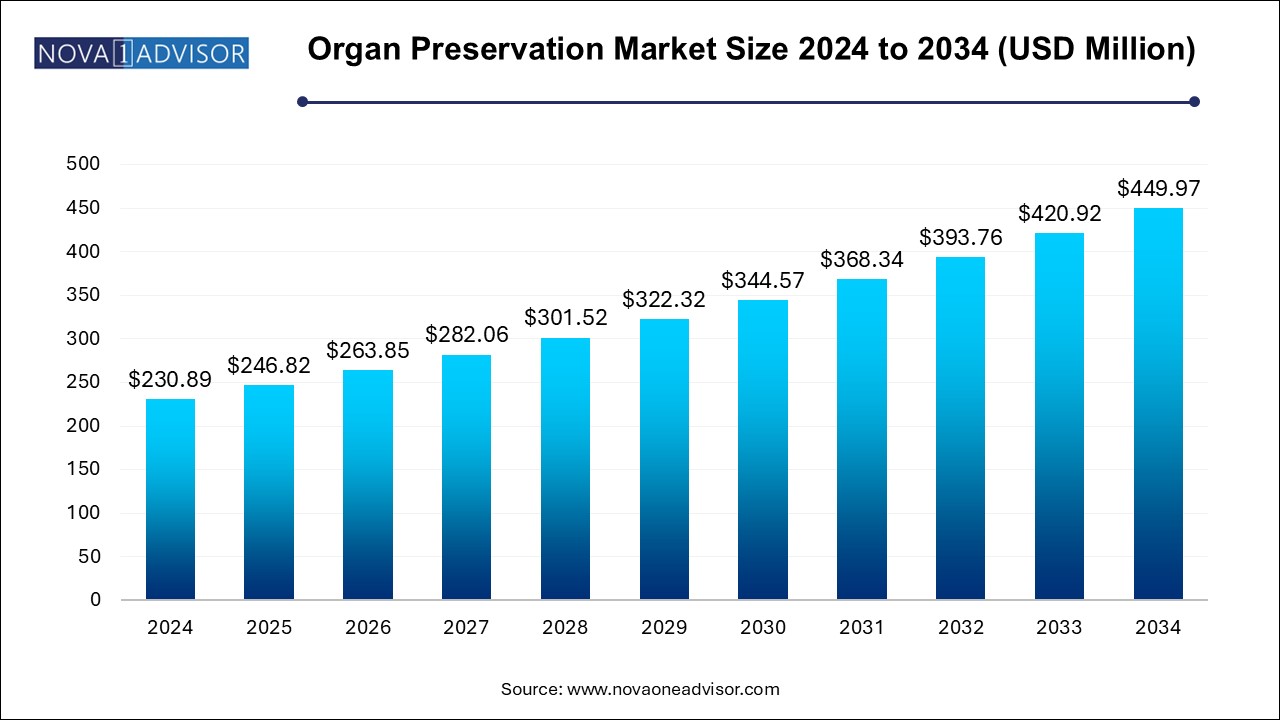

The organ preservation market size was exhibited at USD 230.89 million in 2024 and is projected to hit around USD 449.97 million by 2034, growing at a CAGR of 6.9% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 246.82 Million |

| Market Size by 2034 | USD 449.97 Million |

| Growth Rate From 2024 to 2034 | CAGR of 6.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Solution, Organ Type, Preservation Technique, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | XVIVO Perfusion; TransMedics; 21st Century Medicine; CryoLife, Inc.; Bridge to Life Ltd. |

The demand is on a rise owing to the increasing cases of organ failure across the globe, initiatives encouraging organ donation, geriatric population, and the presence of key players in the developing and developed countries.

The increasing number of organ transplantation procedures across the globe and rising cases of multiple organ failure are the major factors propelling the market growth. According to a report published by the Health Resources & Services Administration in 2024, around 36,528 organ transplantation were performed in the U.S. in 2018, and around 95.00% of adults in the country support organ donation. It also reported that around 17,553 donors were recorded in 2018 of which 10,722 were deceased donors and 6,831 were living donors.

In addition, various awareness campaigns across the globe are also anticipated to positively impact the market. For instance, 12th October is celebrated as European Day for Organ Donation and Transplantation. Furthermore, according to the report published by the Council of Europe in 2024, 41,000 patients underwent organ transplantation in 2018 in Europe. Therefore, such instances are anticipated to promote the organ preservation market growth over the forecast period.

Cardiovascular Diseases (CVD) have become one of the major causes of mortality and morbidity over the last three decades. Coronary artery disease, arrhythmias, peripheral vascular disease, heart failure, and congenital heart defects are the major cardiovascular diseases prevalent across the globe. According to the report published by the American Heart Association in 2018, around 92.1 million Americans are living with some form of CVD and CVD is the most common cause for mortality in the country as compared to cancer and other chronic diseases.

It also reported that around 2,300 Americans die due to cardiovascular disease per day, which is around 1 death every 38 seconds. As per the report published by the World Atlas, Russia has the highest prevalence of CVD, which is around 57.0% of the mortality cases in the country are caused by CVD. Such instances are anticipated to surge the rate of heart transplants across the globe, thereby propelling market growth over the forecast period.

The increasing cases of kidney failures and chronic kidney diseases are expected to surge the kidney transplant rate. According to the report published by the Centers for Disease Control & Prevention (CDC) in 2024, around 15.00% of adults in the U.S. suffer from chronic kidney diseases every year. Similarly, as per the report published by the National Institute of Diabetes and Digestive and Kidney Diseases in 2024, around 661,000 Americans suffer from kidney failure of which 468,000 patients are on dialysis and around 193,000 underwent kidney transplant. Therefore, such factors are anticipated to propel the organ transplantation market growth over the forecast period.

The rising cases of chronic liver diseases and cirrhosis across the globe are also expected to surge the market growth. According to the data published by the National Center for Biotechnology Information in 2024, around 2.0 million deaths occur due to liver diseases per year globally and around 1.0 million deaths occur due to complications of lung cirrhosis. It also reported that liver transplantation is the second most transplanted organ. Furthermore, as per the annual report published by the NHS in 2024, around 8,740 liver transplants were reported in the U.K. in the last 10 years. Such instances indicate considerable growth of the market for organ prevention.

On the basis of solution, the market is categorized into the University of Wisconsin (UW), Custodial HTK, Perfadex, and others. The University of Wisconsin (UW) held the largest share in 2024 owing to its increase in use and several advantages of the solution. The solution allows the preservation of liver grafts of humans for more than 15 hours as compared to other solutions. It also allows easy transportation of organs across large distances without any damage. It is majorly used for liver preservation and helps in increasing the rate of successful liver transplantation. The increasing cases of liver transplantation are anticipated to propel segment growth.

Perfadex segment is anticipated to witness the fastest CAGR over the forecast period. This solution is specifically formulated to preserve the integrity and function of organs that are rich in endothelium at the time of cold ischemic storage and flushing before reperfusion and transplantation. This solution is majorly used for lung preservation but can be used to preserve other organs as well. Therefore, such advantages are anticipated to promote segment growth over the forecast period.

The kidney segment held the largest market share in 2024. Increasing cases of kidney failures and number of kidney transplant procedures across the globe are the major factors influencing the segment growth. According to a report published by the NHS in 2024, in the U.S. around 37.00 million patients suffer from chronic kidney disease and almost 726,000 suffer from end-stage renal disease every year. Various awareness campaign related to the benefits of kidney transplant is also anticipated to promote segment growth. For instance, NHS launched ‘Advancing American Kidney Health’ Initiative with an aim to improve the lives of patients suffering from kidney disease in the U.S.

The heart segment is anticipated to witness the fastest CAGR over the forecast period. The rising number of heart transplantation procedures is expected to propel the segment growth over the forecast period. According to a report published by the Health Resources & Services Administration around 3,408 heart transplantation procedures were performed in 2024, whereas in 2017 around 3,273 heart transplantation were performed in the U.S. This trend is anticipated to drive the growth of the segment in the forthcoming years.

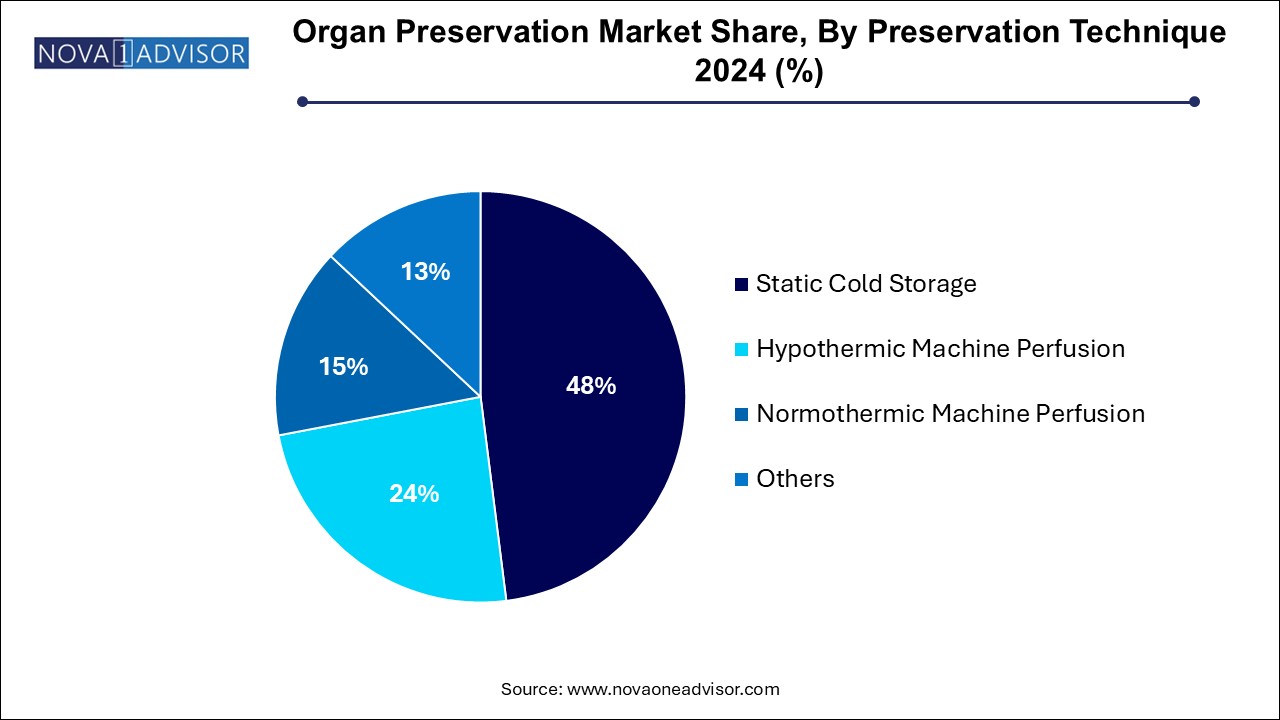

On the basis of preservation technique, the market for organ preservation is fragmented into static cold storage, hypothermic machine perfusion, normothermic machine perfusion, and others. The static cold storage segment held the largest share in 2024 owing to its wide applicability and increase in use. Static cold storage is majorly used for kidney preservation. However, it is also used for the preservation of other organs as well. Furthermore, the presence of various market players offering static cold storage is also anticipated to promote the segment growth.

The normothermic machine perfusion segment is anticipated to witness the fastest CAGR over the forecast period. In this technique, the organ is provided with sufficient nutrition and oxygen that enables aerobic metabolism. It also helps to provide better transplantation outcomes and reduces the chance of post-transplantation side effects. It is majorly used for liver preservation but is also allows efficient preservation of other organs as well. Therefore, such advantages are expected to promote market growth over the forecast period.

North America held the largest market share in 2024 and is expected to maintain its dominance over the forecast period. Rising acceptance of innovative healthcare technologies, high prevalence of chronic kidney diseases and heart failure, better reimbursement policies, and increasing investments for improving healthcare infrastructure are the major factors promoting the growth. Furthermore, rising geriatric population and an increasing number of organ transplantation procedures are also expected to promote the regional market growth.

Asia Pacific is anticipated to witness the fastest growth over the forecast period owing to the increasing healthcare expenditure, rising patient awareness, and growing need for organ transplantation procedures. In addition, the growing aging population, increasing incidence of kidney and heart failure, and rising healthcare expenditure are also anticipated to drive the growth of the market in the forthcoming years.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the organ preservation market

By Solution

By Organ Type

By Preservation Technique

By Regional

Chapter 1 Methodology

1.1 Research Methodology

1.1.1 Information Procurement

1.2 Information or Data Analysis

1.3 Market Formulation & Validation

1.4 Region Wise Market Calculation

1.4.1 Region Wise Market: Base Estimates

1.4.2 Global Market: Cagr Calculation

1.5 Region-Based Segment Share Calculation

1.6 List of Secondary Sources

Chapter 2 Executive Summary

2.1 Market Segmentation

2.2 Market Snapshot

Chapter 3 Organ Preservation Market Variables, Trends & Scope

3.1 Penetration & Growth Prospect Mapping

3.2 Regulatory Framework

3.3 Market Dynamics

3.3.1 Market Driver Analysis

3.3.1.1 Increasing cases kidney failure & chronic kidney diseases

3.3.1.2 Rising number of organ transplant procedures

3.3.1.3 Increasing government initiatives related to organ transplant and organ donation

3.3.2 Market Restraint Analysis

3.3.2.1 High Cost Of Transplantation Cost

3.4 Organ Preservation Market Analysis Tools

3.4.1 Industry Analysis - Porter’s Five Forces Analysis

3.5 Organ Preservation Market Analysis Tools

3.5.1 Swot Analysis, By Pest

3.5.2 Pestle Analysis

3.5.2.1 Political & legal

3.5.2.2 Environmental & social

3.5.2.3 Technological

3.5.2.4 Economic

Chapter 4 Organ Preservation Market: Segment Analysis, By Solution, 2021 - 2034 (USD Million)

4.1 Definitions & Scope

4.2 Solution Market Share Analysis, 2024 & 2034

4.3 Global Organ Preservation Market, by Solution, 2021 to 2034

4.4 Market Size Forecasts and Trend Analysis

4.4.1 University Of Wisconsin (Uw)

4.4.1.1 University Of Wisconsin (Uw) Market, 2021 - 2034 (USD Million)

4.4.2 Custodial Htk

4.4.2.1 Custodial Htk Market, 2021 - 2034 (USD Million)

4.4.3 Perfadex

4.4.3.1 Perfadex Market, 2021 - 2034 (USD Million)

4.4.4 Others

4.4.4.1 Others Market, 2021 - 2034 (USD Million)

Chapter 5 Organ Preservation Market: Segment Analysis, By Organ Type, 2021 - 2034 (USD Million)

5.1 Definitions & Scope

5.2 Organ Type Market Share Analysis, 2024 & 2034

5.3 Global Organ Preservation Market, by Organ Type, 2021 to 2034

5.4 Market Size Forecasts & Trend Analysis

5.4.1 Kidneys

5.4.1.1 Kidneys Market, 2021 - 2034 (USD Million)

5.4.2 Liver

5.4.2.1 Liver Market, 2021 - 2034 (USD Million)

5.4.3 Lungs

5.4.3.1 Lungs Market, 2021 - 2034 (USD Million)

5.4.4 Heart

5.4.4.1 Heart Market, 2021 - 2034 (USD Million)

5.4.5 Others

5.4.5.1 Others market, 2021 - 2034 (USD Million)

Chapter 6 Organ Preservation Market: Segment Analysis, By Preservation Technique, 2021 - 2034 (USD Million)

6.1 Definitions & Scope

6.2 Preservation Technique Market Share Analysis, 2024 & 2034

6.3 Global Organ Preservation Market, by Preservation Technique, 2021 to 2034

6.4 Market Size Forecasts & Trend Analysis

6.4.1 Static Cold Storage

6.4.1.1 Static Cold Storage Market, 2021 - 2034 (USD Million)

6.4.2 Hypothermic Machine Perfusion

6.4.2.1 Hypothermic Machine Perfusion Market, 2021 - 2034 (USD Million)

6.4.3 Normothermic Machine Perfusion

6.4.3.1 Normothermic Machine Perfusion Market, 2021 - 2034 (USD Million)

6.4.4 Others

6.4.4.1 Others Market, 2021 - 2034 (USD Million)

Chapter 7 Organ Preservation Market: Regional Market Analysis, By Solution, Organ Type & Preservation Technique, 2021 - 2034 (USD Million)

7.1 Definitions & Scope

7.2 Regional Market Share Analysis, 2018 & 2026

7.3 Regional Market Snapshot

7.4 Market Size Forecasts & Trend Analysis

7.4.1 North America

7.4.1.1 North America Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.1.2 U.S.

7.4.1.2.1 U.S. Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.1.3 Canada

7.4.1.3.1 Canada Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.2 Europe

7.4.2.1 Europe Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.2.2 U.K.

7.4.2.2.1 U.K. Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.2.3 Germany

7.4.2.3.1 Germany Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.3 Asia Pacific

7.4.3.1 Asia Pacific Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.3.2 China

7.4.3.2.1 China Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.3.3 Japan

7.4.3.3.1 Japan Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.4 Latin America

7.4.4.1 Latin America Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.4.2 Brazil

7.4.4.2.1 Brazil Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.4.3 Mexico

7.4.4.3.1 Mexico Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.5 Middle East & Africa

7.4.5.1 Middle East & Africa Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.5.2 South Africa

7.4.5.2.1 South Africa Organ Preservation Market, 2021 - 2034 (USD Million)

7.4.5.3 Saudi Arabia

7.4.5.3.1 Saudi Arabia Organ Preservation Market, 2021 - 2034 (USD Million)

Chapter 8 Company Profiles

8.1 XVIVO PERFUSION

8.1.1 Company overview

8.1.2 Product benchmarking

8.1.3 Strategic initiatives

8.2 TRANSMEDICS

8.2.1 Company overview

8.2.2 Product benchmarking

8.2.3 Strategic initiatives

8.3 21ST CENTURY MEDICINE

8.3.1 Company overview

8.3.2 Product benchmarking

8.3.3 Strategic initiatives

8.4 PARAGONIX TECHNOLOGIES, INC

8.4.1 Company overview

8.4.2 Product benchmarking

8.4.3 Strategic initiatives

8.5 ESSENTIAL PHARMACEUTICALS LLC

8.5.1 Company overview

8.5.2 Product benchmarking

8.5.3 Strategic initiatives

8.6 BRIDGE TO LIFE LTD.

8.6.1 Company overview

8.6.2 Product benchmarking

8.6.3 Strategic initiatives

8.7 PRESERVATION SOLUTIONS INC

8.7.1 Company overview

8.7.2 Product benchmarking

8.7.3 Strategic initiatives

8.8 ORGAN ASSIST PRODUCTS B.V.

8.8.1 Company overview

8.8.2 Product benchmarking

8.8.3 Strategic initiatives