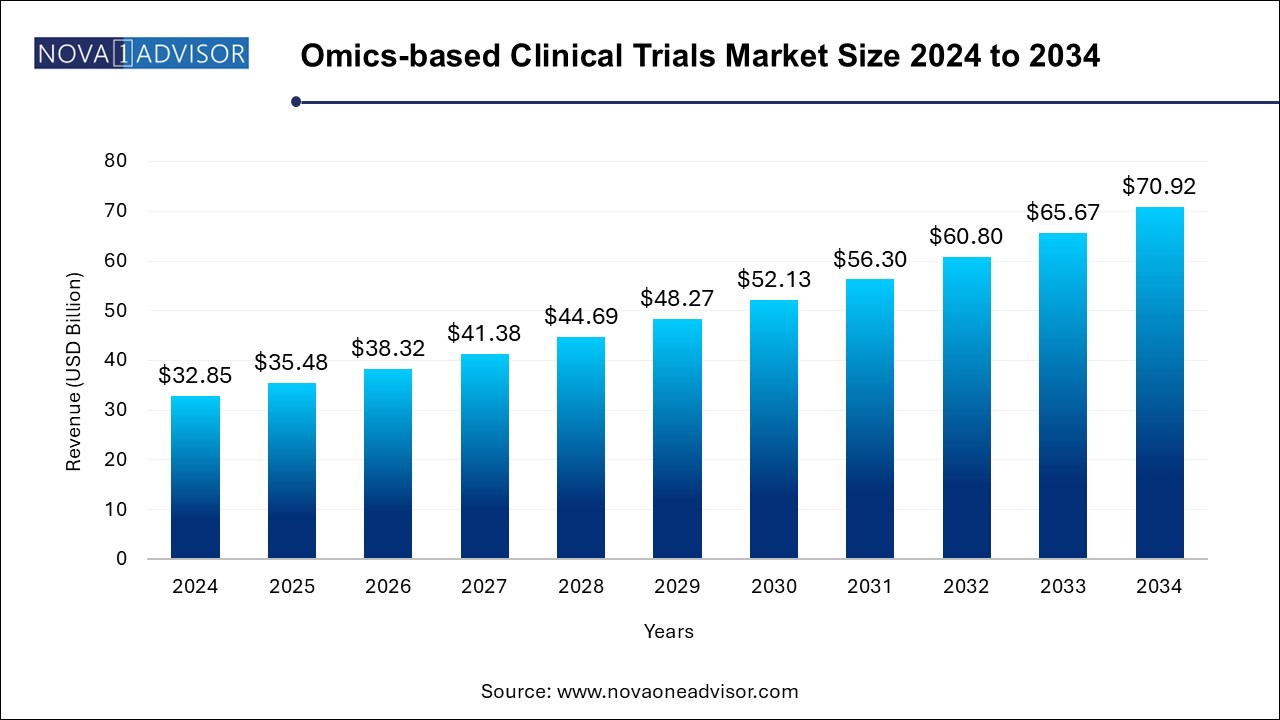

The omics-based clinical trials market size was exhibited at USD 32.85 billion in 2024 and is projected to hit around USD 70.92 billion by 2034, growing at a CAGR of 8.0% during the forecast period 2024 to 2034.

The Omics-based Clinical Trials Market is at the intersection of personalized medicine, high-throughput molecular biology, and clinical research. Leveraging genomics, proteomics, metabolomics, transcriptomics, and epigenomics, omics-based trials provide a molecular-level understanding of disease progression, drug response, and individual patient variability. These trials enable precision-based stratification of patient cohorts, reduce failure rates in drug development, and improve therapeutic efficacy and safety.

As the pharmaceutical and biotechnology sectors increasingly invest in targeted therapies and biologics, the need for more informative and precise clinical trials has accelerated. Traditional trial designs, based largely on one-size-fits-all models, often fall short when dealing with heterogeneous diseases like cancer, autoimmune conditions, or neurodegenerative disorders. Omics-based trials, in contrast, are capable of identifying biomarkers, genetic predispositions, and drug targets that enable tailored intervention strategies. In diseases such as breast cancer, for example, gene expression profiling using omics has helped develop subtype-specific treatments like HER2-targeted therapies.

Surge in Oncology-focused Omics Trials: Cancer remains the largest beneficiary of omics-driven clinical strategies, especially in identifying gene mutations and therapeutic targets.

Integration of Artificial Intelligence (AI) and Machine Learning (ML): These technologies are increasingly being used to process omics data, accelerate analysis, and improve trial designs.

Rise of Decentralized Clinical Trials (DCTs): Combining omics with virtual trial designs is enabling more diverse participation and faster execution.

Increasing Collaborations Between Pharma and Genomics Firms: Strategic alliances are being formed to co-develop biomarkers, companion diagnostics, and tailored therapeutics.

Use of Multi-omics Approaches: Simultaneous analysis of genomics, transcriptomics, and metabolomics is becoming more common for comprehensive patient profiling.

Growth of Population-scale Biobanks: Government and private initiatives are creating large omics databases to fuel observational and interventional studies.

Regulatory Recognition of Biomarkers: Agencies like the FDA and EMA are increasingly approving trials with molecular biomarkers as primary endpoints.

| Report Coverage | Details |

| Market Size in 2025 | USD 35.48 Billion |

| Market Size by 2034 | USD 70.92 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 8.0% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Phase, Study Design, Indication, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Parexel International (MA) Corporation, Thermo Fisher Scientific Inc., Charles River Laboratories, ICON plc, SGS Société Générale de Surveillance SA, Eli Lilly and Company, Pfizer Inc., Laboratory Corporation of America, Novo Nordisk A/S, Rebus Biosystems, Inc. |

A pivotal driver of the omics-based clinical trials market is the growing global emphasis on precision medicine. The traditional model of drug development, often based on large and non-specific patient groups, results in high attrition rates, particularly in Phase II and III trials. Precision medicine aims to tailor therapeutic approaches to individual patients, thereby increasing efficacy and minimizing adverse reactions.

Omics technologies play a central role by identifying genetic markers, epigenetic modifications, and protein expressions linked to disease phenotypes and drug response. In oncology, for instance, omics-based trials have led to the approval of targeted therapies for ALK-positive lung cancer or BRCA-mutated breast and ovarian cancers. These successes are pushing pharmaceutical companies to incorporate omics data early in their clinical trial pipelines, thereby shortening development timelines and improving market success rates.

Despite the vast potential of omics in clinical research, the complexity of omics data and the lack of standardized analysis protocols pose a significant challenge. Omics generates high-dimensional datasets that require sophisticated statistical models and computing resources for interpretation. Moreover, variability in sample quality, data acquisition methods, and population-specific genetic diversity further complicate comparative analysis.

Many clinical research organizations (CROs) and trial sponsors still struggle with integrating omics data into regulatory submissions due to concerns over data reproducibility and validation. While bioinformatics tools have evolved, the lack of universally accepted benchmarks often creates discrepancies in result interpretation, thereby delaying trial outcomes or even jeopardizing regulatory approvals.

An emerging opportunity in the omics-based clinical trials market lies in the integration of omics technologies into early-phase (Phase I and II) trials. These phases traditionally focus on safety and dosage; however, with omics, they can be transformed into platforms for biomarker discovery, patient stratification, and early efficacy signals. This shift could significantly de-risk later-stage trials.

For instance, using transcriptomic analysis in Phase I trials allows researchers to identify drug-induced gene expression changes that predict therapeutic potential. Similarly, pharmacogenomics in Phase II helps exclude non-responders early, making trials more cost-effective. Biopharma companies that adopt this approach may accelerate development timelines, reduce failure rates, and optimize resource allocation. This represents a compelling growth avenue, especially in fields like immuno-oncology and CNS drug development, where trial costs and risks are particularly high.

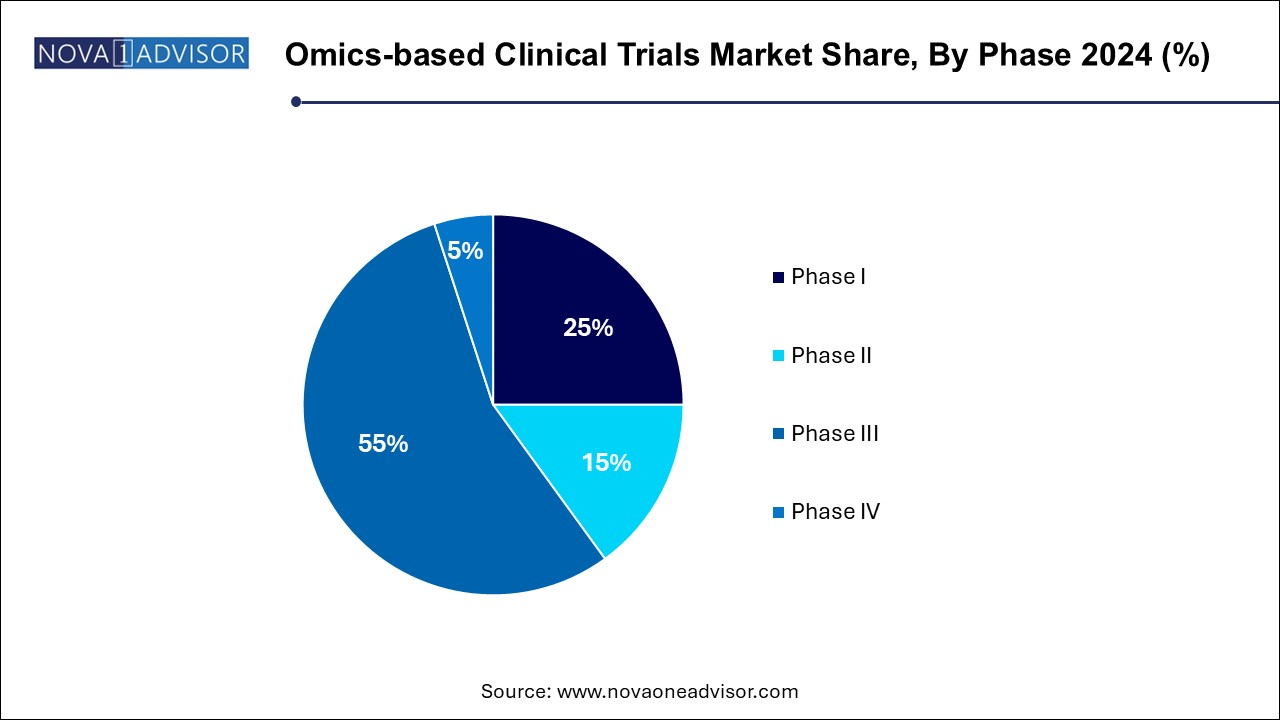

The phase III segment dominated the market, accounting for 55.0% of the total revenue share in 2024. Owing to their critical role in confirming the efficacy and safety of new treatments in large patient populations. Given the high costs and risks associated with this stage, pharmaceutical companies are increasingly leveraging omics to enhance predictive power and support regulatory approvals. These trials frequently use validated biomarkers and companion diagnostics, particularly in oncology, where stratified subgroups are tested for targeted therapy outcomes. The extensive patient data collected also helps in longitudinal molecular analyses that strengthen real-world applicability.

Conversely, Phase I trials are witnessing the fastest growth, driven by a paradigm shift in early-phase research strategies. Sponsors are now incorporating omics from the outset to better understand pharmacogenomic profiles and identify biomarkers for dose-response relationships. Microdosing studies and adaptive trial designs are increasingly relying on genomic, proteomic, and metabolomic profiling to generate early insights. This proactive approach not only informs later stages but also supports more flexible and precise regulatory submissions. Biotech firms, particularly in the U.S. and Europe, are pioneering this trend as a way to expedite go/no-go decisions at lower costs.

Interventional studies are the backbone of omics-based clinical trials, accounting for the lion’s share of the market. These studies involve direct testing of investigational drugs, biologics, or devices on patient groups based on their omics profiles. The ability to use genomics and transcriptomics for cohort selection and endpoint refinement makes interventional studies more efficient and precise. For example, trials for targeted therapies in non-small cell lung cancer (NSCLC) often recruit patients with specific EGFR or ALK mutations identified through genomic screening, drastically improving response rates.

Expanded access studies are growing swiftly, largely due to increased regulatory and ethical support for providing investigational treatments to critically ill patients outside traditional trials. Omics-driven expanded access programs are particularly common in rare diseases and oncology, where patients may not meet standard trial inclusion criteria but possess actionable mutations. The availability of whole-exome sequencing in compassionate use scenarios allows for experimental drug administration in life-threatening cases. Pharmaceutical companies are recognizing the value of such studies in collecting real-world omics data, enhancing post-market research and label expansion strategies.

Oncology remains the dominant indication in omics-based clinical trials, accounting for over half of all ongoing studies. Cancer’s molecular heterogeneity, the abundance of available tumor genomics data, and the success of biomarker-driven therapies like pembrolizumab (Keytruda) have made oncology the primary focus of precision research. Clinical trials in lung, breast, colorectal, and hematological malignancies routinely incorporate next-generation sequencing (NGS), single-cell RNA sequencing, and other omics technologies to discover new targets and refine treatment approaches. The use of liquid biopsies further enhances trial efficiency by enabling non-invasive monitoring of tumor evolution.

Meanwhile, CNS conditions and cardiovascular diseases are rapidly emerging areas for omics-based research. In neurological disorders like Alzheimer’s and Parkinson’s, genomic and transcriptomic profiling is uncovering pathophysiological pathways and aiding in the design of disease-modifying therapies. In cardiovascular trials, proteomics and metabolomics are being employed to identify early biomarkers for heart failure and atherosclerosis. The growth in these indications is also being driven by increasing public funding and multi-center collaboration initiatives, such as the NIH’s Accelerating Medicines Partnership (AMP).

North America leads the global omics-based clinical trials market, driven by its advanced healthcare infrastructure, high R&D investment, and robust regulatory framework. The United States, in particular, is home to several of the world’s largest clinical research organizations (CROs), pharmaceutical giants, and omics data providers. Government-backed initiatives such as the All of Us Research Program and Cancer Moonshot have accelerated omics data generation and its integration into clinical research.

Moreover, the FDA’s progressive biomarker qualification program encourages the adoption of molecular endpoints in trial design. Leading academic institutions, including Harvard Medical School, Johns Hopkins, and Stanford, are at the forefront of translational omics research. Private players like Tempus, Foundation Medicine, and 23andMe have also expanded collaborations with pharmaceutical companies to develop molecularly guided trial protocols.

Asia Pacific is the fastest-growing market for omics-based clinical trials, owing to a combination of expanding biopharma ecosystems, growing patient populations, and favorable regulatory environments. Countries like China, India, South Korea, and Singapore are investing heavily in genomics infrastructure, personalized medicine, and translational research hubs. China’s Precision Medicine Initiative, with an investment exceeding USD 9 billion, is creating a national omics database to fuel drug discovery and clinical development.

India’s strong clinical trial outsourcing sector, coupled with access to diverse genetic populations, makes it an attractive destination for omics-based research. Additionally, regulatory bodies like PMDA in Japan and CDSCO in India are increasingly aligning with global standards, enabling multi-regional trials. The growing use of electronic health records and biobanking capabilities further supports longitudinal omics studies in the region.

March 2025 – Illumina Inc. announced a strategic partnership with AstraZeneca to use multi-omics platforms in early-phase oncology clinical trials, focusing on rare tumor types.

January 2025 – Tempus Labs secured a USD 500 million investment round to expand its AI-powered omics data platform, facilitating faster cohort identification for pharma-sponsored trials.

December 2024 – GSK and 23andMe extended their drug discovery partnership to include multi-omics patient data integration into early-stage CNS trials.

October 2024 – Novartis launched a decentralized omics-based trial in collaboration with Medable, focusing on metabolic disorders using home-based blood collection kits.

September 2024 – The European Union’s IMI-TRIDENT program initiated a multi-country trial platform that uses proteomics and transcriptomics to identify treatment responses in autoimmune diseases.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the omics-based clinical trials market

Phase

Study Design

Indication

Regional