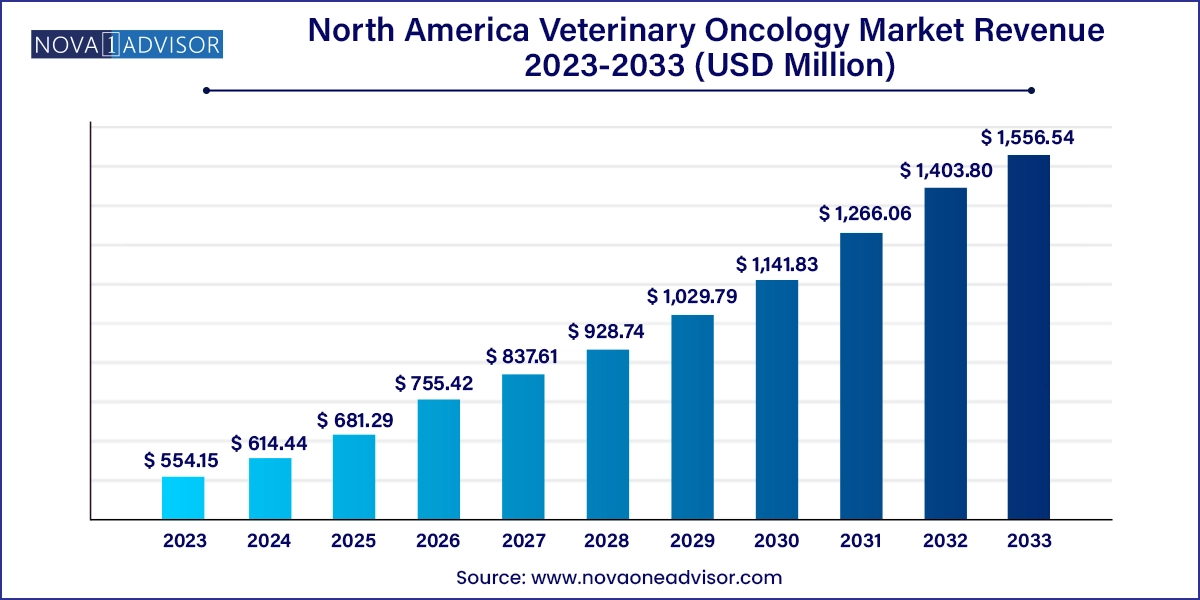

The North America veterinary oncology market size was exhibited at USD 554.15 million in 2023 and is projected to hit around USD 1,556.54 million by 2033, growing at a CAGR of 10.88% during the forecast period 2024 to 2033.

The North America veterinary oncology market is witnessing a significant transformation due to the rising prevalence of cancer in companion animals and increasing awareness among pet owners regarding advanced treatment options. Veterinary oncology, the field of veterinary medicine concerned with the diagnosis and treatment of cancer in animals, has grown steadily as both the demand for pet care and the willingness of pet owners to invest in their animals' health have surged.

Cancer, being one of the leading causes of mortality among pets, particularly dogs and cats, has necessitated the expansion of specialized oncological care. In the U.S. alone, it is estimated that nearly 6 million dogs and a similar number of cats are diagnosed with cancer annually. These staggering statistics have prompted the development of veterinary oncology as a specialized practice area with advanced diagnostic and therapeutic capabilities, including chemotherapy, radiation therapy, surgery, and emerging immunotherapy options.

The market is supported by growing veterinary infrastructure, increasing availability of pet insurance, and collaboration between human oncology and veterinary research institutions. Moreover, the advent of pet diagnostics, high-end imaging tools, and AI-powered oncology tools has boosted clinical outcomes, increasing trust among pet owners in the effectiveness of these therapies.

North America, being home to several key players in the animal health and diagnostics sectors, holds a pivotal role in driving innovations in veterinary oncology. Countries like the U.S. lead the region due to a well-established veterinary healthcare system and widespread access to advanced veterinary care. Canada's market is also gaining momentum, while Mexico is emerging as a potential hotspot for veterinary oncology with increasing adoption of pet care practices.

Rise of Precision Medicine in Veterinary Oncology: Tailored treatment protocols based on molecular profiling of tumors in animals is becoming increasingly common.

Growing Popularity of Immunotherapy: Just like in human oncology, immunotherapy is gaining traction as an effective, minimally invasive, and targeted therapy option in animals.

Increased Integration of Artificial Intelligence in Diagnostics: AI is being used for rapid analysis of biopsy samples and radiological images, improving accuracy in cancer detection.

Development of Veterinary-Specific Radiotherapy Devices: Technological advancements have led to the development of LINAC systems specifically designed for pets.

Expansion of Veterinary Specialty Clinics: Rising investment in multi-specialty animal hospitals and oncology centers across urban North America.

Emerging Role of Telemedicine in Oncology Follow-Ups: With the digitalization of vet care, remote consultation and monitoring for oncology cases is on the rise.

Advancements in Liquid Biopsy for Animals: Non-invasive diagnostic methods, such as liquid biopsies, are being piloted for detecting canine cancers.

| Report Coverage | Details |

| Market Size in 2024 | USD 614.44 Million |

| Market Size by 2033 | USD 1,556.54 Million |

| Growth Rate From 2024 to 2033 | CAGR of 10.88% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Animal, Therapy, Cancer Type, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Zoetis; Boehringer Ingelheim International GmbH.;Elanco; PetCure Oncology; Accuray Incorporated; Varian Medical Systems, Inc.; Morphogenesis, Inc.; Karyopharm Therapeutics, Inc.; Regeneus Ltd.; OHC (One Health Company) |

Increasing Pet Ownership and Emotional Attachment to Companion Animals

The emotional bond between humans and their pets has strengthened significantly, resulting in heightened expectations for the quality of veterinary care. In North America, pet adoption rates are at an all-time high, with over 66% of U.S. households owning at least one pet, according to the American Pet Products Association (APPA). As pets are increasingly viewed as family members, their health and longevity have become a priority for pet parents. This cultural shift has led to a greater demand for advanced medical care, including oncology services for animals suffering from various forms of cancer.

Moreover, owners are more willing to invest in high-cost treatments like radiotherapy or immunotherapy if it ensures an improved quality of life or survival extension for their pets. The increasing uptake of pet health insurance policies also offsets some of the financial burden of cancer treatments, further facilitating market growth.

High Cost and Limited Accessibility of Advanced Oncology Treatments

Despite advancements, one of the significant restraints hindering the widespread adoption of veterinary oncology services in North America is the high cost of treatment. Procedures such as radiotherapy or chemotherapy can range from several thousand to tens of thousands of dollars. These costs often make such therapies inaccessible to middle- or low-income pet owners, particularly in rural or underserved areas where specialty veterinary centers are scarce.

Moreover, veterinary oncology still lacks widespread presence compared to general veterinary services. The shortage of board-certified veterinary oncologists and the limited number of specialized centers restrict the accessibility of these services, especially in regions outside major urban centers. This disparity affects treatment adoption rates and limits the market’s full potential.

Technological Innovations in Non-invasive Cancer Diagnostics

An emerging opportunity lies in the development of non-invasive, early diagnostic tools tailored for animals. Technologies like liquid biopsy widely used in human medicine are being explored in veterinary applications. For instance, veterinary startups are developing DNA-based tests that detect tumor markers in blood samples, enabling early and less distressing cancer detection in pets.

The integration of machine learning algorithms for imaging analysis is also enhancing diagnostic precision. These technologies could significantly increase early detection rates, improve prognosis, and reduce treatment costs by enabling intervention in the earlier stages of cancer. The adoption of such technologies across clinics and hospitals is expected to expand the market base and reach.

Canine segment dominated the veterinary oncology market in North America and is anticipated to continue its dominance over the forecast period. Dogs are more prone to developing cancer compared to other companion animals. Common cancers among dogs include lymphoma, mast cell tumors, and osteosarcoma. The larger population of dogs as pets and the relatively higher willingness of dog owners to invest in advanced treatment drive this segment's growth. According to the Veterinary Cancer Society, approximately 1 in 4 dogs will develop cancer at some point in their life, and nearly half of dogs over the age of 10 will develop cancer, underscoring the need for specialized care.

In contrast, the feline segment is expected to grow at the fastest rate during the forecast period. Though cancer is less frequently diagnosed in cats than dogs, it is often more aggressive and harder to detect early. Increased awareness among cat owners about signs of illness and availability of advanced diagnostics are contributing to segment growth. Innovations in feline-specific cancer diagnostics and therapeutic approaches—especially in treating lymphomas and squamous cell carcinomas—are expected to bolster adoption. Meanwhile, the equine segment remains niche and is focused more on specialized equine oncology services provided in select centers.

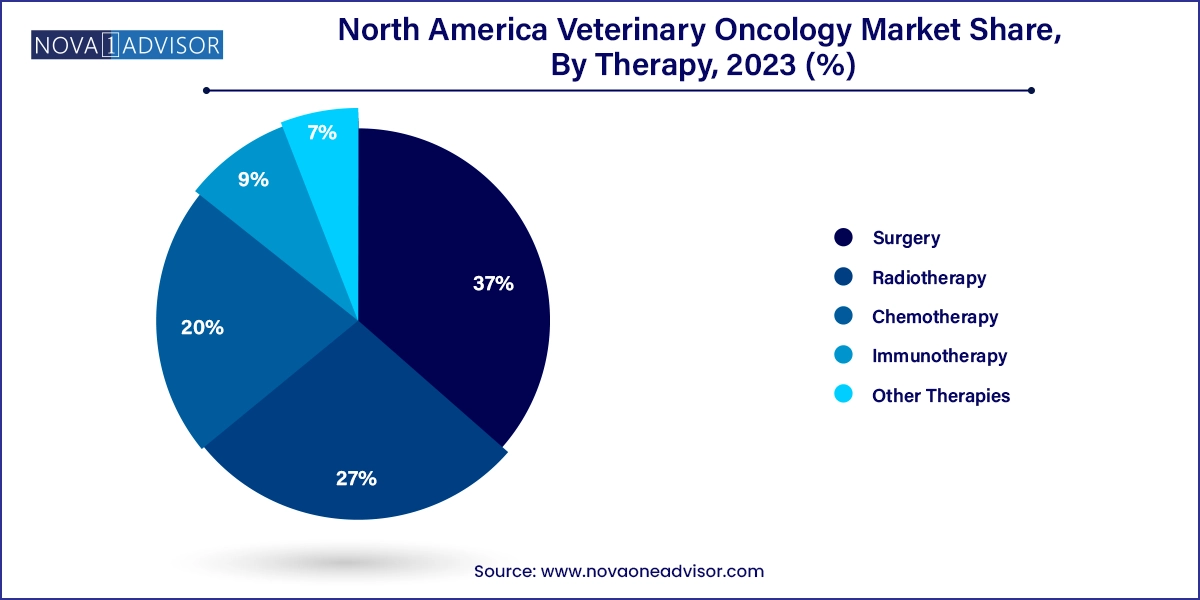

Chemotherapy has historically dominated the therapy segment owing to its widespread availability and effectiveness in treating systemic cancers like lymphoma in pets. It remains a standard treatment across most oncology practices. Veterinary chemotherapy uses lower dosages than human treatments, thus minimizing side effects and allowing pets to maintain their quality of life. Pet owners prefer this approach for its relatively lower cost and non-invasive nature.

However, immunotherapy is emerging as the fastest-growing therapy segment. With advancements in animal immunology and the development of vaccines and monoclonal antibodies targeting cancer cells, this approach is gaining interest. For example, the canine melanoma vaccine (Oncept) has shown promising results in treating oral melanomas. Radiotherapy, particularly LINAC-based stereotactic radiation therapy, is also growing rapidly due to technological advancements, though its use remains limited to larger veterinary oncology centers.

Lymphomas accounted for the largest share in the cancer type segment due to their high incidence rates, particularly among dogs and cats. These cancers affect lymphatic tissues and are typically systemic, requiring multi-modal treatment approaches such as chemotherapy and radiation. Lymphomas are among the most treatable animal cancers, leading to higher detection and treatment rates, thus driving the segment.

On the other hand, skin cancers are expected to be the fastest-growing segment, driven by increased awareness and early diagnosis of visible tumors in pets. Skin tumors are among the most common in dogs and can be malignant or benign. Technological advancements in dermatoscopic imaging and increased pet owner vigilance have enabled earlier intervention, fueling demand for surgical removal and follow-up therapies. Sarcomas and other rare cancer types continue to present challenges in treatment and are the focus of ongoing research in advanced oncology methods.

The U.S. leads the North America veterinary oncology market with the highest share, driven by robust veterinary infrastructure, advanced oncology centers, and high pet ownership rates. The country has seen exponential growth in the adoption of pet insurance, with providers like Trupanion and Nationwide covering oncology services. The presence of key players such as Zoetis and IDEXX Laboratories further amplifies market competitiveness.

Moreover, the American College of Veterinary Internal Medicine (ACVIM) and similar institutions play a critical role in expanding oncological education, increasing the number of board-certified veterinary oncologists in the country. Urban regions, particularly in states like California, New York, and Texas, have witnessed an upsurge in specialized pet cancer care centers.

Canada's veterinary oncology market is expanding steadily, fueled by increasing awareness and adoption of advanced pet healthcare. While the market is smaller in comparison to the U.S., Canadian veterinary hospitals are increasingly incorporating oncology services, especially in metropolitan areas like Toronto, Vancouver, and Montreal. The Canadian Veterinary Medical Association (CVMA) supports continued research and training in veterinary oncology, promoting innovation in diagnostics and therapy.

Mexico is gradually emerging as a market for veterinary oncology. Pet ownership is growing, and urbanization is leading to a shift in consumer attitudes toward pet healthcare. While the availability of advanced cancer treatment options remains limited, veterinary hospitals in cities like Mexico City and Guadalajara are starting to adopt chemotherapy and radiotherapy services. Investment from international veterinary groups and NGOs focused on animal welfare is expected to enhance infrastructure and access to oncology services in the coming years.

Zoetis Inc., a leading animal health company, announced in January 2025 the launch of a new research initiative in collaboration with veterinary universities in the U.S. focused on developing next-generation immunotherapies for canine cancers.

In October 2024, Elanco Animal Health introduced a new oral chemotherapy treatment protocol specifically designed for pet use, aiming to reduce treatment time and side effects in dogs and cats.

IDEXX Laboratories, in August 2024, rolled out a pilot program for AI-based diagnostic tools for identifying early-stage cancer in pets using radiological and blood panel data.

PetCure Oncology, a pioneer in veterinary radiation therapy, expanded its network of treatment centers by opening new clinics in Florida and Illinois in September 2024, equipped with state-of-the-art stereotactic radiosurgery units.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America veterinary oncology market

Animal Type

Therapy

Cancer Type

Country