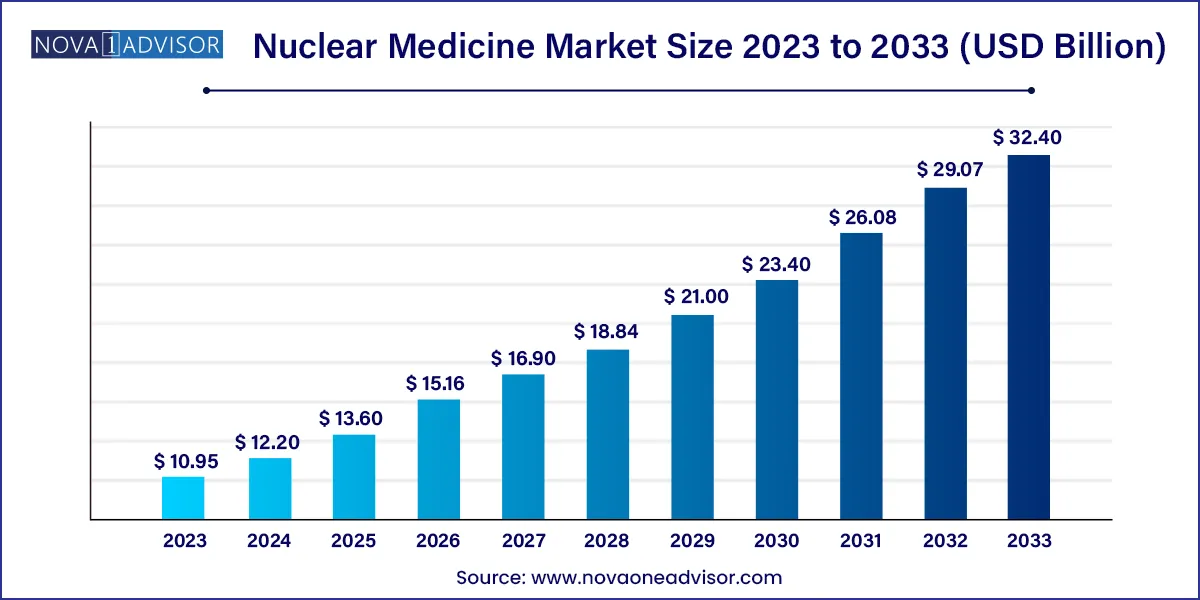

Nuclear Medicine Market Size and Growth

The global nuclear medicine market size was estimated at USD 10.95 billion in 2023 and is expected to be worth around USD 32.40 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 11.46% during the forecast period 2024 to 2033.

Nuclear Medicine Market Key Takeaways

Nuclear Medicine Market Growth Factors

The market is witnessing growth due to the presence of a robust product pipeline and favorable government initiatives to improve access to nuclear medicine. Currently, betalutin, omburtamab, yttrium-90 microspheres, PNT2003, 177Lu‑PNT2002, are some of the products under clinical trials. The market has been moderately impacted due to SARS-CoV-2. The operation of reactors has been largely classified as an essential service, given its criticality. Therefore, nuclear reactors were not shut down during the SARS-CoV-2 lockdown. For instance, under Section 71 of the Labour Act 66 of 1995 in South Africa, its SAFARI-1 reactor remained operational during the lockdown enforced in the country post March 2020.

Moreover, in an article published by ANSTO in May 2020, it was reported that since its reactor provides critical medicines, it had maintained its operations during the COVID-19 crisis, with its staff returning to campus and following strict social distancing measures. According to the American Cancer Society, the estimated incidence of prostate cancer is 268,490, and around 34,500 deaths in 2022 in the U.S. In addition, around 6 out of 10 patients diagnosed are men aged 65 years and older and rare in men under 40 years. Recently, in March 2022, the U.S. FDA approved Pluvicto (177Lu-PSMA-617) for the treatment of adults with metastatic prostate cancer. This approval is anticipated to drive market growth.

The presence of a favorable reimbursement scenario for radiopharmaceuticals in the U.S., is anticipated to boost the market growth. In 2020, the Center for Medical Services (CMS) offered USD 10 add on payment for Tc-99m derived from non-highly enriched uranium (HEU) for hospital outpatient service in addition to payment for imaging procedures. The initiatives, in turn led to greater patient access for much needed diagnostic nuclear medicines used for life-threatening diseases.

Increasing advancements in the diagnosis and treatment of diseases, and approval of new nuclear-medicine-based devices helps in addressing patients treatment needs. For instance, in September 2021, GE Healthcare announced the launch of novel scanner with new automated workflow feature that offers an exceptional view of cardiac anatomy and pathology to help physicians to decide the right treatment for a patient.

Nuclear Medicine Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 12.20 Billion |

| Market Size by 2033 | USD 32.40 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.46% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Eckert & Ziegler; Mallinckrodt; GE Healthcare; Jubilant Life Sciences Ltd.; Nordion (Canada), Inc.; Bracco Imaging S.P.A.; IRE, the Australian Nuclear Science and Technology Organization; NTP Radioisotopes SOC Ltd.; Eczacıbaşı-Monrol; Lantheus Medical Imaging, Inc.; Cardinal Health |

Product Insights

The diagnostic product segment held the highest market share of 73.0 % in 2023 owing to presence of large patient base and availability of advanced technologies such as Single-Photon Emission Computed Tomography (SPECT) and Positron Emission Tomography (PET). According to the World Nuclear Association Analysis 2021, about 40 million nuclear medicine procedures are performed annually and the demand for radioisotopes increase by around 5% every year. A wide range radiotracers that are currently employed in diagnosis of tumors coupled with technological advancements are contributing to the growth of the market.

The therapeutic segment is further divide into alpha emitters, beta emitters, and brachytherapy. The robust product pipeline coupled with the approval and commercialization of nuclear medicine therapeutics may fuel the segment growth. For instance, in October 2021, the U.S. FDA approved and granted breakthrough designation to diffusing alpha-emitters Radiation Therapy (DaRT) for the treatment of patients suffering from recurrent glioblastoma multiforme (GBM). It is a standalone therapy when other therapies have failed to work in patients with GBM. Currently, radium (Ra-223) is the most widely used alpha emitter in therapeutics. Development of potential radioisotopes, such as Terbium (Tb-149), Bismuth (Bi-212), and Actinium (Ac-225) is expected to augment market growth.

Application Insights

Based on application, global nuclear medicine is divided into oncology, thyroid, neurology, cardiology, lymphoma, bone metastasis, endocrine tumors, and other markets, wherein, the oncology segment accounted largest market share of around 41.65% in 2023. Cancer is one of the leading causes of death worldwide. Factors such as, unhealthy diet, bad habits like smoking, and lack of exercise are contribute in rising prevalence. Furthermore, rising investment in R&D of novel nuclear medicines for the treatment of cancer may contribute to segment growth. For instance, in January 2022, ITM Isotope Technologies Munich SE initiated COMPOSE phase 3 trial of177lu-edotreotide to evaluate the viability of product for treating patients with neuroendocrine tumors.

The cardiology segment is expected to witness high growth over the forecast period due to the increasing demand for the diagnosis of CVD. In March 2021, Bracco Diagnostics Inc., entered into a partnership with CardioNavix, LLC aim at improving patient reach to novel cardiac PET imaging system. This new initiative enable provides patients an easy access to hospitals, physician, and diagnostic centers, for cardiac PET imaging. This program may reduce the upfront cost and risk of business loss by encouraging clinical practitioners to prescribe & avail this important diagnostic test.

End-use Insights

Based on end-use, hospitals segment dominated the nuclear medicine market in 2023. The high installed base of SPECT/PET scanners in hospitals is a key reason for the higher number of nuclear medicine procedures being conducted in hospitals. This in turn leads to a higher demand for diagnostic radiopharmaceuticals in hospitals. According to an article published by World Nuclear Association, over 10,000 hospitals worldwide use radioisotopes for diagnostic purposes. Technetium-99 is the most commonly used diagnostic radioisotope in diagnostics with over 40 million procedures being conducted every year.

The hospitals segment is expected to grow at a CAGR of 13.8% during the forecast period. Most of the therapeutic nuclear medicine procedures are conducted in hospitals. The recent approval of multiple therapeutic radioisotopes such as Pluvicto, Lutathera and several other products in pipeline such as Lu 177 PSMA I&T and Lu 177 edotreotide are expected to drive the segment

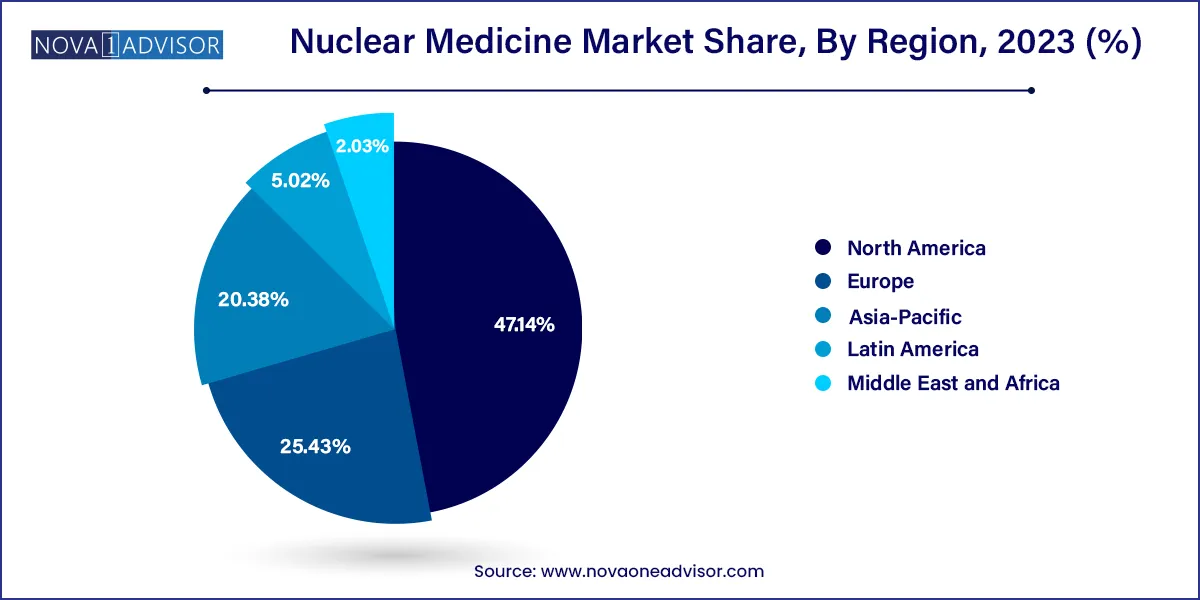

Regional Insights

North America dominated the market with a revenue share of 47.14 % in 2023 and is anticipated to grow at a significant rate over the forecast period. The high market share in the region can be attributed to the increased investment in R&D activities, high volume of nuclear medicine procedures, and strong healthcare infrastructure. For instance, in January 2021, Eckert & Ziegler announced the development plan of a cGMP facility for contract manufacturing of radiopharmaceuticals in Boston, U.S. The facility will be dedicated to the production of late-investigational-stage and commercial-stage radioisotopes used in nuclear medicines and can help address the increasing demand for radionuclides in market.

Asia Pacific region is estimated to be the fastest-growing region owing to increased awareness about nuclear medicine therapies and rising investment in nuclear medicine space. For instance, in March 2022, Penang Adventist Hospital (PAH) announced the launch of private nuclear medicine center in northern part of Thailand. This launch is anticipated to have positive impact on the Asian Market. However, high cost associated with these therapies may restrain the market growth as the lower-income group of population in developing countries may not afford such treatment. For instance, the cost of treatment with Yttrium-90, Lutetium-177, and Iodine-131 may account for approximately USD 23,850, USD 5,962, and USD 3,312 respectively in India.

Recent Developments

Nuclear Medicine Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Nuclear Medicine market.

By Product

By Application

By End-use

By Region