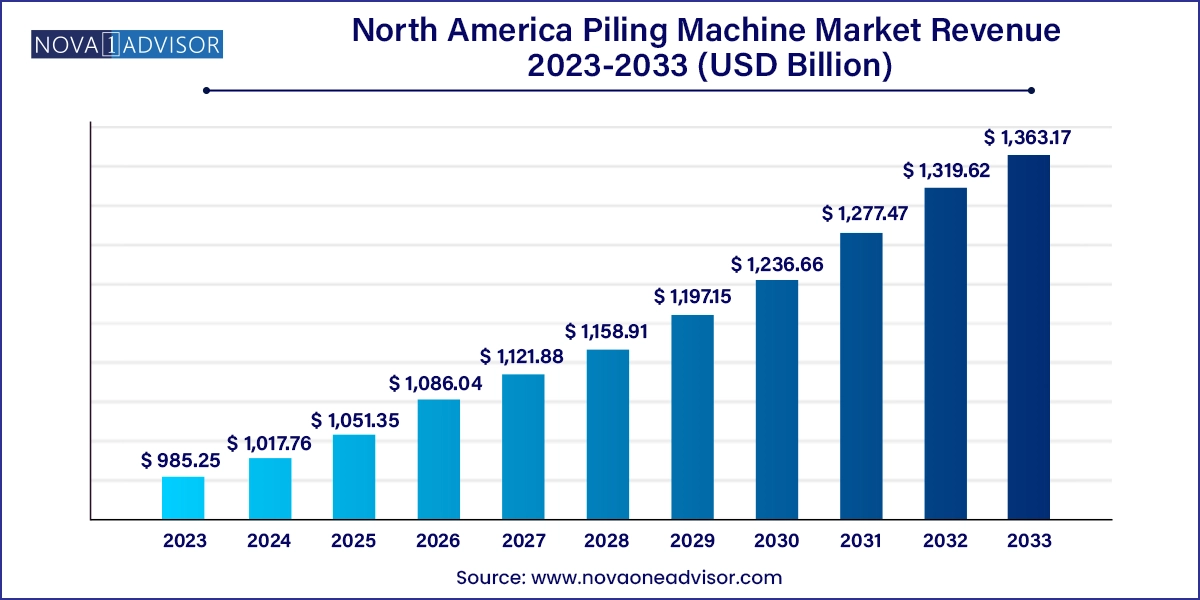

The North America piling machine market size was exhibited at USD 985.25 million in 2023 and is projected to hit around USD 1,363.17 million by 2033, growing at a CAGR of 3.3% during the forecast period 2024 to 2033.

The North America Piling Machine Market plays a crucial role in the continent’s heavy construction and infrastructure development activities. Piling machines are specialized construction equipment designed to drive piles deep foundational elements into the ground to support large structures such as bridges, buildings, ports, tunnels, and offshore platforms. With growing investments in transportation infrastructure, energy projects, and urban redevelopment across the United States, Canada, and Mexico, the demand for technologically advanced, efficient, and environmentally compliant piling machines has seen a consistent upward trajectory.

The North American market has matured in terms of equipment sophistication but is now evolving rapidly due to the introduction of low-emission, high-precision piling rigs and automated vibratory hammers. Urban expansion, resilient infrastructure policies, and sustainability-driven retrofitting of old civil structures are pushing contractors and government agencies to adopt machines that can deliver high-load bearing capacity with minimal soil disturbance and noise pollution.

Additionally, the increasing number of mega infrastructure projects, such as the U.S. Infrastructure Investment and Jobs Act (IIJA), the Ontario Line Subway Project in Canada, and Mexico’s Maya Train (Tren Maya), has significantly increased the scope for piling machine deployment. From dense urban foundations requiring rotary bored piling to coastal flood resilience needing continuous flight augers (CFA), the market is being shaped by a diversity of project types and geotechnical complexities.

Integration of Digital Technologies: GPS-based pile positioning systems, load monitoring sensors, and BIM-integrated controls are increasingly embedded in piling machines to improve accuracy and productivity.

Demand for Silent and Vibration-Free Equipment: Urban and environmentally sensitive projects are driving adoption of CFA, hydraulic press-in, and low-noise vibratory drivers.

Electrification and Hybrid Engines: Manufacturers are launching battery-electric and hybrid piling rigs to comply with Tier 4 emissions standards and improve fuel efficiency.

Growth in Offshore and Wind Energy Applications: Specialized piling machines are being deployed for marine foundations, including monopiles for offshore wind turbines and oil platforms.

Rental-Based Business Models: Due to high capital costs, many contractors in North America are opting for equipment rentals or leasing, spurring growth in rental service providers.

Rise in Modular and Prefabricated Construction: The demand for fast deployment and minimal ground disturbance aligns well with advanced auger boring and rotary systems.

Increased Federal Funding for Infrastructure Modernization: U.S. and Canadian governments are prioritizing road, rail, and water systems, boosting demand for deep foundation equipment.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,017.76 Million |

| Market Size by 2033 | USD 1,363.17 Million |

| Growth Rate From 2024 to 2033 | CAGR of 3.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Piling Method, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | American Piledriving Equipment; Bruce Piling Equipment. Bauer AG; LIEBHERR; SANY Group;Junttan Oy; Dieseko Group; Casagrande S.p.a; Comacchio S.p.A. ; CZM Foundation Equipment; Movax Oy |

One of the most compelling drivers of the North American piling machine market is the significant and sustained investment in public infrastructure. In the United States, the Infrastructure Investment and Jobs Act (IIJA) has allocated over $1.2 trillion for rebuilding roads, bridges, railways, and energy systems. These projects often require deep and secure foundations, especially in flood-prone or earthquake-sensitive zones.

Likewise, Canada's Investing in Canada Plan, with federal investments in public transit, trade corridors, and green infrastructure, is fueling the demand for piling machinery capable of handling challenging soil conditions and maintaining low environmental footprints. These projects often involve complex groundwork that benefits from high-torque rotary rigs, advanced vibratory hammers, and continuous auger systems.

Such policy-driven megaprojects create a ripple effect across equipment procurement, maintenance, rental, and operator training, bolstering not just sales but the entire value chain of piling machine services.

Despite promising growth, the piling machine market in North America faces a notable restraint high capital investment and skilled labor shortages. Piling equipment such as large-diameter rotary rigs, crawler-mounted rigs, or advanced vibratory hammers can cost upwards of $500,000 to $2 million, excluding operating and maintenance costs. This high cost limits adoption among small and mid-sized contractors, especially in Mexico and rural U.S. regions.

Moreover, advanced piling equipment requires trained operators and geotechnical understanding, which are not always readily available. Even when machines are leased, the shortage of skilled technicians to run and maintain them leads to downtime, safety risks, and inefficiency. The aging workforce in the North American construction sector further exacerbates this issue, making workforce development a key barrier to scaling up machine adoption.

An emerging and highly lucrative opportunity in the North America piling machine market lies in the offshore wind and coastal infrastructure sectors. As the U.S. and Canada aim to expand their renewable energy portfolios, offshore wind projects particularly along the Atlantic Coast and Great Lakes are gaining traction. These projects require marine piling machinery capable of driving monopiles and jacket structures into seabeds a highly specialized area that is seeing increased equipment imports and domestic innovation.

Furthermore, with rising climate risks, coastal cities from Miami to Vancouver are investing in seawalls, storm surge barriers, and foundation reinforcement to protect urban assets. These projects demand piling machines capable of operating in saturated soils, with minimal vibration and high load bearing requirements. This opens opportunities for equipment that supports silent piling techniques, press-in methods, and air lift rotary circulation drilling (RCD), along with real-time pile monitoring for safety and performance tracking.

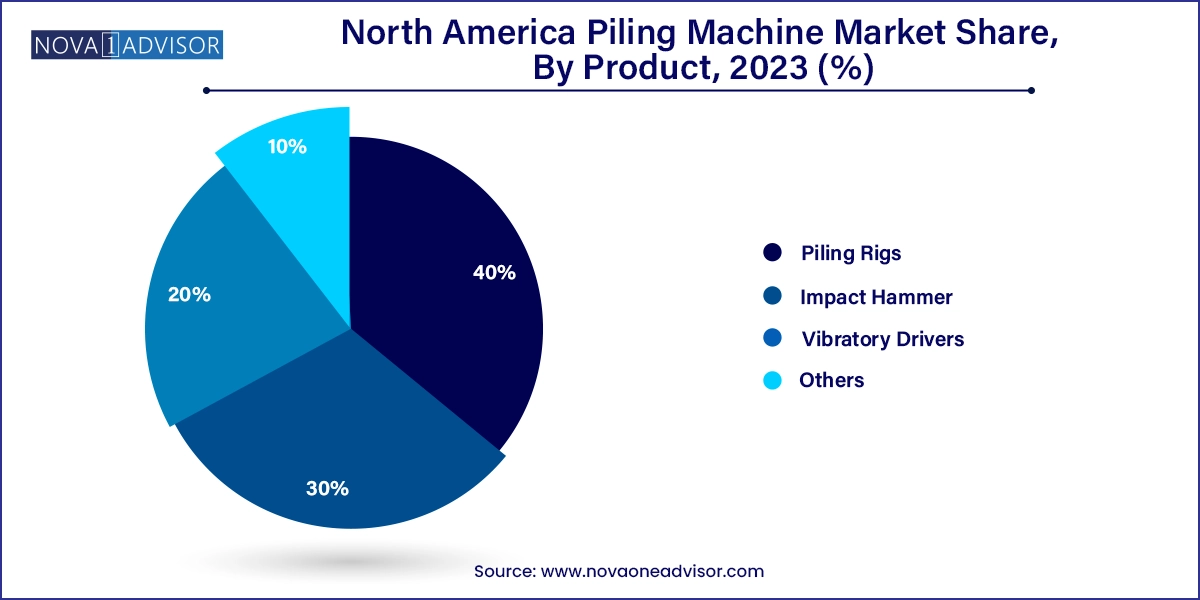

Piling Rigs dominated the market, largely due to their versatility, power, and applicability across both onshore and offshore projects. These rigs can support various piling methods such as rotary boring, continuous flight augering, and CFA with minimal machine changeover. In the U.S., piling rigs are widely used in highway bridge piers, urban skyscrapers, and energy grid foundations. With increasing adoption of modular designs and automated controls, newer rigs offer better torque and fuel efficiency, making them the first choice for large contractors.

Vibratory Drivers are the fastest-growing segment, especially in Canada and the coastal U.S. states. Their ability to rapidly install and extract steel sheet piles with low noise and minimal disruption to surrounding structures is ideal for urban retrofitting and environmental protection projects. Vibratory drivers are commonly deployed in flood barrier construction, port development, and contaminated site remediation, where speed and precision matter. As urban construction density increases, vibratory machines offer a compact, noise-compliant alternative to traditional impact hammers.

Rotary Bored Piling held the dominant market share, as it is best suited for large-diameter, deep foundations often required in urban and industrial infrastructure. Rotary bored piles are particularly favored for high-rise buildings, subway tunneling shafts, and bridge piers, where high axial and lateral loads must be supported. Machines using this method are equipped with Kelly bars, casings, and high-torque rotary drives, offering accuracy and adaptability to different soil types. Many U.S. DOT-funded projects rely on rotary bored piling due to their engineering reliability.

Continuous Flight Auger (CFA) is the fastest-growing piling method, gaining popularity for its minimal vibration, high speed, and suitability in residential and mid-rise commercial buildings. CFA allows for seamless pile formation without open holes, improving safety and productivity. Contractors across Florida, Texas, and Ontario are increasingly deploying CFA rigs for projects in soft or waterlogged soils, where traditional driven piles are less effective. The method is also highly favored in environmentally sensitive zones due to reduced noise and emissions.

United States

The United States is the largest and most dynamic market in North America for piling machines, driven by a dense network of infrastructure projects across transportation, commercial construction, and renewable energy. States like California, Texas, Florida, and New York lead in piling equipment usage, driven by ongoing rail, highway, and coastal development. The IIJA funding has provided new momentum for heavy civil projects, spurring purchases of multi-purpose piling rigs and automated monitoring systems. U.S. contractors are also at the forefront of adopting hybrid and Tier 4 compliant machines, reflecting the shift toward sustainability.

Canada

Canada’s piling machine market is growing steadily, supported by investments in public transit, mining, and real estate development. Ontario’s subway expansion, the Vancouver SkyTrain extension, and Quebec’s hydropower projects are major drivers. The harsh winters and varied geology demand equipment that can operate in cold, rocky, or saturated conditions, pushing demand for rotary rigs with heating systems and air lift RCD drilling techniques. The government’s emphasis on green infrastructure is also favoring low-emission piling equipment.

Mexico

In Mexico, the market is smaller but fast developing, particularly in energy infrastructure, ports, and tourism-driven urban growth. Projects like the Tren Maya railway, airport expansions, and resort developments are driving adoption of mid-range piling rigs and vibratory drivers. While most high-end machines are imported, local contractors are gradually expanding capabilities through rentals and OEM partnerships, particularly in Monterrey, Guadalajara, and Cancun.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America piling machine market

Product

Piling Method

Country