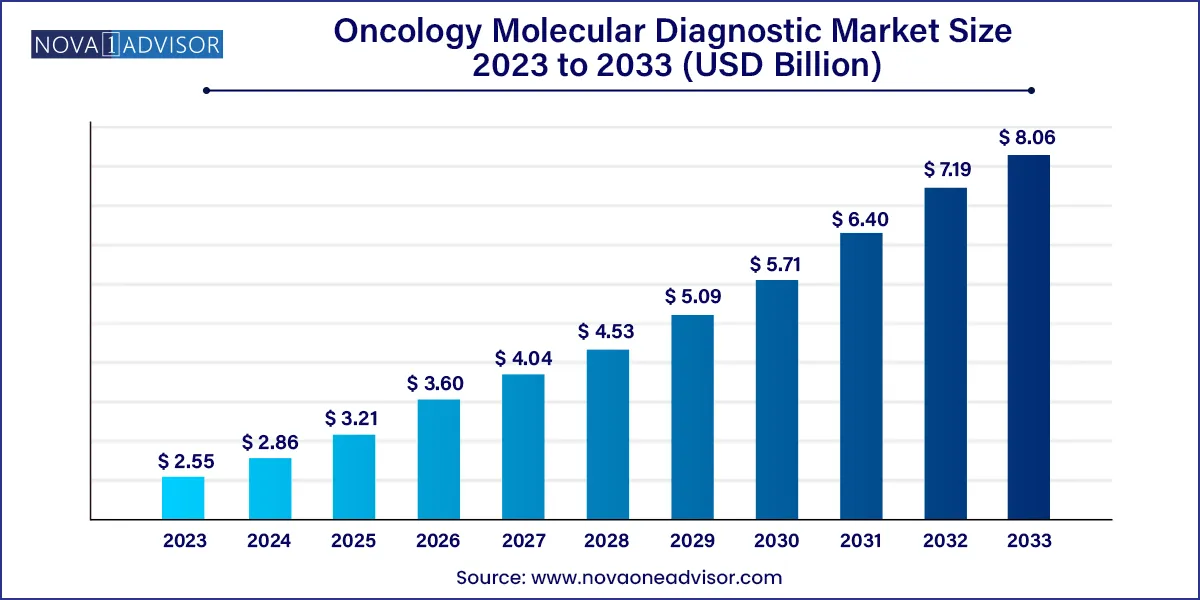

The global oncology molecular diagnostic market size was estimated at USD 2.55 billion in 2023 and is expected to be worth around USD 8.06 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 12.20% during the forecast period 2024 to 2033.

The Oncology Molecular Diagnostic Market is a dynamic sector within the broader field of healthcare diagnostics, characterized by the use of molecular techniques to detect and analyze cancer-related biomarkers. Molecular diagnostics play a pivotal role in the early detection, diagnosis, prognosis, and monitoring of various types of cancer. This market is driven by several factors, including technological advancements leading to more sensitive and specific diagnostic assays, increasing awareness about the importance of early cancer detection, and the growing prevalence of cancer globally. The market is also influenced by factors such as rising healthcare expenditure, aging populations, and lifestyle changes contributing to the increased incidence of cancer. Additionally, collaborations between diagnostic companies and research institutions, as well as supportive government initiatives and funding for cancer research, further stimulate market growth. With ongoing research and development efforts focused on improving the accuracy, accessibility, and affordability of molecular diagnostic tests, the oncology molecular diagnostic market is poised for continued expansion in the coming years.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.86 Billion |

| Market Size by 2033 | USD 8.06 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology and By Product |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific Inc., Illumina, Inc., Qiagen N.V., Bio-Rad Laboratories, Inc., Genomic Health, Inc., Myriad Genetics, Inc., Agilent Technologies, Inc., Siemens Healthineers, Danaher Corporation (Cepheid), Sysmex Corporation, Hologic, Inc., Guardant Health, Inc., Foundation Medicine, Inc. and others. |

Driver: Expanding Applications

According to a study published in Nature Communications, liquid biopsy demonstrated a sensitivity of 82% in detecting cancer-derived mutations, showcasing its potential in cancer diagnostics.

Expanding applications within the field of oncology molecular diagnostics are instrumental in propelling market demand. Traditionally confined to genetic profiling for cancer diagnosis, these diagnostics have evolved to include innovative techniques like liquid biopsy. The introduction of liquid biopsy, a non-invasive method for detecting cancer-related genetic alterations through the analysis of circulating tumor DNA, has revolutionized early cancer detection. This expansion of applications broadens the utility of molecular diagnostics, offering healthcare providers a more comprehensive toolkit for precision medicine. As these technologies become integral in identifying specific biomarkers and genetic anomalies associated with different cancer types, the demand for oncology molecular diagnostics surges, driven by the growing recognition of their role in personalized treatment strategies and improving patient outcomes.

Oncology Molecular Diagnostic Market

The complex regulatory landscape poses a significant restraint on the market demand for oncology molecular diagnostics. Stringent and evolving regulatory requirements for product approval and commercialization introduce challenges for companies operating in this sector. The lengthy and intricate regulatory pathways, including rigorous validation processes, can substantially delay the time to market for molecular diagnostic products. This not only prolongs the development timeline but also increases associated costs, hindering the timely availability of advanced diagnostic technologies to healthcare providers and patients. Moreover, the complexity of regulatory frameworks may lead to uncertainty and confusion among diagnostic companies, potentially discouraging innovation and investment in the development of new molecular diagnostic solutions. Adhering to diverse regulatory standards across different regions further complicates market entry strategies, impacting the seamless global adoption of oncology molecular diagnostics. As a result, efforts to streamline and harmonize regulatory processes are essential to mitigate these challenges and foster a more conducive environment for the growth of the oncology molecular diagnostics market.

Opportunity: Precision Medicine Integration

The integration of precision medicine is opening significant opportunities within the oncology molecular diagnostics market. Precision medicine, which tailors treatments based on an individual's unique genetic characteristics, underscores the need for specialized diagnostic tools. In this context, oncology molecular diagnostics play a crucial role by identifying specific genetic markers and mutations, guiding personalized treatment decisions. The rising demand for advanced molecular diagnostic tests reflects the healthcare industry's commitment to matching patients with the most effective therapies, minimizing side effects, and improving treatment outcomes. As precision medicine gains prominence, there is a growing market for molecular diagnostics capable of delivering precise and reliable genetic information. The accurate identification of biomarkers places these diagnostics at the forefront of guiding targeted therapies, contributing not only to improved patient care but also fostering innovation and growth within the oncology molecular diagnostics market.

In 2023, the breast cancer segment had the highest market share of 22% on the basis of the type. In the oncology molecular diagnostics market, the breast cancer segment focuses on detecting genetic alterations associated with breast cancer. This segment involves the identification of specific biomarkers and mutations through advanced molecular diagnostic techniques, aiding in personalized treatment decisions. Recent trends indicate a growing emphasis on liquid biopsy methods for non-invasive detection and monitoring. Additionally, the integration of next-generation sequencing technologies enhances the accuracy of genetic profiling, contributing to more effective breast cancer diagnostics and tailored therapeutic interventions.

The liver cancer segment is anticipated to expand at a significant CAGR of 13.9% during the projected period. The liver cancer segment in oncology molecular diagnostics refers to the specific focus on diagnosing and characterizing liver cancers through molecular techniques. This involves analyzing genetic and molecular alterations unique to liver tumors. A significant trend in this segment is the increasing adoption of liquid biopsy methods for non-invasive detection of liver cancer-related genetic changes. Liquid biopsies, such as the analysis of circulating tumor DNA, offer a promising avenue for early diagnosis and monitoring of liver cancer, contributing to improved patient outcomes and treatment strategies.

According to the technology, the polymerase chain reaction (PCR) segment held 32% market share in 2023. In the field of oncology molecular diagnostics, the Polymerase Chain Reaction (PCR) segment refers to a technology that amplifies and analyzes DNA sequences. PCR is pivotal for detecting genetic mutations associated with various cancers. Current trends indicate a growing adoption of advanced PCR technologies, such as quantitative PCR (qPCR) and digital PCR, offering enhanced sensitivity and precision in detecting cancer-specific genetic alterations. This evolution in PCR methodologies contributes to the market's capability to provide accurate and reliable molecular insights, facilitating more effective cancer diagnosis and treatment decisions.

The sequencing segment is anticipated to expand fastest over the projected period. In the field of oncology molecular diagnostics, the sequencing segment refers to the technology employed to analyze and decipher the genetic code of cancer cells. Next-generation sequencing (NGS) is a prominent method within this segment, allowing for the rapid and comprehensive analysis of cancer-related genetic alterations. Trends in sequencing technologies involve continuous advancements, enhancing the speed and accuracy of genetic profiling. As the cost of sequencing decreases, it promotes wider accessibility, fostering a trend towards more widespread adoption and integration of sequencing technologies in oncology diagnostics.

According to the product, the reagents segment held 59% revenue share in 2023. In the oncology molecular diagnostics market, the reagents segment refers to the essential chemical substances used in diagnostic assays to detect specific genetic markers or mutations associated with cancer. These reagents play a pivotal role in various molecular diagnostic techniques, such as PCR and sequencing. The trends in this segment involve continuous advancements in reagent formulations to enhance sensitivity, specificity, and overall performance. Additionally, the reagents market experiences a surge in demand as molecular diagnostics become more integral in personalized cancer care, driving innovation and expansion within this product category.

The instruments segment is anticipated to expand fastest over the projected period. The instruments segment in the oncology molecular diagnostics market includes specialized devices and equipment used for genetic and molecular analysis. These instruments, such as DNA sequencers and PCR machines, are essential for processing and analyzing biological samples to identify genetic abnormalities associated with cancer. Current trends in this segment focus on the development of more streamlined and high-throughput instruments, allowing for increased efficiency and rapid processing of molecular diagnostic tests. Advancements aim to enhance the precision and speed of oncology molecular diagnostics, contributing to improved patient care and treatment outcomes.

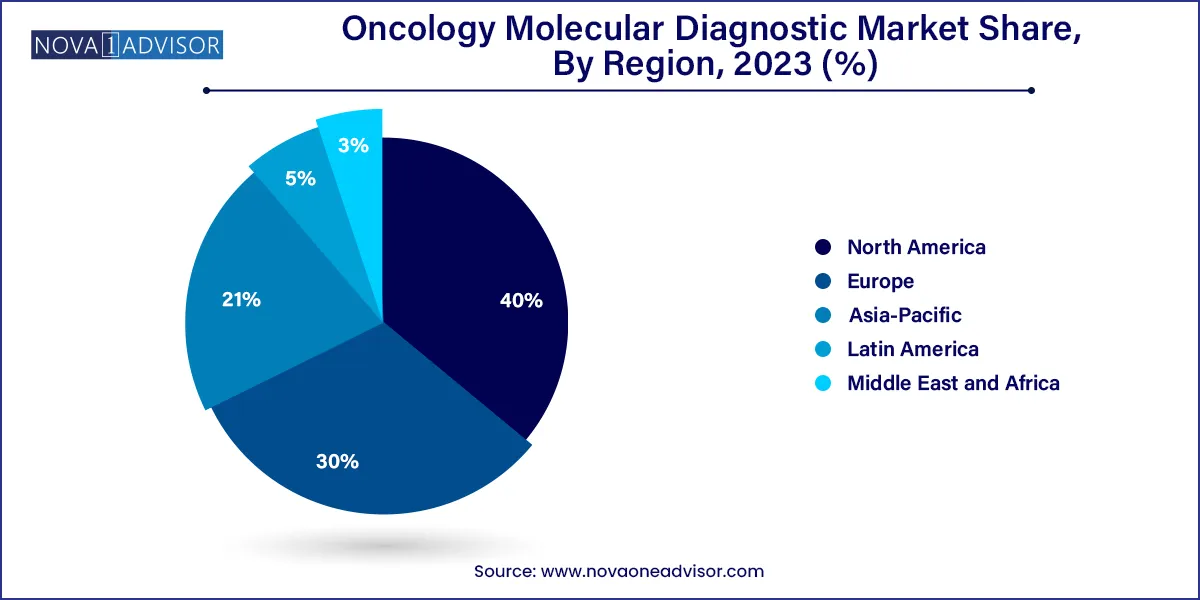

North America held the largest share of 41% in 2023 in the oncology molecular diagnostic market due to advanced healthcare infrastructure, extensive R&D activities, and high adoption rates of innovative diagnostic technologies.

According to 2020 data from the National Cancer Institute (NCI), approximately 1,806,590 cancer cases were identified in the United States, with an expected 2.2 million individuals anticipated to become cancer survivors by the year 2030.

The region benefits from a well-established regulatory framework and significant investments in precision medicine. Moreover, a rising prevalence of cancer, coupled with a strong emphasis on early detection and personalized treatment, propels the demand for molecular diagnostics. The presence of key market players and collaborative efforts between academic institutions and industry further solidify North America's dominant position in the oncology molecular diagnostics market.

Asia-Pacific is poised for rapid growth in the oncology molecular diagnostic market due to several factors. Rising cancer incidence, increasing healthcare infrastructure, and a growing awareness of personalized medicine contribute to the region's demand for advanced diagnostic solutions. Moreover, the availability of cost-effective technologies, coupled with supportive government initiatives, fosters market expansion. Collaborations between regional and international diagnostic companies further drive innovation, positioning the Asia-Pacific market as a key player in the evolving landscape of oncology molecular diagnostics.

Meanwhile, Europe is witnessing substantial growth in the oncology molecular diagnostics market due to factors such as increased cancer incidence, rising awareness of personalized medicine, and advancements in diagnostic technologies. The region's robust healthcare infrastructure, supportive regulatory environment, and collaborative research initiatives further contribute to market expansion. Growing adoption of precision medicine approaches and the development of innovative diagnostic tools are key drivers. The emphasis on early cancer detection and personalized treatment strategies positions oncology molecular diagnostics as integral to enhancing patient outcomes, fostering market growth in Europe.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Oncology Molecular Diagnostic market.

By Type

By Technology

By Product

By Region