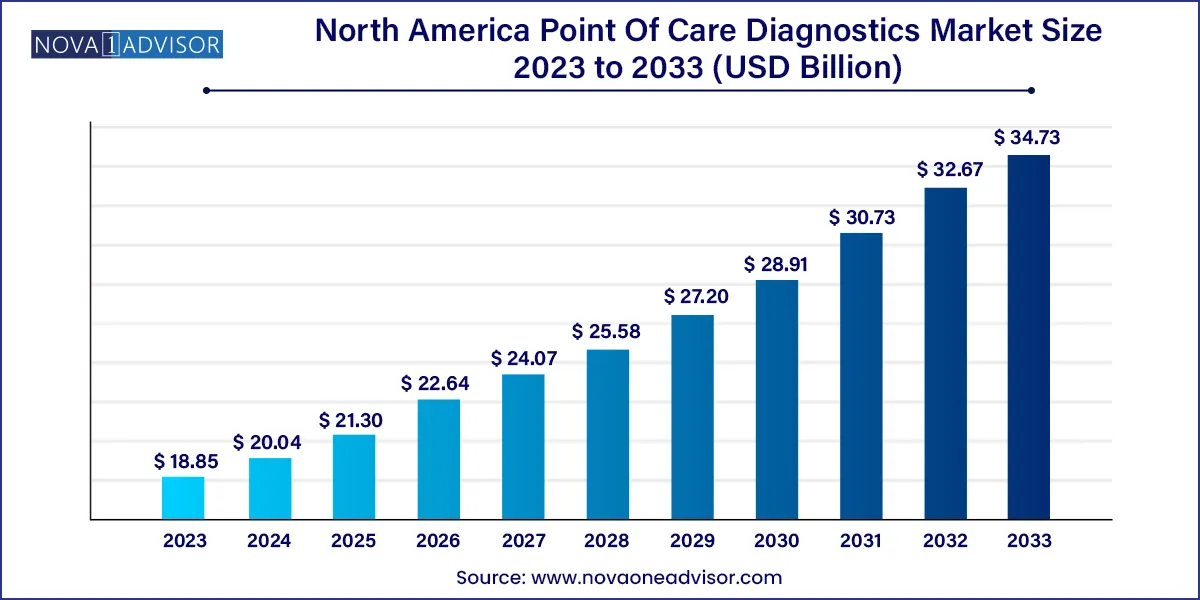

The North America point of care diagnostics market size was exhibited at USD 18.85 billion in 2023 and is projected to hit around USD 34.73 billion by 2033, growing at a CAGR of 6.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 20.04 Billion |

| Market Size by 2033 | USD 34.73 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Type, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S., Canada |

| Key Companies Profiled | F. Hoffmann-La Roche AG; QIAGEN; Danaher Corporation; BD; bioMérieux SA; Abbott; Siemens Healthineers A.G.; Zoetis, Inc.; Instrumentation Laboratory; Nova Biomedical; Trividia Health, Inc.; Quidel Corporation; Trinity Biotech; Sekisui Diagnostics; OraSure Technologies, Inc.; NIPRO, Spectral Medical, Inc. |

Point-of-care (POC) diagnosis refers to performing diagnostic tests at the site of the patient. The growing geriatric population and the ability of POC diagnostic tests to deliver immediate results are likely to fuel the demand for POC diagnostic tests. Furthermore, a rise in funding from the government & private institutions is a key factor driving the market’s growth. An increase in the adoption of mobile diagnostic devices in the region is also one of the key factors driving demand for POC testing.

The COVID-19 outbreak has positively impacted the market. This can primarily be attributed to the urgent need for manufacturing and introduction of rapid & portable diagnostic tests, systems, and accessories in the market that can presently assist in scaling up of COVID-19 testing. Moreover, the advent of rapid data-sharing platforms and solutions is expected to contribute to the development of COVID-19 point-of-care technologies, supplementing the market growth. Companies are actively working toward the development of rapid testing solutions. For instance, in November 2023, Sense Biodetection entered into a collaboration with Bio Nuclear Diagnostics to distribute Sense’s Veros POC, an instrument-free molecular COVID-19 test, in Canada.

Furthermore, increased funding from NIH, private foundations such as the Bill & Melinda Gates Foundation, and the U.S. department of defense (DOD), is anticipated to fuel the market growth. For instance, in November 2021, Hyperfine, Inc., announced receiving USD 3.3 million in funding from the Bill & Melinda Gates Foundation to broaden the usage of portable MRI technology in various countries. Similarly, in August 2023, Nanopath, Inc. received funding of USD 10 million from Medtech Convergence Fund and Norwest Venture Partners with participation from Green D Ventures and Gingerbread Capital. The funding would help develop point-of-care diagnostics for women’s health.

In the U.S., the population aged 65 and older is estimated to double from 52 million in 2018 to 95 million by 2060, which is likely to increase demand for POC diagnostics. According to projections, there will be a 23% increase in the overall population. Aging increases the risk of diseases such as cardiovascular diseases and cancer. Therefore, an increase in the geriatric population is expected to boost the demand for continuous monitoring via facilities requiring point-of-care diagnostics, such as home healthcare and assisted living healthcare facilities.

The infectious diseases segment accounted for 25.3% of the total market share in 2023, owing to increasing cases of dengue fever, enteric, malaria, syphilis, tuberculosis, and others in the region. The significant demand for rapid tests has encouraged market players to offer point-of-care solutions to decentralized regions. For instance, in March 2020, Abbott launched a molecular POC test that could detect the presence of coronavirus in less than five minutes.

The cardiac markers segment is anticipated to witness the fastest CAGR in the coming years owing to due to increase in acceptance of sensitivity and premium-priced POC Troponin testing. The growing trend toward value-based and efficient healthcare service delivery, along with stringent finances, is strengthening the market for point-of-care cardiac diagnostics.Furthermore, in emergency care settings, the majority of medical professionals prefer POC cardiac testing to monitor the state of patients experiencing chest discomfort or other heart illness symptoms.

The hospitals segment dominated the North America point-of-care diagnostics market in 2023, capturing a revenue share of 37.68%. POC is beneficial for healthcare personnel as it provides mobility to the diagnosis system and allows reaching patients effectively. The development of wireless communication and miniaturized devices is a boon for hospital-based POC diagnostics as these provide single-level access throughout the hospital.

The laboratories segment is projected to witness the fastest growth during the forecast period owing to the rise in the need for early identification of many diseases. In addition, each year, more than 7 billion clinical laboratory examinations are performed in the U.S., as per an article published by the American Clinical Laboratory Association. The market is predicted to increase due to the presence of a strong distribution network of companies, such as Quest Diagnostics Incorporated, Siemens Healthineers, Laboratory Corporation of America Holdings, and Abbott, among others.

The POC devices that are developed have different medical diagnostic applications, such as cancer, infectious diseases, and pregnancy. Physicians& patients use POC tests to screen diseases, confirm diagnoses, and design suitable therapeutic approaches based on the patient’s health. For instance, in July 2020, BD launched a portable, Rapid POC Antigen Test which detects COVID-19 infection within 15 minutes. It has expanded access to COVID-19 testing.

The LDT segment is anticipated to witness the fastest growth rate in the coming years with a CAGR of 6.2%. Laboratory-developed tests are testing services developed in patient care at clinical laboratories, academics, and hospitals. These services are not commercially marketed and manufactured, but are developed, performed, designed, validated, and interpreted by certified professionals in a laboratory. These are used to meet clinical demands and are instrumental for early diagnosis, monitoring, and guidance of patient treatment.

The U.S. dominated the North America point-of-care market in 2023 due to the presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics is positively influencing the market growth. For instance, in November 2020, in the U. S., QIAGEN started offering a portable digital test that allows labs to detect SARS-CoV-2 antigens in persons with current illnesses in 2 to 15 minutes.

Canada is estimated to witness the fastest growth rate over the coming years. Usage of POC diagnostic devices in these regions is increasing owing to the increasing prevalence of target diseases such as cardio-metabolic disorders, infectious diseases, and increasing cases of drug abuse. Increasing demand for rapid and early diagnosis leading to better treatment alternatives and presence of health-conscious population are also considered as other factors fueling industrial growth. People in this region are also shifting their focus towards self-testing devices as compared to frequent laboratory testing visits, thus influencing industrial growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America point of care diagnostics market

Product

End-use

Type

Country