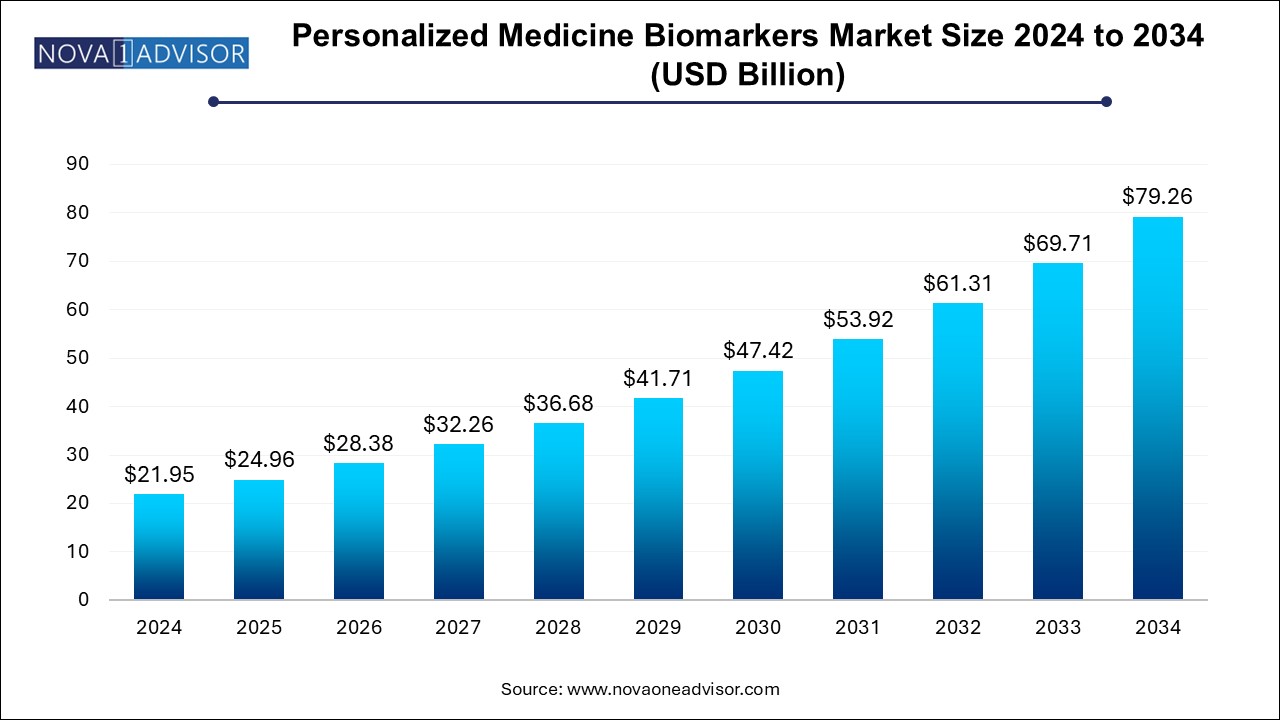

The personalized medicine biomarkers market size was exhibited at USD 21.95 billion in 2024 and is projected to hit around USD 79.26 billion by 2034, growing at a CAGR of 13.7% during the forecast period 2024 to 2034.

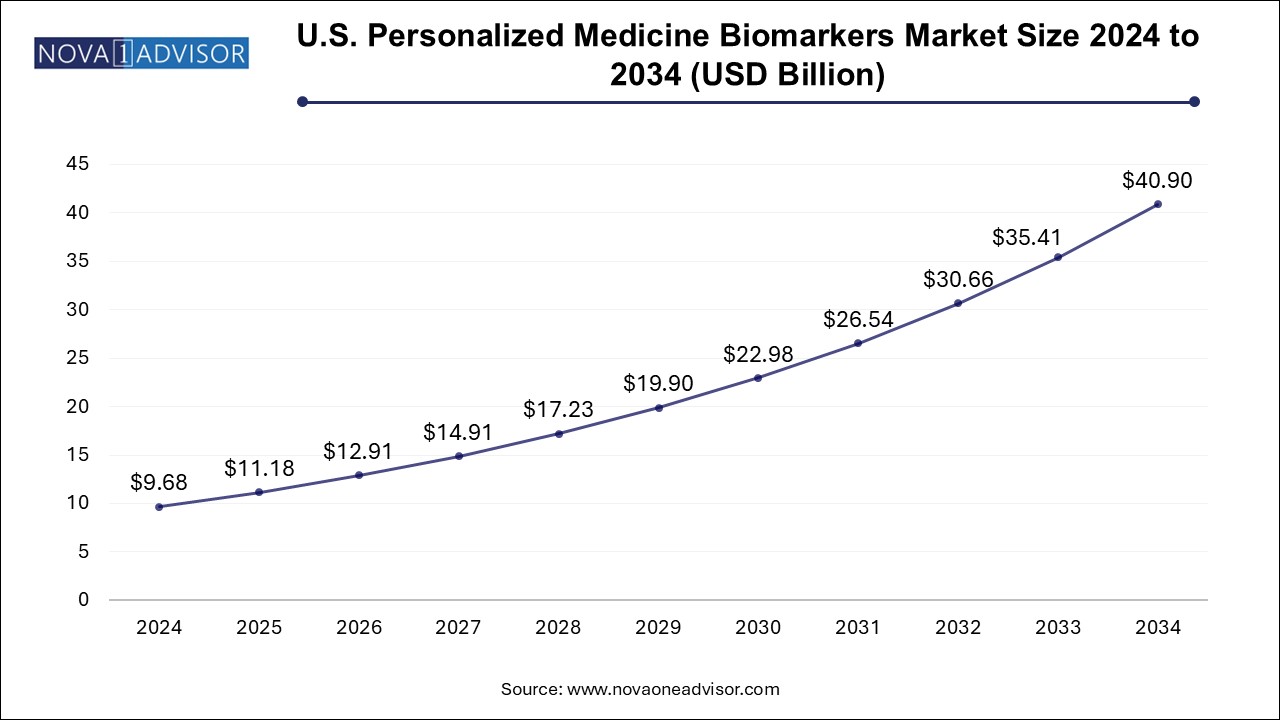

The U.S. Personalized Medicine Biomarkers Market size is exhibited at USD 9.68 billion in 2024 and is projected to be worth around USD 40.90 billion by 2034, growing at a CAGR of 15.5% from 2024 to 2034.

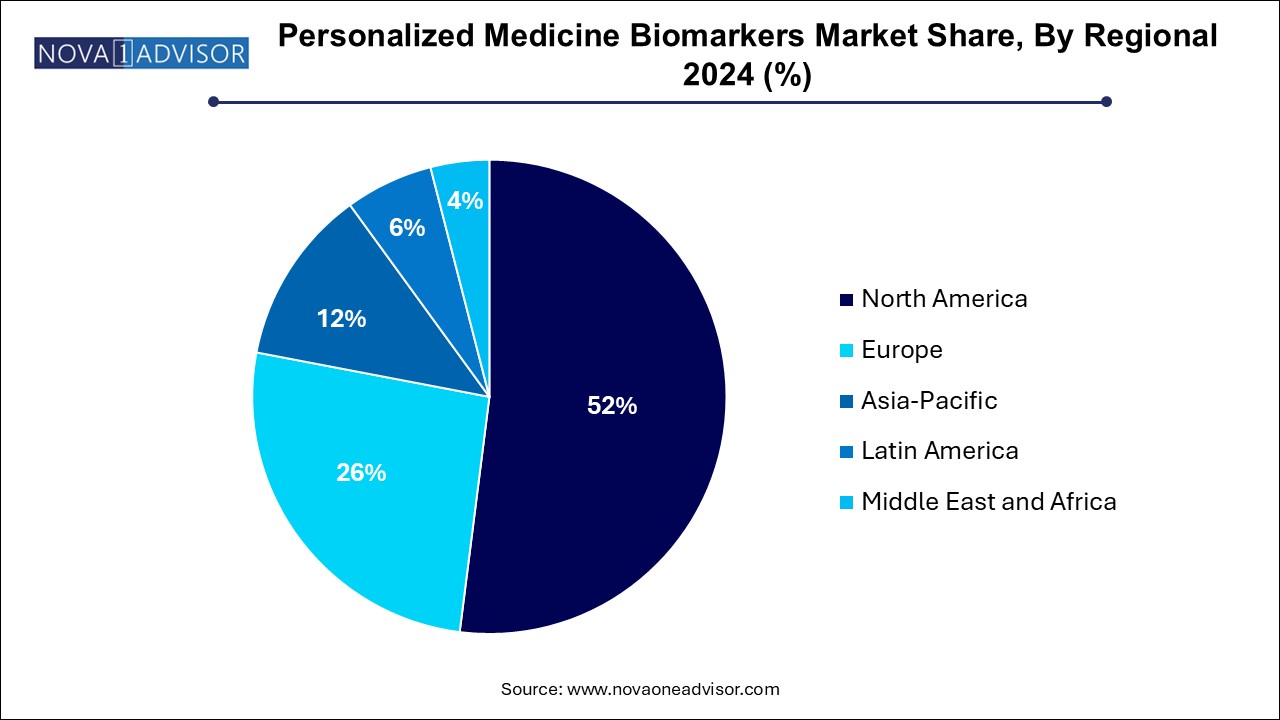

The North America personalized medicine biomarkers market dominated the global market and accounted for 52.0% of revenue share in 2024, which can be attributed to increasing funding for biomarkers aided by technological advancements, high disposable income, and the presence of key market players operating in the region. The U.S. held the largest share of personalized medicines in the region owing to increasing private and public initiatives and raising awareness among the population about chronic diseases and treatments. Moreover, key players are focusing on developing novel products to maintain their dominance over the market. For instance, in February 2022, FoundationOne CDx was approved by the FDA approval as a companion diagnostic for Keytruda to categorize patients with microsatellite instability-high solid tumors.

U.S. Personalized Medicine Biomarkers Market Trends

The U.S.personalized medicine biomarkers market held a significant share of North America market in 2024, driven by advancements in genomics and increased demand for targeted therapies. Rising investments in research, regulatory support for companion diagnostics, and a growing emphasis on precision medicine in oncology and chronic disease management are further propelling market expansion in this sector.

Europe Personalized Medicine Biomarkers Market Trends

The Europe personalized medicine biomarkers market driven by advancements in personalized medicine and intensive research efforts in oncology. Innovations such as next-generation sequencing and proteomics are improving biomarker discovery and diagnostic accuracy, enabling more tailored treatment approaches. European research institutions are increasingly focused on identifying novel biomarkers specific to cancers and other chronic disorders, fostering innovation in personalized medicine. According to the European Society of Cardiology, approximately 45% of individuals over the age of 65 are affected by cardiovascular diseases (CVDs), highlighting the significant health challenges faced by this demographic. In 2022, nearly 4 million people in Europe died from CVDs. This combination of technological advancements and dedicated research initiatives is significantly propelling the growth of the personalized medicine biomarkers market across the region, enhancing the potential for targeted therapies and improved patient outcomes.

The UK personalized medicine biomarkers market is expected to show significant growth driven by increasing research and development investments and enhanced funding for innovative projects. This financial support is facilitating the discovery of novel biomarkers and advancing precision medicine initiatives, leading to improved diagnostics and targeted therapies, ultimately enhancing patient outcomes across the region.

The Germany personalized medicine biomarkers market is experiencing significant growth, largely due to the rising prevalence of chronic disorders such as cancer, diabetes, and cardiovascular diseases. This increasing burden on healthcare systems is driving demand for targeted diagnostics and tailored therapies, fostering advancements in personalized medicine and enhancing patient care in the region.

Asia Pacific Personalized Medicine Biomarkers Market Trends

The Asia Pacific personalized medicine biomarkers market is expected to grow at the fastest CAGR over the forecast period. The growth of the market in the region is owing to growing healthcare reforms in the region aided by improved healthcare infrastructure, a growing population, and an increase in the number of companies entering the market. The Asia Pacific region has a large population and high cancer prevalence. Thus, the usage of screening tests for cancer has increased in the past few years owing to growing government initiatives, such as free screening for breast cancer and increased collaborations for the distribution and supply of these tests.

The China personalized medicine biomarkers market is growing at a lucrative rate. Presence of government funding and initiatives in the region further fuels regional growth. For instance, The Chinese Personal Medicine Initiative which is expected to be funded with USD 9.0 billion by 2030, aims to provide better healthcare provisions mainly for oncology.

Latin America Personalized Medicine Biomarkers Market Trends

The Latin America personalized medicine biomarkers market exhibits high growth potential for the personalized medicine biomarkers market. Driven by improvements in healthcare infrastructure and strong government support. Many countries in the region are investing in modernizing their healthcare systems, which enhances access to advanced diagnostic tools and personalized treatment options. Government initiatives aimed at promoting research and development in personalized medicine are further accelerating market expansion. Additionally, as awareness of the benefits of tailored therapies increases among healthcare providers and patients, demand for biomarkers that facilitate precision medicine is on the rise. These factors collectively contribute to the positive trajectory of the personalized medicine biomarkers market in Latin America.

Middle East and Africa Personalized Medicine Biomarkers Market Trends

The MEA personalized medicine biomarkers market growth driven by the increasing prevalence of chronic disorders, such as diabetes, cardiovascular diseases, and cancer. As healthcare systems in the region focus on improving diagnosis and treatment through personalized medicine, the demand for innovative biomarkers is rising, enhancing patient outcomes.

The Saudi Arabia personalized medicine biomarkers market growth is driving the market, largely supported by government funding aimed at enhancing healthcare innovation. Increased investment in research initiatives and the establishment of advanced healthcare facilities are fostering the development of novel biomarkers, which are essential for improving personalized treatment strategies and patient care in the region.

| Report Coverage | Details |

| Market Size in 2025 | USD 24.96 Billion |

| Market Size by 2034 | USD 79.26 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 13.7% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Application, Indication, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Laboratory Corporation of America Holding; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Genome Medical, Inc.; Coriell Life Sciences; Thermo Fisher Scientific Inc.; NeoGenomics Laboratories; FOUNDATION MEDICINE, INC.; Illumina, Inc.; Guardant Health. |

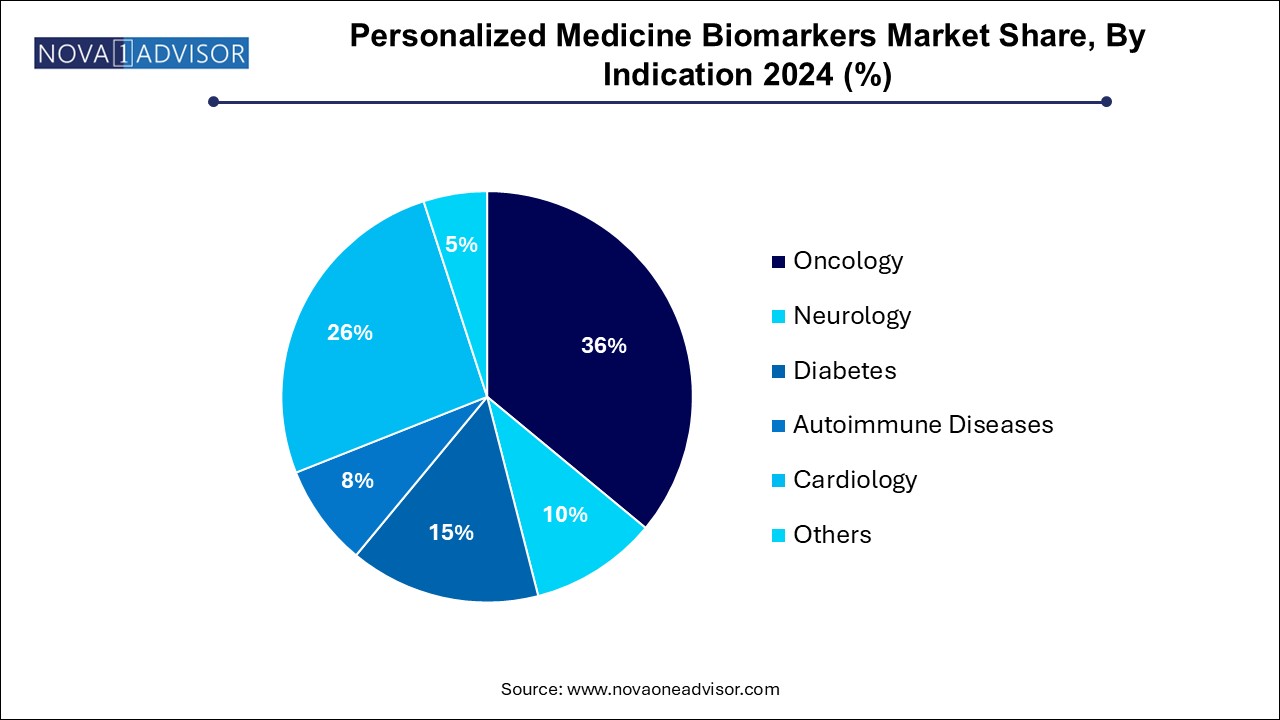

The treatment selection segment dominated the market with the largest market share of 50.2% in 2024. Based on the molecular characteristics of the tumor, personalized medicine biomarkers help choose the most suitable patients for early-phase clinical trials. They also provide information regarding action mechanism of a particular medicine. The focus of oncology drug development programs has shifted from the creation of non-specific cytotoxic chemotherapies to the creation of molecularly targeted therapeutics as a result of the identification of particular mutations that efficiently perform the prediction for a given drug in a molecularly defined patient group. Moreover, with an enhanced selection of treatment the probability to tackle the condition increases which further propels the demand for personalized medicine biomarkers.

Early detection/screening is expected to grow at a significant CAGR of 15.8% over the forecast period. The growth of the segment can be attributed to the need to provide early treatment. For patients who display the biomarker linked to a therapy's response, the probability of survival is dependent on the course of treatment. For instance, the expression of the HER2/neu protein is a prognostic biomarker of breast cancer. Moreover, KRAS is a frequently mutated oncogene in colorectal cancer and a biomarker for anti-EGFR monoclonal antibody therapy resistance. Moreover, the development of novel technologies to help in the early detection of various conditions is further propelling the growth of the market.

Oncology dominated the market with the largest share of 36.0% in 2024, driven by the increasing prevalence of cancer worldwide. According to the World Health Organization, cancer cases are projected to rise to 29.5 million by 2040, necessitating more precise diagnostic and therapeutic approaches. Personalized medicine, which tailors treatment based on individual genetic and molecular profiles, enhances the efficacy of cancer therapies and minimizes adverse effects. According to GLOBOCAN, there were 18,741,966 cancer cases globally in 2022. Among these, 9,566,825 cases were reported in men, while 9,175,141 cases were recorded in women. The demand for biomarkers that can predict patient responses to targeted therapies and immunotherapies is rapidly increasing, facilitating earlier detection and improving overall patient outcomes in oncology, thus propelling market growth in this segment.

The diabetes segment is the fastest-growing segment and is expected to grow at a CAGR of 17.4% over the forecast period. The diabetes segment is experiencing notable growth within the personalized medicine biomarkers market, driven by the rising global prevalence of diabetes. According to the IDF Diabetes Atlas, the global number of individuals living with diabetes is on the rise and is expected to increase by 46% from 2020 to 2045, while the world’s population is anticipated to grow by just 20%. Personalized medicine, which focuses on tailoring treatments based on individual biomarkers, plays a crucial role in diabetes management by identifying patients at risk for complications and optimizing therapeutic strategies. The demand for biomarkers that can predict glycemic control, insulin sensitivity, and other metabolic responses is increasing, fostering advancements in targeted therapies and improving patient outcomes in diabetes care.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the personalized medicine biomarkers market

By Application

By Indication

By Regional