The North America spirits market size was exhibited at USD 217.15 billion in 2023 and is projected to hit around USD 407.62 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2024 to 2033.

The North America spirits market represents one of the most mature yet dynamically evolving sectors in the global alcoholic beverage industry. Encompassing a wide range of distilled beverages such as whiskey, vodka, gin, rum, brandy, and other specialty liquors, the market continues to thrive on a fusion of tradition and innovation. With a rich legacy rooted in centuries of distillation practices, especially in the U.S. and Canada, spirits hold a deep cultural and economic value in the region.

The market is largely driven by evolving consumer preferences, the resurgence of premium and craft offerings, and the growing influence of experiential drinking. North American consumers are increasingly leaning towards artisanal spirits, low-alcohol and flavored variants, and those associated with sustainability and transparency. In addition, a growing young adult population—particularly millennials and Gen Z—are altering the trajectory of product development, packaging, and marketing. With cross-border trade, tourism influence, and a highly developed hospitality infrastructure, North America remains a critical hub for both global and local spirits producers.

The rise of home mixology, supported by digital content and social media trends, has further amplified demand for high-quality and aesthetically branded spirits. Regulatory evolutions, such as loosened shipping restrictions in certain U.S. states, and an increasing trend toward online liquor purchases are shifting distribution landscapes. The interplay of heritage brands and innovative newcomers continues to create a vibrant competitive field where authenticity and storytelling often win consumer loyalty.

Premiumization and Craft Distilling: Consumers are moving beyond mass-market offerings, seeking out premium, small-batch, and handcrafted spirits with unique provenance and ingredient sourcing.

Flavored Spirits on the Rise: From honey-infused whiskeys to botanical gins, flavored variants are gaining traction, especially among younger drinkers and those seeking novelty.

Sustainability and Ethical Production: Brands are emphasizing eco-friendly practices, recyclable packaging, and organic ingredients, responding to growing environmental consciousness.

Ready-to-Drink (RTD) and Cocktail Culture: RTD cocktails and spirits-based beverages in cans are becoming increasingly popular, particularly for outdoor events and convenience-driven consumers.

Digital Engagement and Direct-to-Consumer Sales: Online marketing campaigns, influencer partnerships, and D2C platforms are transforming how consumers discover and purchase spirits.

Celebrity Collaborations and Brand Ownership: Celebrities are increasingly investing in spirit brands (e.g., Ryan Reynolds with Aviation Gin, Dwayne Johnson’s Teremana Tequila), bringing cultural cachet and media buzz.

Low-ABV and Health-Conscious Innovations: There’s growing demand for spirits with lower alcohol content or infused with botanicals, adaptogens, and other wellness-oriented ingredients.

Heritage Rebranding and Nostalgia Marketing: Legacy brands are reviving historic recipes, retro labels, and storytelling elements to reconnect with both older and younger demographics.

| Report Coverage | Details |

| Market Size in 2024 | USD 231.26 Billion |

| Market Size by 2033 | USD 407.62 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Caps & Closures, Caps & Closures Material, Distribution Channel, Coutry |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S, Canada, Mexico |

| Key Companies Profiled | Suntory Holdings Ltd.; Pernord Ricard; Constellation Brands; Rémy Cointreau; Brown-Forman; Asahi Group Holdings, Ltd.; Bacardi Limited.; Davide Campari-Milano N.V.; William Grant & Sons |

The primary driver fueling the North America spirits market is the escalating consumer inclination toward premium, craft, and experiential spirits. As disposable incomes rise and consumer tastes become more refined, there’s a noticeable shift away from bulk or economy spirits toward those that offer quality, exclusivity, and storytelling. This is especially evident in whiskey and gin categories, where consumers prefer small-batch distilleries or heritage producers with unique maturation techniques and flavor profiles. Brands such as Woodford Reserve, Buffalo Trace, and High West Distillery have capitalized on this trend by offering differentiated and regionally-inspired spirits. The “craft” appeal isn't just about taste—it’s a lifestyle choice associated with authenticity, artisanal value, and brand transparency, making it a compelling proposition for modern consumers.

Despite its promising trajectory, the spirits industry in North America faces considerable regulatory complexities, particularly concerning taxation and distribution. In the U.S., for example, the three-tier alcohol distribution system—comprising producers, distributors, and retailers—imposes significant compliance burdens. State-level restrictions often complicate interstate sales, and federal excise taxes on spirits are relatively high compared to beer and wine. These factors hinder smaller producers from scaling efficiently. Furthermore, labeling regulations, advertising restrictions, and age-verification requirements for online sales pose ongoing operational challenges. Compliance costs and evolving laws can significantly affect margins, innovation pace, and accessibility for newer entrants in the market.

One of the most exciting opportunities in the North America spirits market lies in digital transformation—particularly through e-commerce and omnichannel strategies. Traditionally constrained by legal limitations, online spirits sales have seen increased acceptance post-COVID-19, as several states in the U.S. revised alcohol delivery laws. Direct-to-consumer (D2C) channels are enabling brands to own their customer relationships, collect first-party data, and deliver personalized experiences. Platforms such as Drizly and ReserveBar have thrived by offering curated selections, delivery services, and educational content. Moreover, brands are leveraging virtual tasting rooms, AR labels, and mobile loyalty apps to enhance consumer engagement. This digital frontier presents immense potential for growth, especially for niche and craft producers aiming to reach broader audiences without relying on traditional retail.

Whiskey dominated the product segment in 2024, owing to its entrenched legacy, strong branding, and a growing connoisseur culture. American bourbon and Tennessee whiskey, in particular, have witnessed surging demand both domestically and internationally. Consumers are drawn to age statements, rare barrel selections, and limited-edition releases. Brands like Jack Daniel’s and Maker’s Mark have become staples, while newer entrants like WhistlePig and Angel’s Envy are adding diversity. Whiskey tourism in regions like Kentucky has also contributed to brand loyalty and experiential value. As whiskey continues to mature in both perception and price, its dominance in value and cultural influence remains undisputed in the North American spirits landscape.

Gin emerged as the fastest-growing segment, fueled by a renaissance in cocktail culture and experimentation with botanical infusions. Artisanal and locally distilled gins are finding favor among consumers who appreciate complex flavor profiles. The versatility of gin in mixology—ranging from classic G&Ts to herbaceous cocktails—has made it a staple for both bars and home settings. The introduction of pink gin, citrus-forward variants, and limited-edition botanical infusions has reinvigorated its appeal among younger consumers. Brands like Empress 1908 and Aviation Gin exemplify this resurgence. With its adaptability and creative potential, gin is carving out a distinctive niche in the modern spirits portfolio.

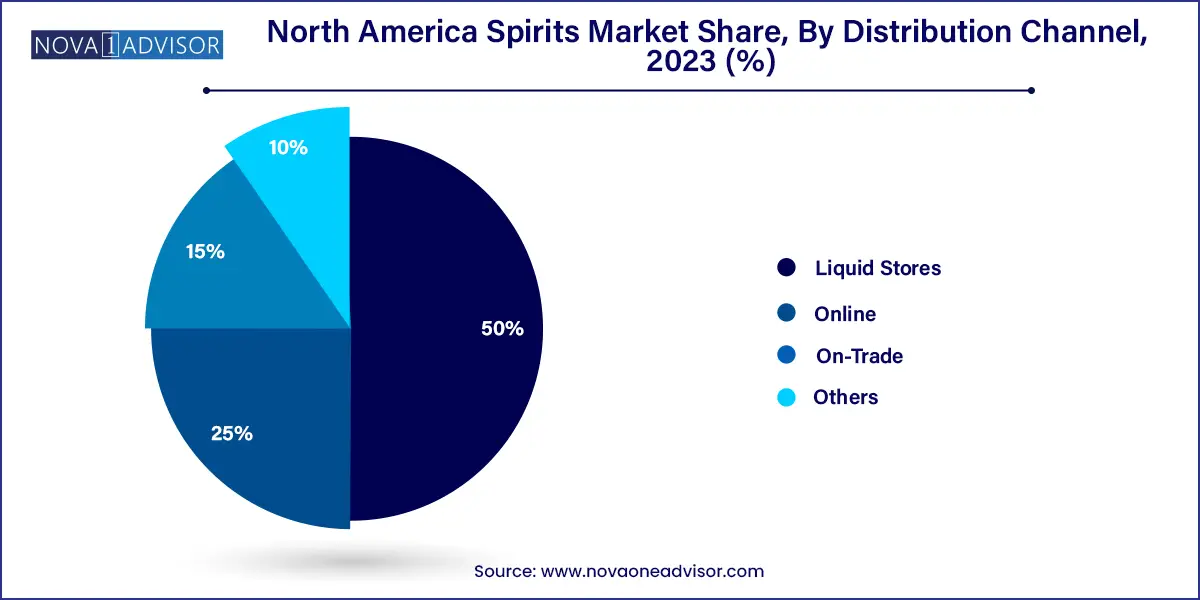

On-trade channels dominated the distribution landscape, driven by the robust bar, restaurant, and hospitality culture across North America. Spirits consumption in social environments such as cocktail bars, nightclubs, hotel lounges, and fine-dining restaurants accounts for a significant share of revenue, especially for premium brands. On-trade venues serve as experiential platforms where consumers discover new products, guided by expert mixologists or tasting events. High-margin cocktails and curated spirit lists have solidified this channel’s importance, particularly in urban centers and tourist destinations.

Online distribution is the fastest-growing channel, fueled by shifting consumer behavior, technological advancements, and favorable legislative changes. Platforms such as Drizly, Total Wine, and ReserveBar offer unparalleled convenience, home delivery, product education, and customization options. COVID-19 accelerated the normalization of online alcohol shopping, and even post-pandemic, the trend persists. Virtual happy hours, gifting options, and subscription boxes have further enriched the online shopping experience. Emerging D2C strategies, supported by data analytics and social media integration, are allowing brands to bypass traditional retail intermediaries and build direct customer relationships.

Screw-top closures dominated the caps and closures segment, primarily due to their convenience, cost-effectiveness, and tamper-evidence. Popular across both mass and mid-tier spirits, screw-tops ensure product integrity and are favored in retail environments where volume movement is high. Their reusability and ease of opening make them ideal for casual and home use. Brands often utilize custom metal screw caps as a branding surface, incorporating embossed logos or color-coding to distinguish SKUs. The growth of canned cocktails and RTD spirits has also contributed to the preference for secure screw-top packaging.

Bar-top and cork closures are witnessing the fastest growth, especially in the premium and ultra-premium categories. They lend an artisanal feel to spirits packaging, reinforcing product quality and traditional heritage. High-end whiskey, brandy, and aged rum brands often utilize bar-top corks for both functional and aesthetic purposes. These closures also offer opportunities for creative branding, such as custom cork toppers or wooden stoppers. The resurgence of cork reflects consumer desire for tactile and luxurious unboxing experiences, aligning with the broader trend of gifting and collecting spirits.

Plastic closures lead the market, particularly in mass-market and volume-driven product categories. Their lightweight nature, durability, and low production cost make them ideal for high-turnover SKUs and entry-level spirits. Plastic is also used for tamper-proof elements and resealable designs, often coupled with anti-counterfeit features in mid-range products. However, sustainability concerns are prompting producers to explore recyclable plastics or plant-based alternatives.

Metal closures are growing fastest, especially in premium packaging. Often made from aluminum or steel, these closures offer sleek aesthetics and are increasingly used for high-end vodkas, gins, and liqueurs. Metal caps often signify quality and sophistication, and their recyclability adds environmental appeal. As consumers become more environmentally conscious, metal closures are being adopted not only for their elegance but also for their lower ecological footprint compared to traditional plastic.

The U.S. spirits market is the most influential within North America, shaped by diverse demographics, strong domestic brands, and global consumption trends. The country is home to legendary whiskey producers, burgeoning craft distilleries, and highly innovative gin and vodka labels. States like Kentucky, Tennessee, and California lead in production, while major metropolitan areas drive consumption. Digital expansion and home mixology are transforming retail, while experiential venues like distillery tours and tasting events are reinforcing brand engagement.

Canada is witnessing a growing appreciation for premium and locally crafted spirits. Canadian whiskey remains a national hallmark, with brands such as Crown Royal and Canadian Club enjoying legacy status. Newer distilleries are pushing boundaries with maple-infused vodka, rye blends, and botanical gins. Canadian consumers are also increasingly embracing e-commerce and subscription-based discovery models. Regulatory structures are easing, encouraging greater competition and innovation in the domestic market.

While known globally for tequila and mezcal, Mexico’s spirits market is expanding to include whiskey and rum segments. Urbanization, tourism, and rising affluence are creating demand for diverse spirits categories, including international brands. Local distilleries are modernizing their offerings with packaging and flavors designed for younger demographics. Online alcohol delivery platforms are also making inroads, especially in major cities like Mexico City and Guadalajara.

January 2025: Diageo North America launched a limited-edition range of Johnnie Walker Blue Label bottles inspired by North American landscapes, targeting collectors and gifting segments.

February 2025: Beam Suntory opened a state-of-the-art visitor center in Kentucky, enhancing whiskey tourism and educational experiences around its Maker’s Mark brand.

March 2025: Brown-Forman partnered with eco-packaging firm Pulpex to trial paper-based bottle packaging for Jack Daniel’s, as part of their 2030 sustainability commitment.

January 2025: Constellation Brands acquired a minority stake in a boutique Canadian gin distillery, expanding its craft portfolio and cross-border influence.

February 2025: Campari Group introduced a U.S.-exclusive Aperitivo kit via D2C platform, tapping into at-home cocktail-making trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America spirits market

Product

Caps & Closures

Caps & Closures Material

Distribution Channel

Regional