The North America trail running shoes market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 5.56 billion by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.Increasing participation in trail running and high spending on trial sports are significant drivers contributing to the market demand for trail running shoes in North America.

The North America trail running shoes market has experienced dynamic growth over the past decade, fueled by a rising passion for outdoor recreational activities, wellness-driven lifestyles, and the expansion of nature-based sports communities. Trail running—defined as running on outdoor paths, typically involving uneven terrain, elevation, and natural obstacles—has evolved from a niche segment into a mainstream fitness pursuit. As a result, the demand for performance-optimized footwear specifically designed for trail conditions has escalated across the United States and Canada.

Unlike conventional road-running shoes, trail running shoes are engineered for off-road use, offering features such as durable outsoles with aggressive lugs for traction, reinforced toe guards, water-resistant uppers, rock plates, and responsive cushioning. These elements are designed to protect against the hazards of unpaved routes, including roots, rocks, mud, and changing elevations. Consumers—ranging from amateur runners to elite athletes—seek gear that provides a blend of comfort, stability, durability, and adaptability.

The North American region, blessed with vast trail networks such as the Pacific Crest Trail, Appalachian Trail, and the Bruce Trail in Canada, provides the perfect backdrop for growing trail running participation. Additionally, the influence of fitness influencers, social media communities, eco-tourism, and environmental awareness has bolstered the visibility of trail running as a lifestyle. As the outdoor gear market becomes more sophisticated, trail running shoes are being increasingly viewed not only as athletic wear but also as functional lifestyle products.

Hybrid Footwear Designs: Trail running shoes that blur the line between road and trail use are gaining popularity among urban athletes seeking versatility.

Sustainable and Eco-Friendly Materials: Brands are responding to environmental consciousness by launching models made from recycled plastics, plant-based textiles, and biodegradable midsoles.

Increased Popularity of Ultra-Trail Events: Events like the Western States 100 or Ultra-Trail du Mont-Blanc (UTMB) in North America are driving sales of high-performance shoes with endurance-specific features.

Direct-to-Consumer (DTC) E-commerce Growth: Leading brands are leveraging their digital platforms for exclusive launches, virtual fittings, and community engagement.

Gender-Specific Product Innovation: Custom fit and biomechanics-focused designs for men and women are seeing higher consumer uptake, especially in mid-to-premium segments.

Smart Shoe Technology: Integration of fitness tracking sensors and smart insoles for gait analysis is emerging as a niche but promising segment.

Collaborative & Limited Edition Releases: Brand collaborations with athletes, influencers, and eco-organizations are generating buzz and product scarcity to boost desirability.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.95 Billion |

| Market Size by 2033 | USD 5.56 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S; Canada |

| Key Companies Profiled | Salomon; Nike, Inc.; Brooks Sports, Inc (Berkshire Hathaway); Hoka One One; New Balance; Merrel, Saucony; The North Face (Americas); ALTRA RUNNING (Outdoor Segment); Adidas Outdoor; La Sportiva |

The primary driver propelling the North American trail running shoes market is the surge in outdoor fitness participation, catalyzed by shifting lifestyle preferences, heightened health awareness, and post-pandemic recreation habits. Trail running has become a popular alternative to gym-based workouts and traditional running due to its physical intensity and mental health benefits derived from immersion in nature.

Outdoor sports retailers and fitness communities have recorded increased registrations for trail races, group runs, and hiking-running hybrid events. This behavioral shift has created consistent demand for footwear optimized for varying terrains. Trail runners not only need performance and comfort but also weather protection, traction, and durability—criteria that road shoes cannot satisfy. The diverse trail ecosystems in the U.S. and Canada provide the ideal environment for both casual weekend runners and competitive ultra-endurance athletes, thus establishing a robust market base for trail-specific shoes.

Despite positive momentum, a core restraint in the market is the relatively high cost and niche technical specifications of trail running shoes, which can deter entry-level consumers. While entry-level models begin around $100, premium trail runners often exceed $180–$200, particularly those featuring advanced waterproofing (e.g., GORE-TEX), carbon fiber plates, or proprietary foam technologies.

This price point is often higher than average road running shoes, especially when accounting for the additional gear that trail running often requires, such as hydration packs, compression wear, and navigation tools. The complexity of choosing between models for different terrain types—light trail, rugged trail, or off-trail—can overwhelm new users. This knowledge gap, coupled with price sensitivity, particularly among younger consumers or casual runners, limits mass-market penetration and repeat purchases among non-enthusiasts.

One of the most promising opportunities lies in the expansion of trail running shoes into urban and lifestyle use cases, merging performance gear with casual fashion. The modern consumer seeks multifunctional footwear that transitions seamlessly from trail to town. Brands are now designing aesthetically appealing shoes with rugged outsoles, breathable uppers, and neutral color palettes that fit into both athletic and everyday wardrobes.

This cross-functional appeal has led to trail shoes being worn for walking, light hiking, urban commuting, and even travel. Urban consumers living near trail-accessible parks or green belts prefer shoes that accommodate both city pavements and dirt paths. By capitalizing on this trend and promoting trail shoes as versatile lifestyle products, companies can target a broader demographic, including fitness walkers, recreational hikers, and eco-conscious consumers seeking durable, all-terrain footwear.

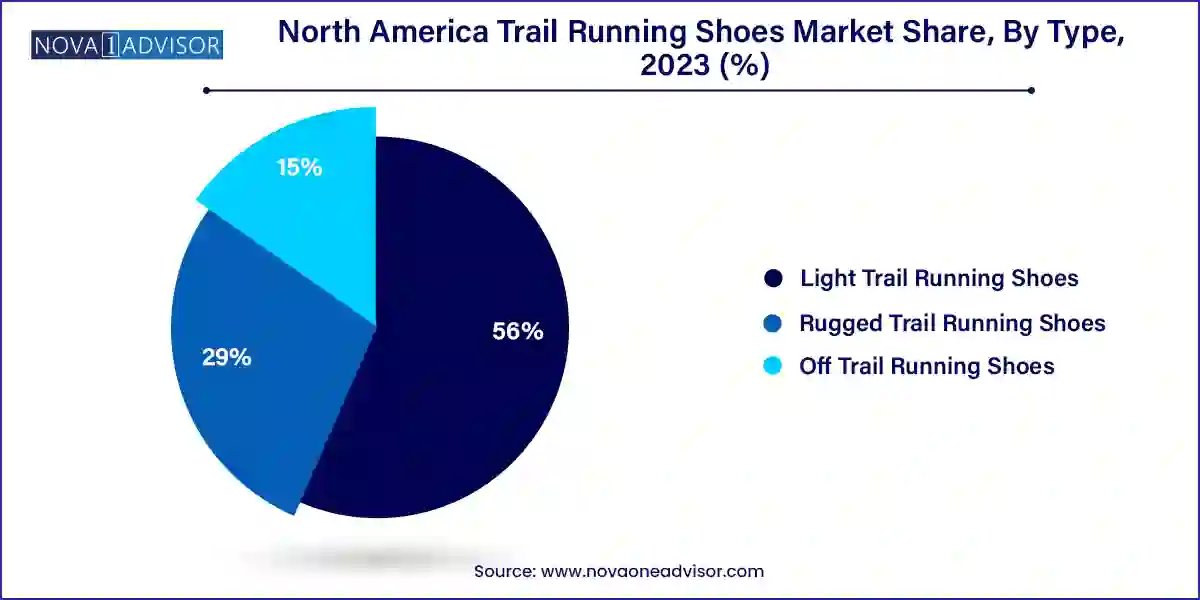

Light trail running shoes dominate the North American market due to their versatility and mass appeal. These shoes are ideal for groomed trails, gravel paths, and urban park routes—terrains commonly used by entry-level and intermediate runners. Lightweight construction, flexible soles, and breathable mesh uppers make these models suitable for speed-focused training and short-distance trail runs. Their lower profile also allows for a smoother transition to road surfaces, increasing their usability across multiple running environments. Light trail shoes are often the first choice for new trail runners or road runners seeking to diversify their training terrain.

On the other hand, off-trail running shoes are the fastest-growing segment, driven by the rise in ultra-distance races, adventure racing, and backcountry exploration. These shoes feature aggressive lug patterns, reinforced toe caps, rock plates, and high-cut ankle collars for better grip, stability, and injury prevention on unpredictable terrain. Designed to withstand mud, snow, scree, and water crossings, they cater to experienced runners tackling remote or technical trails. As more runners take on ambitious trail goals and seek greater adventure, demand for rugged and protective off-trail shoes is growing significantly.

Outdoor and sporting goods stores currently lead the trail running shoe market in North America, particularly in performance-driven segments. Specialty retailers like REI, MEC (Canada), Bass Pro Shops, and Dick’s Sporting Goods offer personalized fitting, technical guidance, and the opportunity to try different models in-store. These outlets often stock exclusive trail running brands or models unavailable in generalist footwear chains. Additionally, proximity to trailhead regions boosts retail traffic in cities like Denver, Vancouver, and Salt Lake City. Retail staff often double as local running guides or enthusiasts, providing credible product recommendations and building brand trust.

Online retail channels are growing the fastest, fueled by DTC brand strategies, e-commerce logistics improvements, and consumer comfort with virtual shopping. Brands like HOKA, Altra, and Salomon offer exclusive releases, product customization, and detailed guides through their websites. Multi-brand platforms such as Zappos, Backcountry, and Amazon offer expansive selections and flexible return policies that replicate the trial process of in-store shopping. The convenience of doorstep delivery, especially for rural or trail-proximate regions, further supports this channel. Moreover, digital content—such as YouTube reviews, social media athlete endorsements, and 3D product visualizations—is encouraging more consumers to purchase shoes online without physical trials.

The United States dominates the North American trail running shoes market, accounting for the majority of revenue and participation. States like Colorado, California, Utah, Oregon, and Washington are recognized hotspots for trail running culture, supported by extensive trail systems, national parks, and annual race circuits. Consumer demand in the U.S. is bolstered by a strong fitness culture, a vibrant outdoor apparel industry, and high disposable income. In addition to performance-focused customers, a growing number of American consumers are purchasing trail shoes for lifestyle and walking purposes, particularly in suburban and semi-urban areas.

The presence of several major retailers and logistics providers makes product availability seamless. U.S.-based brands like Merrell and Brooks cater directly to local terrain preferences, while international giants like Salomon and HOKA maintain strong footholds through retail partnerships and direct sales. With high digital engagement, U.S. consumers are also more likely to participate in brand communities, challenges, and product beta-testing.

Canada is witnessing steady growth, driven by a national appreciation for outdoor sports and an increasing population of recreational trail users. Trails such as the Bruce Trail, Sea to Sky Corridor, and parts of the Trans Canada Trail attract runners, hikers, and adventurers across regions. Provincial parks, forested areas, and mountainous terrain in British Columbia, Alberta, and Quebec provide fertile ground for trail running participation. Canadian consumers value sustainability, durability, and weather-adaptable designs—factors that shape product development and marketing in the region.

Retailers like MEC and Sport Chek dominate the offline space, while niche e-commerce platforms cater to specific trail disciplines such as ultra-running or mountain racing. Canadian weather patterns also create seasonal surges in demand for water-resistant or insulated trail footwear. As local running clubs and outdoor influencers promote the sport across social media, participation and corresponding shoe sales continue to rise.

HOKA (March 2024): Released the Speedgoat 6 model in North America with a lighter upper, redesigned Vibram outsole, and expanded sizing to accommodate wide feet and gender-specific biomechanics.

Salomon (February 2024): Announced the launch of the “S/Lab Genesis” trail racing shoe designed for rugged terrains, tested in North American high-altitude races and receiving attention among elite runners.

Merrell (January 2024): Introduced its “Eco-Trail” line made with recycled mesh, sugarcane EVA midsoles, and PFC-free water repellents, aligning with eco-conscious consumer values in Canada and the U.S.

Brooks Running (December 2023): Opened its first North America-based trail lab in Oregon to focus on R&D specific to rugged terrain footwear and biomechanical testing in real-world trail environments.

Altra (November 2023): Collaborated with North American trail race organizers to promote its Lone Peak and Olympus lines, launching a limited-edition “Enduro Series” designed for technical climbs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America trail running shoes market

Type

Distribution Channel

Country