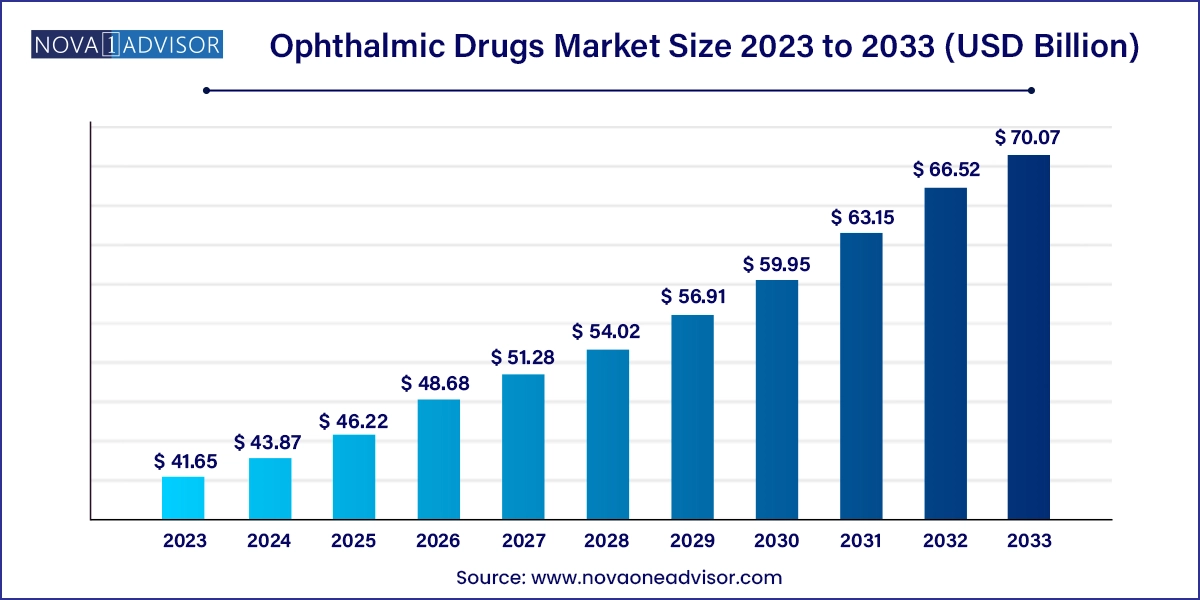

The global ophthalmic drugs market size was valued at USD 41.65 billion in 2023 and is projected to surpass around USD 70.07 billion by 2033, registering a CAGR of 5.34% over the forecast period of 2024 to 2033.

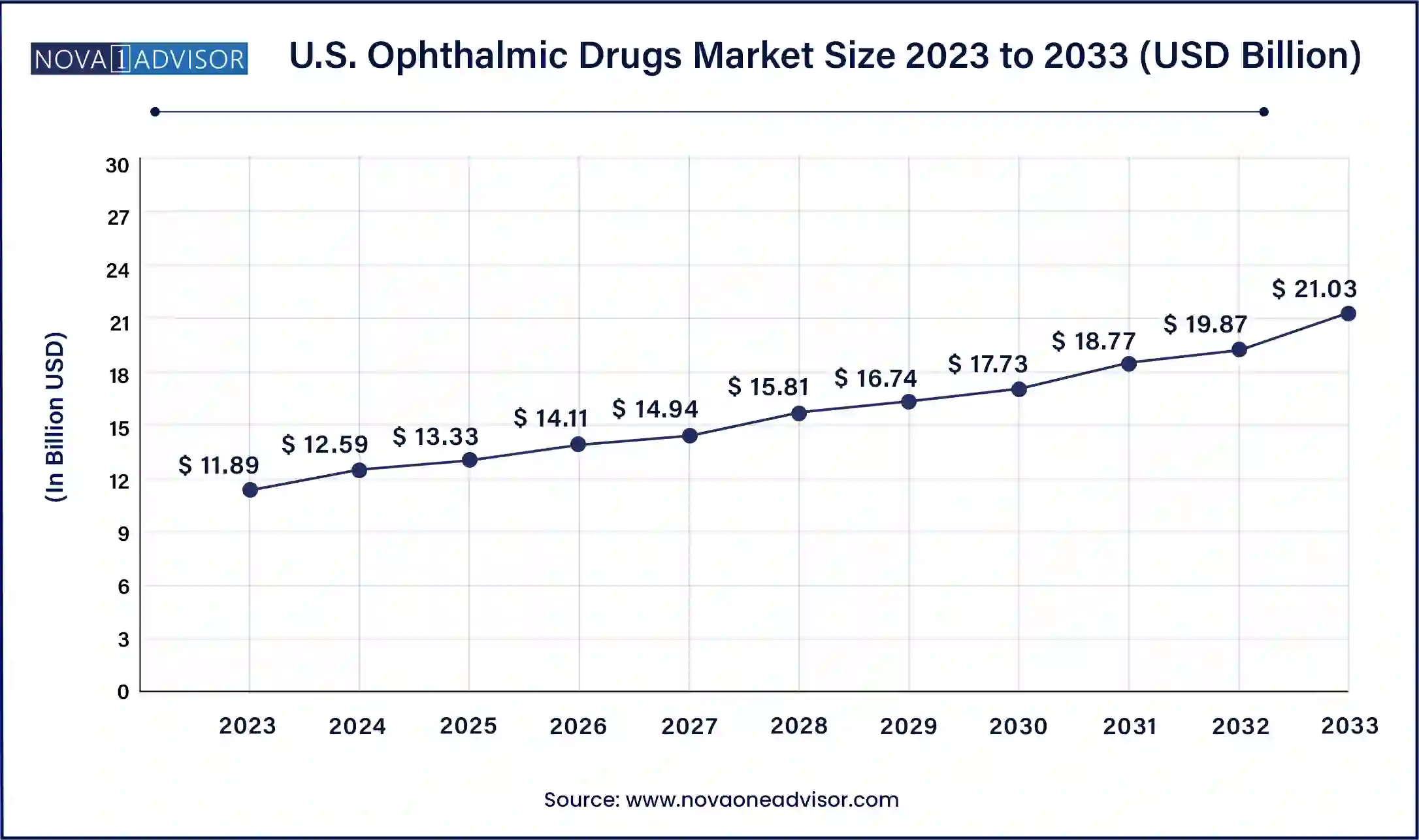

The U.S. ophthalmic drugs market size was estimated at USD 11.89 billion in 2023 and is projected to hit around USD 21.03 billion by 2033, growing at a CAGR of 5.87% during the forecast period from 2024 to 2033.

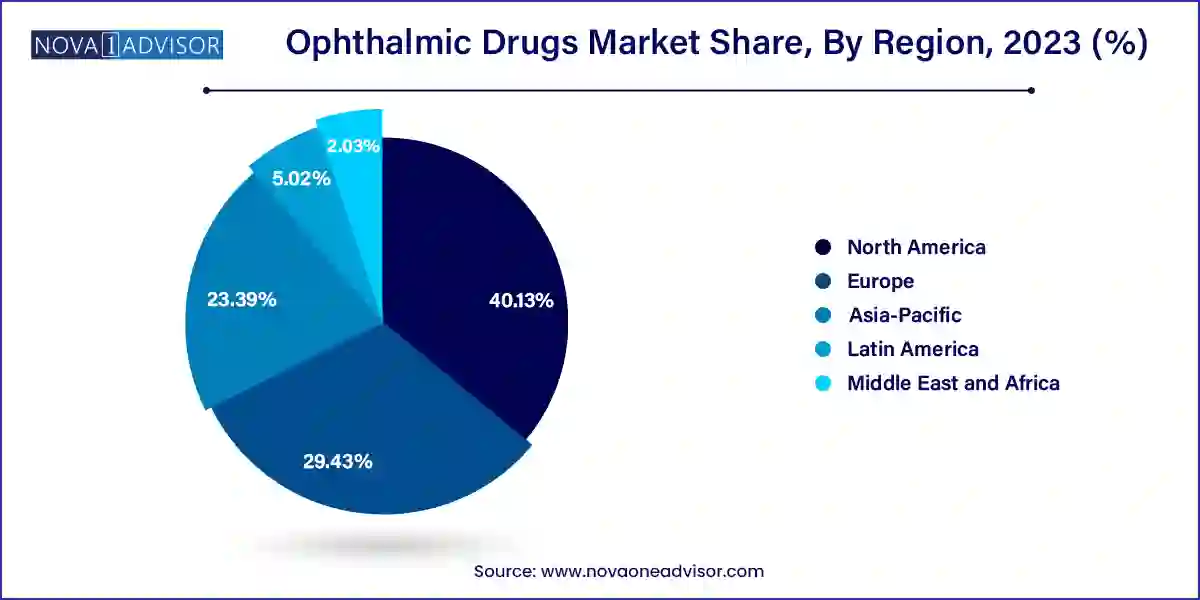

North America dominates the global ophthalmic drugs market, attributed to a high prevalence of age-related eye disorders, advanced healthcare systems, and significant pharmaceutical innovation. The U.S. leads in drug approvals, R&D investments, and access to biologics and specialty eye care. Moreover, a strong reimbursement infrastructure supports patient uptake of expensive therapies like anti-VEGF injections.

Asia-Pacific is the fastest-growing region, driven by large populations, increasing diabetes prevalence, expanding healthcare infrastructure, and growing awareness. Countries like China, India, Japan, and South Korea are investing heavily in ophthalmology, with rapid market penetration by global and regional pharma companies. The expansion of domestic generic drug industries also supports cost-effective access.

The ophthalmic drugs market plays a crucial role in the global pharmaceutical landscape, addressing a wide array of vision-related disorders and diseases. It includes therapeutic formulations intended to treat eye infections, allergies, glaucoma, dry eye, retinal disorders, and inflammatory conditions. With the rising prevalence of eye disorders, increasing geriatric population, technological advances in drug delivery systems, and growing awareness regarding eye health, the market is witnessing significant expansion.

According to the World Health Organization, at least 2.2 billion people worldwide suffer from some form of vision impairment, with conditions like dry eye syndrome, diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD) being particularly prevalent. The ophthalmic drugs market addresses this unmet need by offering both prescription and over-the-counter (OTC) solutions, through diverse dosage forms such as eye drops, gels, capsules, and suspensions.

The market has evolved from traditional topical eye drops to sustained-release implants, intravitreal injections, and targeted biologics. Innovations like Anti-VEGF agents for retinal diseases and combination therapies for glaucoma are reshaping treatment paradigms. Additionally, pharmaceutical players are investing in biosimilars, gene therapy, and nanotechnology-based delivery platforms to increase efficacy and compliance.

With regulatory approvals accelerating, and the availability of cost-effective generics growing, the ophthalmic drug space is expected to remain one of the most dynamic areas in global healthcare.

Rise of Biologics and Anti-VEGF Therapies: These are dominating retinal disorder treatment, especially for AMD and diabetic retinopathy.

Increasing Preference for Sustained-Release Formulations: Implants and long-acting injections are gaining traction for chronic conditions.

OTC Eye Health Expansion: The self-care trend is boosting OTC sales, particularly in dry eye and allergy segments.

Technological Advancements in Drug Delivery: Nanocarriers, micro-dosing devices, and punctal plugs are being developed for enhanced efficacy.

Growth of Generic Drug Approvals: Regulatory agencies are facilitating approvals to reduce treatment costs.

Strategic Partnerships for Pipeline Development: Pharma companies are entering collaborations to accelerate drug discovery and commercialization.

Digital Health Integration: AI and teleophthalmology are supporting better diagnostics and treatment adherence, indirectly influencing drug usage.

| Report Attribute | Details |

| Market Size in 2024 | USD 43.87 Billion |

| Market Size by 2033 | USD 70.07 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.34% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Drug class, disease, route of administration, dosage form, product type, product, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Pfizer Inc.; Alcon; Novartis AG; Bausch Health Companies Inc.; Merck & Co., Inc.; Regeneron Pharmaceuticals Inc.; Allergan (AbbVie Inc); Bayer AG; Genentech, Inc. (F. Hoffmann-La Roche Ltd); Nicox; Coherus Biosciences, Inc. |

Anti-glaucoma drugs dominate the drug class segment, owing to the high prevalence of glaucoma and the need for long-term treatment. These drugs include prostaglandin analogs, beta-blockers, carbonic anhydrase inhibitors, and combination therapies that help reduce intraocular pressure and prevent optic nerve damage.

Anti-VEGF agents are the fastest-growing class, driven by the explosion of biologic therapies for retinal disorders like wet AMD and diabetic macular edema. Agents such as Lucentis (ranibizumab) and Eylea (aflibercept) have set new standards for treatment efficacy, with biosimilars and extended-release versions boosting market potential.

Glaucoma dominates the disease segment, representing one of the most common causes of irreversible blindness worldwide. Due to its chronic nature, patients require lifelong therapy, ensuring a stable market for glaucoma medications.

Retinal disorders are the fastest-growing segment, fueled by the success of anti-VEGF therapies, aging populations, and increasing diabetes-related eye complications. Subtypes like wet and dry AMD, diabetic retinopathy, and macular edema are particularly driving this expansion.

Topical administration leads the market, given its prevalence in treating anterior segment disorders. Most eye care medications are applied as drops or ointments for immediate local action with minimal systemic absorption.

Intravitreal administration is growing rapidly, particularly for biologics used in retinal diseases. Though invasive, it offers direct drug delivery to the posterior eye, improving outcomes in conditions that are otherwise hard to treat with topicals.

Eye drops dominate the dosage form segment, offering non-invasive and convenient drug delivery for anterior segment diseases like dry eye, glaucoma, and allergies. The ease of administration makes eye drops the most commonly prescribed and purchased formulation.

Gels and ointments are growing steadily, especially for overnight or severe condition management. However, capsules and tablets are also gaining ground for systemic conditions or infections that require broader treatment coverage.

Prescription drugs dominate due to the complexity and chronic nature of many ophthalmic conditions. Most anti-glaucoma and anti-VEGF medications require clinician oversight and are prescribed in hospital or specialty eye clinic settings.

Generic drugs are growing faster than branded drugs, driven by cost-containment pressures, expiring patents, and the entry of bioequivalents in both developed and developing markets. The introduction of biosimilar ranibizumab and aflibercept variants is further accelerating this trend.

March 2025 – Roche/Genentech launched Vabysmo® (faricimab) in Europe for dual inhibition of Ang-2 and VEGF-A in retinal disease treatment, challenging established anti-VEGF drugs.

February 2025 – Regeneron received FDA approval for Eylea HD (aflibercept 8mg), a high-dose version aimed at reducing injection frequency in wet AMD and DME patients.

January 2025 – Novartis entered a licensing agreement with a Chinese biotech firm for a novel gene therapy targeting glaucoma-related optic nerve degeneration.

December 2024 – Sun Pharma launched a biosimilar version of ranibizumab in India under the brand name Seffalair™, expanding its ophthalmic product line.

October 2024 – AbbVie (Allergan) released Phase 3 results showing positive outcomes for AGN-231868, an investigational drug for chronic dry eye.

The following are the leading companies in the ophthalmic drugs market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these ophthalmic drugs companies are analyzed to map the supply network.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Ophthalmic Drugs market.

By Drug Class

By Disease

By Dosage Form

By Route of Administration

By Product Type

By Product

By Region