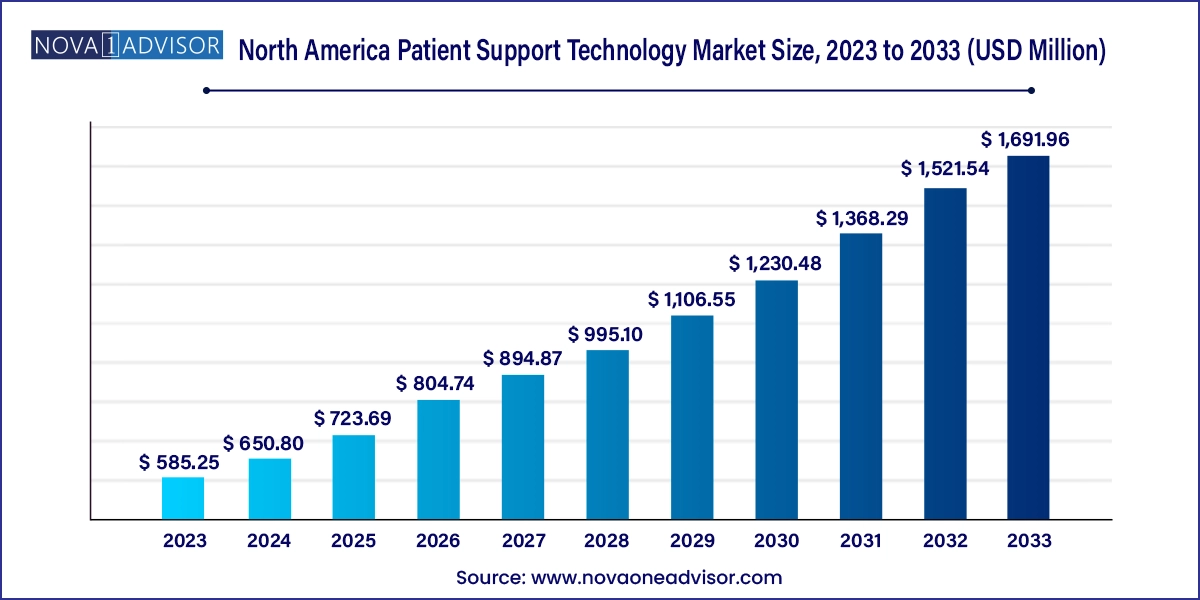

The North America patient support technology market size was exhibited at USD 585.25 million in 2023 and is projected to hit around USD 1,691.96 million by 2033, growing at a CAGR of 11.2% during the forecast period 2024 to 2033.

The North America Patient Support Technology Market has emerged as a vital component of modern healthcare infrastructure. These technologies are designed to improve patient care, streamline clinical workflows, enhance communication, and reduce the burden on medical staff. As healthcare systems evolve towards value-based care and digital transformation, patient support technologies are becoming central to delivering personalized, efficient, and accessible care.

Patient support technology includes hardware and software systems that assist in patient monitoring, communication, mobility, rehabilitation, and administrative management. This encompasses electronic health record (EHR)-integrated platforms, AI-powered chatbots, virtual care assistants, patient portals, and clinical decision support systems (CDSS). Increasingly, this category also includes remote monitoring tools and voice-assisted bedside systems.

The North American region particularly the United States and Canada has been at the forefront of adopting these tools, spurred by increasing pressure on healthcare providers to reduce readmission rates, improve patient satisfaction, and manage chronic diseases more effectively. Additionally, post-COVID-19 recovery has further elevated the importance of contactless patient engagement, digital triaging, and real-time symptom tracking.

The proliferation of smartphones, IoT in healthcare, and telehealth platforms, along with regulatory incentives from CMS and Health Canada, has catalyzed market expansion. Additionally, the presence of tech-forward healthcare systems, robust IT infrastructure, and a well-funded innovation ecosystem make North America an ideal environment for patient support technology development and deployment.

Integration of AI and NLP in Patient-facing Chatbots and Support Tools

Adoption of Remote Patient Monitoring (RPM) Devices in Chronic Disease Management

Growth in Personalized Patient Engagement Platforms Linked to EHRs

Expansion of Virtual Health Assistants in Triage and Medication Adherence

Use of Predictive Analytics to Identify Patient Risk and Improve Outcomes

Shift from Standalone Tools to Interoperable, Integrated Support Platforms

Rising Demand for Multilingual, Culturally-sensitive Support Systems

Gamification of Patient Education and Therapy Adherence

| Report Coverage | Details |

| Market Size in 2024 | USD 650.80 Million |

| Market Size by 2033 | USD 1,691.96 Million |

| Growth Rate From 2024 to 2033 | CAGR of 11.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada |

| Key Companies Profiled | Deloitte; Accenture; McKesson Corporation; Cardinal Health; DataRiver S.r.l; Medisafe; Inizio Engage; AssistRx |

A significant driver of the North American patient support technology market is the expansion of telehealth and remote care ecosystems, particularly following the COVID-19 pandemic. Healthcare delivery models have undergone a paradigm shift, with patients now expecting continuous, digital-first engagement that doesn’t require in-person visits.

Patient support technologies enable telehealth providers and hospitals to maintain communication, care coordination, and monitoring across physical distances. Tools such as automated reminders, tele-triage systems, wearable device integrations, and AI chatbots help providers manage patient loads efficiently and keep patients engaged in their care journey.

Additionally, U.S. federal programs like Medicare’s Remote Patient Monitoring reimbursement rules and the 21st Century Cures Act have supported widespread adoption. These regulations encourage healthcare providers to use digital tools for care coordination and provide patients with access to their own medical data, leading to improved adherence and satisfaction.

Despite promising growth, the market faces a major restraint in the form of cybersecurity and patient privacy concerns. The increasing use of cloud-based platforms, mobile health applications, and interoperable software tools opens up potential vulnerabilities to data breaches, unauthorized access, and compliance failures.

Patient support technologies often handle sensitive personal health information (PHI), requiring strict compliance with HIPAA (U.S.) and PIPEDA (Canada). However, not all systems meet the same security standards, especially when deployed across third-party platforms or mobile environments. Moreover, patients may be reluctant to engage with digital health tools due to lack of trust in how their data is managed.

Healthcare providers must balance innovation with security, ensuring that end-to-end encryption, consent management tools, and regular vulnerability assessments are part of their deployment strategy. The cost and complexity of securing large-scale digital systems can delay adoption among smaller health systems and independent practices.

One of the most exciting opportunities in the market is the evolution of integrated patient experience platforms that seamlessly combine various functionalities from appointment scheduling and check-in to remote monitoring and clinical alerts in a single ecosystem.

As healthcare delivery becomes increasingly team-based and multidisciplinary, stakeholders require systems that consolidate patient interactions across all touchpoints. This creates demand for interoperable platforms that connect with EHRs, pharmacy systems, billing departments, and telehealth portals, enabling a truly holistic view of patient care.

Companies that offer API-friendly platforms with strong integration capabilities are best positioned to capitalize on this trend. Health systems benefit from better care continuity, fewer dropped handoffs, and enhanced outcomes, while patients enjoy a more intuitive, seamless experience often via a single mobile app or portal.

Integrated patient support technologies dominate the North American market due to the growing preference among health systems for centralized platforms that offer multiple functionalities, such as communication, monitoring, education, and care coordination. These platforms enable healthcare providers to manage patients across various clinical environments using unified dashboards and EHR-integrated interfaces.

Leading vendors have partnered with health systems to deploy enterprise-level solutions that are scalable across departments and regions. For instance, a single integrated platform might include automated appointment reminders, discharge planning, medication adherence alerts, and remote monitoring device data, offering full-spectrum support in chronic and acute care settings.

Standalone patient support tools such as symptom checkers, chatbot assistants, and wellness trackers are the fastest-growing segment, particularly in outpatient and consumer-facing settings. These tools are often deployed as mobile apps or browser-based interfaces, giving patients direct access to health resources, care teams, or AI-driven triage systems.

Their agility and low upfront cost make them ideal for primary care networks, behavioral health providers, and community clinics that may not have full IT support. Furthermore, standalone tools are rapidly gaining traction in digital therapeutics and post-discharge care, offering flexible, targeted solutions with minimal integration requirements.

The United States dominates the North American patient support technology market, driven by its expansive healthcare system, advanced IT infrastructure, and progressive regulatory frameworks. U.S. healthcare providers and payers are under increasing pressure to improve patient satisfaction, reduce hospital readmissions, and manage value-based care contracts, which makes investment in patient support tools essential.

Large-scale health networks and accountable care organizations (ACOs) are deploying advanced patient engagement platforms with remote monitoring, 24/7 virtual triage, and AI-based decision support. Initiatives like the ONC’s Interoperability Rule and CMS's Hospital Readmissions Reduction Program have made digital support tools not only beneficial but financially necessary.

Canada is emerging as the fastest-growing market, with provincial governments and health authorities adopting nationalized digital health strategies. Following the pandemic, Canada invested in virtual care platforms and mobile patient engagement apps, especially in underserved or rural regions.

Federal and provincial initiatives like Canada Health Infoway have prioritized interoperability and patient access to records, laying the groundwork for widespread adoption of bilingual, culturally competent patient support systems. Moreover, public-private collaborations are driving innovation in indigenous health, chronic care, and telepsychiatry, boosting demand for flexible digital tools.

March 2025 – Epic Systems announced a new AI-enabled patient communication module that personalizes reminders and care plans using behavioral analytics.

February 2025 – Teladoc Health expanded its chronic care virtual coaching platform to integrate patient-generated data from at-home devices into real-time clinical dashboards.

January 2025 – Cognizant partnered with a Canadian health system to deploy its multilingual patient support platform across 50 facilities, focusing on remote communities.

December 2024 – Cerner (Oracle Health) launched a virtual assistant tool to support medication adherence and pre-surgery patient preparation via voice commands.

November 2024 – Philips Healthcare rolled out its integrated remote patient monitoring suite in partnership with a major U.S. insurer to manage diabetes and hypertension at home.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America patient support technology market

Type

Regional Scope