The pharmaceutical contract packaging market size was exhibited at USD 17.25 billion in 2024 and is projected to hit around USD 34.57 billion by 2034, growing at a CAGR of 7.2% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size by 2034 | USD 5.41 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 12.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Component, Delivery Model, Function, End-use, Disorder |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Oracle (Cerner Corporation); Core Solutions, Inc.; Epic Systems Corporation; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualifacts; Welligent; SimplePractice, LLC; TherapyNotes, LLC.; TheraNest |

Driven by the increasing trend of outsourcing packaging operations to specialized contract packaging companies. Facing pressure to cut costs and increase operational efficiency, pharmaceutical companies find outsourcing an effective solution. By partnering with packaging suppliers, they can focus on their core activities, such as drug discovery and development, leaving behind complex packaging, including compliance with regulatory requirements and managing new packaging for outside experts.

Another key factor driving the market's growth is the demand for customized, complex packaging products such as biologics, biosimilars, and personalized medicines that require specialized packaging. For instance, biologics and injectables often require temperature-controlled, sterile, non-deformable packaging to ensure packaging stability and safety. Contract packaging suppliers have increasingly deployed the technical capabilities and resources to handle these complex packaging requirements, ensuring that pharmaceutical companies deliver quality to consumers while meeting stringent regulatory standards.

Moreover, pharmaceutical products are subject to safety regulations, such as serialization requirements for traceability and compliance with Good Manufacturing Practices (GMP), ensuring that packaging adheres to the specific guidelines of regulatory bodies such as the FDA, EMA, and other regional agencies. Since packaging is critical to drug safety and counterfeit assurance, pharmaceutical companies have increasingly relied on experienced contract packagers to meet these evolving regulatory requirements and drive overall market expansion.

Primary packaging led segment dominating the market with the largest revenue share of 76.6% in 2024 due to the essential role primary packaging plays in safeguarding the pharmaceutical product’s integrity, safety, and compliance. Primary packaging includes direct contact materials such as blister packs, bottles, vials, and ampoules. Furthermore, primary packaging is often the first point of interaction between the drug and the consumer, making its design and functionality crucial for patient safety and product performance, thus driving the significant demand for primary packaging services in the pharmaceutical industry.

The secondary packaging segment is expected to grow significantly over the forecast period, driven by the increasing need for enhanced branding, consumer safety, and regulatory compliance. Secondary packaging, including outer packaging such as cartons, boxes, labels, and instructions, is the first defense in protecting the product during transportation. Secondary packaging plays a crucial role in serialization and traceability requirements, which are increasingly mandatory in many countries to prevent counterfeiting and ensure compliance with safety standards, providing clear product information and enhancing patient safety is growing.

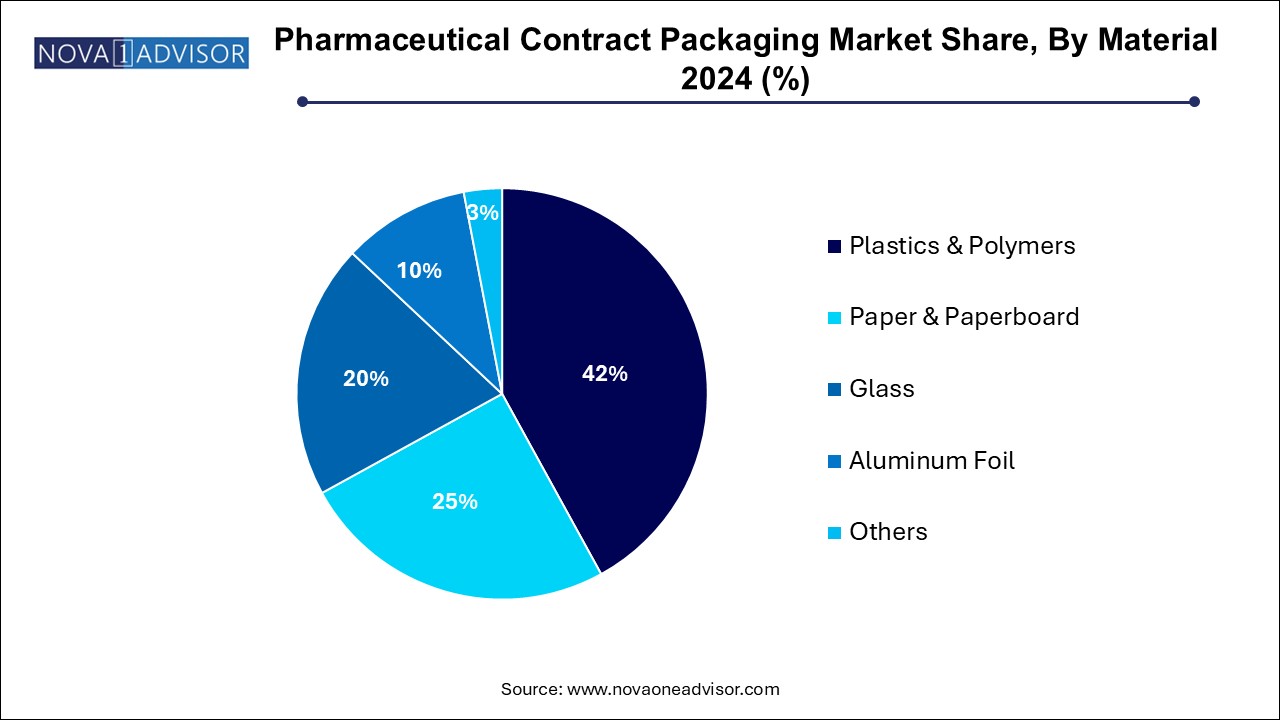

The plastics and polymers segment contributed the largest revenue share, 42.0%, by 2024, mainly due to their versatility, cost-effectiveness, durability, ease of manufacturing, and ability to be molded into various shapes and sizes. These materials are ideal for special packaging such as bottles, blister packs, vials, and ampoules, commonly used in the pharmaceutical industry. In addition, plastics and polymers can be easily tailored to specific regulatory requirements for sterility, tamper proof, and child resistance, making them popular materials for chemical packaging.

The paper & page segment is expected to grow at the highest CAGR of 7.65% during the forecast period, driven by increasing demand for sustainable, non-conductive packaging of the environment. With growing environmental concerns about plastic waste and sustainability, more and more companies are adopting biodegradable and recyclable materials that do not impact the environment. Paper and paper board are low-cost and versatile renewable resources, making them attractive alternatives to secondary materials.

North America's pharmaceutical contract packaging market has dominated the global market and accounted for the largest revenue share of 36.0% in 2024 due to the region’s highly established pharmaceutical industry, technological advancements, and regulations. This ensures that North America is equipped with the latest technologies to meet the complex needs of a wide range of pharmaceutical packaging, including biologics, vaccines, and advanced therapies. The ability of North American packaging providers to manage these complex needs, highly skilled workers, and advanced infrastructure continues to position them as the leading global player in the medicine contract packaging market.

U.S. Pharmaceutical Contract Packaging Market Trends

The U.S. pharmaceutical contract packaging market in North America dominated, with the largest revenue share in 2024. This is due to the country’s advanced pharmaceutical capacity and extensive and heavily regulated healthcare system. innovations in packaging. The market is also fueled by innovations in packaging technologies, such as non-tampering, child-resistant, and anti-counterfeiting, which are critical to maintaining chemical safety and regulatory compliance, driving the market Demand for packaging solutions

Asia Pacific Pharmaceutical Contract Packaging Market Trends

Asia Pacific pharmaceutical contract packaging market is expected to grow at a CAGR of 7.74% over the forecast period, driven by rapidly advanced technologies, growing healthcare demand, and increasing outsourcing of services in the Asian region. Asia Pacific contract packaging services offer competitive pricing, advanced technology and large-scale manufacturing capabilities, driving the industry’s market growth. For instance, India is a global leader in the generic pharmaceutical industry and relies heavily on contract packaging services to meet domestic and international needs.

Europe Pharmaceutical Contract Packaging Market Trends

The growth of Europe's pharmaceutical contract packaging market is driven by an increasing demand for high-quality packaging solutions, stringent regulations, and the growing prevalence of personalized medicines. Europe is one of the most well-regulated pharmaceutical markets, ensuring that packaging meets safety, security, and traceability standards.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pharmaceutical contract packaging market

By Type

By Material

By Regional