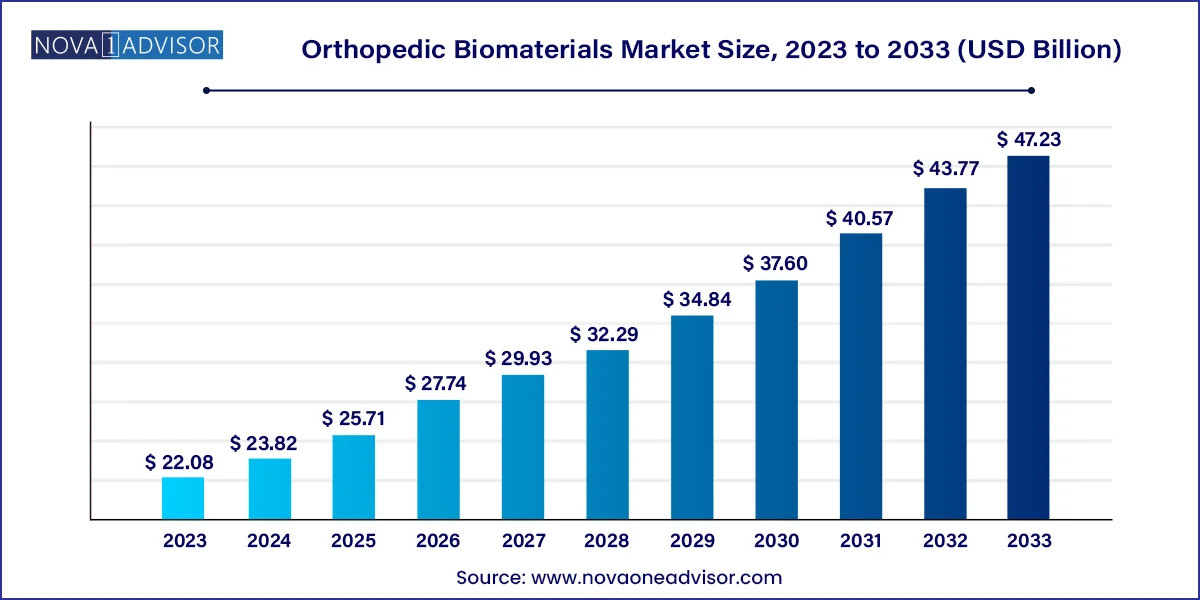

The global orthopedic biomaterials market size was exhibited at USD 19.50 billion in 2023 and is projected to hit around USD 41.71 billion by 2033, growing at a CAGR of 7.9% during the forecast period of 2024 to 2033.

The orthopedic biomaterials market is a vital component of the global medical devices industry, supplying the raw and engineered materials that form the backbone of modern orthopedic treatments. These biomaterials are engineered substances used to repair, replace, or enhance the functionality of bone and joint systems. From total hip arthroplasty to spinal fusion and tissue scaffolds, orthopedic biomaterials provide the essential foundation for innovative solutions in musculoskeletal medicine.

Orthopedic biomaterials include a diverse array of materials such as metals, ceramics, polymers, calcium phosphate cement, and bioactive glasses each tailored to specific biomechanical and biological performance needs. They are integral to orthopedic implants, joint reconstructions, orthobiologics, and tissue fixation systems. With the aging population, rising sports injuries, and growing incidence of degenerative bone conditions like osteoarthritis and osteoporosis, demand for these materials has surged globally.

Technological advancements have also redefined the market. Bioabsorbable polymers, nanostructured ceramics, and composite materials have expanded design possibilities while reducing complications like implant rejection or loosening. Moreover, additive manufacturing (3D printing) is facilitating the production of customized implants with precise biomimetic features. As the focus shifts toward regenerative and minimally invasive orthopedics, biomaterials will remain pivotal in transforming surgical and nonsurgical orthopedic therapies.

Shift Toward Biodegradable and Bioactive Materials: Bio-resorbable polymers and calcium-based cements are increasingly favored in tissue fixation and bone regeneration.

Integration of 3D Printing in Orthopedic Implant Design: Additive manufacturing enables patient-specific implant fabrication and structural optimization using novel biomaterials.

Rise of Nanotechnology in Surface Modification: Nanostructured coatings on metals and ceramics enhance osseointegration and reduce infection rates.

Growing Demand for Smart Biomaterials: Responsive biomaterials that adjust to environmental stimuli (e.g., pH, load, temperature) are gaining interest in orthobiologics.

Increasing Use of Composites in Load-Bearing Applications: Hybrid materials combine the strength of metals with the biocompatibility of ceramics or polymers.

Focus on Sustainable and Cost-Effective Materials: Companies are exploring biodegradable materials to reduce long-term surgical waste and enhance cost-effectiveness.

Regenerative Orthopedics and Stem Cell Compatibility: Biomaterials are being designed to work synergistically with stem cells and growth factors for tissue engineering.

| Report Coverage | Details |

| Market Size in 2024 | USD 19.50 Billion |

| Market Size by 2033 | USD 41.71 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | DSM Biomedical; Evonik Industries AG; Stryker Corp.; DePuy Synthes Inc.; Zimmer Biomet; Invibio Ltd.; Globus Medical; Exactech, Inc.; Matexcel; AdvanSource Biomaterials Corp.; CAM Bioceramics B.V.; Heraeus Holding. |

Two significant dynamics shape the orthopedic biomaterials market. Firstly, the aging population demographic trend is a primary driver. With the global population aging, the prevalence of orthopedic disorders such as osteoarthritis and osteoporosis is increasing, driving the demand for orthopedic interventions. Biomaterials play a critical role in addressing these conditions, offering solutions like joint replacements and bone grafts that enhance mobility and improve quality of life for elderly patients.

Two significant restraints affecting the orthopedic biomaterials market warrant attention. Firstly, regulatory challenges pose a considerable barrier to market entry and product commercialization. The orthopedic biomaterials sector is subject to stringent regulations governing product safety, efficacy, and quality assurance. Navigating these regulatory requirements demands substantial investment in preclinical and clinical studies, as well as rigorous adherence to regulatory standards throughout the product development lifecycle. Additionally, the lengthy approval processes can significantly delay market entry and hinder innovation, particularly for smaller companies with limited resources.

Two notable opportunities exist within the orthopedic biomaterials market. Firstly, the increasing adoption of minimally invasive surgical techniques presents a significant opportunity for biomaterial manufacturers. As surgeons seek to minimize tissue damage and accelerate patient recovery, there is growing demand for biomaterials that facilitate less invasive procedures, such as bioresorbable implants and tissue-engineered scaffolds. These materials offer advantages such as reduced post-operative complications, faster healing times, and improved patient outcomes, driving their adoption in orthopedic surgeries.

Two significant challenges confronting the orthopedic biomaterials market merit attention. Firstly, biocompatibility and material performance remain critical concerns. While biomaterials aim to mimic the properties of natural tissues, ensuring optimal biocompatibility and long-term performance poses challenges. Issues such as material degradation, wear debris, and immune responses can compromise implant functionality and lead to adverse patient outcomes. Overcoming these challenges requires ongoing research and development efforts to identify and develop biomaterials with superior biocompatibility and durability, as well as rigorous testing to assess their safety and efficacy in clinical settings.

Ceramics & bioactive glasses dominate the orthopedic biomaterials segment, especially in applications involving bone integration and joint resurfacing. Hydroxyapatite and tricalcium phosphate ceramics are widely used due to their chemical similarity to natural bone mineral. These materials facilitate bone cell attachment and regeneration, making them ideal for spinal fusion and dental implants. Bioactive glasses, which bond to both bone and soft tissue, are gaining popularity for their antimicrobial and osteoconductive properties. The increasing emphasis on regenerative orthopedics has solidified the importance of ceramics and bioactive glasses in both surgical and non-surgical bone repair.

Polymers are the fastest-growing type, owing to their versatility in orthopedic applications such as joint articulations, bio-resorbable screws, and soft tissue reconstruction. Ultra-high molecular weight polyethylene (UHMWPE) is commonly used in knee and hip replacements for its wear resistance. Emerging bioabsorbable polymers like polylactic acid (PLA) and polyglycolic acid (PGA) are transforming orthopedic fixation by providing structural support and gradually dissolving post-healing. Their role in reducing the need for secondary surgeries makes them highly attractive in both developed and developing healthcare systems.

Orthopedic implants dominate the application segment, accounting for the largest share of biomaterials use. These implants include plates, screws, hip and knee prostheses, and spinal rods, primarily composed of metals, ceramics, and composite coatings. The performance demands in load-bearing applications have spurred innovations in corrosion-resistant titanium alloys, plasma-sprayed hydroxyapatite coatings, and porous metal scaffolds. The orthopedic implant market is mature yet constantly evolving with newer material formulations that enhance implant lifespan and biocompatibility.

Orthobiologics is the fastest-growing application, driven by the rise of regenerative medicine. These include bone grafts, growth factor-enhanced matrices, and bioactive scaffolds derived from or supported by biomaterials. Orthobiologics aim to stimulate the body's healing mechanisms and are increasingly used in trauma, spinal fusion, and sports medicine. The integration of stem cells and biomimetic surfaces in bone scaffolds offers promising results in complex fracture healing and large bone defect repair, making this an exciting frontier in orthopedic care.

North America dominates the global orthopedic biomaterials market, thanks to its advanced healthcare infrastructure, high surgical volume, and presence of leading manufacturers. The U.S. has one of the highest rates of joint replacement procedures globally, supported by favorable reimbursement and a culture of early elective surgery for osteoarthritis. Research funding from institutions like the National Institutes of Health (NIH) and partnerships between academia and medtech companies drive constant material innovation. Furthermore, FDA-approved biomaterial devices often set a global benchmark, strengthening North America's leadership in the market.

Asia-Pacific is the fastest-growing region, fueled by an aging population, rising healthcare expenditure, and expanding orthopedic procedure volumes. China and India are key markets due to their large patient base and increasing focus on healthcare modernization. Government-led initiatives to boost domestic medical device manufacturing and regulatory reforms are supporting faster adoption of orthopedic implants and biomaterials. Additionally, Asia-Pacific serves as a manufacturing hub for biomaterial components, further strengthening its growth outlook.

Stryker Corporation (April 2025): Introduced a new line of 3D-printed orthopedic implants using titanium composite coatings to enhance osseointegration and reduce micromotion in hip replacements.

Zimmer Biomet (March 2025): Announced clinical trials of a novel bio-resorbable polymer screw for use in anterior cruciate ligament (ACL) reconstruction procedures.

Smith & Nephew (February 2025): Launched a calcium phosphate cement product designed for minimally invasive vertebral compression fracture repairs.

Medtronic (January 2025): Partnered with a regenerative medicine startup to co-develop nanostructured collagen scaffolds for spinal fusion applications.

DePuy Synthes (December 2024): Expanded its advanced ceramics portfolio with a new alumina-zirconia composite designed for long-term wear performance in knee arthroplasty.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global orthopedic biomaterials market.

Type

Application

By Region