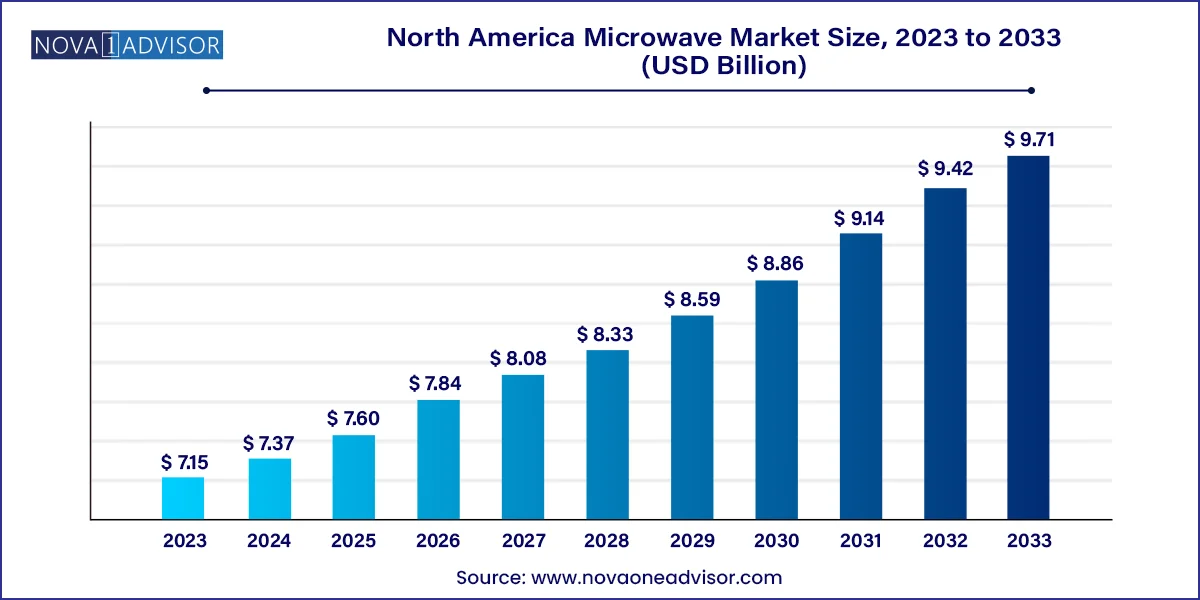

The North America microwave market size was exhibited at USD 7.15 billion in 2023 and is projected to hit around USD 9.71 billion by 2033, growing at a CAGR of 3.11% during the forecast period 2024 to 2033.

The North America microwave market has matured into a highly competitive and innovation-driven segment of the home appliance industry. With changing consumer lifestyles, the demand for quick and efficient cooking solutions has grown exponentially. Microwaves have become a kitchen staple in American and Canadian households, evolving from basic reheating tools to multifunctional, tech-enhanced devices capable of convection baking, grilling, defrosting, and even air-frying. This transformation reflects a broader shift in consumer preferences toward convenience, time-efficiency, and compact kitchen appliances that support versatile cooking habits.

A steady rise in the number of nuclear families, dual-income households, and urban dwellers has reinforced the need for practical, space-saving appliances. Microwave ovens, with their rapid cooking and energy-saving capabilities, have emerged as a cornerstone of modern kitchen designs. The integration of microwaves with smart technologies—such as Wi-Fi control, voice assistant compatibility, and auto-cook programs—further expands their appeal across both tech-savvy and traditional consumers.

Moreover, the microwave market in North America is not limited to residential buyers. The foodservice and hospitality sectors also contribute significantly, using heavy-duty commercial microwaves in restaurants, cafes, and institutional kitchens. These segments are driven by rising demand for ready-to-eat meals and growing consumer reliance on frozen food products. Overall, the North America microwave market is a blend of evolving consumer behaviors, retail innovations, and technological advancements—setting the stage for continuous growth through 2033.

Smart Microwaves with IoT Integration: Increasing adoption of AI-enabled and app-controlled microwaves that offer programmable functions and voice command compatibility.

Growth in Convection Microwave Sales: Consumers prefer convection models for their versatility in baking, grilling, and cooking, replacing traditional ovens in smaller households.

Sustainability and Energy Efficiency: Demand for eco-friendly and energy-efficient microwave ovens is surging, supported by consumer awareness and regulatory initiatives.

Design Aesthetics and Built-In Preferences: Premium kitchens are opting for sleek, built-in microwaves that align with modular cabinetry and enhance space utilization.

Rise of Multi-Cooking Appliances: Hybrid models that combine air frying, steaming, and microwave functionality are gaining popularity among health-conscious users.

E-commerce Expansion: Online retail platforms are witnessing rapid growth in microwave sales due to discounts, broad variety, and customer reviews.

Premiumization of Home Appliances: Consumers are upgrading to high-end models with advanced sensors, LCD touch panels, and smart cooking algorithms.

Customization and Localization: Manufacturers are tailoring models to regional cooking styles and preferences, such as adding specific pre-set options for North American meals.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.37 Billion |

| Market Size by 2033 | USD 9.71 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Technology, Price, Capacity, Power, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada |

| Key Companies Profiled | Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Frigidaire (Electrolux Inc.); Kenmore (Transform Holdco LLC); GE Appliances (a Haier company); Panasonic Corporation; Breville; Sharp Corporation |

A primary driver of the North America microwave market is rapid urbanization, which has redefined residential architecture and kitchen space utilization. With increasing apartment-style living and the shrinking size of modern kitchens, there's a heightened demand for compact, efficient, and multifunctional appliances. Microwaves meet these criteria by offering convenience, speed, and multiple cooking functionalities in a single compact unit.

Urban dwellers, particularly in cities like New York, Toronto, and Los Angeles, often face time constraints that limit elaborate cooking. Microwaves, especially convection models, provide a reliable solution for meal preparation, defrosting, and even gourmet cooking in a fraction of the time. Additionally, the influx of young professionals and students into urban regions contributes to rising sales of mid-range and entry-level microwave models, which prioritize essential features over luxury add-ons. This urban momentum continues to propel demand across both countertop and built-in variants.

Despite growth, the saturation of the North American market acts as a key restraint. A large proportion of households already own at least one microwave, which limits the scope for first-time sales. As a result, market growth in mature regions like the U.S. becomes increasingly dependent on product replacement or upgrades rather than new purchases. Consumers often delay upgrading unless the existing microwave becomes non-functional or outdated.

Furthermore, the relatively long product lifecycle of microwaves—often exceeding 7-10 years—means that replacements are infrequent. This dynamic presents a challenge for manufacturers, as they must consistently innovate and introduce compelling features to entice customers to replace functional appliances. This replacement-driven growth model could lead to slower overall expansion unless new value propositions, such as AI integration or health-oriented functions, are aggressively promoted.

One of the most exciting opportunities in the North American microwave market lies in catering to the health-conscious consumer base. With growing awareness around healthy eating and clean cooking, there is a rising demand for microwaves that can support healthier meal preparation. This includes steam-based cooking, air frying capabilities, low-oil recipes, and auto-programs for nutrient-rich meals.

Manufacturers are leveraging this trend by launching microwaves equipped with health-specific features. For instance, Panasonic’s “Inverter Technology” ensures even cooking that preserves the nutritional value of food. Similarly, Whirlpool’s “Scan-to-Cook” technology allows users to scan food packages and optimize cook settings automatically—ideal for health-conscious consumers seeking consistent quality. Companies that align their product development with these evolving consumer values are poised to capture significant market share in the coming years.

Countertop microwave market accounted for a share of over 57% of the North America revenues in 2023. These models are affordable, require no installation, and cater to the mass market segment. They are particularly popular among renters, students, and budget-conscious households. Brands such as Toshiba, Panasonic, and Hamilton Beach lead this segment, offering a variety of models under $200. These microwaves are ideal for reheating, defrosting, and basic cooking needs and are widely available across supermarkets, electronics retailers, and online platforms.

On the other hand, built-in microwaves are emerging as the fastest-growing segment, driven by a shift in consumer focus toward premium kitchen aesthetics and integrated appliances. Built-in models are common in modular kitchens, especially among urban homeowners renovating their living spaces. These microwaves offer advanced features like touch panels, multi-stage cooking, and seamless integration with smart home systems. Though priced higher, their growing adoption in upscale residential projects is expected to significantly boost their market share over the next decade.

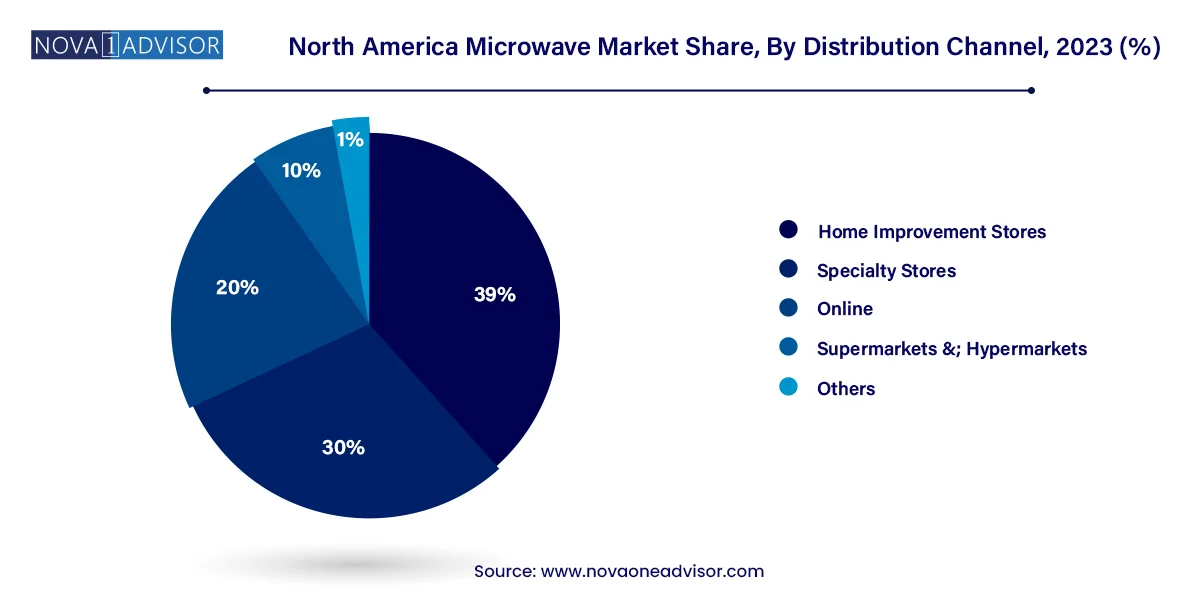

The sales of microwave through home improvement stores accounted for a share of around 39% in 2023. driven by consumer trust, in-store promotions, and bundled discounts. Retail giants like Walmart and Costco carry an extensive inventory, often supported by manufacturer incentives and seasonal offers. Consumers value the ability to physically evaluate appliances before purchasing.

The sales of microwave through online distribution channels are projected to grow at a CAGR of 4.2% from 2024 to 2033. E-commerce platforms like Amazon, Best Buy, and manufacturer websites are increasingly preferred, especially among tech-savvy and younger demographics. Flash sales, return policies, and digital financing options have further boosted the online microwave market in North America.

Traditional microwaves continued to lead the market in terms of volume, especially in the below-$300 price segment. These models cater to the most basic heating and cooking functions and are preferred by older consumers and those uninterested in complex cooking features. Despite limited capabilities, their affordability and widespread availability make them a staple in many North American kitchens.

In contrast, convection microwave ovens are witnessing the fastest growth, driven by the demand for versatile and multifunctional cooking appliances. These models combine microwave radiation with a convection fan and grill, allowing users to bake, roast, and crisp food. As a result, they appeal to cooking enthusiasts and families who want to replace conventional ovens with a compact, energy-efficient solution. Increased marketing by brands like LG, Samsung, and GE has further enhanced their visibility and acceptance in the market.

Microwaves priced between USD 301 to USD 500 accounted for a share of over 35.4% of the North America revenues in 2023. These models often include stainless steel designs, Wi-Fi control, inverter technology, and sensor cooking features. Consumers undertaking kitchen renovations or seeking to match existing high-end appliances are increasingly willing to invest in this premium segment.

The market for microwaves priced between USD 100 to USD 300 is projected to grow at a CAGR of 4.0% from 2024 to 2033. Consumers in this range seek value-for-money options, such as mid-sized countertop or entry-level over-the-range microwaves with digital displays and pre-programmed functions. This segment attracts both first-time buyers and replacement customers, making it a volume-driven category.

Medium (1.5 to 2.5 cubic feet) capacity microwave accounted for a share of over 67% of the North America revenues in 2023. serving the average needs of North American households. They provide sufficient internal space for family-sized meals, dinner plates, and casserole dishes. This segment also includes many mid-range models that balance power and capacity, catering to a broad user base.

Small (Less than 1.5 cubic feet) capacity microwave market is projected to grow at a CAGR of 3.7% from 2024 to 2033. Their compact form factor, energy efficiency, and affordable pricing make them ideal for single users and space-constrained kitchens. With minimal compromise on functionality, these microwaves are favored in secondary use-cases like office pantries and studio apartments.

Medium power (800 to 1,200 watts) microwave accounted for a share of over 78% of the North America revenues in 2023. These units offer a good mix of speed, energy efficiency, and compatibility with most cooking tasks. Brands commonly optimize these units for frozen meals, popcorn settings, and one-touch cooking programs.

These microwaves offer a significant improvement in cooking speed without consuming excessive amounts of energy, making them an attractive option for those seeking both efficiency and convenience in their kitchen appliances.According to a February 2024 Gitnux report, approximately 90% of households in the U.S. own a microwave.

High powered microwave market is projected to grow at a CAGR of 3.6% from 2024 to 2033, particularly within the convection and commercial-grade segments. These microwaves reduce cooking time, improve texture, and support complex recipes. They are increasingly used in restaurants, cloud kitchens, and premium home kitchens—where speed and performance are critical.

The U.S. represents the largest market for microwaves in North America, accounting for the lion’s share of both residential and commercial sales. With over 90% household penetration, the focus has shifted toward premium features, aesthetic integration, and smart functionality. Built-in and over-the-range models are gaining ground in urban homes, while traditional countertop microwaves remain dominant in rural and suburban areas.

The rising trend of modular kitchens and health-focused eating habits is reshaping product preferences. Tech-driven innovations, such as Amazon Alexa and Google Home compatibility, are gaining traction in smart homes. Moreover, increasing restaurant and café chains across the U.S. use high-wattage commercial microwaves for rapid meal service—further diversifying the demand landscape.

Canada’s microwave market is marked by steady growth, driven by evolving culinary trends, urban housing expansion, and rising disposable incomes. Canadian consumers are environmentally conscious and prefer appliances that align with energy-saving norms and sustainable practices. The demand for mid-priced, medium-capacity convection microwaves is particularly strong.

Additionally, regional preferences vary—with urban centers like Toronto and Vancouver opting for sleek, space-efficient models, while rural households still favor conventional, high-capacity microwaves. The Canadian government’s emphasis on energy efficiency under the ENERGY STAR program further influences purchase decisions. Online retail is gaining momentum, especially for premium appliance brands not widely available in brick-and-mortar stores.

January 2024 – LG Electronics launched its “NeoChef 2024 Series” in North America featuring inverter technology, humidity sensors, and smart diagnostics.

September 2023 – Whirlpool Corporation introduced its smart microwave with Scan-to-Cook technology, improving automation and cooking accuracy.

June 2023 – GE Appliances debuted its latest built-in microwave collection compatible with Amazon Alexa and integrated into its smart kitchen suite.

April 2023 – Panasonic Canada introduced compact inverter models targeting urban consumers looking for countertop efficiency and energy savings.

February 2023 – Samsung Electronics expanded its over-the-range microwave lineup with voice-controlled capabilities and ceramic interiors for easy cleaning.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America microwave market

Type

Technology

Price

Capacity

Power

Distribution Channel

Country