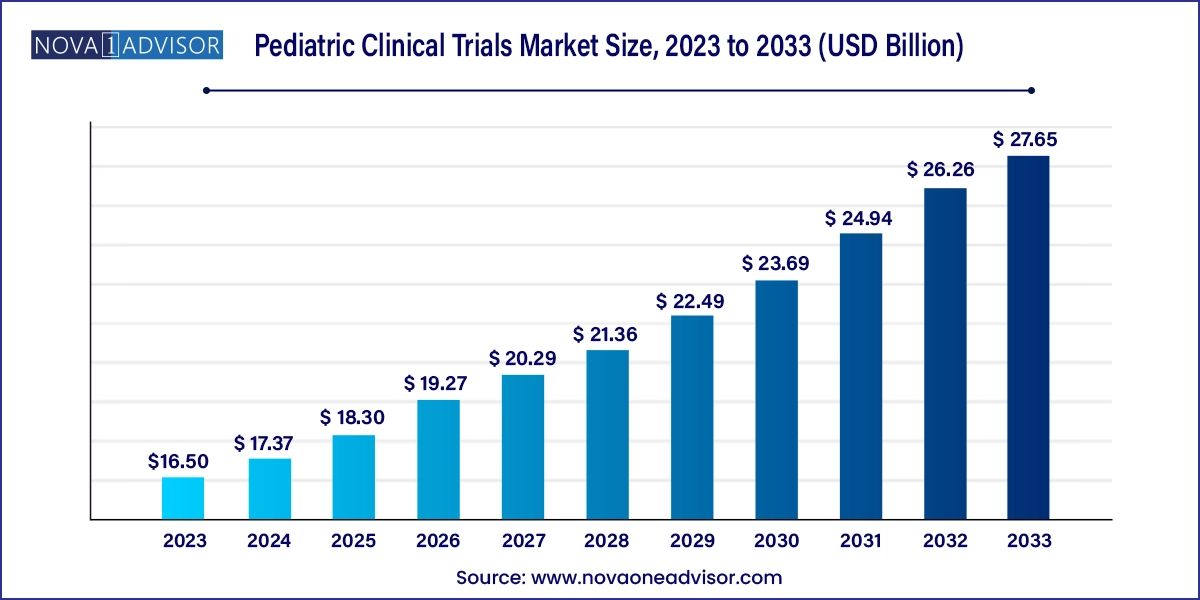

The pediatric clinical trials market size was exhibited at USD 16.50 billion in 2023 and is projected to hit around USD 27.65 billion by 2033, growing at a CAGR of 5.3% during the forecast period 2024 to 2033.

The Pediatric Clinical Trials Market has grown significantly in recent years, emerging as a vital segment of global clinical research. Unlike adult trials, pediatric clinical studies are designed specifically to assess the safety, efficacy, and appropriate dosing of pharmaceuticals and medical interventions in neonates, infants, children, and adolescents. This market addresses a critical unmet need: historically, a significant number of drugs approved for adult use were either not tested in pediatric populations or lacked pediatric-specific labeling, leading to off-label usage and uncertain outcomes in children.

Globally, pediatric clinical trials encompass diverse therapeutic areas ranging from oncology, infectious diseases, and rare genetic conditions to mental health disorders and respiratory illnesses. With increasing awareness of pediatric pharmacology and stronger regulatory mandates—such as the U.S. Pediatric Research Equity Act (PREA) and the European Union Pediatric Regulation—pharmaceutical companies and CROs are being compelled to include pediatric populations in their drug development pipelines.

Despite operational and ethical complexities, including consent issues, smaller sample sizes, and longer recruitment timelines, the pediatric trial ecosystem is evolving. Technological advancements in decentralized trials, electronic health records (EHRs), wearable monitoring, and real-world data integration are reshaping how pediatric trials are designed and executed. Governments, academic centers, and advocacy groups are also playing a key role in funding and facilitating pediatric research, especially for rare and orphan diseases that disproportionately affect children.

As innovations in precision medicine, immunotherapies, and gene editing expand, so too does the need for rigorous pediatric testing. The next decade will likely witness significant growth in pediatric clinical trials, fueled by supportive policy landscapes, public-private partnerships, and increased industry commitment to pediatric health.

Shift Toward Adaptive and Decentralized Trial Designs: Virtual and hybrid models are becoming more common in pediatric trials, especially in rare disease research, to overcome geographic and logistical barriers.

Increased Regulatory Enforcement and Incentives: Agencies like the FDA and EMA are pushing for greater pediatric inclusion in trials via mandates and exclusivity incentives.

Growth in Orphan and Rare Pediatric Indications: Many pediatric trials now target rare genetic conditions such as spinal muscular atrophy and Duchenne muscular dystrophy, supported by orphan drug policies.

Rise of Pediatric Oncology Trials: New immunotherapies and targeted cancer treatments are being trialed in children earlier in the drug development process.

Digital Recruitment and Engagement Platforms: AI-driven recruitment platforms are being used to identify eligible pediatric participants from EHR databases more efficiently.

Use of Wearable Devices for Monitoring: Non-invasive, continuous monitoring tools are gaining traction for real-time safety and efficacy data collection.

Focus on Neurodevelopmental and Mental Health Disorders: A growing number of pediatric trials are targeting autism, ADHD, and pediatric depression as awareness increases.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.37 Billion |

| Market Size by 2033 | USD 27.65 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Phase, Study Design, Therapeutic Areas, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | Synteract; ICON plc; Syneos Health; Medpace, Inc.; PPD Inc.; Premier Research; LabCorp Drug Development; QPS Holdings; Pfizer Inc.; The Emmes Company, LLC; IQVIA Inc. |

A key driver of growth in the pediatric clinical trials market is the increasingly stringent regulatory requirements for pediatric data in drug approval processes. Agencies like the U.S. FDA and the European Medicines Agency (EMA) now mandate pediatric clinical trial data for many drugs intended for use in children. In the U.S., the Pediatric Research Equity Act (PREA) requires that companies include pediatric assessments in their new drug applications unless a waiver is granted. Similarly, the Best Pharmaceuticals for Children Act (BPCA) offers incentives such as extended market exclusivity to sponsors who voluntarily conduct pediatric studies.

In Europe, the EMA’s Pediatric Regulation requires companies to submit a Pediatric Investigation Plan (PIP) early in drug development. These regulations ensure that children are not left behind in therapeutic innovation and that drugs are tested appropriately in pediatric populations before they are widely prescribed. These mandates have increased trial volumes and expanded the role of pediatric clinical research in the overall biopharmaceutical R&D ecosystem.

A significant challenge limiting the growth of the pediatric clinical trials market is the complex ethical and operational framework involved in conducting trials involving children. Recruiting pediatric participants is inherently more difficult due to the need for parental consent and, in many cases, assent from the child. These added layers of consent and oversight extend recruitment timelines and complicate trial design.

Operationally, designing age-appropriate protocols, dosage formulations, and endpoints can be resource-intensive. Children have different pharmacokinetics and metabolism profiles compared to adults, requiring tailored study arms. Moreover, pediatric populations are typically smaller and more geographically dispersed, particularly for rare diseases, making multicenter collaboration essential but logistically complex. These factors increase costs, regulatory burden, and development timelines, leading some sponsors to delay or deprioritize pediatric research.

The development of novel therapies for rare pediatric diseases presents a significant opportunity for growth in the pediatric clinical trials market. With over 7,000 identified rare diseases—many of which manifest in childhood—there is an urgent demand for safe and effective pediatric treatments. The rise of gene therapies, enzyme replacement therapies, and mRNA technologies has opened new possibilities for targeting conditions previously considered untreatable.

For instance, treatments like Zolgensma for spinal muscular atrophy and Luxturna for inherited retinal disease have demonstrated the viability of advanced therapies in children. The Orphan Drug Act and similar legislation in Europe incentivize the development of treatments for these small populations, creating favorable economics for drug developers. As technology enables more precise targeting of pediatric conditions at the genetic and molecular levels, sponsors are increasingly investing in early pediatric trials to capture first-mover advantage and address unmet needs.

Phase III clinical trials dominate the pediatric trials market, primarily due to their pivotal role in confirming drug efficacy and safety before regulatory approval. These large-scale, multi-center trials often involve hundreds of pediatric participants and are designed to gather statistically significant data on outcomes. Because pediatric patients respond differently to medications, Phase III trials are essential to fine-tune dosing, assess long-term safety, and test drug interactions across various age groups.

Many regulatory bodies require robust Phase III data for pediatric labeling. In therapeutic areas like oncology, metabolic disorders, and infectious diseases, Phase III trials help validate early-stage findings and form the backbone of FDA and EMA submission packages. These trials are typically the most expensive and complex, underscoring their importance in drug development pathways.

Phase II trials are the fastest growing, driven by increasing early-stage investment in pediatric programs, particularly in rare diseases and gene therapies. In Phase II, the focus is on dose-ranging, short-term efficacy, and safety—critical components for understanding how children respond to investigational drugs. With rising competition and pressure to demonstrate pediatric viability early, companies are conducting Phase II trials more proactively.

Additionally, many pediatric trials in rare diseases begin at Phase II due to limited patient populations and existing data from adult studies. The use of adaptive trial designs, biomarkers, and real-world evidence in Phase II is streamlining development and accelerating progression to pivotal studies, further driving segment growth.

Treatment studies hold the majority share, as they aim to evaluate the therapeutic effect of new drugs, biologics, or interventions in pediatric populations. These studies are central to the drug approval process and are typically sponsored by pharmaceutical companies seeking to expand product indications or fulfill regulatory obligations. Treatment studies are particularly prevalent in pediatric oncology, neurology, and rare disease trials, where active intervention is necessary to test hypotheses.

These interventional trials require rigorous protocols, randomization, and control arms to establish efficacy and safety. They often include pharmacokinetic and pharmacodynamic assessments tailored to pediatric physiology. Due to their importance in commercialization strategies, treatment studies dominate funding and regulatory attention.

Observational studies are growing rapidly, particularly in academic and public health research. These non-interventional studies collect real-world data on disease progression, quality of life, and treatment outcomes without assigning interventions. They are increasingly used to support post-marketing surveillance, identify biomarkers, and inform clinical guidelines for pediatric care.

As the importance of real-world evidence rises in regulatory decision-making, observational studies offer a valuable, low-risk method to understand drug effects in diverse pediatric populations. Moreover, advances in health informatics and patient registries are making these studies easier to conduct and more robust in design.

Infectious diseases remain the largest therapeutic area, driven by the historical and ongoing global burden of pediatric infections. Vaccines and antimicrobials form a major part of pediatric drug development, and clinical trials in this area are essential for disease prevention and control. Trials for conditions such as respiratory syncytial virus (RSV), pediatric HIV, influenza, and COVID-19 have contributed significantly to market share.

Recent trials evaluating novel RSV vaccines, COVID-19 vaccines in young children, and next-generation antibiotics highlight the continued relevance of this therapeutic segment. The high incidence of infectious diseases among pediatric populations and the need for ongoing vaccine development ensure this segment's leadership.

Pediatric oncology is the fastest growing segment, reflecting rapid advancements in immunotherapies, targeted drugs, and precision oncology. Historically, few cancer drugs were tested in children early in development, but new regulations and increased scientific interest are changing that paradigm. Breakthroughs in CAR-T therapies, checkpoint inhibitors, and tumor-specific antibodies are now being trialed in pediatric patients earlier.

For example, trials involving leukemia, brain tumors, and neuroblastoma are expanding due to growing survival rates and demand for less toxic therapies. As cancer remains a leading cause of death among children, investment in pediatric oncology trials is expected to rise sharply in the coming years.

North America, particularly the United States, dominates the pediatric clinical trials market, due to strong regulatory support, extensive research infrastructure, and high R&D investment. The U.S. FDA plays a leading role in advancing pediatric studies through regulatory incentives, priority review vouchers, and mandatory pediatric assessments. The National Institutes of Health (NIH) and Children’s Oncology Group also fund and support pediatric research initiatives.

Many global pharmaceutical companies base their pediatric trial programs in the U.S. due to streamlined regulatory processes, access to leading academic hospitals, and collaboration networks like the Pediatric Trials Network. Canada, with its universal healthcare system and robust pediatric research institutions, also contributes significantly to regional dominance.

Asia Pacific is the fastest growing region, owing to increasing disease burden, expanding clinical research capabilities, and supportive government policies. Countries like China, India, and Japan are investing heavily in pediatric health infrastructure and trial capacity. The region’s large pediatric population, rising awareness, and growing presence of global CROs create a favorable environment for trial recruitment and execution.

Additionally, regulatory reforms in countries like China are accelerating clinical trial approvals, and collaborations with international sponsors are bringing more pediatric trials to the region. As pharmaceutical companies look to diversify trial sites and reduce costs, Asia Pacific is becoming a key destination for pediatric clinical research.

In February 2025, Pfizer announced the initiation of a Phase III pediatric trial for its RSV vaccine in children aged 6 months to 5 years across multiple U.S. and European sites.

In December 2024, Novartis launched a Phase I/II trial evaluating a gene therapy for a rare pediatric neurodegenerative disease in partnership with NIH.

In October 2024, the EMA approved a Pediatric Investigation Plan for a new CAR-T therapy being developed by Gilead Sciences for relapsed pediatric leukemia.

In August 2024, the Children’s Oncology Group partnered with Thermo Fisher Scientific to implement genomic sequencing in pediatric oncology trials.

In May 2024, the FDA granted Rare Pediatric Disease Designation to a new monoclonal antibody developed by Roche for juvenile idiopathic arthritis.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the pediatric clinical trials market

Phase

Study Design

Therapeutic Areas

Regional