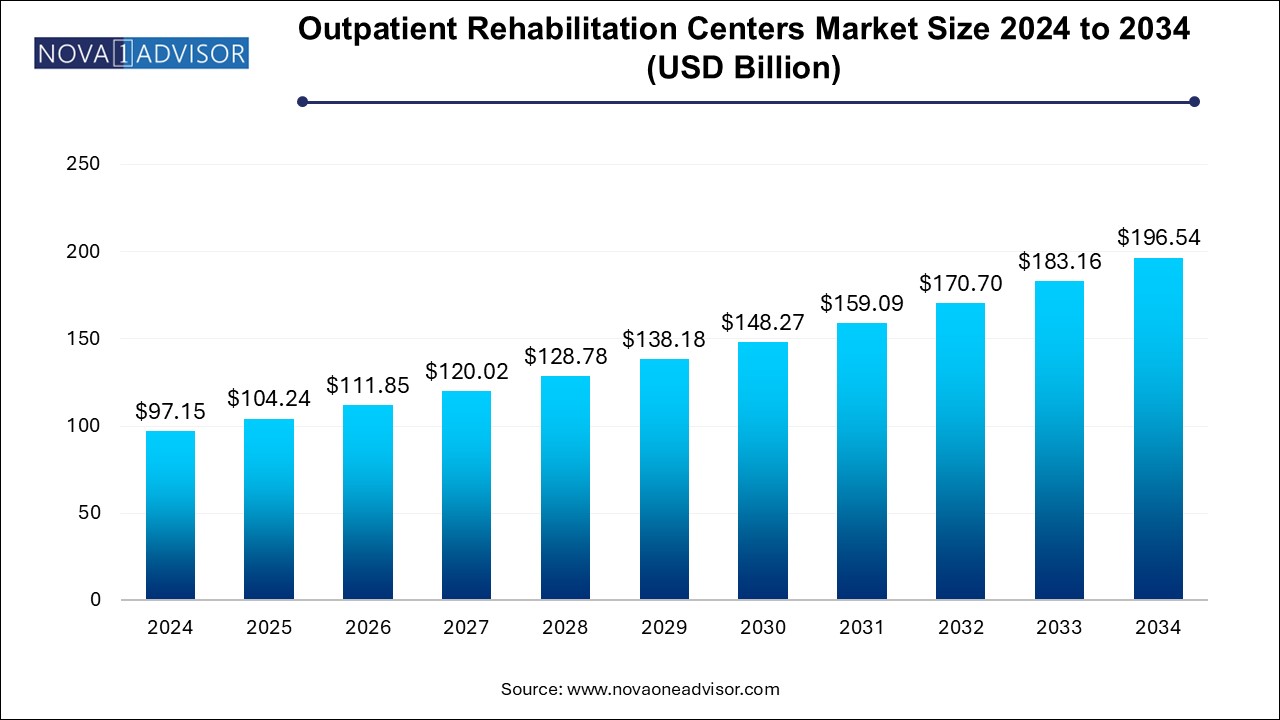

The outpatient rehabilitation centers market size was exhibited at USD 97.15 billion in 2024 and is projected to hit around USD 196.54 billion by 2034, growing at a CAGR of 7.3% during the forecast period 2025 to 2034.

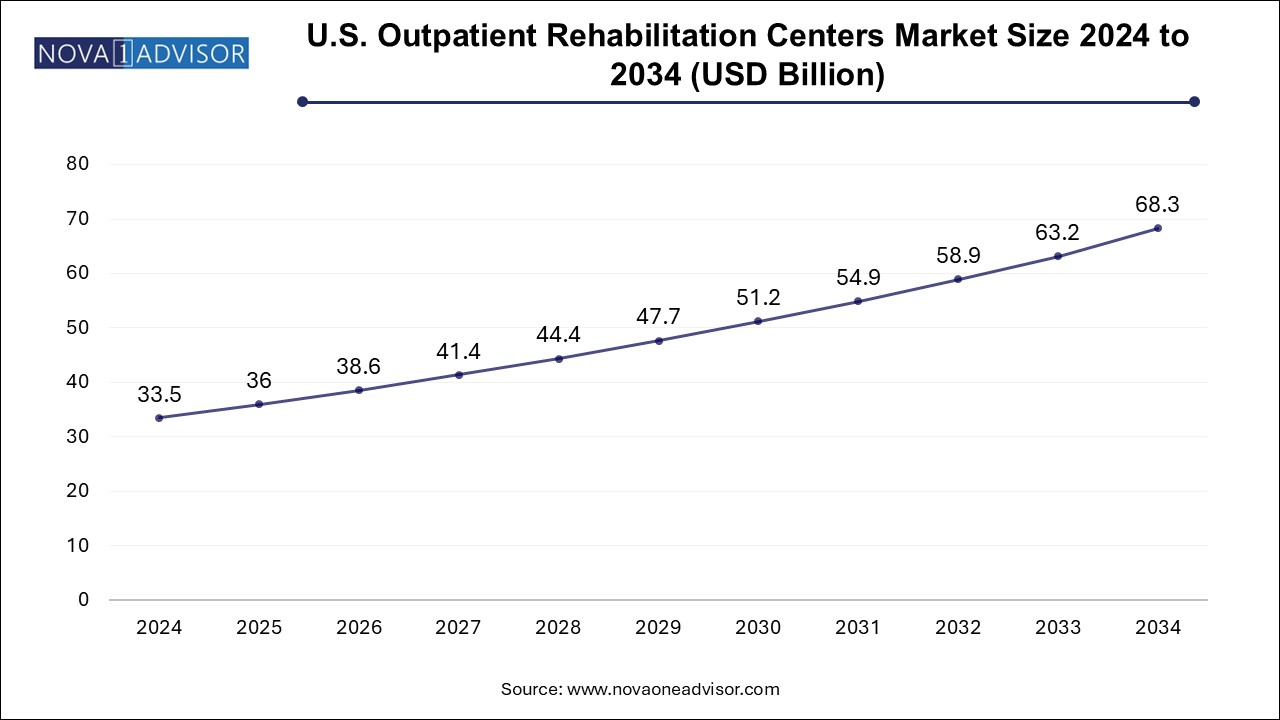

The U.S. outpatient rehabilitation centers market size is evaluated at USD 33.5 billion in 2024 and is projected to be worth around USD 68.3 billion by 2034, growing at a CAGR of 6.69% from 2025 to 2034.

The North America holds the largest share in the global outpatient rehabilitation centers market, underpinned by a strong healthcare infrastructure, high public awareness, and advanced therapeutic techniques. The United States accounts for the majority of this market, owing to the presence of large rehabilitation chains, robust insurance coverage, and government initiatives promoting community-based care. Medicare and private insurers offer reimbursement for outpatient rehab services, especially for post-stroke, orthopedic, and cardiac recovery.

In addition, the U.S. opioid crisis has spurred significant investment in outpatient addiction treatment programs, contributing to growth in behavioral therapy segments. Canada, too, has seen growing outpatient rehab networks integrated into public health models. The adoption of tele-rehab in rural areas across North America has further extended access and scalability, reinforcing regional dominance.

Asia Pacific is projected to experience the fastest growth during the forecast period, fueled by increasing healthcare investment, rising awareness, and the emergence of private rehabilitation providers. Countries such as India, China, and Japan are seeing a growing burden of chronic diseases, traffic-related injuries, and aging-related mobility issues. Urbanization and lifestyle changes have also led to a surge in musculoskeletal and neurological disorders.

Governments and private stakeholders are working to build outpatient rehab centers within public hospitals and standalone clinics. The expansion of health insurance coverage and telemedicine regulations is supporting outpatient therapy services. Moreover, the proliferation of mobile health (mHealth) apps, wearable fitness devices, and remote monitoring solutions is enabling outpatient care to reach previously underserved populations in the region.

The Outpatient Rehabilitation Centers Market is gaining significant traction worldwide as healthcare systems increasingly shift from inpatient to community-based care models. Outpatient rehabilitation centers provide a cost-effective and flexible alternative to hospital-based rehabilitation by offering services such as physical therapy, speech therapy, occupational therapy, cognitive rehabilitation, and substance abuse treatment. These centers cater to patients recovering from surgery, injuries, neurological disorders, chronic pain, speech difficulties, and mental health conditions, allowing them to receive specialized therapies without the need for overnight hospitalization.

Driven by an aging global population, rising incidences of chronic conditions such as stroke and arthritis, increasing sports-related injuries, and substance use disorders, outpatient rehabilitation centers are emerging as vital pillars of modern healthcare. Patients and payers alike are recognizing the clinical and economic advantages of outpatient models, which promote faster recovery, reduce hospital readmissions, and offer greater accessibility. As healthcare policies continue to emphasize value-based care, outpatient rehabilitation services are well-positioned to see sustained growth through 2034.

Moreover, advancements in therapeutic techniques, tele-rehabilitation platforms, and personalized care plans are enhancing the quality of services delivered in these facilities. Countries across North America, Europe, and Asia Pacific are witnessing a surge in rehabilitation center openings, both in urban and suburban areas, to meet the growing demand. The market is also evolving in terms of integrated services, where multidisciplinary teams collaborate to treat complex patient needs under a unified outpatient framework.

Rising Demand for Multidisciplinary Rehabilitation Approaches in Outpatient Settings

Increased Integration of Tele-rehabilitation and Remote Monitoring Technologies

Growing Focus on Neurological and Cognitive Rehabilitation for Post-Stroke and Dementia Patients

Surge in Demand for Substance Use Rehabilitation Amid Mental Health Crisis

Technological Advancements in Motion Tracking, Biofeedback, and Virtual Reality-Based Therapies

Expansion of Geriatric-Focused Rehabilitation Services for Age-Related Conditions

Proliferation of Ambulatory Care Networks Incorporating Specialized Rehab Units

Healthcare Reimbursement Models Supporting Preventive and Outpatient Therapies

Growing Collaboration Between Public Health Authorities and Private Rehab Chains

Shift Toward Personalized Treatment Plans with Data-Driven Outcome Measurement

| Report Coverage | Details |

| Market Size in 2025 | USD 104.24 Billion |

| Market Size by 2034 | USD 196.54 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.3% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Therapy, Age, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Icahn School of Medicine at Mount Sinai; UAB Health System; Nanz medico GmbH & Co. KG; Beijing United Family Rehabilitation Hospital (BJURH); CMRC; Lovelace Health System; KIMSHEALTH TRIVANDRUM; Unity Health Toronto.; Baylor Scott & White Institute for Rehabilitation; Select Medical Corporation; Northern Colorado Rehabilitation Hospital |

A key driver fueling the outpatient rehabilitation centers market is the global aging population and the rising burden of chronic diseases. As life expectancy increases, so does the prevalence of age-associated conditions such as stroke, osteoarthritis, Parkinson’s disease, and cardiac disorders—many of which require long-term rehabilitative care. Elderly individuals recovering from surgeries like hip replacements or cardiovascular events often prefer outpatient services for their flexibility, continuity of care, and minimal disruption to daily life.

According to the World Health Organization, by 2030, 1 in 6 people globally will be aged 60 or older. This demographic trend is especially pronounced in developed regions like North America and Europe, where outpatient rehabilitation centers are being specifically tailored to meet geriatric care needs. These facilities offer targeted therapies to enhance mobility, reduce fall risk, manage chronic pain, and promote independence. As preventive healthcare gains prominence, outpatient rehabilitation plays a critical role in maintaining quality of life for aging populations.

Despite the growing demand, a significant challenge for the outpatient rehabilitation centers market is the shortage of qualified therapists and uneven geographic distribution of facilities. There is a global dearth of licensed physical therapists, occupational therapists, speech-language pathologists, and behavioral therapists, particularly in low-income and rural regions. These shortages lead to long wait times, limited service hours, and burnout among existing staff.

Additionally, many rural and remote communities lack adequate outpatient rehabilitation infrastructure. Patients in these areas often face transportation challenges, reduced availability of specialized therapy programs, and limited insurance coverage, deterring them from accessing essential rehabilitative care. While tele-rehabilitation has emerged as a solution, its implementation is hindered by digital literacy gaps and unreliable internet connectivity in underserved areas. These access and capacity barriers hinder the full-scale adoption of outpatient rehabilitation, especially in developing economies.

A transformative opportunity for the outpatient rehabilitation market lies in the growing adoption of tele-rehabilitation and home-based rehabilitation services. The COVID-19 pandemic significantly accelerated digital transformation in healthcare, prompting providers to invest in remote rehabilitation platforms. These technologies allow patients to engage in guided therapy sessions from their homes using video conferencing, motion sensors, wearable devices, and AI-based assessment tools.

Tele-rehab solutions are particularly effective for patients with mobility issues, post-surgical needs, or those living in remote locations. In neurological rehabilitation, virtual reality and gamified applications have shown promising results in enhancing cognitive and motor skills recovery. Healthcare providers are increasingly offering hybrid care models where initial assessment and follow-ups are conducted in person, while maintenance sessions are held virtually. With increasing reimbursement support, improved technology access, and growing patient preference for at-home care, tele-rehabilitation is set to become a major growth driver.

The Physical therapy remains the dominant segment in the outpatient rehabilitation centers market, driven by its wide application across orthopedic, neurological, post-operative, and sports injury rehabilitation. Patients recovering from musculoskeletal injuries, joint replacements, spinal surgeries, or stroke commonly undergo structured physical therapy to restore strength, flexibility, and mobility. These services form the backbone of most outpatient rehab programs, especially for adults and elderly populations.

Meanwhile, neurological therapy is witnessing the fastest growth, owing to increased diagnosis of stroke, Parkinson’s disease, multiple sclerosis, and traumatic brain injuries. Outpatient neuro-rehabilitation programs now include specialized therapists, robotic-assisted equipment, and cognitive retraining modules to support both motor and mental recovery. As awareness of neuroplasticity grows, early and intensive outpatient rehabilitation is becoming a preferred approach, particularly for stroke survivors seeking to regain independence.

The Adults form the largest consumer base for outpatient rehabilitation services. This age group frequently accesses rehab centers for musculoskeletal injuries, back pain, repetitive strain injuries, sports-related trauma, and recovery from surgeries. Working-age individuals prefer outpatient services as they offer flexible scheduling and minimal disruption to work and lifestyle.

The elderly segment, however, is the fastest-growing. With aging comes increased risk of falls, fractures, joint degeneration, and chronic conditions like arthritis and Alzheimer's. Outpatient rehab centers are increasingly designing geriatric-specific programs with fall prevention training, low-impact exercise regimens, and memory rehabilitation sessions. The elderly also benefit from interdisciplinary approaches that combine physical therapy with cognitive and behavioral interventions. This demographic shift will significantly boost demand in the coming decade.

March 2025: ATI Physical Therapy, a major U.S.-based provider, announced a strategic partnership with tele-rehab startup RehabNow to integrate virtual rehab sessions into its outpatient programs, focusing on rural and underserved communities.

February 2025: Kindred Healthcare expanded its outpatient neurological rehabilitation services in Florida by opening four new specialty centers equipped with AI-driven gait training and cognitive therapy units.

January 2025: Banyan Treatment Centers launched a new outpatient substance use rehabilitation campus in Texas to meet rising demand for mental health and addiction services among young adults.

December 2024: In India, Apollo Hospitals launched its first outpatient rehab center focused on orthopedic and geriatric care, aiming to roll out similar facilities across tier-2 cities by 2026.

November 2024: Upstream Rehabilitation, one of the largest outpatient rehab groups in the U.S., acquired Rehab Associates of Central Virginia, expanding its footprint in the mid-Atlantic region with over 20 additional clinics.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the outpatient rehabilitation centers market

By Therapy

By Age

By Regional