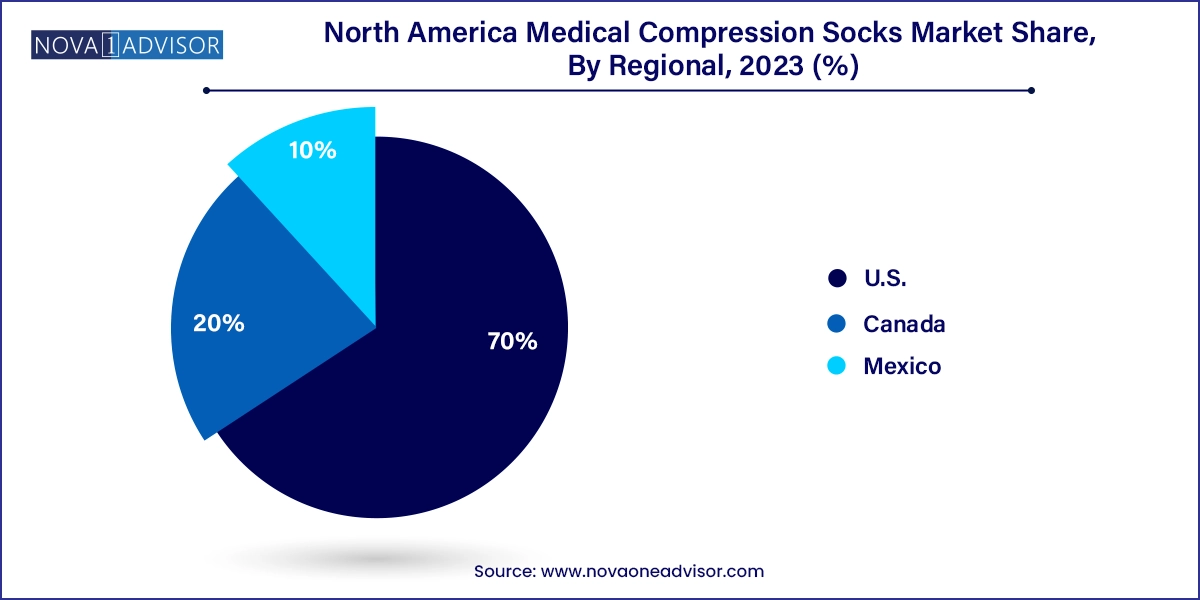

The U.S. dominates the regional market, but Canada and Mexico are witnessing growing penetration, supported by increasing healthcare awareness, expanding retail distribution, and aging populations. As innovation continues to blur the lines between medical necessity and lifestyle convenience, the North America medical compression socks market is set to experience sustained demand and diversification.

Expansion into Athletic Wear: Compression socks are increasingly designed for performance athletes and runners, marketed for post-workout recovery, reduced muscle soreness, and improved endurance.

Integration with Smart Wearables: Companies are exploring smart compression socks embedded with sensors to track blood flow, gait, and pressure changes in real time.

Growth in Direct-to-Consumer Sales Channels: Online platforms and brand-owned e-commerce stores are driving retail sales, especially post-pandemic.

Fashion-Function Fusion: Stylish patterns, colors, and lightweight materials are being used to cater to young professionals and female consumers who demand both efficacy and aesthetics.

Increased Use in Maternity Care: Compression socks are being recommended during pregnancy to combat leg swelling, improve circulation, and prevent varicose veins.

Post-Pandemic Rise in Sedentary Lifestyles: Work-from-home culture and long screen-time hours have spurred a surge in usage among sedentary workers concerned about lower limb circulation.

Sustainability in Compression Wear: Use of eco-friendly and recycled fabrics is on the rise as brands cater to environmentally conscious consumers.

| Report Coverage | Details |

| Market Size in 2024 | USD 344.64 Million |

| Market Size by 2033 | USD 538.79 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.09% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Target Group, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | Julius Zorn, Inc.; Essity; SIGVARIS GROUP; Medi; Goodhew, LLC; Cardinal Health; Medline; Mölnlycke Health Care AB; CHARMKING; Thuasne; COMRAD; Enovis (DJO, LLC); 3M; beltwell.com; Surgical Appliance Industries (SAIBrands); Ames Walker |

Sedentary professionals dominated the North America medical compression socks market by target group. This dominance stems from the increasingly sedentary nature of work in sectors such as technology, finance, education, and administration. Long hours spent sitting at desks without adequate leg movement often lead to leg fatigue, swelling, and increased risk of circulatory issues. Compression socks designed for this group offer mild to moderate pressure, enhancing comfort during work and promoting healthy circulation. These products are frequently purchased online, especially in metro areas with high white-collar employment density.

On the other hand, athletes and sports people represent the fastest-growing segment, as awareness spreads regarding the benefits of compression therapy for muscle recovery and athletic performance. Brands are leveraging sports marketing and social media influencers to promote performance-enhancing features such as lactic acid reduction and post-exercise recovery. Athletes both professional and recreational are now using compression socks as a standard part of their gear for running, training, and competitive sports. Innovations such as zoned compression, breathable knits, and temperature-regulating fibers have further enhanced product adoption in this niche.

The United States is the largest market for medical compression socks in North America, accounting for a dominant share of total regional revenue. This is due to its large elderly population, high incidence of chronic diseases, and well-established health and wellness culture. The U.S. has witnessed extensive integration of compression therapy into physical rehabilitation, outpatient care, and even preventive workplace wellness programs. Moreover, DTC (Direct-to-Consumer) e-commerce channels like Amazon, Zappos, and brand websites have made it easier for users to browse, consult, and purchase compression socks tailored to their lifestyle and medical needs.

Canada is emerging as a fast-growing market driven by a rising focus on active aging, preventive medicine, and national healthcare support. With one in five Canadians expected to be over 65 by 2030, there is growing emphasis on managing circulatory health and reducing hospitalization for preventable conditions like DVT and varicose veins. Provinces such as Ontario and British Columbia have introduced reimbursement programs for compression therapy in clinical care, enhancing affordability. Additionally, the increase in e-commerce penetration and fitness consciousness is encouraging younger Canadians to explore compression products beyond medical use.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America medical compression socks market

Target Group

Regional