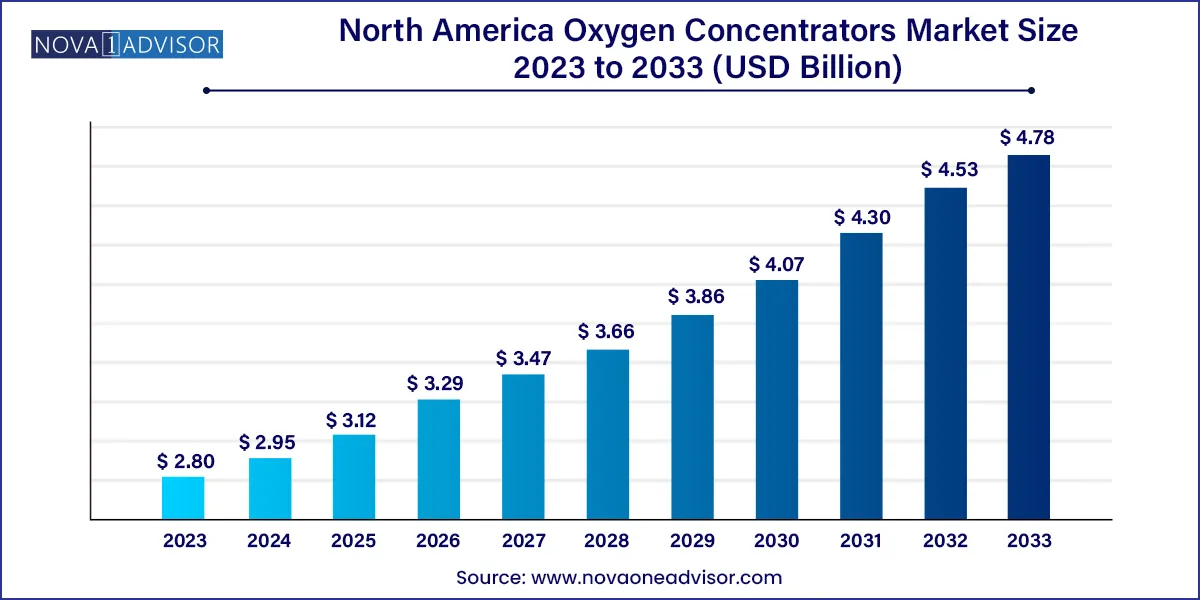

The North America oxygen concentrators market size was exhibited at USD 2.80 billion in 2023 and is projected to hit around USD 4.78 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.95 Billion |

| Market Size by 2033 | USD 4.78 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America |

| Key Companies Profiled | Inogen, Inc.; Respironics (a subsidiary of Koninklijke Philips N.V.); React Health (Respiratory Product Line from Invacare Corporation); Caire Medical (a subsidiary of NGK Spark Plug); DeVilbiss Healthcare (a subsidiary of Drive Medical); O2 Concepts; Nidek Medical Products, Inc. |

The increasing prevalence of respiratory conditions, such as COPD, asthma, and sleep apnea, is driving the growth of the respiratory care market. According to a February 2023 article by the American Lung Association, over 34 million Americans suffer from chronic lung diseases including COPD, asthma, chronic bronchitis, and emphysema. In addition, advancements in respiratory technology have played a significant role in fueling market expansion. The COVID-19 pandemic had a limited positive impact on the market, leading to increased demand for advanced and cost-effective devices.

Oxygen therapy became a preferred choice for managing respiratory disorders during the pandemic, providing medical intervention for acute and chronic patient care. The market also benefited from the rising adoption of portable oxygen concentrators, with a significant increase in market penetration in the U.S. from 8% in 2015 to 22% in 2021. Furthermore, favorable reimbursement policies have contributed to the attractiveness of the oxygen concentrators market. These policies provide better reimbursement coverage for portable oxygen concentrators in the U.S. Additionally, healthcare spending in the U.S. and Canada has been increasing, triggering the need for effective diagnosis and treatment of respiratory diseases and driving the demand for oxygen concentrators.

Initiatives by public and private authorities, such as the World Health Organization's distribution of oxygen concentrators and the efforts of associations like the American Lung Association, promote awareness of respiratory diseases. Market players also employ strategies such as acquisitions, collaborations, expansions, and new product launches to extend their product offerings and geographical reach. For instance, React Health's acquisition of Invacare's Respiratory line in February 2023 strengthened its market position, expanded its product portfolio, and enabled them to cater to a wider customer base.

On the basis of the product, the market is segmented into portable oxygen concentrators and fixed oxygen concentrators. The Portable Oxygen Concentrators (POCs) segment dominated the market and accounted for a revenue market share of 53.8% in 2023. Moreover, the segment is projected to witness the fastest growth rate of 7.3% over the forecast period owing to the increasing need for portable medical oxygen concentrators, especially among mobile patients seeking out-of-home solutions.

Inogen's 10K form for the fiscal year ended December 31, 2021, reveals that approximately 80% of U.S. long-term oxygen therapy users preferred ambulatory oxygen, indicating a strong demand for portable medical oxygen concentrators. On the other hand, the fixed concentrators segment is expected to demonstrate moderate growth. Factors such as a substantial number of long-term patients, the growing elderly population, and the rising demand for these hospital devices contribute to the segment's steady performance.

On the basis of technology, the market is segmented into continuous flow and pulse flow. The continuous flow segment accounted for the largest revenue share of 61.7% in the market in 2023. This segment's dominance can be attributed to the increasing prevalence of long-term respiratory disorders, including asthma, COPD, bronchiectasis, and chronic sinusitis. Continuous flow technology is also widely used in residential and military applications, providing a safer alternative to storing oxygen under pressure.

The pulse flow technology segment is expected to experience the fastest CAGR of 5.7% during the forecast period. The growth is driven by the advantages offered by pulse flow technology, including high mobility, lightweight design, and suitability for patients with active lifestyles. Pulse flow technology is particularly beneficial for treating respiratory conditions that require a lower oxygen delivery rate per minute. It is extensively used in portable oxygen concentrators (POCs), which are anticipated to drive the demand for this segment in the coming years.

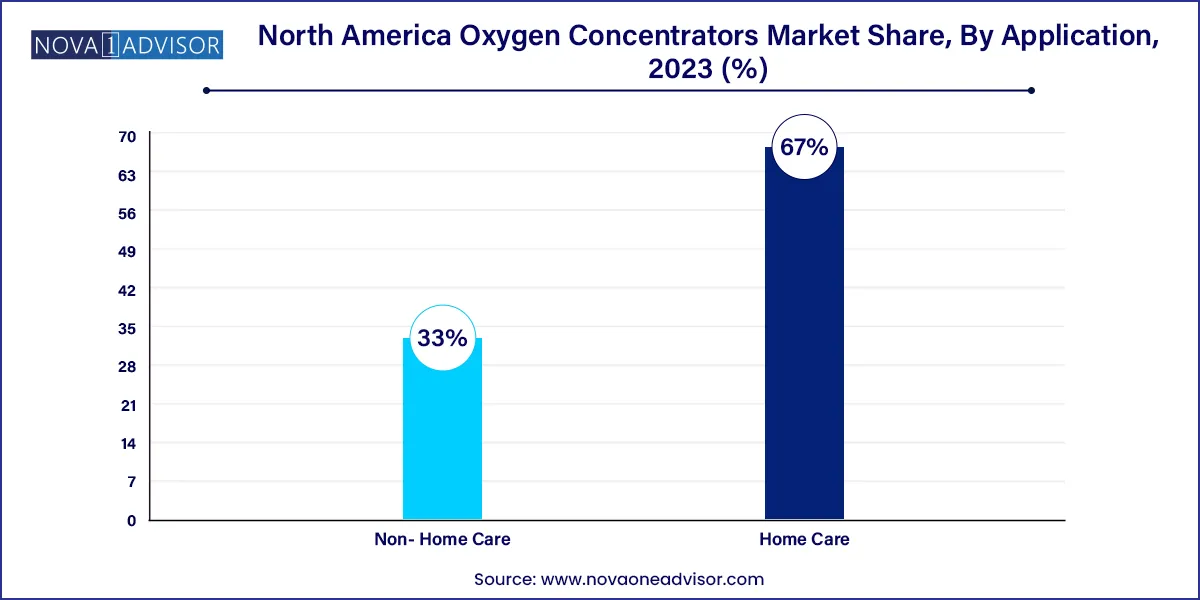

On the basis of application, the market is segmented into home care and non-home care. The home care application segment dominated the market in 2023 and accounted for a significant share of 67.0% of the overall revenue. The segment is also projected to register the fastest growth rate of 6.3% during the forecast period. The growth of this segment can be attributed to the rising adoption of Long-Term Oxygen Therapy (LTOT) devices in home settings and the availability of a wide range of home oxygen therapy devices (including Liquid Oxygen systems and portable concentrators).

In addition, the shifting preferences of patients towards receiving treatment at home is another key factor contributing to the growth of the home care application segment. On the other hand, the non-homecare segment is expected to exhibit moderate growth over the forecast period, driven by the increased adoption of oxygen therapy in hospitals and clinics. The segment also witnessed growth in 2020 due to the heightened usage of oxygen therapy for hospitalized COVID-19 patients.

Due to its significant investment in R&D, advanced healthcare infrastructure, access to the newest technology, and new product launches, the U.S. dominates the market in 2023. According to analyzed Medicare claims data, the Medicare penetration rate for portable oxygen concentrators (POCs) in the U.S. has steadily risen. For instance, in 2021, the POC penetration was 22.0%, while that of stationary was 17%. This is a developing trend favoring portable oxygen concentrators (POCs) over fixed oxygen concentrators and fueling market expansion. Government support, such as the Federal Aviation Administration's (FAA) approval of portable concentrators during plane travel, further drives the country's growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America oxygen concentrators market

Product

Technology

Application

Regional