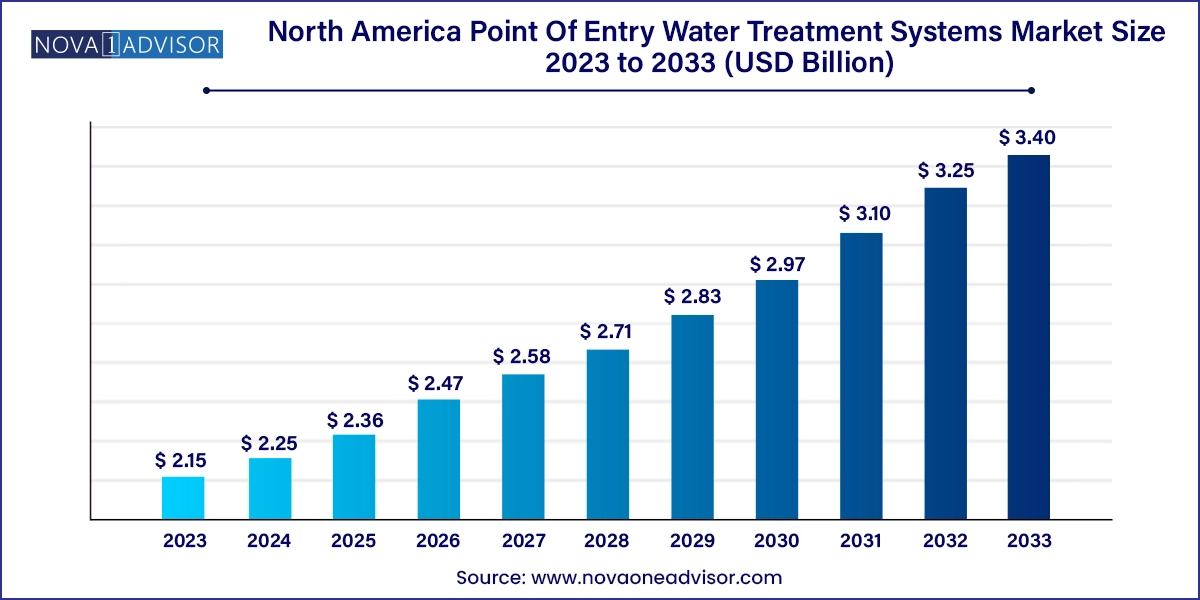

The North America point of entry water treatment systems market size was exhibited at USD 2.15 billion in 2023 and is projected to hit around USD 3.40 billion by 2033, growing at a CAGR of 4.7% during the forecast period 2024 to 2033.

The North America Point of Entry (POE) Water Treatment Systems Market is witnessing a robust phase of expansion, driven by growing public awareness about water quality and the increasing presence of contaminants in municipal water supplies. Point of Entry systems are installed at the main water line entering a residential, commercial, or industrial building, ensuring that all water used within the premises—whether for drinking, bathing, cooking, or cleaning—is treated and free from harmful contaminants.

North American households and businesses are becoming increasingly cautious about the presence of pollutants like chlorine, heavy metals, lead, bacteria, nitrates, and pharmaceutical residues in tap water. Municipal treatment plants often fail to remove all impurities, particularly in older infrastructures, prompting the need for supplementary, property-level filtration. POE systems bridge this gap by delivering a comprehensive, end-to-end water purification solution.

In addition to health considerations, economic and infrastructure-related factors also influence market growth. Ageing pipeline networks across urban areas in the U.S. and Canada have led to increased incidences of secondary water contamination. Moreover, industries such as pharmaceuticals, food & beverage, and electronics manufacturing demand ultra-pure water for operational excellence, fueling adoption in the industrial segment. With water quality becoming a key health and compliance concern, POE systems are no longer a luxury but a necessity in several parts of North America.

Surge in consumer preference for whole-house water treatment solutions over Point-of-Use systems.

Growing adoption of smart water purification systems integrated with IoT for real-time monitoring.

Increased installation in commercial spaces like restaurants, hotels, and hospitals.

Expansion of customized water filtration solutions based on regional contaminant profiles.

Emergence of salt-free and eco-friendly water softening technologies.

Rise in home renovation projects including water system upgrades.

Government grants and tax incentives for water filtration infrastructure in specific U.S. states.

Consolidation and acquisition among filtration system manufacturers to expand geographic presence.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.25 Billion |

| Market Size by 2033 | USD 3.40 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | 3M; DuPont; Pentair Plc; BWT Holding GmbH; Culligan; Watts; Aquasana, Inc.; Calgon Carbon Corp.; EcoWater Systems LLC; GE Appliances |

A primary driver for the North American POE water treatment market is the growing consumer awareness regarding waterborne illnesses and chronic exposure to chemical contaminants. Events like the Flint, Michigan water crisis, which revealed dangerously high levels of lead in the public water supply, have heightened public scrutiny of tap water safety across the U.S. and beyond. The psychological impact of such events has catalyzed a consumer shift toward personal responsibility for water safety.

Recent findings by the U.S. Geological Survey and Environmental Working Group have also uncovered traces of PFAS (per- and polyfluoroalkyl substances) often dubbed "forever chemicals" in several municipal water supplies. These contaminants have been linked to serious health effects including cancer, thyroid disease, and developmental issues. As such, consumers are increasingly investing in POE systems equipped with advanced filtration, softening, and disinfection technologies to proactively safeguard their water.

Despite the growing demand, a significant barrier to widespread adoption remains the high capital cost associated with POE systems, especially those employing advanced purification technologies like reverse osmosis or UV disinfection. For residential users, the upfront investment including system cost, plumbing, and installation can range from $1,500 to over $5,000, depending on complexity. Additionally, recurring costs such as filter replacements, energy consumption, and system maintenance deter price-sensitive consumers.

Commercial and industrial users face even higher expenses. For instance, in hospitals or manufacturing units, customized POE systems often require integration with existing infrastructure, water usage analysis, and regular compliance testing. These financial considerations can delay or limit installations, particularly in older buildings or remote facilities. Though the long-term benefits of these systems are considerable, the initial outlay remains a major roadblock for broader market penetration.

An exciting opportunity lies in the rise of smart water purification systems embedded with Internet of Things (IoT) technology. These systems allow users to monitor water quality in real-time, track filter health, receive maintenance alerts, and even control water flow remotely through mobile apps or cloud platforms. For residential users, this adds a layer of convenience and control. For commercial and industrial users, it enhances operational efficiency by reducing downtime and predicting failures.

Several companies are launching smart POE systems that integrate with home automation platforms like Amazon Alexa and Google Home. In the commercial segment, restaurants and healthcare facilities are deploying connected systems that automatically notify maintenance teams when performance dips or contamination is detected. As water treatment converges with smart home and industrial IoT trends, companies offering connected, data-driven POE solutions are poised to gain significant traction in North America.

Filtration methods dominated the market, benefiting from their wide applicability and cost-effectiveness.

Filtration systems—especially multi-media filters and activated carbon filters—are the most commonly used POE technologies due to their affordability and effectiveness in removing particulates, chlorine, and bad odors. These systems are widely adopted in both residential and commercial settings, where high flow rates and minimal water waste are preferred. For example, carbon block filters are particularly popular in U.S. households to improve taste and remove common volatile organic compounds (VOCs) without affecting water pressure.

Reverse osmosis systems are emerging as the fastest-growing technology due to their ability to remove a wide spectrum of contaminants.

Reverse osmosis (RO) systems are witnessing increasing uptake in households dealing with hard water and high Total Dissolved Solids (TDS). These systems force water through semi-permeable membranes to remove salts, heavy metals, bacteria, and even PFAS. RO is also gaining ground in the industrial sector where ultrapure water is required for sensitive applications such as semiconductor manufacturing or pharmaceutical production. The challenge of water wastage is being addressed by new RO models with lower rejection ratios, improving their appeal across the market.

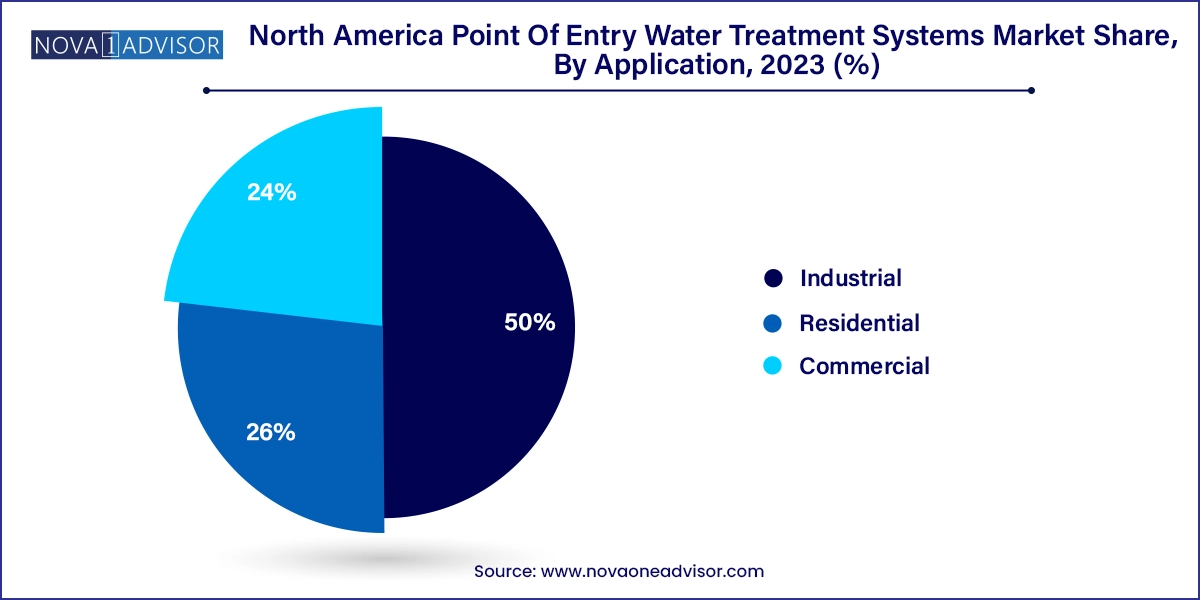

Residential application dominated the POE water treatment market due to heightened public health concerns and growing homeowner investments.

The residential sector is the primary user of POE systems, particularly in suburban and rural areas where private wells or ageing municipal systems are prevalent. Homeowners in regions like Texas, Florida, and California are increasingly opting for whole-house systems to mitigate contaminants such as lead, arsenic, and nitrates. The rise in DIY home improvement projects during the pandemic further boosted installations of POE units, often combined with water softeners or UV disinfection to ensure comprehensive treatment.

Commercial applications especially in hotels and restaurants represent the fastest-growing segment.

The commercial sector, particularly hospitality, healthcare, and food services, is accelerating the adoption of POE systems to ensure hygiene compliance and protect brand reputation. Hotels use such systems to enhance guest experience through softer laundry, cleaner showers, and better-tasting water. Restaurants rely on consistent water quality for food preparation, coffee machines, and dishwashing. In healthcare, systems are employed to reduce pathogen exposure in showers, handwashing stations, and utility rooms. This surge in health and safety protocols post-COVID-19 has led to a noticeable rise in commercial demand for POE solutions.

United States

The U.S. dominates the North American POE water treatment systems market, accounting for the majority of installations and revenues. The country has a long-standing issue with deteriorating municipal infrastructure, particularly in older cities like Chicago, Detroit, and Philadelphia. These systems, often built in the early 20th century, are susceptible to contamination through corroded pipes and outdated treatment techniques. As a result, residents and businesses are increasingly supplementing municipal supply with POE systems.

Government initiatives such as the Bipartisan Infrastructure Law (2021), which allocates over $55 billion to improve water infrastructure, are also encouraging POE adoption. States like California and Michigan offer tax credits or rebates for installing certified water filtration systems, further boosting the market. Moreover, the rising popularity of smart homes is leading to increased demand for connected POE systems with remote monitoring capabilities.

Canada

Canada has been investing significantly in water safety, particularly in rural and indigenous communities where boil water advisories are still prevalent. Municipal water treatment infrastructure is robust in urban centers like Toronto and Vancouver; however, small towns often lack adequate filtration. This discrepancy has created a niche market for POE systems in homes, schools, and community centers. Moreover, increasing environmental regulations are pushing industries to adopt sustainable water management practices, encouraging uptake in manufacturing and mining sectors.

Canadian consumers also show strong environmental consciousness. Systems that reduce plastic bottled water consumption and minimize wastewater are gaining favor. Companies that offer energy-efficient, salt-free systems have seen positive reception, particularly in eco-sensitive markets like British Columbia and Quebec.

Mexico

Mexico’s growing urban population and uneven access to safe drinking water are key factors influencing the POE market. While urban areas like Mexico City and Monterrey benefit from municipal supplies, water quality often varies, prompting affluent households and businesses to invest in supplementary purification. Bottled water remains common, but a gradual shift toward home and office filtration systems is taking shape.

The Mexican government’s support for water infrastructure projects, particularly in tourism hubs like Cancun and Los Cabos, is also propelling the commercial POE segment. Hotels and resorts are installing whole-property filtration systems to comply with international health standards and improve customer satisfaction. Additionally, industrial demand in sectors like food processing and beverage bottling is growing, as businesses seek to ensure consistent water quality while maintaining compliance with export regulations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America point of entry water treatment systems market

Technology

Application

Country