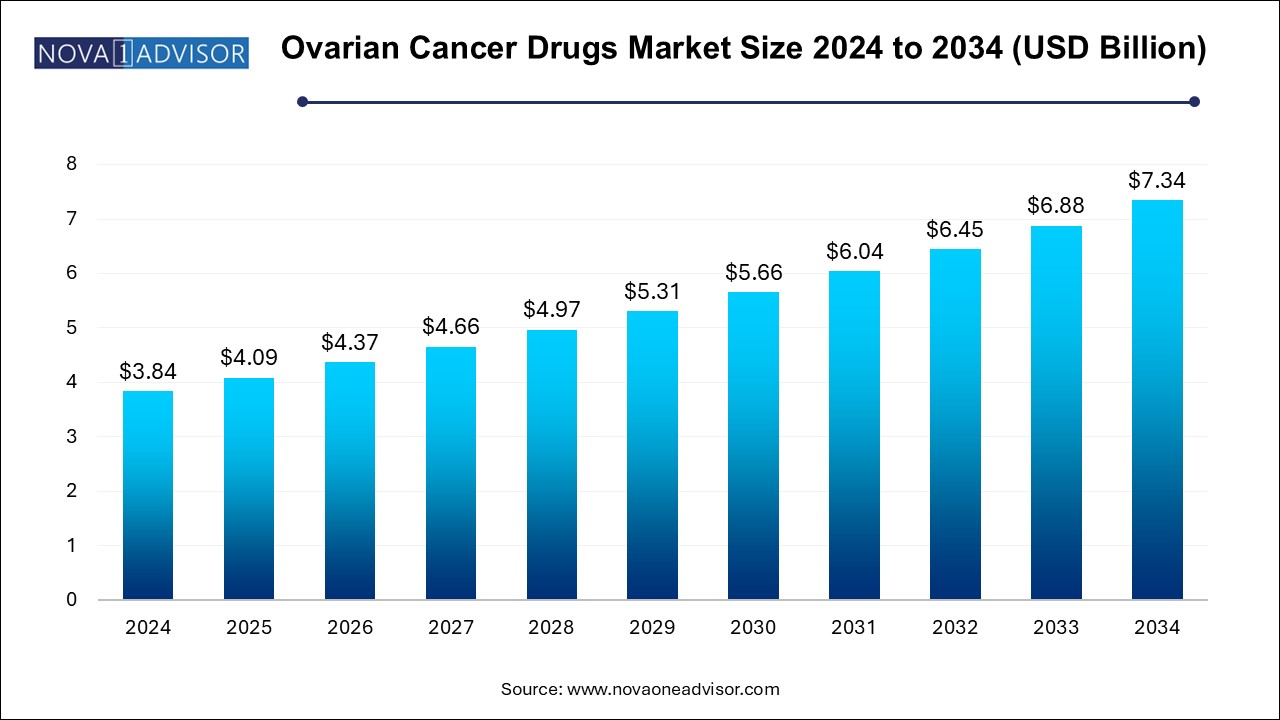

The ovarian cancer drugs market size was exhibited at USD 3.84 billion in 2024 and is projected to hit around USD 7.34 billion by 2034, growing at a CAGR of 6.7% during the forecast period 2025 to 2034.

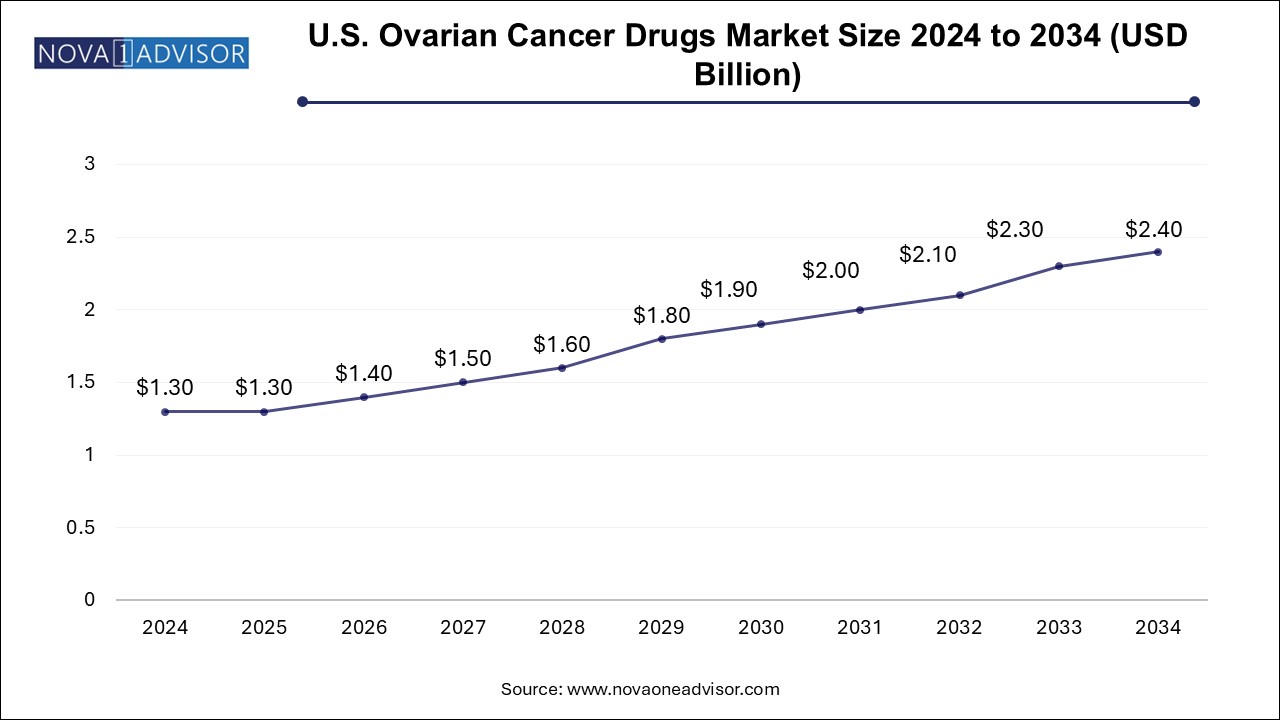

The U.S. ovarian cancer drugs market size is evaluated at USD 1.3 billion in 2024 and is projected to be worth around USD 2.4 billion by 2034, growing at a CAGR of 5.73% from 2025 to 2034.

North America dominated the market and accounted for the largest revenue share of 44.0% in 2024. The region has a well-developed healthcare infrastructure and advanced medical facilities, which facilitate early diagnosis and treatment of ovarian cancer. The increasing awareness among patients has led to increased screening and detection rates. Additionally, North America is home to many pharmaceutical companies, research institutions, and academic centers focusing on developing innovative cancer treatments. According to the American Cancer Society, ovarian cancer ranks fifth in cancer death among women. Additionally, it is the deadliest of all gynecologic malignancies. In 2023, 19,710 women were diagnosed with ovarian cancer, and 13,270 deaths were reported in the U.S.

Asia Pacific is expected to grow at the fastest CAGR of 8.0% during the forecast period. The growth over the forecast period can be attributed to the large population and the increasing prevalence of ovarian cancer in Asian countries. This rising prevalence of ovarian cancer creates a substantial patient pool and drives the demand for effective treatment options, thus contributing to market growth. Furthermore, an increasing focus on healthcare infrastructure development in the Asia Pacific region fuels the demand for ovarian cancer drugs and drives the market growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.09 Billion |

| Market Size by 2034 | USD 7.34 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Therapeutic Class, Treatment, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | AbbVie Inc.; Pfizer, Inc., AstraZeneca; F. Hoffmann-La Roche AG; Johnson & Johnson Services, Inc.; Boehringer Ingelheim International GmbH; Clovis Oncology; ImmunoGen, Inc.; Vivesto AB |

Among the major drug classes, PARP inhibitors contributed to the majority of the market share in 2024, supported by continued uptake of approved drugs and superior efficacy. The surging uptake of checkpoint inhibitors is also projected to benefit the growth of the market. Current research in ovarian cancer is focused on using novel treatments such as immunotherapy, targeted therapy, and, most importantly, combination regimens. Immuno-oncologic agents have shown promising results with improved survival and lower toxicity.

However, a single-agent response rate of PD-1/ PD-L1 molecules such as Opdivo and Keytruda for ovarian cancer treatment is less than 20.0%. Combination therapies, specifically checkpoint inhibitors, are poised to be introduced in the first-line setting to target major unmet needs, including overcoming tumor resistance, improving progression-free survival, and maintaining the quality of life.

The targeted therapy segment held the largest revenue share in 2024. Targeted therapies are designed to specifically identify and attack cancer cells while sparing healthy cells, resulting in more effective treatment with fewer side effects. In ovarian cancer, targeted therapies aim to inhibit specific molecular targets that drive the growth of cancer cells. Bevacizumab, an angiogenesis inhibitor administered to patients with ovarian cancer as targeted therapy, is proven to shrink and slow the growth of advanced epithelial ovarian cancers.

The radiation therapy segment is expected to grow at the fastest CAGR over the forecast period. Radiation therapy utilizes high-energy X-rays to kill cancer cells. It is a painless procedure that only targets the area affected by the cancer. Radiation therapy is beneficial in treating areas where cancer has spread, either close to the primary tumor or in another organ, such as the spinal cord and brain. External beam radiation therapy and brachytherapy are the most common radiation therapy administered to women with ovarian cancer.

The hospital pharmacy segment accounted for the largest revenue share of around 46.0% in 2024. The dominance of the segment is attributed to the fact that hospital pharmacies ensure timely access to necessary drugs for patients undergoing ovarian cancer treatment, which is essential for their care. Furthermore, patients who are diagnosed and treated for ovarian cancer in hospitals have increased trust in these hospital pharmacies contributing to the growth of the segment.

The online pharmacy material segment is estimated to register the fastest CAGR of 8.1% over the forecast period. These digital pharmacies provide convenient access to a wide range of medications, including drugs used in the treatment of ovarian cancer. Online pharmacies offer patients the convenience of ordering their prescribed medications from the comfort of their homes, eliminating the need for physical visits, therefore, attributing to the growth over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the ovarian cancer drugs market

By Therapeutic Class

By End-use

By Treatment

By Regional