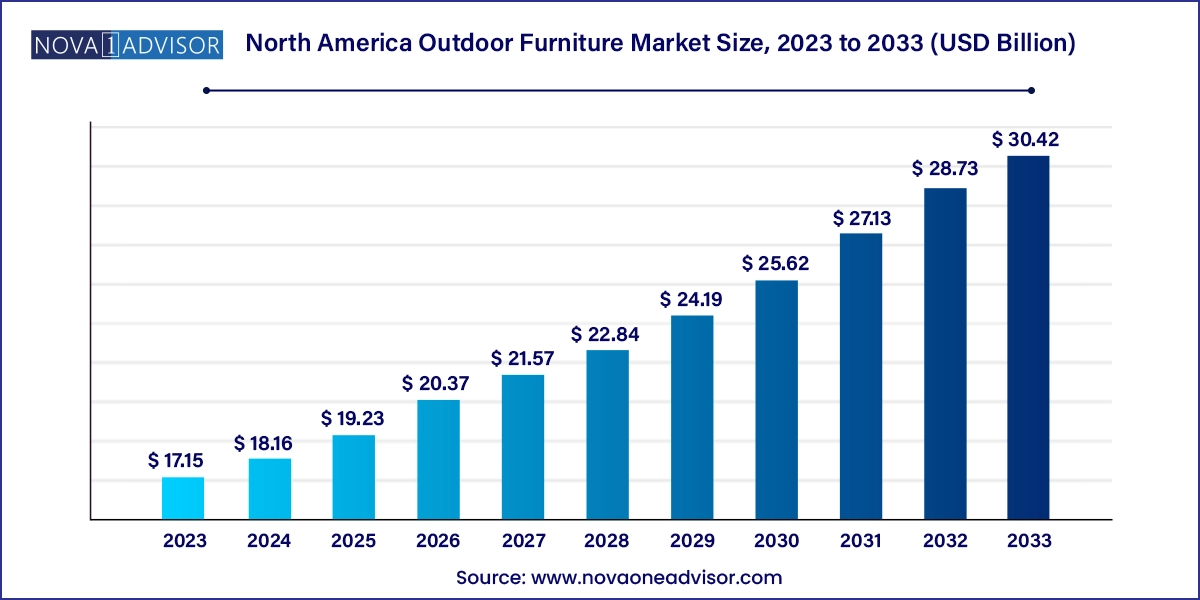

The North America outdoor furniture market size was exhibited at USD 17.15 billion in 2023 and is projected to hit around USD 30.42 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 18.16 Billion |

| Market Size by 2033 | USD 30.42 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Material Type, End-use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. Canada, Mexico |

| Key Companies Profiled | Ashley Furniture Industries, Inc.; Brown Jordan Inc.; Agio International Company, LTD.; Lloyd Flanders, Inc.; Barbeques Galore; Century Furniture LLC.; Kimball International Inc.; Andreu World; Homecrest Outdoor Living; Gloster |

With the rapid expansion of real estate as well as commercial construction, the demand for outdoor furniture in North America is expected to increase from this segment. According to the World Property Journal, the total value of every home in the U.S. was USD 33.6 trillion in January 2020. Increasing infrastructural developments as well as new building permits in the region are expected to present the outdoor furniture market with numerous opportunities.

North America outdoor furniture market accounted for 34.24% share of the global outdoor furniture market revenue in 2023. The market growth of outdoor as well as indoor furniture changed with the pandemic. People transformed their porch and the backyards into a gym, restaurants, and workplaces as they had to stay inside their homes for a long time. According to a blog published in Home News Now in March 2022, sales of American Furniture Warehouse peaked during the pandemic due to the transformation of the backyards made by people in order to experience outdoor comfort at their own place. The company usually buy products from 200 factories in 13 countries to keep the furniture in stock to meet the rising customer demand for outdoor furniture.

The rapid rise in commercial construction activities, especially in the hospitality sector, is also driving the demand for outdoor furniture. The hotel industry is a significant contributor to the hospitality market, fueling the development of new hotels. The thriving real estate industry, followed by numerous infrastructure improvements in the hospitality sector, will continue to drive the market growth.

According to Consumer Buying Trends Survey, Casual Living reported that there is an increase in outdoor furniture buying activity and millennials tend to purchase more than others. Millennial households accounted for 37 percent of purchases. Baby boomers followed close behind with 34 percent of sales, while generation X-ers accounted for 23 percent. Industry experts expect millennials’ buying power to continue in this sector, as Americans aged 19-35 years old begin to build careers, families, and homes.

The outdoor seating furniture market in North America accounted for a revenue share of 28% in 2023. Growing demand for comfortable seating seat in commercial and residential sector is expected to boost segment growth over the forecast period.

The demand for outdoor tables in North America is projected to grow at a CAGR of 6.6% from 2024 to 2033. Consumers increasingly spent on home renovation by making their balconies or outdoor spaces more usable, thereby contributing to the increased demand for multipurpose and high quality tables. Tables are the important product in outdoor furniture, it helps to create aesthetic look and takes less space.

The North America wooden outdoor furniture market accounted for a revenue share of 66.0% in 2023. The capacity of wooden outdoor furniture to withstand harsh climatic conditions including rain, protection from insects, dust, and solid particles, and resistance to extreme temperatures have encouraged more people to buy outdoor furniture. Additionally, there is a considerable market need for outdoor furniture made of upholstery fabrics, teak wood, eucalyptus, and premium metals to adorn outdoor spaces.

The demand for metal outdoor furniture market in North America is projected to grow at a CAGR of 6.0% from 2024 to 2033. There is increasing usage of cast aluminum in outdoor furniture by manufacturers due to its rising popularity among consumers. Cast aluminum is best for chairs as it is lightweight, and dining chairs must constantly be moved. Moreover, aluminum does not rust and is thinner than concrete, making it more appealing. Cast and hard tube aluminum have superior efficiency. Tubular metal is lightweight and hollowing, as well as less durable. However, because of its lightweight, it is suitable for poolside furniture and is often used for tables, folding chairs, and swing sets.

The residential outdoor furniture market in North America accounted for a revenue share of 41.48% in 2023.Consumers increasingly spent on home renovation by making their balconies or outdoor spaces more usable, thereby contributing to the increased demand for outdoor furniture. According to the survey conducted by Home Advisor, there has been a noticeable increase in spending for home improvement in the U.S., with USD 13,138 in 2020, which is USD 4,000 more than the previous year. Furthermore, in May 2019, Brown Jordan Inc. acquired Casttella Furniture Co., Inc. and its Costa Rican operations. Through this, Brown Jordan will be able to provide outdoor casual furniture to residential markets and expand its distribution network.

The North America commercial outdoor furniture market is projected to grow at CAGR of 5.8% over the forecast period of 2024-2033. The demand for outdoor furniture in North America has risen owing to the growing trend of family gatherings and dinners at home. This trend is further supported by the rising interest in creating and maintaining front yard and backyard gardens not only to enhance the aesthetics of the homes but also to entertain guests outdoor. This is likely to boost the demand for outdoor furniture in the residential segment.

The North America outdoor furniture market is projected to grow at a CAGR of 5.8% from 2024 to 2033. According to the latest Outdoor Furnishings Trend Report released by the International Casual Furnishings Association 71% of Americans have been spending much more time outside in 2022 compared to last year—as many as 7 hours. One of the main reasons for this is that more Americans are choosing to work from home and a lot of that time has been spent outdoors. The study also showed that 63% of Americans intend to upgrade their outdoor furniture this year, referring to purchases like outdoor chairs, dining tables, and sofas, among others.

U.S. Outdoor Furniture Market Trends

The outdoor furniture market held 80% of the North American sales revenue in 2023. The presence of companies such as Brown Jordan and Forever Patio, the availability of innovative and trendy furniture products in the market, and the willingness of consumers to spend on home furnishings, including outdoor furniture, are among the key factors fueling the U.S. market growth. With increased demand for outdoor furniture for various settings, direct retailers and furniture stores have been increasing their offerings to keep up with the demand.

For instance, in April 2022, stars of an HGTV home renovation show launched an outdoor décor line with retail giant Walmart. Dave and Jenny Marrs launched the Marrs Collection by Better Homes & Gardens, which features 30 outdoor furniture and décor items in an elevated and livable style to create the perfect backyard setup. The warm capsule collection includes a Teak Wood Outdoor Dining Table (at USD 997) and a Teak Wood Porch Swing with Cushions (at USD 897).

Canada Outdoor Furniture Market Trends

The outdoor furniture market in Canada is expected to grow at a CAGR of 7% from 2024 to 2033. The sales of outdoor furniture in Canada have seen an increase as the creation of outdoor living spaces such as decks, patios, balconies, porches, gardens, and poolside areas has risen in recent years. This can be attributed to positive economic growth. However, the Canadian climate can be rather unpredictable, with extreme temperature fluctuations ranging from rain to snow to sleet to hail. This has been known to take a toll on outdoor furniture, depending on the material used. This factor could limit the purchase of outdoor furniture in Canada.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America outdoor furniture market

Product

Material Type

End Use

Regional