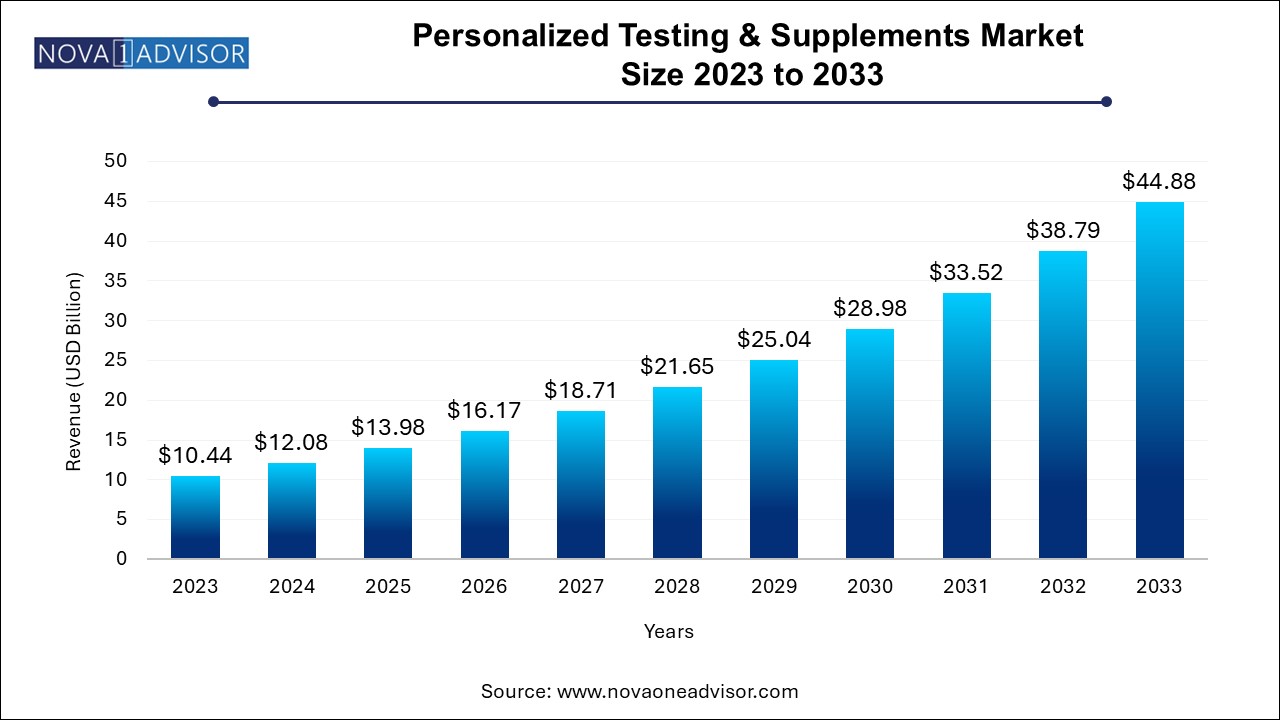

The personalized testing & supplements market size was exhibited at USD 10.44 billion in 2023 and is projected to hit around USD 44.88 billion by 2033, growing at a CAGR of 15.7% during the forecast period 2024 to 2033.

The Personalized Testing & Supplements Market has emerged as a transformative domain in health, wellness, and preventive medicine, fueled by rising consumer awareness, the integration of biotechnology in everyday health, and a cultural shift toward personalization. This market encapsulates a range of offerings that begin with individual-specific diagnostics—such as blood, DNA, and app-based tests—and translate the data into customized nutrition and supplement recommendations tailored to each person’s unique genetic makeup, lifestyle, health goals, and physiological parameters.

Unlike traditional, generic wellness products, personalized supplements are formulated based on test results that consider nutrient deficiencies, metabolic tendencies, digestive efficiency, immune health, and even sleep quality. From DNA-based insights about vitamin absorption to AI-powered algorithms recommending weekly probiotic blends, the market combines advanced diagnostics with targeted nutraceuticals.

This shift is particularly pronounced among millennials and Gen Z consumers, who prioritize wellness and are tech-savvy, open to direct-to-consumer (DTC) models, and willing to spend more on preventive solutions. The market is also witnessing growing traction among aging populations focused on optimizing longevity and chronic disease prevention.

Industry players are leveraging innovations in omics sciences (genomics, proteomics, metabolomics), machine learning, wearable technology, and microbiome analysis to refine personalization further. The result is a fast-evolving landscape where data-driven health meets consumer convenience, and where continuous testing loops are creating dynamic health ecosystems that evolve with the individual.

Rise of DTC (Direct-to-Consumer) personalized health platforms: Companies like Viome, Baze, and Rootine are offering test kits and supplements directly to consumers without medical intermediaries.

Microbiome-driven supplement recommendations: Gut health is at the center of many personalized programs, with fecal testing guiding customized probiotic and dietary recommendations.

Wearable device integration: Fitness trackers and smartwatches are increasingly syncing with health platforms to inform supplement needs in real-time (e.g., hydration, electrolyte loss, sleep quality).

AI-powered personalization engines: Algorithms analyze user data to fine-tune supplement formulation and delivery schedules dynamically.

Monthly subscription models: Repeat and continuous personalization cycles are replacing one-off purchases, increasing customer retention and LTV.

Functional supplements gaining momentum: Personalized adaptogens, nootropics, and anti-aging compounds are increasingly being formulated for stress, focus, and metabolic regulation.

Men’s and women’s health specialization: Gender-specific testing and supplement lines are rapidly expanding to address hormonal, reproductive, and lifestyle-related needs.

Integration of digital nutrition coaching: Many platforms now offer virtual dietician consultations or app-based coaching as part of subscription bundles.

Sustainability in supplement production: Eco-conscious consumers are driving demand for clean-label, ethically sourced, and environmentally sustainable supplements.

Regulatory scrutiny and self-regulation: As the market matures, more companies are investing in clinical validation and transparency to win consumer trust and comply with evolving regulations.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.08 Billion |

| Market Size by 2033 | USD 44.88 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Service Provider, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Viome, DSM Nutritional Products AG, Thorne, Pharmavite, Baze, NC Holding, The Vitamin Shoppe, Nestlé Health Science, Vitaminpacks, Inc., myDNA, LifeNome. |

A primary driver fueling the personalized testing and supplements market is the rising global shift from curative to preventive healthcare. Consumers, healthcare systems, and insurers alike are recognizing the cost-effectiveness and long-term benefits of early intervention and wellness optimization. With chronic diseases like diabetes, obesity, and cardiovascular conditions placing an ever-increasing burden on healthcare systems, preventive strategies that incorporate personalized diagnostics and targeted nutrition are gaining traction.

Personalized supplements offer a compelling value proposition: they empower individuals to make informed health decisions based on actual physiological data rather than generic assumptions. For example, a DNA test might reveal a genetic mutation that affects vitamin B12 absorption—prompting a higher-dose, methylated supplement formulation. By addressing individual needs precisely, these solutions enhance efficacy, reduce waste, and improve overall well-being, all while aligning with a broader global narrative around longevity and personalized care.

Despite the market’s rapid growth, a key restraint remains the lack of clear regulatory standards and scientific uniformity, particularly in how personalized supplements are tested, manufactured, and marketed. Many personalized testing platforms operate under varying regulatory frameworks depending on the country, and the supplements they recommend may not always undergo rigorous clinical trials or FDA approval processes. This lack of standardization can lead to variability in quality and efficacy.

Moreover, while the personalization model is appealing, the scientific validity of some recommendations—especially those based on limited genetic markers or self-reported data—can be questionable. Inconsistent results, overpromising marketing claims, and absence of long-term data may undermine consumer trust. For the market to mature sustainably, there must be stronger industry-wide efforts toward evidence-based practice, third-party validation, and regulatory compliance.

A significant opportunity lies in the integration of personalized testing and supplement programs into mainstream retail, insurance, and corporate wellness ecosystems. As consumer health literacy improves, large retailers (e.g., CVS, Walgreens, Amazon) are beginning to partner with or launch their own testing platforms, expanding the accessibility of personalized wellness products to mass markets.

Similarly, employers are investing in proactive health programs for their workforce—offering subsidized DNA testing, biomarker screenings, and personalized supplement subscriptions as part of corporate wellness benefits. This not only enhances employee productivity and satisfaction but also reduces long-term healthcare costs. Insurance companies, too, are exploring how personalized supplementation, informed by validated testing, can reduce claims related to preventable chronic diseases. These integrations mark the transition from niche to mainstream, opening doors to exponential market expansion.

Based on service, the personalized supplements segment dominated the overall market with a revenue share of 82.43% in 2023. Among these, vitamins and probiotics dominate, especially for consumers focused on immunity, digestion, and energy. Probiotic formulations customized based on gut microbiome profiles—offered by companies like Viome—are rapidly gaining popularity. Similarly, proteins and amino acids are in high demand among fitness-oriented users and those managing muscle loss or metabolic health.

The personalized testing segment is expected to grow at the fastest CAGR from 2024 to 2033. Particularly due to the increasing consumer interest in data-driven health management and the accessibility of at-home testing kits. Within this segment, blood tests remain the most commonly used modality, as they provide direct, quantifiable biomarkers—such as vitamin D, iron, lipid profiles, and hormonal levels—that are essential for precise supplement recommendations. Platforms like Baze and Thorne offer finger-prick blood test kits that allow users to regularly monitor nutrient deficiencies and adjust intake accordingly.

Based on service provider, the personalized testing & supplement companies (DTC) segment dominated the market with a share of 54.36% in 2023. largely due to the rise of digitally native brands that offer end-to-end solutions—from testing and analysis to personalized supplement delivery. These companies often use proprietary algorithms, maintain in-house labs, and manage seamless subscription logistics, giving them a competitive edge in user experience. Viome, Persona Nutrition, and Care/of are notable examples that have scaled rapidly using influencer marketing, data science, and customer feedback loops.

The dieticians & nutritionists segment is expected to grow at a significant CAGR over the forecast period. As consumers seek expert guidance to interpret complex test results and integrate supplement plans into holistic health regimens. Many dietitians are now partnering with personalized testing platforms or using AI-enabled software to enhance their recommendations. Their credibility and ability to provide behavioral counseling make them indispensable in translating data into actionable lifestyle changes, especially for individuals managing chronic conditions or undergoing therapeutic interventions.

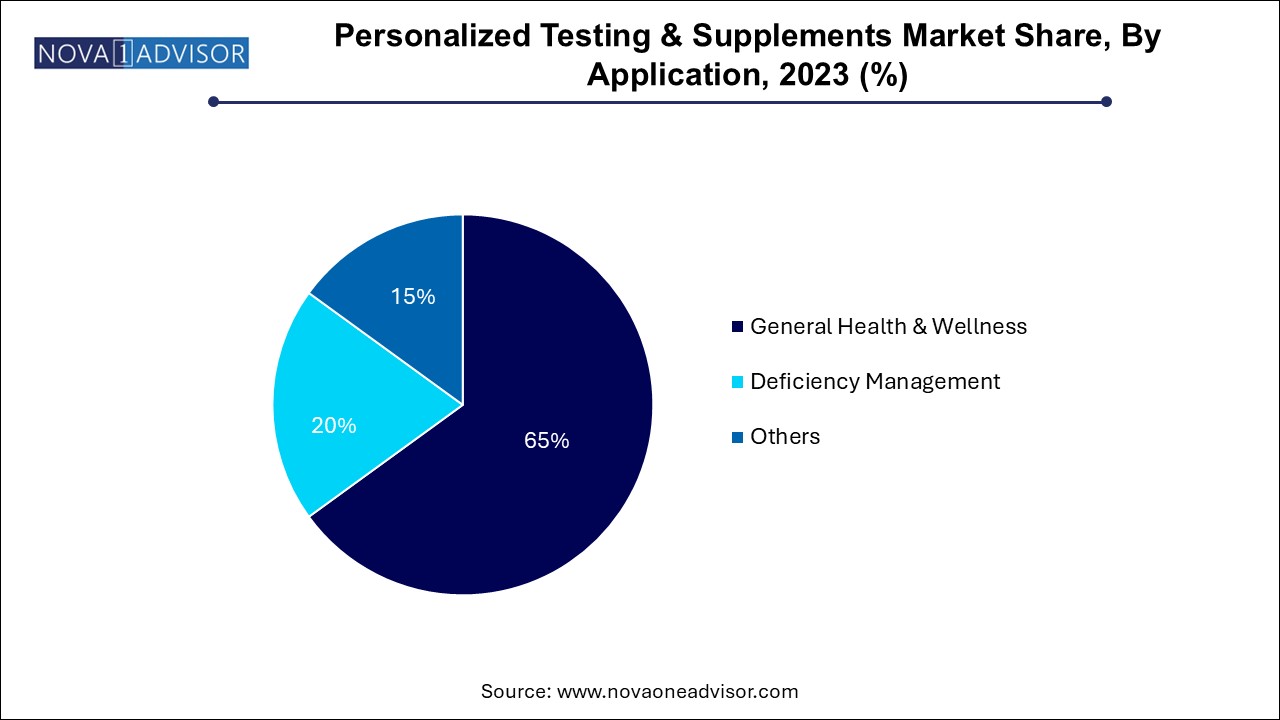

Based on application, the general health and wellness segment dominated the market with a revenue share of 65.0% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2033. This segment appeals to a broad demographic—from young professionals interested in biohacking, to seniors looking to maintain functional longevity. Many consumers begin with simple goals (e.g., better sleep or increased energy) and progressively adopt more advanced testing and supplementation programs as they see tangible results.

The deficiency management segment is expected to grow at a significant rate over the forecast period. As more consumers become aware of micronutrient imbalances and the implications of subclinical deficiencies. Personalized supplements provide a precise approach to correcting issues like vitamin D deficiency, iron-related anemia, or magnesium-linked fatigue. Athletes, vegetarians, pregnant women, and people with malabsorption issues particularly benefit from this tailored intervention. The ability to track improvements over time through repeat testing reinforces adherence and loyalty.

North America holds the dominant share of the global personalized testing & supplements market, driven by high health literacy, advanced digital infrastructure, widespread consumer acceptance of DTC models, and the presence of leading market players. The U.S. leads in terms of innovation, funding, and consumer demand. American companies are pioneering at-home test kits, AI-based supplement algorithms, and subscription-based delivery. Additionally, regulatory frameworks such as FDA’s Nutritional Labeling standards and growing transparency norms are helping mature the industry.

Asia Pacific is emerging as the fastest-growing region, propelled by increasing disposable incomes, changing health behaviors, and expanding digital health ecosystems. Countries like Japan, South Korea, and China are witnessing a rise in personalized health startups that blend traditional medicine insights with modern diagnostics. India, too, is seeing rapid growth, with companies offering low-cost genetic testing and personalized Ayurvedic supplements. Cultural emphasis on preventive care, combined with large youth populations and tech-savvy urban centers, positions Asia Pacific for robust growth.

February 2025: Viome Life Sciences announced the expansion of its AI-powered precision supplement platform into Europe, including microbiome-based tests for metabolic health optimization.

December 2024: Thorne HealthTech partnered with Google Fit to integrate wearable health data into its personalized supplement algorithms, enabling dynamic plan updates.

October 2024: Care/of launched its new personalized pregnancy supplement line, offering DNA-informed formulations for maternal wellness.

August 2024: Rootine secured $10 million in Series A funding to enhance its DNA-driven multinutrient platform and expand into B2B wellness partnerships.

June 2024: Persona Nutrition, a Nestlé Health Science company, introduced real-time supplement recommendations via a chatbot-powered mobile app synced with daily user inputs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the personalized testing & supplements market

Service

Service Provider

Application

Regional