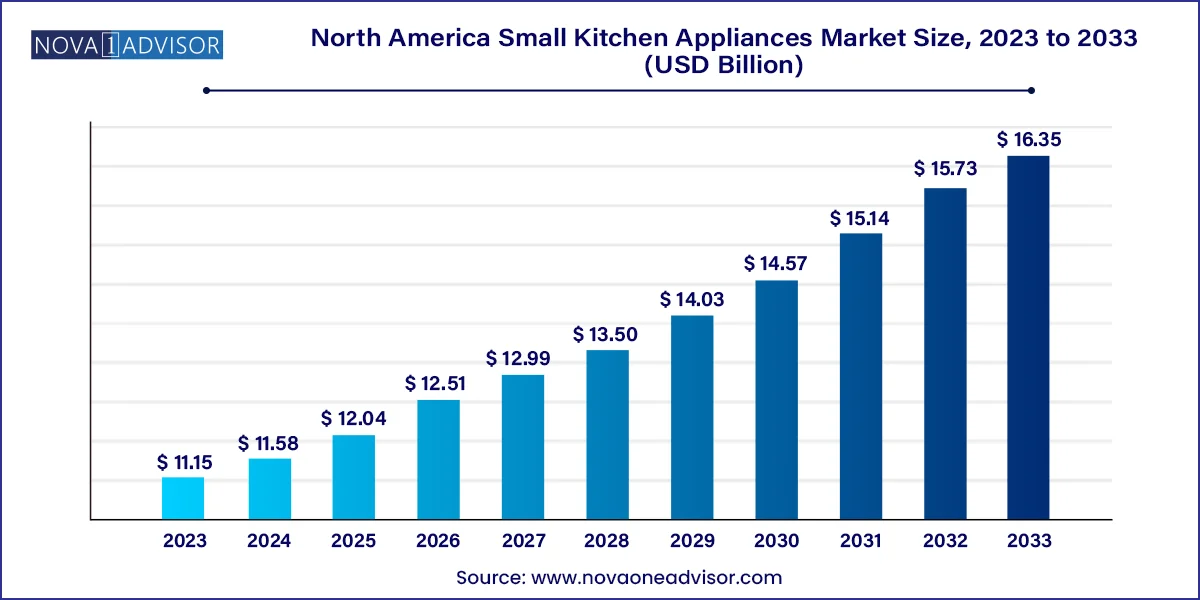

The North America small kitchen appliances market size was exhibited at USD 11.15 billion in 2023 and is projected to hit around USD 16.35 billion by 2033, growing at a CAGR of 3.9% during the forecast period 2024 to 2033.

The North America small kitchen appliances market is witnessing robust growth, driven by evolving consumer lifestyles, rising culinary interest, and the shift toward convenience-oriented home cooking. These appliances, ranging from coffee makers and air fryers to blenders and rice cookers, have transitioned from luxury goods to daily essentials in both urban and suburban households. With rising urbanization, changing dietary patterns, and increasing disposable incomes, North American consumers are investing in appliances that save time, promote healthy eating, and enhance the culinary experience.

The market benefits from a diverse range of consumers, including working professionals seeking quick meal prep solutions, health-conscious individuals preferring juicers and air fryers, and culinary enthusiasts investing in mixers, blenders, and specialty appliances. The COVID-19 pandemic further accelerated this shift, as home-bound individuals turned to cooking as both necessity and leisure, creating unprecedented demand for countertop appliances.

As of the current landscape, manufacturers are focusing on energy efficiency, smart features, ergonomic designs, and multifunctionality. Integration with smart home ecosystems, voice assistants, and mobile applications is becoming increasingly common. Brands are also placing strong emphasis on sustainability—releasing appliances with recyclable materials, low power consumption, and modular designs for easy maintenance. The North American small kitchen appliances market is expected to sustain this trajectory through a combination of product innovation, digital transformation, and increasing consumer expectations.

Smart Kitchen Integration: Rise of app-connected and voice-activated appliances compatible with Amazon Alexa, Google Assistant, and proprietary apps.

Health and Wellness-Oriented Appliances: Surge in sales of air fryers, juicers, and blenders as consumers seek oil-free, vitamin-rich cooking solutions.

Multifunctional and Space-Saving Devices: Products offering multiple functionalities like food processing, chopping, and blending in one compact design are in high demand.

Sustainability in Design: Emphasis on energy-efficient components, recyclable packaging, and longer-lasting motors.

Premiumization and Design Aesthetics: Increasing consumer preference for sleek, modern, and aesthetically pleasing kitchen appliances.

Growth of Subscription-Based and Replacement Parts Models: Subscription services for accessories (e.g., coffee pods, blender blades) and modular replacement parts gaining popularity.

Do-It-Yourself (DIY) and Home Cooking Boom: Influencer-led recipes and at-home culinary experimentation continue to drive appliance sales.

E-commerce and Direct-to-Consumer Growth: Online sales platforms are becoming the primary retail channel for most brands, aided by product comparisons, reviews, and digital marketing.

| Report Coverage | Details |

| Market Size in 2024 | USD 11.58 Billion |

| Market Size by 2033 | USD 16.35 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product Type, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Tefal S.A.S. (T-fal); Cuisinart; General Appliances (a Haier company); Hamilton Beach; Bella Housewares (Gather); Kenmore (Transform Holdco LLC); Russell Hobbs; SPECTRUM BRANDS, INC.; Panasonic Corporation; Ninja (SharkNinja, LLC); SMEG USA, Inc |

A significant market driver is the emergence of cooking as a lifestyle activity rather than just a domestic chore. The pandemic era reshaped how consumers view their kitchens, with many turning to cooking as a hobby, a means of healthy living, or even a form of self-expression. This has led to increased interest in diverse cuisines, cooking techniques, and tools that can replicate restaurant-style dishes at home.

Appliances such as air fryers, espresso machines, and food processors are no longer niche purchases—they’ve become centerpieces in modern kitchens. Consumers actively research brands, features, and functionalities before purchase, indicating a highly engaged and informed buyer segment. From viral TikTok recipes to YouTube culinary tutorials, the influence of social media has played a pivotal role in driving demand for new appliances, seasonal launches, and specialty tools. The rise in interest for fermentation, vegan meals, and high-protein shakes, for instance, has triggered increased demand for yogurt makers, plant milk blenders, and protein shake mixers.

While the market shows strong growth potential, product saturation poses a considerable restraint, especially in mature urban markets. Many households already own one or more types of small kitchen appliances, leading to replacement-driven sales rather than first-time purchases. As a result, market competition is stiff, price sensitivity is high, and customer retention becomes challenging.

Additionally, the product lifecycle of appliances is relatively short, with frequent innovations and new models launched every few months. This creates consumer hesitation around early adoption, particularly for premium or smart appliances. Frequent upgrades can also lead to electronic waste, which is a concern among environmentally conscious consumers. Without strong after-sales service, repair options, or upgrade programs, brands may struggle to maintain loyalty in an increasingly crowded landscape.

The ongoing digital transformation of the kitchen represents a significant opportunity for manufacturers. As smart homes become mainstream across North America, consumers are increasingly inclined toward appliances that offer remote control, automatic scheduling, and integration with digital assistants. From refrigerators that notify users when ingredients are low to coffee makers that brew based on daily routines, the potential for connectivity is reshaping product innovation.

Small kitchen appliances are catching up fast—smart toasters, Bluetooth-enabled air fryers, and programmable pressure cookers are emerging in the market. These connected devices offer consumers greater control, recipe customization, and cooking assistance through mobile apps. This trend is especially appealing to tech-savvy millennials and Gen Z households who prioritize digital convenience, automation, and personalization in every aspect of their lives. Brands that integrate IoT, AI, and cloud-based data insights into their appliance offerings are well-positioned to dominate this evolving market space.

The coffeemaker segment held the largest revenue share, 26.7%, in 2023. Whether in single-serve pods, drip coffee, or espresso machines, coffee appliances cater to nearly every demographic. The U.S. alone sees over 60% of adults consuming coffee daily, making this product a morning essential. Single-serve systems like Keurig and Nespresso have revolutionized home brewing, offering barista-level quality with one-touch convenience. This segment continues to benefit from workplace models, compact dorm-friendly units, and smart models that integrate with morning routines via smartphone alarms and scheduling apps.

The air fryer segment is expected to grow at the fastest CAGR of 5.7% from 2024 to 2033. These appliances appeal to those seeking crispy, fried textures with minimal oil—ideal for those managing cholesterol, obesity, or calorie-controlled diets. Their versatility—from cooking vegetables to baking pastries—has expanded their appeal across age groups. Social media has played a major role in popularizing air fryer recipes, with thousands of creators sharing content on platforms like TikTok, Pinterest, and Instagram. Brands are launching multi-function air fryer ovens with rotisserie, toaster, and convection options, pushing this segment toward even higher value per unit.

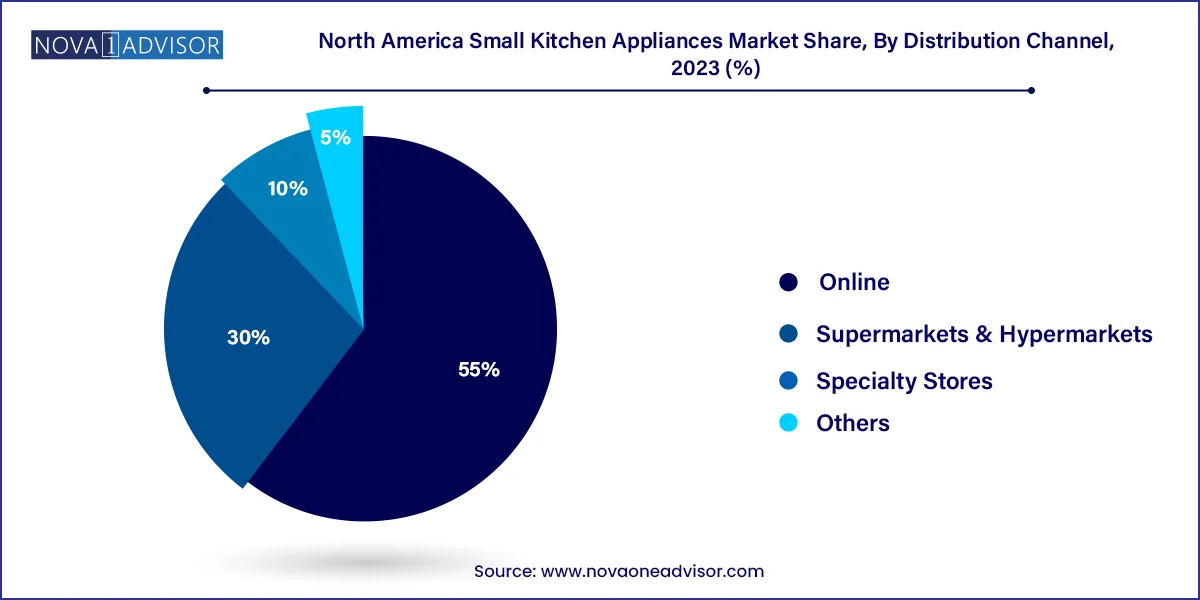

Supermarkets and hypermarkets dominate the distribution landscape, particularly for mid-range and affordable small kitchen appliances. Retailers like Walmart, Costco, and Target offer in-store promotions, product bundling, and seasonal discounts that appeal to both impulse and planned buyers. In-store displays allow consumers to compare brands physically, test functionalities, and make informed purchase decisions. Bulk-buying habits, especially during holiday seasons and Black Friday sales, contribute significantly to this segment's performance.

However, online channels are the fastest-growing, reshaping how consumers browse and purchase small kitchen appliances. Amazon, Wayfair, Best Buy online, and direct-to-consumer brand websites offer extensive product comparisons, user reviews, and flash discounts. Online-exclusive product launches, influencer collaborations, and free shipping have made e-commerce the preferred mode of purchase among millennials and tech-savvy shoppers. Subscription models, such as coffee pod deliveries or blade replacements for blenders, are also gaining traction in the online space, creating recurring revenue for manufacturers.

United States

The U.S. accounts for the largest share of the North American small kitchen appliances market, driven by a highly urbanized population, strong culinary culture, and advanced retail infrastructure. American consumers prioritize time-saving, health-promoting, and tech-integrated kitchen tools, which has led to rising sales in categories like smart pressure cookers, air fryers, and food processors. Cities like Los Angeles, New York, and Chicago show high adoption of premium appliances, while suburban regions continue to support consistent demand for mid-range, utility-driven devices.

Additionally, the U.S. market benefits from a mature e-commerce ecosystem, frequent promotional campaigns, and strong brand competition. Major retailers offer customer loyalty programs and in-house appliance lines that strengthen consumer retention. Regulatory trends related to energy efficiency and recycling have also started influencing product design and marketing. Manufacturers that prioritize environmental consciousness and repairability are seeing greater acceptance among younger buyers.

Canada

Canada represents a steadily growing market with distinct consumer preferences shaped by cultural diversity and environmental awareness. Urban centers like Toronto and Vancouver exhibit high interest in multi-functional appliances and compact designs suitable for smaller kitchens. Canadians also display strong brand loyalty, often sticking with established players known for quality and durability.

Sustainability plays a larger role in Canadian purchasing behavior, prompting demand for energy-efficient devices, biodegradable packaging, and long-lasting warranties. The market has also seen a rise in smart appliance adoption, particularly in newer, tech-integrated homes. Retailers such as Canadian Tire, Hudson’s Bay, and Amazon Canada play crucial roles in distribution, while local regulations encourage recyclable and repairable designs.

March 2024 – Breville announced the launch of its "Smart Oven Air Fryer Pro" in the U.S. and Canada, featuring an AI-based interface for adaptive cooking modes and recipe memory.

January 2024 – Hamilton Beach partnered with Amazon Alexa to release a line of voice-activated coffee makers and blenders, targeting smart home enthusiasts in North America.

November 2023 – KitchenAid introduced a limited-edition color range for its stand mixers ahead of the holiday season, boosting brand engagement and specialty store sales.

September 2023 – Instant Brands launched the “Instant Precision Blender” with programmable nutrient retention settings, catering to health-focused consumers in the U.S.

June 2023 – Cuisinart expanded its countertop oven series in Canada with multi-function air fryer combinations, targeting compact kitchen spaces in urban homes.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America small kitchen appliances market

Product Type

Distribution Channel

Country