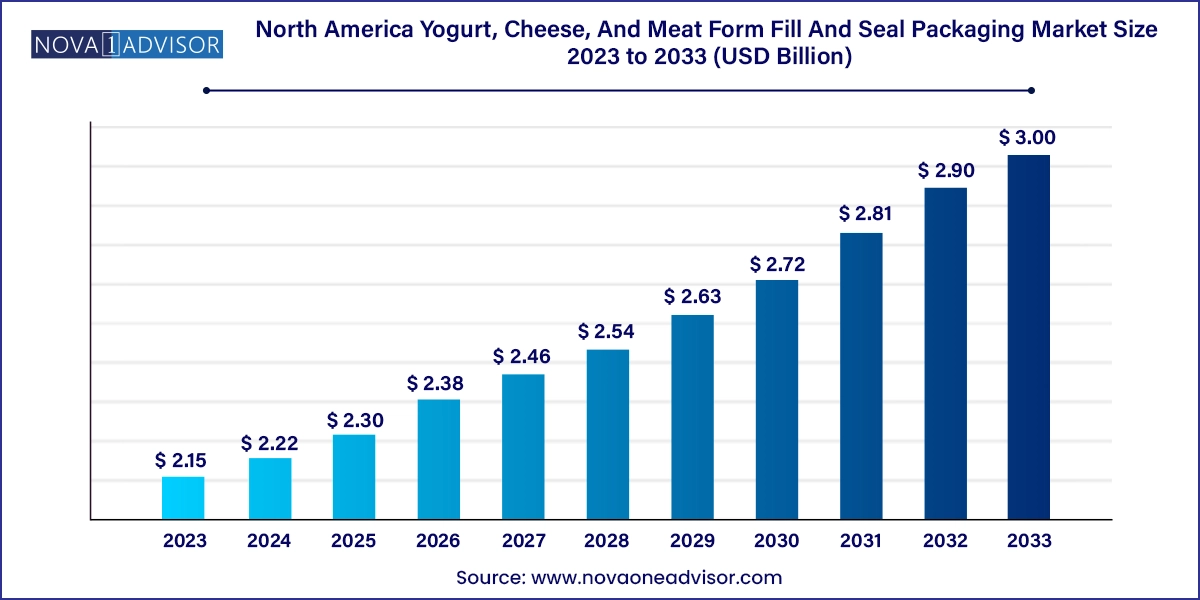

The North America yogurt, cheese, and meat form fill and seal packaging market size was exhibited at USD 2.15 billion in 2023 and is projected to hit around USD 3.00 billion by 2033, growing at a CAGR of 3.4% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.22 Billion |

| Market Size by 2033 | USD 3.00 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | WINPAK LTD.; Huhtamaki Oyj; Berry Global Inc.; Amcor plc; Transcontinental Inc.; Harpak Ulma; ProAmpac; Sealed Air; Smurfit Kappa; Scholle IPN; Polytainers Inc.; Tetra Pak |

The flourishing fast food industry and growing consumption of yogurt in North America are fueling the demand for yogurt, cheese, and meat form fill and seal packaging in North America.

The flourishing fast food industry in North America has significantly contributed to the growth of the yogurt, cheese, and meat form fill and seal (FFS) packaging market in the region. As North America is witnessing a surge in the demand for convenient and ready-to-eat food products, it is fueling the growth of the fast-food industry. The increasing preference of consumers for on-the-go meals and quick-service options has intensified the requirement for efficient packaging solutions for yogurt, cheese, and meat products. This fuels the regional market growth.

The reliance of the fast-food industry on form fill and seal packaging solutions is also contributing to the growth of the market in North America. These packaging solutions offer airtight sealing, thereby preserving the freshness and quality of perishable packed food items, such as dairy and meat products. The speed and efficiency offered by form fill and seal machines align well with the fast-paced nature of the fast-food industry. This not only enhances the productivity of the industry but also ensures that packed products reach consumers quickly, thereby meeting the requirements of the time-sensitive fast-food industry.

In addition, North America has the presence of some major fast-food companies, such as McDonald's, Burger King, Wendy's, Subway, Taco Bell, Pizza Hut, and Domino's. The fast-food products of these companies that use cheese, yogurt, and meat are Big Mac, Quarter Pounder with Cheese, Whopper, yogurt parfaits, Dave's Single, Baconator, Meatball Marinara, Roasted Chicken Signature Wrap, Quesadilla, Cheesy Gordita Crunch, and Creamy Tuscan Chicken Pizza.

According to the National Agricultural Statistics Service (NASS), yogurt production in the U.S. was 391,361 thousand pounds in June 2022 which increased by 0.4% compared to that of June 2021. Moreover, the yogurt production in North America has been steadily growing over the years owing to an increase in its consumption. This surge in the consumption of yogurt in the region can be attributed to the recognition of yogurt as a nutritious and healthy food option. It is packed with essential nutrients such as protein, calcium, and probiotics, which are beneficial for gut health. Thus, these benefits offered by yogurt are expected to fuel its consumption among the masses in North America, thereby contributing to the demand for form fill seal packaging for yogurt.

Based on material, the North America yogurt, cheese, and meat form fill and seal (FFS) packaging market is segmented into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and other materials. Polyethylene terephthalate (PET) dominated the overall market with a revenue share of over 33.0% in 2023. PET for FFS packaging offers a significant advantage with its clear and glossy appearance, allowing consumers to easily see the packaged contents. Besides, it provides an excellent oxygen and carbon dioxide barrier, which helps prevent spoilage and oxidation of the form fill and sealed product, thereby extending the shelf life of the packaged product.

The polypropylene (PP) segment, on the other hand, is expected to grow at the fastest CAGR of 3.5% during the forecast period. Polypropylene is advantageous for FFS packaging due to its barrier properties. The chemical structure of PP results in low moisture vapor transmission, protecting packaged contents from moisture gain or loss. Moreover, it is an economical option for form fill and seal packaging, as compared to materials, such as polyester or advanced multilayer barrier films such as ethylene vinyl alcohol (EVOH) and polyvinylidene chloride (PVDC).

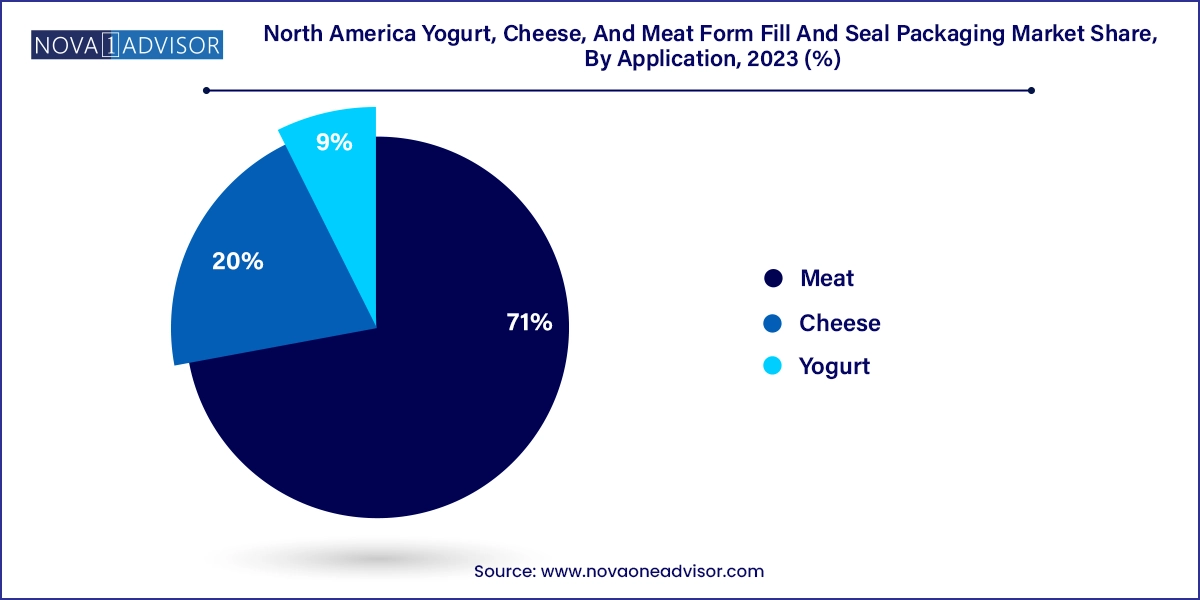

Based on application, the market is segmented into yogurt, cheese, and meat. The meat segment dominated with the largest revenue share of over 71.0% in 2023. This positive outlook can be attributed to the combination of food safety, shelf-life extension, portion control, product visibility, tamper-evidence, efficient processing, and cost-effectiveness. These above-mentioned factors make form fill and seal packaging the preferred choice for meat packaging in the North American market.

The yogurt application segment is projected to progress at the fastest CAGR of 4.4% over the forecast period. This positive outlook is attributed to the rising consumption of yogurt due to its numerous health benefits. It is an excellent source of essential nutrients such as calcium, protein, vitamin B12, potassium, and probiotics. These nutrients play crucial roles in supporting bone health, boosting the immune system, maintaining healthy digestion, and promoting overall well-being.

Based on product, the market is segmented into pouches, cups, films & wraps, and trays & containers. The films & wraps segment dominated the market and accounted for the largest revenue share of over 42.0% in 2023. Flexible films and wraps provide excellent barrier properties against moisture, oxygen, and other environmental factors that can degrade the quality and shelf life of perishable foods such as yogurt, cheese, and meat. These barrier properties help preserve freshness and extend shelf life.

On the other hand, pouches are a widely used product in the form fill and seal (FFS) packaging of various food products, including cheese, yogurt, and meat. These pouches are opted to prevent leaks, resist punctures, and maintain the integrity of the product during storage and transportation.

U.S. Yogurt, Cheese, And Meat Form Fill And Seal Packaging Market Trends

The yogurt, cheese, and meat form fill and seal packaging market in U.S. dominated the region and accounted for the largest revenue share of over 47.0% in 2023. This positive outlook can be attributed to the presence of prominent producers of dairy products, such as cheese and yogurt, high meat production, and high per capita consumption of all dairy products. For instance, the United States Department of Agriculture (USDA) reported that per capita consumption of all dairy products in the U.S. reached 653 pounds per person in 2022. This positive export outlook is expected to trigger the U.S. yogurt, cheese, and meat form fill and seal packaging market.

Moreover, the key players operating in the U.S. yogurt, cheese, and meat form fill and seal packaging market are implementing diverse strategies, including product introductions, mergers & acquisitions, joint ventures, and geographic expansion, to enhance their market presence and stimulate growth. For instance, in May 2022, ProAmpac acquired Specialty Packaging, a U.S.-based manufacturer of specialty paper, film, and foil packaging products. The acquisition is expected to expand ProAmpac's range of highly customized, recyclable food packaging solutions. The acquisition is anticipated to enhance ProAmpac's presence in the South U.S. and strengthen its position in the food packaging sector. Hence, such strategic initiatives are expected to benefit the overall yogurt, cheese, and meat form fill and seal packaging market in the country.

Canada Yogurt, Cheese, And Meat Form Fill And Seal Packaging Market Trends

The yogurt, cheese, and meat form fill and seal packaging market in Canada is anticipated to witness new opportunities owing to the expansion of the dairy industry. According to the Canadian Dairy Information Centre (CDIC), Canada exported various dairy products in 2022, including skim milk powder, yogurt, cheese, whey products, and products comprising natural milk constituents, with a total value of USD 508.9 million. Additionally, the country produced 495.8 thousand tons of cheese and 371.3 thousand tons of yogurt in the same year. The growing dairy industry may create an increased need for packaging solutions, which can open avenues for packaging companies to expand their operations and cater to the needs of the dairy industry.

Mexico Yogurt, Cheese, And Meat Form Fill And Seal Packaging Market Trends

The yogurt, cheese, and meat form fill and seal packaging market in Mexico is expected to witness significant growth, owing to the continuous rise in domestic cheese production, driven by rising demand in both the domestic and export markets. The primary driver of domestic demand in Mexico was the significant presence of the hotel, restaurant, and institutional (HRI) sector, closely followed by the food delivery sectors. This surge in domestic cheese production drives the need for efficient and high-capacity form fill and seal packaging solutions to handle larger quantities, thus benefiting the cheese form fill and seal packaging market in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America yogurt, cheese, and meat form fill and seal packaging market

Material

Product

Application

Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Materials & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2. Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.2.1. Material Outlook

2.2.2. Product Outlook

2.2.3. Application Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends

3.2.3. Profit Margin Analysis

3.2.4. Sales Channel Analysis

3.3. Technology Overview/ Timeline

3.4. Regulatory Framework

3.4.1. Standard & Compliance

3.4.2. Safety

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter’s Five Forces

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

3.6.3. Market Entry Strategies

3.7. Latest Trends & Technologies in the North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market

3.8. Unmet Needs & Challenges in North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market

3.9. Impact of Environmental, Social, and Governance (ESG) initiatives on the North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market

Chapter 4. North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market: Market Supplier Intelligence

4.1. Kraljic Matrix (Portfolio Analysis)

4.1.1. Non-Critical Items

4.1.2. Leverage Items

4.1.3. Bottleneck Items

4.1.4. Strategic Items

4.2. Engagement Model

4.3. Negotiation Strategies

4.4. Sourcing Best Practices

4.5. Vendor Selection Criteria

Chapter 5. North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market: Material Estimates & Trend Analysis

5.1. Definition & Scope

5.2. Material Movement Analysis & Market Share, 2024 & 2033

5.3. Polyethylene (PE)

5.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

5.4. Polypropylene (PP)

5.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

5.5. Polyethylene Terephthalate (PET)

5.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

5.6. Other Materials

5.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

Chapter 6. North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market: Product Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Product Movement Analysis & Market Share, 2024 & 2033

6.3. Pouches

6.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

6.4. Cups

6.4.1. Market estimates and forecasts, 2018 – 2030 (USD Million) (Kilotons)

6.5. Films & Wraps

6.5.1. Market estimates and forecasts, 2018 – 2030 (USD Million) (Kilotons)

6.6. Trays & Containers

6.6.1. Market estimates and forecasts, 2018 – 2030 (USD Million) (Kilotons)

Chapter 7. North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market: Application Estimates & Trend Analysis

7.1. Definition & Scope

7.2. Application Movement Analysis & Market Share, 2024 & 2033

7.3. Yogurt

7.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

7.4. Cheese

7.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

7.5. Meat

7.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

Chapter 8. North America Yogurt, Cheese, and Meat Form Fill and Seal Packaging Market: Country Estimates & Trend Analysis

8.1. Key Takeaways

8.2. Country Movement Analysis & Market Share, 2024 & 2033

8.3. North America

8.3.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

8.3.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

8.3.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million) (Kilotons)

8.3.4. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

8.3.5. U.S.

8.3.5.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

8.3.5.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

8.3.5.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million) (Kilotons)

8.3.5.4. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

8.3.6. Canada

8.3.6.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

8.3.6.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

8.3.6.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million) (Kilotons)

8.3.6.4. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

8.3.7. Mexico

8.3.7.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

8.3.7.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

8.3.7.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million) (Kilotons)

8.3.7.4. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

Chapter 9. Start-up Ecosystem Evaluation, 2024

9.1. List of Start-up Companies

9.1.1. Progressive Companies

9.1.2. Responsive Companies

9.1.3. Dynamic Companies

9.1.4. Starting Blocks

9.2. Government Funding for Start-ups across the globe

Chapter 10. Competitive Landscape

10.1. Key Global Players & Recent Developments & Their Impact on the Industry

10.2. Key Company/Competition Categorization (Key innovators, Market leaders, emerging players)

10.3. List of key Raw Material Distributors and Channel Partners

10.4. List of Potential Customers, by Application

10.5. Company Market Share Analysis, 2024

10.6. Company Heat Map Analysis

10.7. Competitive Dashboard Analysis

10.8. Company-Wise Product Prices

10.9. Strategy Mapping

10.9.1. Expansion

10.9.2. Collaboration/ Partnerships/ Agreements

10.9.3. New Product launches

10.9.4. Mergers & Acquisitions

10.9.5. Divestment

10.9.6. Research & Development

10.9.7. Others

10.10. List of Potential Customers/ Clientele, by Application

Chapter 11. Company Listing / Profiles

11.1. WINPAK LTD.

11.1.1. Company Overview

11.1.2. Financial Performance

11.1.3. Product Benchmarking

11.2. Huhtamaki Oyj

11.2.1. Company Overview

11.2.2. Financial Performance

11.2.3. Product Benchmarking

11.3. Berry Global Inc.

11.3.1. Company Overview

11.3.2. Financial Performance

11.3.3. Product Benchmarking

11.4. Amcor plc

11.4.1. Company Overview

11.4.2. Financial Performance

11.4.3. Product Benchmarking

11.5. Transcontinental Inc.

11.5.1. Company Overview

11.5.2. Financial Performance

11.5.3. Product Benchmarking

11.6. Harpak Ulma

11.6.1. Company Overview

11.6.2. Financial Performance

11.6.3. Product Benchmarking

11.7. ProAmpac

11.7.1. Company Overview

11.7.2. Financial Performance

11.7.3. Product Benchmarking

11.8. Sealed Air

11.8.1. Company Overview

11.8.2. Financial Performance

11.8.3. Product Benchmarking

11.9. Smurfit Kappa

11.9.1. Company Overview

11.9.2. Financial Performance

11.9.3. Product Benchmarking

11.10. Scholle IPN

11.10.1. Company Overview

11.10.2. Financial Performance

11.10.3. Product Benchmarking

11.11. Polytainers Inc.

11.11.1. Company Overview

11.11.2. Financial Performance

11.11.3. Product Benchmarking

11.12. Tetra Pak

11.12.1. Company Overview

11.12.2. Financial Performance

11.12.3. Product Benchmarking

Chapter 12. Strategic Recommendations/ Analyst Perspective