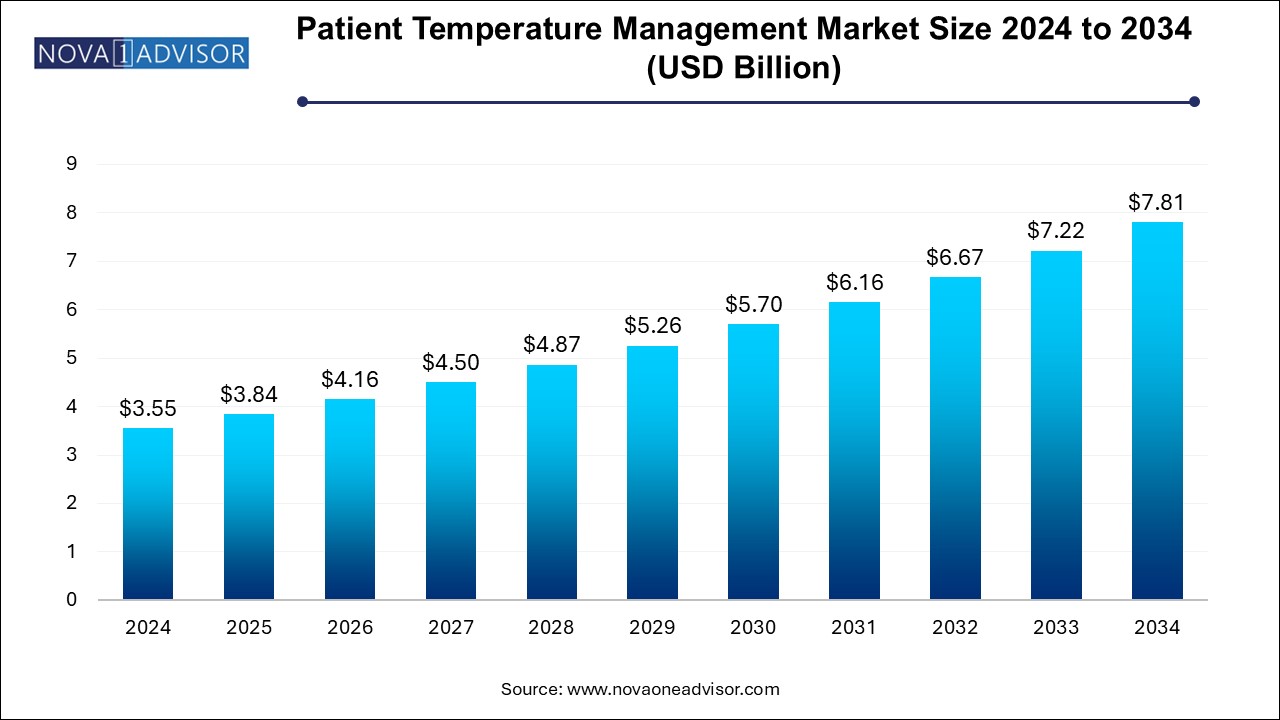

The patient temperature management market size was exhibited at USD 3.55 billion in 2024 and is projected to hit around USD 7.81 billion by 2034, growing at a CAGR of 8.2% during the forecast period 2024 to 2034.

The patient temperature management market is a dynamic segment within the broader field of medical devices, focusing on technologies that regulate body temperature during critical medical interventions. Patient temperature management is essential for optimizing surgical outcomes, managing post-operative recovery, preventing complications in intensive care, and supporting neonates and patients with neurological trauma. Hypothermia or hyperthermia during clinical procedures can significantly impact mortality and morbidity rates, making precise temperature control a vital element of modern healthcare.

In clinical settings such as operating rooms (ORs), intensive care units (ICUs), and emergency departments, patient temperature management systems are employed to maintain normothermia (normal body temperature), prevent perioperative hypothermia, and induce therapeutic hypothermia when necessary. These systems include warming devices (blankets, mattresses, fluids, and devices) and cooling systems that utilize surface or intravascular approaches to regulate core body temperature. Whether treating cardiac arrest patients with therapeutic hypothermia or warming neonates in critical care, these devices enhance clinical outcomes, reduce infections, and lower recovery times.

As surgical volumes, chronic diseases, and aging populations increase worldwide, the demand for precise thermal management is growing rapidly. Advancements in medical technologies have enabled more compact, efficient, and automated devices capable of integrating with broader patient monitoring systems. Furthermore, global health protocols and clinical guidelines are increasingly advocating for strict temperature control, making this market one of strategic importance across surgical, emergency, and critical care domains.

Increased focus on perioperative normothermia, especially in orthopedic, cardiac, and general surgeries.

Growing adoption of intravascular temperature management systems in critical care settings for faster and more precise control.

Rising integration of temperature regulation with ICU and OR monitoring systems, enhancing automation and clinical efficiency.

Expansion of neonatal temperature management solutions, especially in low-resource settings through innovations in portable warmers.

Development of closed-loop systems that automate cooling and warming based on continuous patient feedback.

Technological innovations in surface temperature management, including wearable warming blankets and smart gels.

Growth in patient-centric care models, increasing outpatient and pre/post-operative usage of compact warming systems.

Focus on sustainability and disposable warming accessories, reducing cross-contamination and waste.

Rise in therapeutic hypothermia applications, particularly in neurological emergencies such as stroke and traumatic brain injury (TBI).

| Report Coverage | Details |

| Market Size in 2025 | USD 3.84 Billion |

| Market Size by 2034 | USD 7.81 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 8.2% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Stryker Corporation; Medtronic; ZOLL Medical Corporation; Bard Medical, Inc.; Cincinnati Sub-Zero Products, LLC; 3M Company; Geratherm Medical AG; The 37Company; Inditherm Plc; Atom Medical Corporation |

A primary market driver is the growing number of surgical procedures worldwide, which is increasing the demand for intraoperative and postoperative temperature regulation. Hypothermia is a common risk during surgery due to anesthesia’s effect on thermoregulation, which can lead to complications such as increased blood loss, wound infections, prolonged hospital stays, and delayed recovery. To mitigate these risks, healthcare providers are investing in advanced warming systems that ensure stable patient body temperatures throughout the surgical continuum.

For example, in orthopedic and cardiovascular surgeries, maintaining normothermia can significantly impact clinical outcomes. Hospitals are now mandating warming protocols using surface or convective warming blankets in both preoperative and intraoperative environments. The adoption of guidelines from organizations such as the National Institute for Health and Care Excellence (NICE) and the American Society of Anesthesiologists (ASA) has further solidified the importance of patient temperature management as a clinical standard, boosting market adoption.

A key market restraint is the high cost associated with advanced patient temperature management systems, which can hinder their adoption in smaller hospitals and emerging economies. While larger tertiary and academic medical centers in developed nations are equipped with state-of-the-art temperature regulation systems, many facilities in low- and middle-income countries (LMICs) face limitations in capital expenditure, skilled personnel, and infrastructure required to deploy and maintain such equipment.

For instance, intravascular systems, though highly effective, demand specialized catheters, sterile environments, and trained technicians, making them less feasible in resource-limited settings. The recurring cost of disposables and consumables further contributes to budgetary strain. This disparity in access to advanced care modalities restricts overall market growth and widens the gap in patient outcomes across regions. Market players must focus on cost-optimization, scalable technologies, and mobile platforms to address this challenge effectively.

A significant opportunity in the patient temperature management market lies in the integration of artificial intelligence (AI), machine learning, and automated monitoring systems. These innovations allow for real-time feedback and closed-loop thermal regulation, improving precision, reducing human error, and enhancing patient safety.

Smart systems that adjust heating or cooling parameters based on continuous feedback from core temperature sensors can be particularly impactful in neonatal and neurological care. AI-driven systems can also predict hypothermic or hyperthermic events, allowing for proactive intervention. This is especially relevant in ICUs, where multiple variables must be managed simultaneously. Companies that leverage AI for patient-centric, automated temperature control will not only improve clinical efficiency but also gain a competitive edge in this rapidly evolving market.

The patient warming systems led the market with the largest revenue share of 72.2% in 2024, Driven by their widespread application in surgical, post-operative, and neonatal care. Conventional and surface warming systems—such as forced air warming blankets, electric warming pads, and fluid warmers—are standard across operating rooms. Their adoption is reinforced by strong clinical evidence that perioperative warming reduces surgical site infections and improves recovery. Surface warming systems, in particular, are user-friendly and cost-effective, contributing to high market penetration across hospital sizes and geographic regions.

The patient cooling systems are expected to witness at a promising CAGR during the forecast period. Intravascular cooling, which involves circulating cooled saline through catheters, enables rapid and controlled hypothermia induction, particularly for post-cardiac arrest patients. Surface cooling systems like cooling pads and ice packs are being upgraded with automated thermostats and integrated feedback mechanisms. As therapeutic hypothermia gains traction for stroke, TBI, and cardiac procedures, cooling systems are expected to see accelerated adoption in ICUs and emergency departments globally.

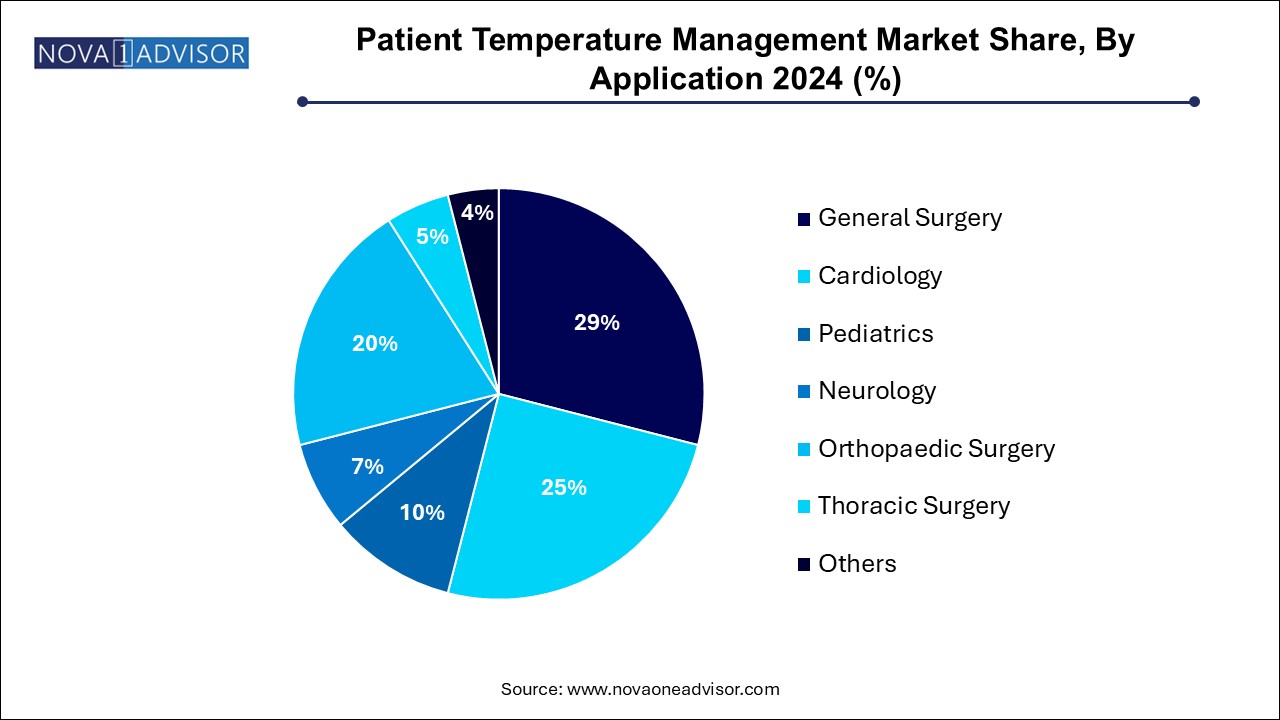

Based on application, the general surgery segment led the market with the largest revenue share of 29.0% in 2024 and is anticipated to grow at the fastest CAGR of 8.1% over the forecast period. Most surgical disciplines now consider temperature management as part of standard perioperative care, especially for prolonged surgeries and those with high blood loss risk. Pre-warming protocols, intraoperative warming pads, and fluid warmers are commonly used in abdominal, orthopedic, and urological procedures to maintain normothermia and reduce complications.

Neurology and cardiology are the fastest growing applications, driven by increased recognition of the benefits of targeted temperature management (TTM). Cooling is used therapeutically to reduce cerebral metabolic demand and limit brain damage in ischemic and traumatic injuries. Similarly, post-cardiac arrest patients benefit from controlled hypothermia to minimize reperfusion injuries. Hospitals specializing in stroke and cardiac care are investing in intravascular and surface cooling systems to improve patient outcomes, thereby expanding the application of temperature management beyond surgical wards.

Based on end use, the operating room segment led the market with the largest revenue share of 20.7% in 2024 and is expected to witness at the fastest CAGR of 7.7% during the forecast period. Here, temperature management devices help reduce intraoperative hypothermia and are integrated into anesthesia and surgical protocols. ORs in developed countries are increasingly using temperature monitoring sensors and warming devices in tandem with anesthetic systems to ensure patient safety.

ICUs and emergency rooms are the fastest growing end-users, reflecting broader use of cooling systems for acute interventions. In ICUs, particularly in cardiology and neurology units, temperature control is a crucial part of post-resuscitation care. Emergency rooms are adopting mobile, quick-deploy warming systems for trauma patients, neonates, and hypothermic individuals. Furthermore, advancements in wearable and portable warming blankets are supporting temperature regulation in ambulance and pre-hospital care settings.

North America leads the global patient temperature management market, backed by a mature healthcare infrastructure, high surgical volume, and favorable reimbursement policies. The United States, in particular, has made intraoperative warming and ICU-based cooling systems a standard part of patient care, with strong guidelines from regulatory and medical bodies. Key players such as 3M, Stryker, and Cincinnati Sub-Zero have strong operational bases in the region, enabling rapid adoption of advanced technologies.

Moreover, the high prevalence of cardiovascular surgeries, cancer procedures, and neonatal care units contributes to sustained product demand. Research funding and the presence of academic hospitals further drive innovation in AI-integrated and minimally invasive temperature regulation systems.

Asia Pacific is the fastest growing regional market, fueled by rising surgical volumes, improving hospital infrastructure, and increasing awareness of advanced post-operative care. Countries like China, India, South Korea, and Japan are rapidly scaling up their critical care and surgical capabilities. As governments invest in universal healthcare and hospital modernization, demand for patient warming and cooling systems is gaining traction.

Multinational companies are expanding into Asia through local partnerships, product localization, and training initiatives. Additionally, the rising birth rate and neonatal ICU admissions are driving demand for advanced warming technologies. Asia Pacific’s large patient base, coupled with improving reimbursement policies, presents immense growth potential for both local and global players.

February 2025 – Stryker Corporation unveiled a next-gen patient warming system with integrated temperature monitoring and AI-based predictive analytics, enhancing safety in orthopedic and cardiovascular surgeries.

November 2024 – 3M Healthcare expanded its Bair Hugger line of forced-air warming devices with new features optimized for outpatient surgical centers.

August 2024 – Inspiration Healthcare Group launched a portable neonatal warming device tailored for rural and low-resource settings, in collaboration with UNICEF.

June 2024 – ZOLL Medical Corporation received FDA clearance for its new intravascular temperature management system used in stroke and cardiac arrest patients.

April 2024 – Medtronic plc partnered with a German startup to integrate closed-loop cooling systems into its neurocritical care equipment portfolio.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the patient temperature management market

By Product

By Application

By End-use

By Regional