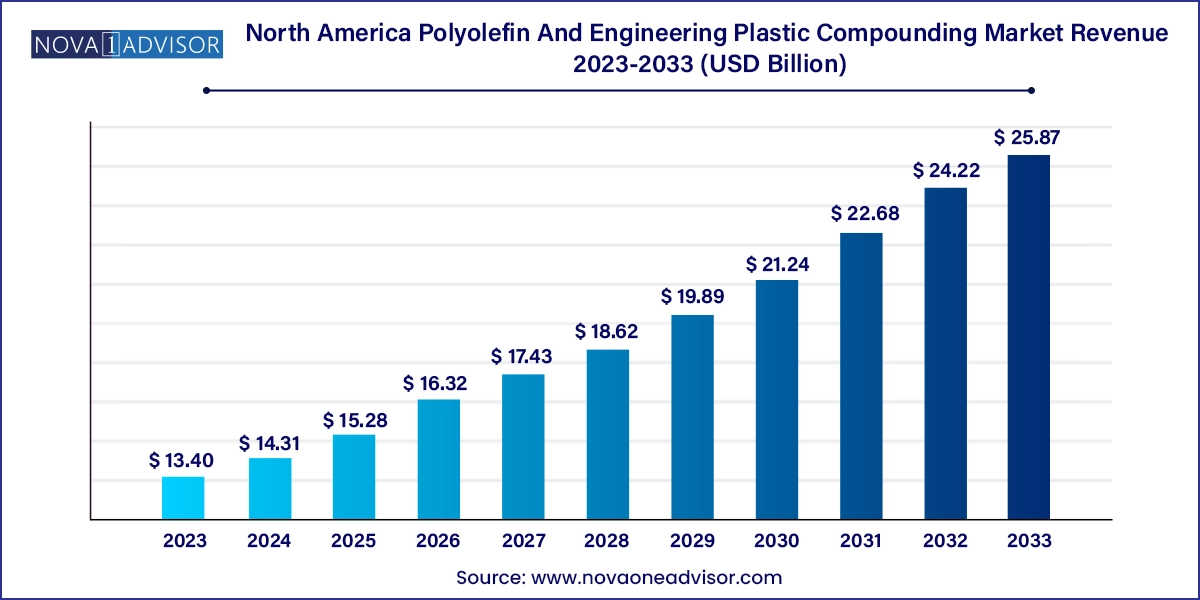

The North America polyolefin and engineering plastic compounding market size was exhibited at USD 13.40 billion in 2023 and is projected to hit around USD 25.87 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.31 Billion |

| Market Size by 2033 | USD 25.87 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | BASF SE; LyondellBasell Industries Holdings B.V.; Dow Inc.; DuPont; SABIC; RTP Company; S&E Specialty Polymers LLC (Aurora Plastics); Asahi Kasei Corporation; Covestro AG; Washington Penn; Ascend Performance Materials; Kuraray Co. Ltd.; Teijin Limited; Evonik Industries AG; 3M |

The growth of the market is primarily driven by the escalating demand across diverse end-use sectors, such as packaging, automotive, and construction. This can be attributed to the remarkable attributes of polyolefins and engineering plastics such as lightweight, durability, and cost-effectiveness.

North America is a highly competitive market with significant demand for polyolefin and engineering plastic compounds across various end-use sectors such as automotive and electrical & electronics. The presence of prominent automobile manufacturers, such as Chrysler, Tesla, Ford, and Cadillac coupled with high disposable income are expected to drive the regional market growth. In addition, the market is characterized by the presence of several established suppliers and high domestic demand, particularly in the automotive end-use sector. Polyolefin and engineering plastics find many applications in various industries due to their versatile benefits, easy molding, and desired shape formation. Many automobile manufacturers prefer plastic vehicle components, which aid companies in achieving low-cost production.

The recent surge in production utilizing shale gas and increasing exploration activities have enabled North American consumers and producers to obtain an unprecedented level of cost-effectiveness, which, in turn, has bolstered the demand for polyolefin & engineering plastic compounding.

Rapid infrastructure expansion in the U.S. and Mexico is expected to increase product demand in the coming years. National measures to support the recovery of the housing sector are expected to have a positive impact on future construction development. Reconstruction activities in the U.S. coupled with infrastructure development in Canada and Mexico owing to rapid industrialization are expected to create huge market potential for polyolefin & engineering plastic compounds in North America over the forecast period.

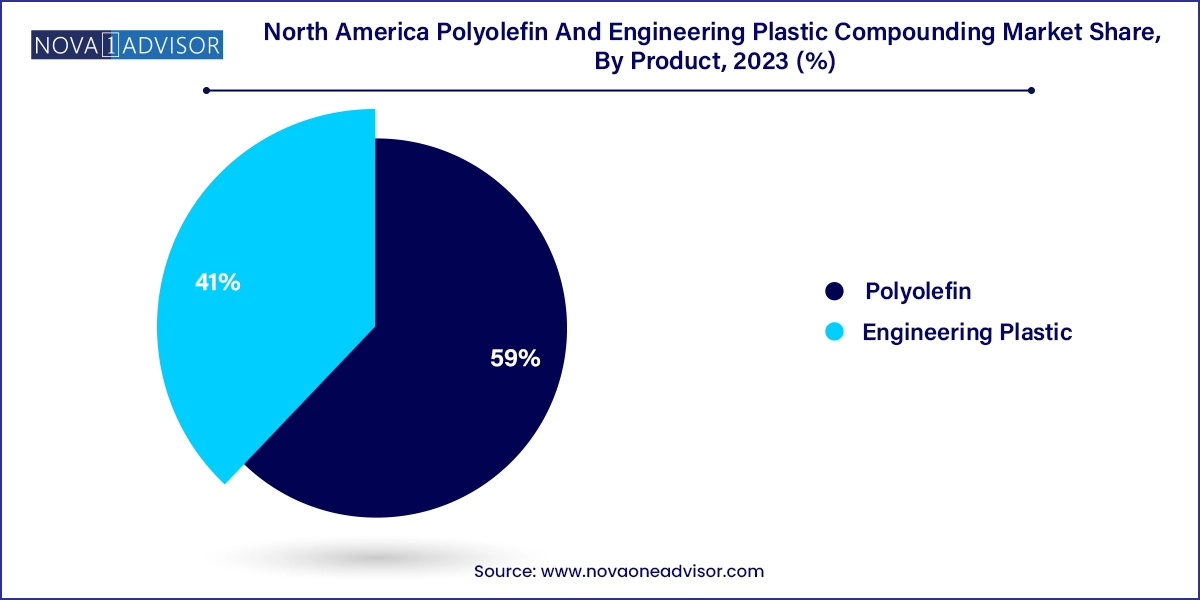

In terms of product revenue, the polyolefin segment accounted for the largest revenue share of 59.0% in 2023. Polyolefin is a polymer derived from a small set of simple olefins. It is nonporous, odorless, and nonpolar materials that finds applications in various industries including packaging, automotive, consumer goods, electrical & electronics, and building & construction, among others. Polyolefin finds applications in aforementioned industries owing to its lightweight nature, sealing capabilities, ease of processing, and stiffness. Player operating in the polyolefin market are focusing on innovation and new product development.

The engineering plastic segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2033. Engineering plastics refer to high-performance plastics with better mechanical and thermal properties than conventional plastics. Acrylonitrile butadiene styrene (ABS), acetal, polyamide (PA), polybutylene terephthalate, polyethylene terephthalate, and polyvinyl chloride are some of the major engineering plastics. Increasing applications of these plastics in industries, such as automotive, medical, packaging, and consumer electronics, among others, have increased their consumption in aforementioned industries in recent years. Players operating in the market are launching new products to meet the rising demand for engineering plastic products such as PET and PBT.

In terms of application, the automotive & transportation segment led the market in 2023 with share of 25.8%. The increasing production of automobiles in North America is driving the growth of polyolefin & engineering plastic compounding market in the region. Plastics compounds such as polypropylene (PP), polybutylene terephthalate (PBT), and polymethyl methacrylate (PMMA) are extensively used in various automotive applications such as exterior body parts, wiper arm casing & housings, bumpers, moldings, front grilles, cladding, and roof trims. The wide application scope of these materials can be attributed to their low thermal expansion, high stiffness, lightweight, good dimensional stability, resistance to moisture, good scratch resistance, and impact resistance in low temperatures.

The packaging segment is expected to witness the fastest CAGR of 7.5% during the forecast period. The demand for polyolefin & engineering plastic compounds in the packaging industry in North America is driven by mass consumption in the U.S. and Canada. Various regulatory agencies have established guidelines for packaging materials used in products that remain in contact with food. The use of polypropylene formulation results in the development of a cost-effective packaging solution with improved impact strength, flexibility, transparency, and process efficiency. The high demand for polyethylene in the packaging industry has contributed significantly to the growth of the regional plastic compound market.

U.S. Polyolefin & Engineering Plastic Compounding Market Trends

The polyolefin & engineering plastic compounding market in U.S. is expected to grow significantly over the forecast period. The U.S. has one of the world’s largest automotive markets with the presence of several large vehicles and auto parts manufacturers. The demand for engineered plastic compounds in the country is majorly generated by the expanding automotive industry coupled with rising construction activities. Engineer plastics such as PVC, PET, PBT, ABS, PMMA, and polyacetal are majorly used in the automotive industry. Capacity addition and plant expansion by automotive companies in the U.S. are further expected to augment the demand for polyolefin & engineering plastic compounds.

Canada Polyolefin & Engineering Plastic Compounding Market Trends

The polyolefin & engineering plastic compounding market in Canadais likely to account for a significant demand for plastic compounding owing to the rising demand in the automotive industry for new vehicles, mainly among the aging baby boom population in Canada. In addition, Canada holds favorable trade agreements with the Asian and European regions, which has bolstered the automotive industry’s growth, in turn, driving the polyolefin & engineering plastic compounding market.Moreover, the growth of the electronics sector in Canada is also a crucial factor for the polyolefin & engineering plastic compounding market growth. Polyolefin offers high heat resistance, which makes it ideal for use in various electronic devices such as cables and integrated circuit components.

Mexico Polyolefin & Engineering Plastic Compounding Market Trends

The Mexico polyolefin & engineering plastic compounding market is witnessing constant economic growth in the past few years. Rapid urbanization & industrialization, positive growth in the automotive, construction, and services sectors, and considerable investments in infrastructure are the key factors driving the market. The expanding automotive sector, on account of electric vehicles and the shift in consumer purchase behavior from considering cars as luxuries to now considering them as necessities, is anticipated to fuel the growth of the polyolefin & engineering plastic compounding market in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America polyolefin and engineering plastic compounding market

Product

Application

Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. North America Polyolefin & Engineering Plastic Compounding Market Variables, Trends & Scope

3.1. North America Polyolefin & Engineering Plastic Compounding Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Type Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. North America Polyolefin & Engineering Plastic Compounding Market: Product Outlook Estimates & Forecasts

4.1. North America Polyolefin & Engineering Plastic Compounding Market: Product Movement Analysis, 2024 & 2033

4.2. Polyolefin

4.2.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.2.2. Polyethylene (PE)

4.2.2.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.2.3. Polypropylene (PP)

4.2.3.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.2.4. Ethylene-Vinyl Acetate (EVA)

4.2.4.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.2.5. Thermoplastic Polyolefins (TPOs)

4.2.5.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.2.6. Polymethyl Methacrylate (PMMA)

4.2.6.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.2.7. Other Polyolefins

4.2.7.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3. Engineering Plastics

4.3.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.2. Polycarbonate (PC)

4.3.2.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.3. Acrylonitrile Butadiene Styrene

4.3.3.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.4. Polyamide

4.3.4.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.5. Polyvinyl Chloride (PVC)

4.3.5.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.6. Thermoplastic Polyester

4.3.6.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.7. Polyacetal

4.3.7.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.8. Fluoropolymer

4.3.8.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

4.3.9. Other Engineering Plastics

4.3.9.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

Chapter 5. North America Polyolefin & Engineering Plastic Compounding Market: Application Outlook Estimates & Forecasts

5.1. North America Polyolefin & Engineering Plastic Compounding Market: Application Analysis, 2024 & 2033

5.2. Automotive & Transportation

5.2.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

5.3. Consumer Appliances

5.3.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

5.4. Electrical & Electronics

5.4.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

5.5. Building & Construction

5.5.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

5.6. Industrial & Machinery

5.6.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

5.7. Packaging

5.7.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

5.8. Other Applications

5.8.1. Market estimates and forecast, 2021 - 2033 (Kilotons) (USD Million)

Chapter 6. North America Polyolefin & Engineering Plastic Compounding Market Regional Outlook Estimates & Forecasts

6.1. Regional Snapshot

6.2. North America Polyolefin & Engineering Plastic Compounding Market: Regional Movement Analysis, 2024 & 2033

6.3. North America

6.3.1. Market estimates and forecast, by product, 2021 - 2033 (Kilotons) (USD Million)

6.3.2. Market estimates and forecast, by application, 2021 - 2033 (Kilotons) (USD Million)

6.3.3. U.S.

6.3.3.1. Market estimates and forecast, by product, 2021 - 2033 (Kilotons) (USD Million)

6.3.3.2. Market estimates and forecast, by application, 2021 - 2033 (Kilotons) (USD Million)

6.3.4. Canada

6.3.4.1. Market estimates and forecast, by product, 2021 - 2033 (Kilotons) (USD Million)

6.3.4.2. Market estimates and forecast, by application, 2021 - 2033 (Kilotons) (USD Million)

6.3.5. Mexico

6.3.5.1. Market estimates and forecast, by product, 2021 - 2033 (Kilotons) (USD Million)

6.3.5.2. Market estimates and forecast, by application, 2021 - 2033 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Ranking

7.4. Heat Map Analysis

7.5. Company Market Share Analysis, 2023

7.6. Market Strategies

7.7. Vendor Landscape

7.7.1. List of raw material supplier, key manufacturers, and distributors

7.7.2. List of prospective end-users

7.8. Strategy Mapping

7.9. Company Profiles/Listing

7.9.1. BASF SE

7.9.1.1. Company Overview

7.9.1.2. Financial Performance

7.9.1.3. Product Benchmarking

7.9.2. LyondellBasell Industries Holdings B.V.

7.9.2.1. Company Overview

7.9.2.2. Financial Performance

7.9.2.3. Product Benchmarking

7.9.3. Dow, Inc.

7.9.3.1. Company Overview

7.9.3.2. Financial Performance

7.9.3.3. Product Benchmarking

7.9.4. DuPont

7.9.4.1. Company Overview

7.9.4.2. Financial Performance

7.9.4.3. Product Benchmarking

7.9.5. SABIC

7.9.5.1. Company Overview

7.9.5.2. Financial Performance

7.9.5.3. Product Benchmarking

7.9.6. RTP Company

7.9.6.1. Company Overview

7.9.6.2. Financial Performance

7.9.6.3. Product Benchmarking

7.9.7. S&E Specialty Polymers, LLC (Aurora Plastics)

7.9.7.1. Company Overview

7.9.7.2. Financial Performance

7.9.7.3. Product Benchmarking

7.9.8. Asahi Kasei Corporation

7.9.8.1. Company Overview

7.9.8.2. Financial Performance

7.9.8.3. Product Benchmarking

7.9.9. Covestro AG

7.9.9.1. Company Overview

7.9.9.2. Financial Performance

7.9.9.3. Product Benchmarking

7.9.10. Washington Penn

7.9.10.1. Company Overview

7.9.10.2. Financial Performance

7.9.10.3. Product Benchmarking

7.9.11. Ascend Performance Materials

7.9.11.1. Company Overview

7.9.11.2. Financial Performance

7.9.11.3. Product Benchmarking

7.9.12. Kuraray Co. Ltd.

7.9.12.1. Company Overview

7.9.12.2. Financial Performance

7.9.12.3. Product Benchmarking

7.9.13. Teijin Limited

7.9.13.1. Company Overview

7.9.13.2. Financial Performance

7.9.13.3. Product Benchmarking

7.9.14. Evonik Industries AG

7.9.14.1. Company Overview

7.9.14.2. Financial Performance

7.9.14.3. Product Benchmarking

7.9.15. 3M

7.9.15.1. Company Overview

7.9.15.2. Financial Performance

7.9.15.3. Product Benchmarking