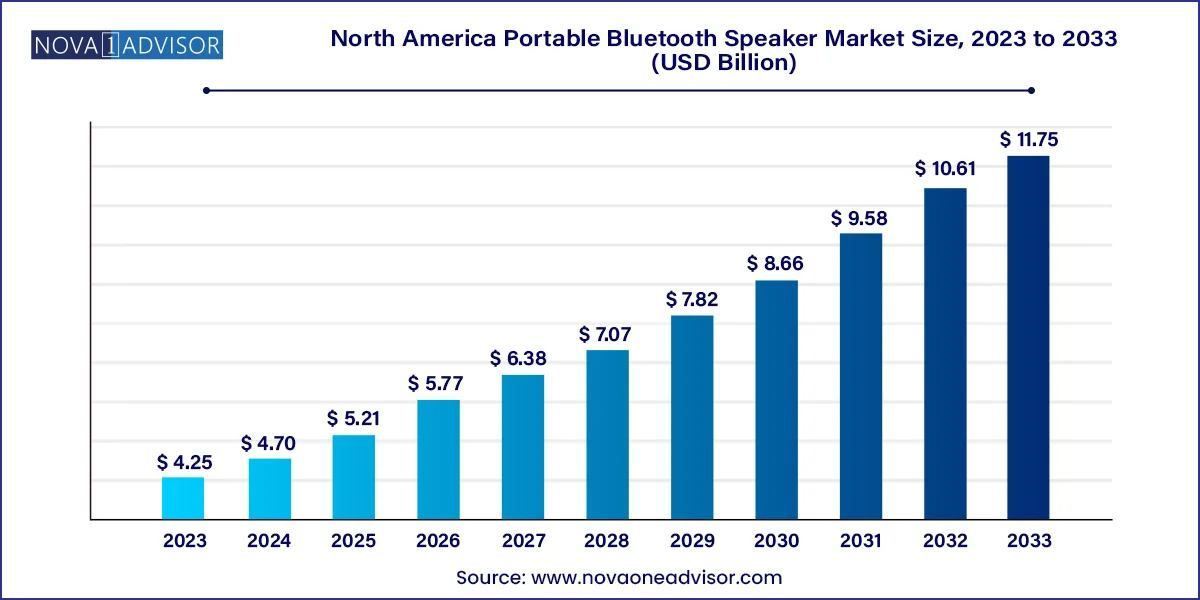

The North America portable bluetooth speaker market size was exhibited at USD 4.25 billion in 2023 and is projected to hit around USD 11.75 billion by 2033, growing at a CAGR of 10.7% during the forecast period 2024 to 2033.

The North America portable Bluetooth speaker market is experiencing robust expansion, driven by changing consumer lifestyles, the proliferation of smart devices, and the growing demand for on-the-go entertainment solutions. As consumers increasingly prioritize convenience, wireless connectivity, and immersive sound quality, Bluetooth speakers have evolved from niche tech gadgets into mainstream audio essentials across households, outdoor gatherings, fitness environments, travel, and even business settings.

This market includes a wide range of products—from compact, entry-level speakers for casual use to high-performance premium models equipped with waterproofing, voice assistant integration, and surround sound capabilities. Technological advancements in battery life, connectivity range, sound clarity, and materials have significantly expanded the product portfolio. Brands are capitalizing on these improvements to cater to diverse consumer segments, including audiophiles, outdoor adventurers, gym-goers, party enthusiasts, and casual users.

North America represents one of the most technologically advanced regions for consumer electronics adoption. The widespread use of smartphones, tablets, and smart TVs in the U.S., Canada, and Mexico has created a fertile ground for Bluetooth speaker proliferation. Additionally, the presence of major audio technology companies, sophisticated retail ecosystems, and a high disposable income population reinforces market momentum.

The COVID-19 pandemic reshaped consumer audio habits, with remote work, virtual socializing, and home entertainment becoming more prominent. Post-pandemic, consumers are increasingly investing in premium audio gear to elevate their home and outdoor experiences. The growing popularity of outdoor recreational activities like camping, beach trips, and RV travel has also boosted demand for durable, portable, and waterproof Bluetooth speakers. With continued innovation, competitive pricing strategies, and expanding online retail penetration, the North American portable Bluetooth speaker market is positioned for sustained growth through 2033.

Integration with Smart Assistants: Many Bluetooth speakers now support voice-activated assistants such as Alexa, Google Assistant, or Siri, offering hands-free control.

Rising Popularity of Waterproof and Rugged Speakers: Consumers increasingly favor IPX-rated speakers that are resistant to water, dust, and shock for outdoor use.

Adoption of Multi-Speaker Connectivity: Brands are offering pairing and party mode features that allow multiple speakers to connect for a surround sound effect.

Eco-Friendly and Sustainable Designs: Manufacturers are launching speakers made with recycled plastics, sustainable materials, and energy-efficient components.

Hybrid Bluetooth-WiFi Models: Products that can switch between Bluetooth and Wi-Fi for seamless home and travel use are gaining popularity.

Compact, Travel-Friendly Designs: Ultra-portable, pocket-sized speakers are trending among frequent travelers, hikers, and students.

Growing Demand for Long Battery Life: Speakers with 20+ hours of playback time and quick-charging capabilities are increasingly preferred.

Enhanced Audio Features: Dolby Atmos support, 360-degree sound dispersion, and bass boost functionality are being incorporated into mid-range and premium models.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.70 Billion |

| Market Size by 2033 | USD 11.75 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | HARMAN International; Bose Corporation; Marshall Group AB; Sony Group Corporation; Apple Inc.; Logitech; Plantronics Inc.; Fugoo; VOXX International Corporation; Bang & Olufsen |

Proliferation of Smart Devices and On-the-Go Audio Consumption

A significant driver of growth in the North American portable Bluetooth speaker market is the explosive adoption of smart devices and the corresponding shift in consumer audio consumption patterns. With over 85% of Americans owning smartphones and an increasing number of users adopting tablets, smartwatches, and laptops, Bluetooth has become the universal standard for wireless audio connectivity. This has created a seamless ecosystem where users can instantly pair their devices with speakers to enjoy music, podcasts, audiobooks, and virtual meetings anywhere, anytime.

Moreover, modern lifestyles have evolved to emphasize flexibility, mobility, and multi-tasking. Whether it's working from a park, hosting a backyard barbecue, or exercising at a home gym, consumers demand portable and reliable sound systems. Bluetooth speakers fulfill this need with compact form factors, robust battery performance, and wireless connectivity. The driver is further reinforced by high-speed internet penetration, music streaming service growth (Spotify, Apple Music, etc.), and cultural shifts that prioritize experience-driven consumption.

Market Saturation and Price Competition Among Brands

Despite its growth trajectory, the North American Bluetooth speaker market faces a key restraint in the form of increasing market saturation and price wars. The low barrier to entry in the consumer electronics segment has resulted in a flood of new entrants, particularly from budget and unbranded manufacturers. These companies often compete aggressively on price, leading to profit margin erosion for mid-range and established brands.

As the market becomes more crowded, differentiation becomes a challenge. Consumers are overwhelmed with options, and brand loyalty is harder to establish in lower-priced segments. Even leading companies must offer frequent product updates and promotional discounts to maintain market share, which can strain marketing and R&D budgets. The situation is further complicated by the commoditization of basic Bluetooth speaker features—such as waterproofing, USB-C charging, and stereo pairing—which are now standard across most models, making innovation a constant necessity rather than a competitive edge.

Rising Demand for Voice-Enabled and Smart Home-Compatible Bluetooth Speakers

An emerging opportunity in the North America portable Bluetooth speaker market lies in the rising consumer interest in smart home ecosystems and voice-controlled devices. As homes become increasingly connected, consumers are integrating speakers with smart assistants to manage lighting, climate control, reminders, and entertainment—all through voice commands. This convergence of Bluetooth speakers with smart home capabilities opens up a new frontier of use cases.

Several leading audio brands have responded to this trend by embedding AI assistants directly into their speaker designs or enabling seamless pairing with existing smart hubs. Consumers value the dual benefit of high-quality audio and smart assistant functionality in a single, stylish device. Furthermore, households that already own smart appliances or home automation systems are more inclined to purchase compatible Bluetooth speakers, expanding the opportunity beyond traditional audio enthusiasts to tech-savvy, convenience-driven buyers.

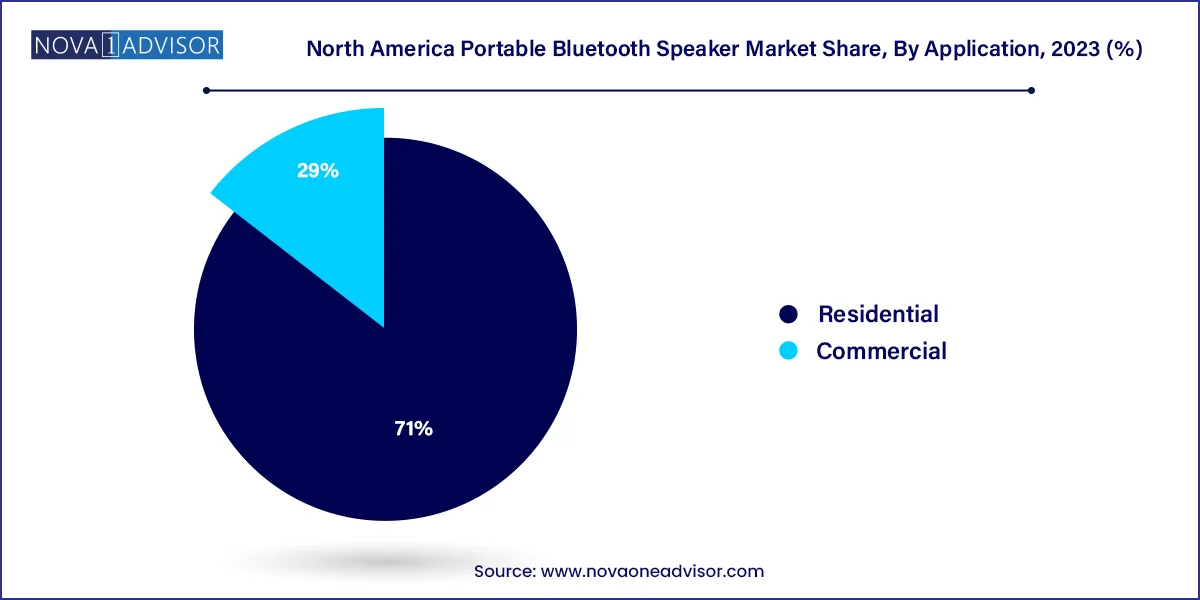

The residential sector accounted for a share of 71.0% in 2023. This dominance is attributed to the widespread integration of wireless audio devices into everyday home environments. Consumers use portable speakers across living rooms, kitchens, patios, and bedrooms for music streaming, podcasts, TV audio enhancement, and virtual communication. The ability to relocate speakers based on mood or activity—without the hassle of wires or fixed installation—resonates with the modern home design ethos of flexibility and minimalism.

On the other hand, the commercial segment is the fastest growing, supported by the increasing use of Bluetooth speakers in retail stores, restaurants, fitness centers, event venues, and even office spaces. Businesses are leveraging portable speakers to improve customer experience, set ambiance, and provide flexible sound solutions without investing in complex sound systems. The ease of portability and wireless setup makes these devices ideal for small-scale pop-ups, training sessions, and outdoor brand activations. In the post-pandemic era, mobile wellness classes, open-air events, and temporary workspaces have further amplified demand in this segment.

The offline distribution channel accounted for a share of 62.5% in 2023. Consumers often prefer to experience audio quality firsthand before making a purchase. In-store demos, bundled offers, and personalized guidance contribute to a tactile and trustworthy buying experience. Retailers like Best Buy, Walmart, and Costco remain key players, stocking a wide variety of Bluetooth speaker brands across price tiers.

However, online channels are growing at the fastest pace, driven by convenience, deep discounts, and access to a broader range of brands—including international or niche manufacturers not available in physical stores. E-commerce platforms like Amazon, B&H, and Newegg offer detailed user reviews, comparison tools, and flash sales that appeal to informed and budget-conscious buyers. Direct-to-consumer (DTC) websites by companies like JBL, Bose, and Sonos also allow brands to cultivate customer relationships through loyalty programs, customization options, and early access to new launches.

United States

The U.S. holds the lion’s share of the North American portable Bluetooth speaker market, underpinned by a tech-savvy consumer base, high disposable incomes, and a vibrant audio product culture. Urban consumers, in particular, have embraced portable audio as a lifestyle staple, integrating Bluetooth speakers into everything from personal fitness routines to weekend getaways. The U.S. market is also characterized by high penetration of smart home devices, with many consumers seeking smart speaker systems that can double as portable audio companions.

The presence of key market players, early adoption of new technologies, and favorable retail ecosystems make the U.S. the epicenter of innovation and volume sales in the region. Seasonal buying patterns—such as Black Friday, Prime Day, and holiday gifting further contribute to cyclical spikes in Bluetooth speaker demand.

Canada and Mexico

While Canada benefits from similar technological maturity and consumer behavior as the U.S., its growth is comparatively moderate due to a smaller population base. Nonetheless, Canadian consumers are increasingly purchasing high-quality Bluetooth speakers for personal and family entertainment. Government support for smart technology and the expansion of e-commerce are enhancing accessibility and driving growth.

Mexico is witnessing rapid growth in the portable Bluetooth speaker market, fueled by a rising middle class, smartphone adoption, and youth-driven interest in portable entertainment. Urbanization, increasing access to 4G/5G connectivity, and the popularity of music streaming apps have positioned Mexico as a key growth market in North America. Local retailers and cross-border e-commerce are bridging supply gaps, making global brands more accessible to Mexican consumers.

JBL (January 2024): JBL unveiled the updated “Charge 6” Bluetooth speaker featuring a solar charging panel and integrated voice assistant support. The product was showcased at CES 2025, highlighting the brand’s push into eco-friendly, outdoor-friendly design.

Sonos (February 2024): Sonos launched the “Roam 2,” an ultra-portable speaker with simultaneous Wi-Fi and Bluetooth connectivity and enhanced bass response. It also features upgraded compatibility with both Alexa and Google Assistant.

Bose (December 2023): Bose announced a strategic partnership with Spotify to offer personalized playlists synced with speaker acoustics via an AI-based sound adaptation app.

Sony (November 2023): Sony expanded its “XB” series with the XB200, a waterproof Bluetooth speaker featuring LED visualizers and 24-hour battery life, targeting Gen Z consumers.

Ultimate Ears (March 2024): Ultimate Ears introduced a fully biodegradable Bluetooth speaker named “UE Earth,” aligning with the brand’s commitment to sustainability and targeting eco-conscious consumers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America portable bluetooth speaker market

Application

Distribution Channel

Country