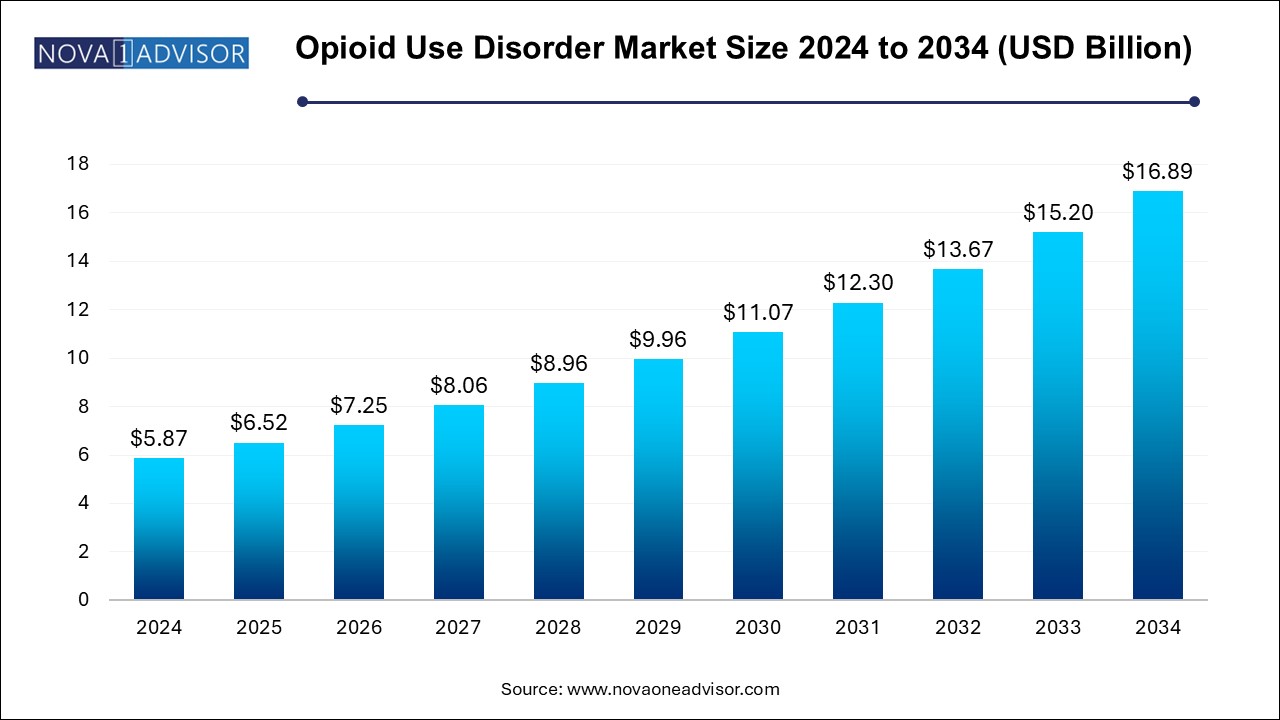

The opioid use disorder market size was exhibited at USD 5.87 billion in 2024 and is projected to hit around USD 16.89 billion by 2034, growing at a CAGR of 11.15% during the forecast period 2025 to 2034.

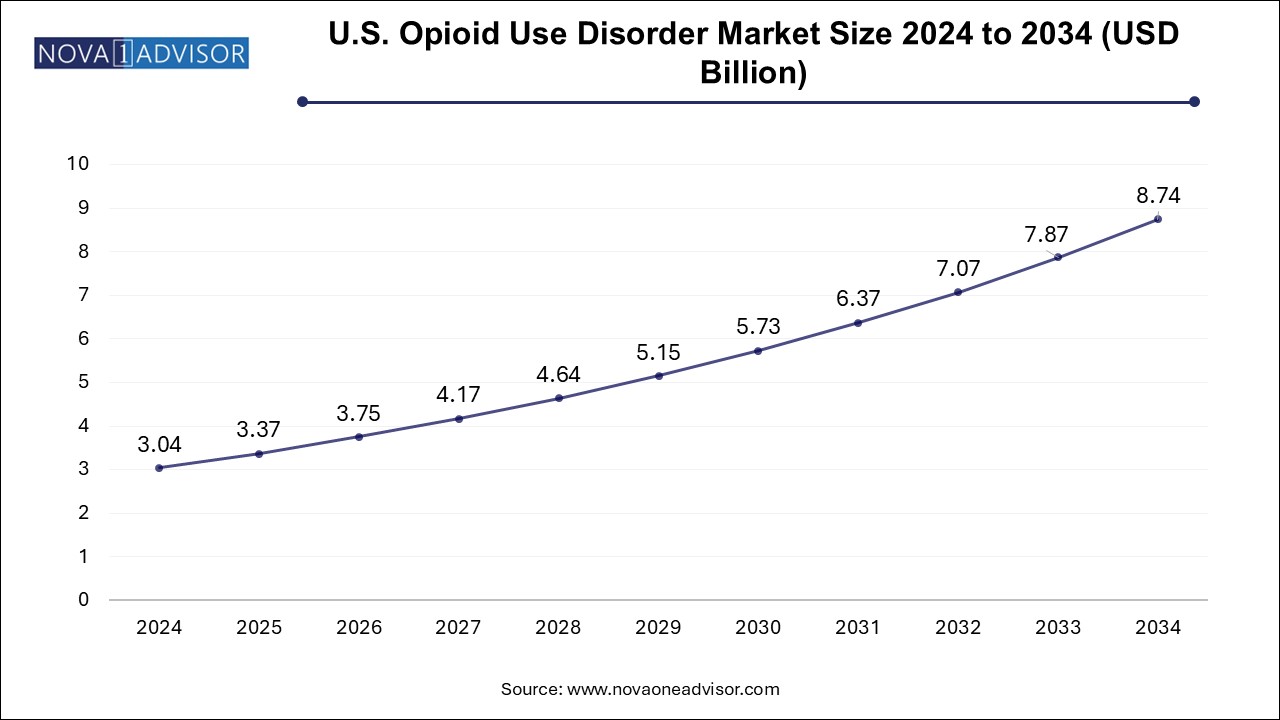

The U.S. opioid use disorder market size is evaluated at USD 3.04 billion in 2024 and is projected to be worth around USD 8.74 billion by 2034, growing at a CAGR of 10.7% from 2025 to 2034.

North America held the largest market share in 2024, driven by an acute opioid crisis, robust healthcare infrastructure, and strong policy focus on addiction treatment. The U.S. accounts for the majority of demand due to high opioid overdose rates, expanded Medicaid coverage for MAT, and significant investments in addiction research. Programs such as the 21st Century Cures Act and the Opioid State Targeted Response (STR) grants have injected billions into improving treatment access.

Pharmaceutical innovation is heavily centered in this region, with companies like Indivior, Alkermes, and Braeburn introducing novel therapies and digital integration models. Canada, facing a parallel crisis, is also ramping up funding for opioid agonist therapy and safe supply initiatives. The presence of clinical guidelines, academic research, and provider training programs ensures continued dominance of the North American region in this market.

Asia Pacific is anticipated to grow at the highest CAGR, spurred by increasing opioid abuse, shifting socio-economic conditions, and policy reform. Countries like India and China are experiencing rising opioid dependence due to both prescription misuse and illicit drug trafficking. While MAT programs are still in nascent stages in many APAC countries, government-backed pilot projects are being launched to build treatment infrastructure.

For example, India’s National AIDS Control Organization (NACO) has incorporated buprenorphine-naloxone combinations into harm reduction strategies for intravenous drug users. Similarly, China is scaling up methadone maintenance therapy centers across provinces. International collaborations, such as United Nations support for Southeast Asia, are facilitating technology transfer, physician training, and procurement of essential MAT drugs. As awareness grows and stigma decreases, Asia Pacific is expected to become a pivotal growth engine in the global OUD market.

The opioid use disorder (OUD) market has evolved into a critical segment of the global healthcare system, responding to an intensifying public health crisis. Opioid use disorder is characterized by the compulsive use of opioids despite harmful consequences. It can result from the misuse of prescription opioids such as oxycodone and hydrocodone or the use of illicit opioids like heroin and synthetic fentanyl. The market encompasses medications approved for opioid dependence treatment, including methadone, buprenorphine-based formulations, and naltrexone, along with behavioral therapy integration and long-acting injectable therapies.

The market has expanded in response to the staggering rise in opioid addiction cases, especially in North America, where the crisis has led to hundreds of thousands of overdose deaths in the last two decades. Public and private sectors have significantly increased funding to combat the epidemic through medication-assisted treatment (MAT), broader access to care, harm reduction strategies, and legislative reform. Regulatory agencies such as the U.S. FDA and EMA have accelerated approvals of long-acting formulations to ensure better compliance and reduce relapse rates.

The demand for OUD treatment is further driven by the need to transition patients from emergency care or incarceration into long-term recovery pathways. Pharmaceutical innovation, increased awareness, government-backed insurance coverage, and reduced stigma surrounding addiction have all contributed to market growth. Despite challenges related to social stigma, regulatory scrutiny, and potential misuse of treatment drugs, the outlook for the OUD market remains promising. As governments, healthcare providers, and drug manufacturers collaborate more closely, the stage is set for innovations that balance efficacy, accessibility, and safety.

Growth of Long-Acting Injectable Therapies: Injectable buprenorphine options like Sublocade are gaining popularity due to improved adherence and reduced diversion risk.

Policy-Driven Expansion of MAT (Medication-Assisted Treatment): Countries are revising healthcare coverage to expand access to MAT, especially in community health settings.

Increased Integration of Telehealth in OUD Treatment: The pandemic-era shift to telemedicine has extended OUD care into rural and underserved populations.

Emphasis on Harm Reduction: Government and NGO initiatives now include distribution of naloxone and syringe service programs to minimize health consequences.

Shift Toward Personalized Therapy: Genomic profiling and real-world data are being used to tailor treatment regimens to individual patient needs.

Focus on Criminal Justice Reform and Rehabilitation: Court-mandated treatment programs are becoming key channels for MAT administration.

Rising R&D for Abuse-Deterrent Formulations: Pharmaceutical companies are developing formulations that reduce misuse while maintaining efficacy.

Public-Private Collaborations to Boost Access: Partnerships are forming between pharma companies and public health departments to widen treatment reach.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.52 Billion |

| Market Size by 2034 | USD 16.89 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.15% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Drug, Route of Administration, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Indivior PLC, Teva Pharmaceutical Industries, Ltd., Pfizer, Inc., Collegium Pharmaceutical (BioDelivery Sciences International, Inc.), Alkermes, Inc., Orexo US, Inc. (a part of Orexo AB), Titan Pharmaceuticals, Inc., Omeros Corporation, Camurus AB, Hikma Pharmaceuticals PLC |

The principal driver for the opioid use disorder market is the escalating global opioid crisis, particularly acute in the United States and parts of Canada, where synthetic opioids like fentanyl are causing unprecedented fatalities. The U.S. Centers for Disease Control and Prevention (CDC) reported over 110,000 overdose deaths in the U.S. in 2023, with opioids implicated in more than 70% of those cases.

In response, governments have declared the opioid crisis a public health emergency, unlocking funding for MAT, training programs, and expanded treatment infrastructure. Federal programs such as the U.S. Substance Abuse and Mental Health Services Administration (SAMHSA) grants, state Medicaid expansion, and rural health initiatives have made opioid addiction treatment a strategic priority. These interventions have led to increased demand for OUD treatment drugs, particularly long-acting injectables and buprenorphine-naloxone combinations, which are seen as both effective and safer alternatives to methadone in outpatient settings.

A significant restraint in the OUD market is the barriers posed by stringent regulatory requirements and societal stigma. Many countries still mandate special licenses or physician waivers for MAT prescription, which limits the number of providers able to offer these therapies. Methadone, despite being effective, is often restricted to specialized opioid treatment programs (OTPs), limiting its accessibility.

Moreover, the stigma surrounding addiction discourages individuals from seeking help, and some communities resist the establishment of MAT clinics due to "Not In My Back Yard" (NIMBY) sentiments. In addition, concerns over the potential for diversion of treatment drugs—especially with sublingual buprenorphine—result in conservative prescribing practices. These challenges underscore the need for policy reform and broad educational initiatives to shift perceptions and regulatory structures toward more inclusive care models.

An emerging opportunity lies in the integration of digital therapeutics and telemedicine platforms into OUD treatment pathways. The COVID-19 pandemic catalyzed the use of virtual care in addiction medicine, with regulatory bodies allowing remote prescribing of MAT drugs under emergency provisions. These measures are now evolving into permanent policy changes in several countries.

Telehealth platforms are enabling patients—especially in rural or underserved regions—to consult addiction specialists, receive digital behavioral counseling, and even initiate buprenorphine therapy remotely. Companies are also exploring digital tools such as mobile apps for medication adherence tracking, craving management, and real-time clinician feedback. These innovations reduce logistical and psychological barriers to treatment while offering scalable solutions for resource-strapped health systems. As reimbursement models adapt to include digital health, this area holds high growth potential for both established and emerging OUD care providers.

The Buprenorphine-based therapies dominated the market in 2024, with a wide range of branded and generic options available for both oral and injectable administration. Formulations like Suboxone (buprenorphine/naloxone), Sublocade (monthly injectable), and Zubsolv offer varying delivery mechanisms to suit patient preferences and clinical needs. These therapies strike a balance between efficacy and safety, as they act as partial agonists—providing symptom relief without the high abuse potential of full agonists like methadone. They are also increasingly favored in outpatient settings due to reduced regulatory burdens and fewer overdose risks.

Long-acting buprenorphine injectables are expected to be the fastest-growing segment, particularly in developed markets such as the U.S. and Europe. Sublocade, a once-monthly extended-release injection, is being adopted for its superior adherence rates and reduced diversion potential. BELBUCA, a buccal film formulation, is gaining popularity among patients requiring pain management with a lower abuse profile. These innovations improve compliance and patient outcomes, especially in populations with erratic lifestyles or limited healthcare access.

Oral administration remains the dominant route, encompassing tablets, films, and sublingual solutions. The convenience and low cost of oral formulations make them ideal for both initiating and maintaining treatment. Most generic versions of buprenorphine and methadone are available in oral forms, which facilitates broad public health adoption, especially in publicly funded treatment programs.

Injectable administration is poised to experience the fastest growth, particularly due to the rising popularity of long-acting formulations like Sublocade and extended-release naltrexone (Vivitrol). These options reduce the burden of daily compliance and are being integrated into correctional settings, residential programs, and community clinics. Healthcare providers increasingly favor injectables for patients with prior treatment failures, relapse history, or complex social determinants of health.

Hospital pharmacies accounted for the largest share of the market, as they play a critical role in initiating treatment for opioid overdose survivors and patients undergoing inpatient detoxification. These settings ensure controlled dispensing, specialist oversight, and seamless transitions into outpatient care. Hospitals also facilitate rapid administration of injectables, making them central to early intervention strategies.

Retail pharmacies are projected to grow at the fastest rate, driven by regulatory changes allowing community pharmacists to dispense MAT drugs. Countries like the U.S. have expanded the role of pharmacies in addiction care, especially for Suboxone and naltrexone prescriptions. Retail chains are also introducing dedicated counseling areas, digital support tools, and collaborative care models with prescribers. Their accessibility, especially in rural areas, makes them ideal points of care for OUD treatment continuity.

In March 2025, Indivior received FDA approval for a new extended-release formulation of Sublocade with enhanced bioavailability, designed to reduce breakthrough cravings.

In January 2025, Braeburn Pharmaceuticals initiated a Phase III trial of its monthly injectable Brixadi in correctional facilities across several U.S. states to test adherence and relapse rates.

In December 2024, Alkermes expanded manufacturing of Vivitrol at its Ohio facility to meet growing demand from U.S. and European markets.

In October 2024, Camurus AB received EMA approval for Buvidal, a weekly injectable buprenorphine, marking its official entry into the broader European outpatient MAT market.

In August 2024, the Indian government partnered with UNODC to distribute low-cost buprenorphine-naloxone generics in high-burden states like Punjab and Manipur.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the opioid use disorder market

By Drug

By Route Of Administration

By Distribution Channel

By Regional