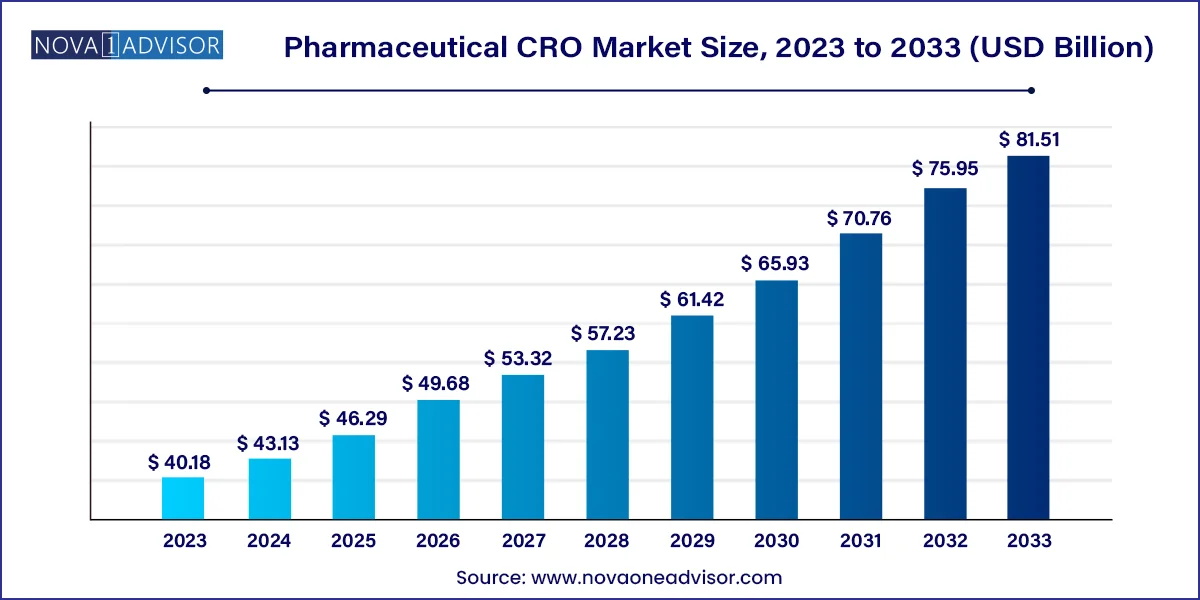

The global Pharmaceutical CRO market size was valued at USD 40.18 billion in 2023 and is anticipated to reach around USD 81.51 billion by 2033, growing at a CAGR of 7.33% from 2024 to 2033.

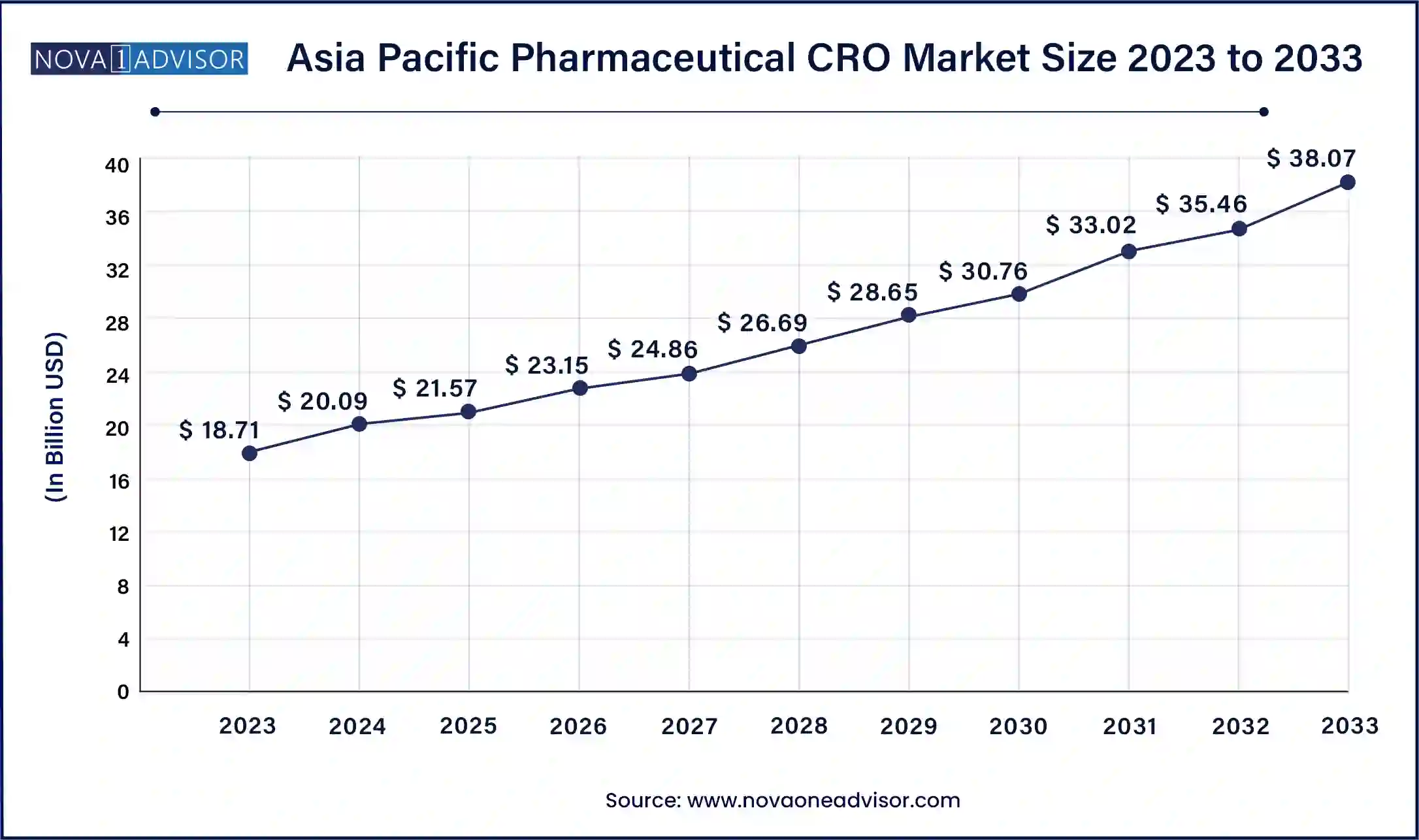

The Asia Pacific Pharmaceutical CRO market size was exhibited at USD 18.71 billion in 2023 and is projected to be worth around USD 38.07 billion by 2033, poised to grow at a CAGR of 7.36% from 2024 to 2033.

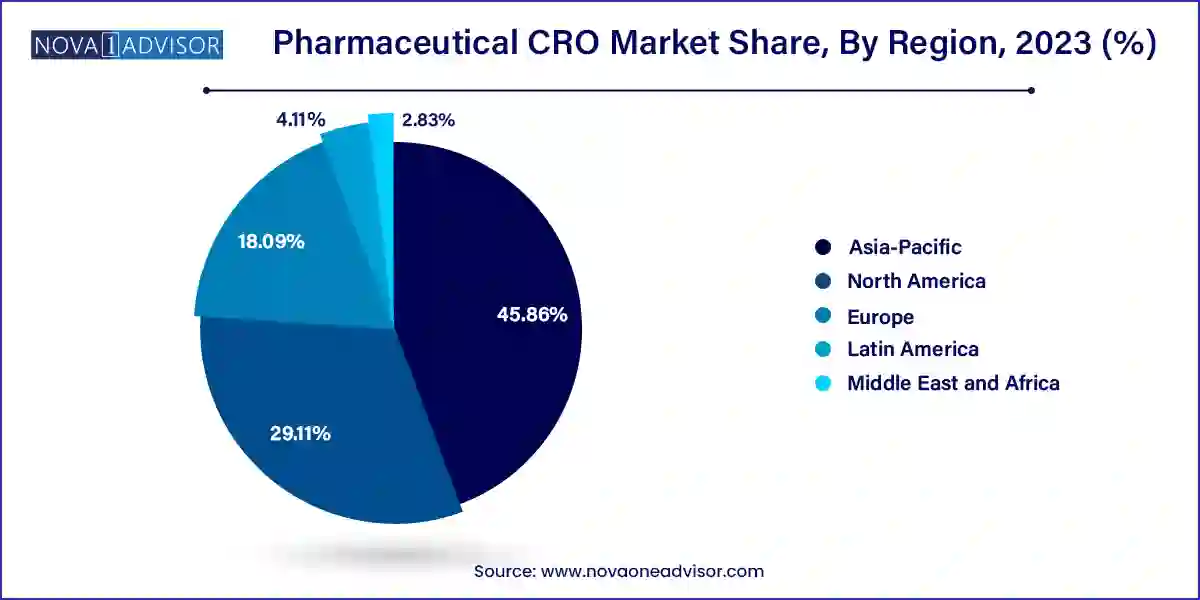

North America, especially the United States, dominates the pharmaceutical CRO market, due to the concentration of top pharmaceutical companies, robust clinical research infrastructure, and advanced regulatory systems. The U.S. is home to several major CROs, including IQVIA, Parexel, and Labcorp Drug Development, and continues to lead in clinical trial volumes.

Strong government support for drug innovation, the presence of academic medical centers, and a favorable investment climate further bolster the region. Additionally, North America is the launchpad for many first-in-human and rare disease trials, reinforcing its leadership in both scale and innovation.

Asia-Pacific is the fastest growing CRO market, driven by low trial costs, expanding patient pools, and increasing investments in life sciences infrastructure. Countries like China, India, South Korea, and Singapore are becoming hubs for global trials, supported by skilled investigators and improving regulatory harmonization.

Biopharma companies are increasingly including Asia-Pacific sites in pivotal trials to accelerate enrollment, access diverse genetic populations, and establish regional market readiness. The combination of cost-efficiency and operational maturity is expected to sustain this growth trajectory.

The Pharmaceutical Contract Research Organization (CRO) Market has emerged as a cornerstone of the modern drug development ecosystem. CROs offer outsourced research services that support pharmaceutical, biotechnology, and medical device companies in developing new therapies. Their services span from early-stage drug discovery and preclinical development to clinical trials, regulatory submissions, post-marketing surveillance, and pharmacovigilance. With growing pressure to expedite time-to-market, control R&D costs, and navigate complex regulatory environments, pharmaceutical companies increasingly rely on CROs as strategic partners.

The global pharmaceutical industry is undergoing a structural transformation marked by rising R&D expenditures, the advent of biologics and personalized medicine, and heightened regulatory scrutiny. These shifts have catalyzed the need for operational flexibility, specialized expertise, and technological innovation—core strengths of CROs. Today, CROs not only provide functional services but also strategic value in protocol design, regulatory planning, data analytics, and global trial execution.

The rise of virtual trials, decentralized clinical trial models, and real-world evidence (RWE) collection has further expanded the CRO service portfolio. Mergers and acquisitions are reshaping the CRO landscape, with larger players acquiring niche firms to broaden capabilities, enhance geographic reach, and offer end-to-end services. Meanwhile, emerging biopharma companies—who often lack in-house infrastructure—form a growing clientele base for CROs, especially in oncology, CNS, and rare disease research.

With a surge in new molecular entities, increasing complexity in trial design, and a globally distributed patient population, CROs are poised to play an increasingly integral role in pharmaceutical innovation and commercialization.

Growing outsourcing by small and mid-sized biopharma companies with limited internal R&D infrastructure.

Rising demand for full-service, integrated CROs offering drug discovery to post-marketing services under one roof.

Increased adoption of decentralized and hybrid clinical trial models enabled by digital tools and remote monitoring.

Surging investments in oncology-focused CRO services, reflecting the dominance of cancer drugs in global pipelines.

Artificial intelligence and data analytics integration for protocol optimization, predictive recruitment, and trial monitoring.

Strategic CRO partnerships and mergers to enhance capabilities in biometrics, regulatory affairs, and global trial execution.

Globalization of clinical trials, especially in Asia-Pacific and Eastern Europe, driven by access to large, treatment-naïve populations.

Emphasis on patient recruitment and retention strategies, particularly for chronic and rare disease trials.

| Report Attribute | Details |

| Market Size in 2024 | USD 43.13 Billion |

| Market Size by 2033 | USD 81.51 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.33% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, molecule type, services, therapeutic areas, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Parexel International (MA) Corporation., ICON plc, Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Medpace, IQVIA, CTI Clinical Trial & Consulting, WuXi AppTec, Veeda Clinical Research |

A key driver propelling the pharmaceutical CRO market is the escalating cost of drug development and the corresponding need for operational efficiency. According to industry estimates, bringing a new drug to market now exceeds $2 billion and spans over 10–12 years. As pipelines become more complex and regulatory requirements intensify, pharmaceutical firms are under pressure to reduce costs while maintaining scientific rigor.

CROs provide scalable infrastructure, geographic flexibility, and specialized knowledge that enable sponsors to optimize timelines and budgets. By outsourcing to CROs, companies avoid the capital expenditure of building internal capabilities while gaining access to therapeutic expertise, patient recruitment networks, and technology platforms. This not only accelerates development but also allows sponsors to focus on core R&D and commercialization strategies. Consequently, outsourcing is no longer tactical but a critical strategic decision across the pharmaceutical industry.

Despite their value, CRO operations involve significant risks related to data privacy, security, and regulatory compliance. Clinical trials generate sensitive personal health data governed by strict laws such as HIPAA in the U.S., GDPR in the EU, and data localization laws in various countries. Ensuring cross-border data protection, ethical patient engagement, and compliance with evolving regulations is a complex task—especially for multinational studies.

Moreover, discrepancies in regulatory frameworks across regions can slow down trial approvals or create compliance bottlenecks. CROs that fail to meet audit standards or mismanage safety reporting may expose sponsors to litigation, financial penalties, and reputational damage. As digitalization increases, cybersecurity threats also become more acute. These risks underscore the need for CROs to invest in compliance systems, training, and IT infrastructure—factors that may constrain smaller or less resourced firms.

A significant market opportunity lies in CRO expansion into high-growth therapeutic areas such as rare diseases, cell & gene therapies, immuno-oncology, and neurodegenerative disorders. These fields require deep scientific knowledge, flexible study designs, and adaptive recruitment strategies—attributes well-aligned with specialized CRO capabilities.

For example, gene therapy trials often involve small cohorts, novel biomarkers, and long-term follow-up, necessitating CROs with experience in complex biologics, advanced analytics, and patient-centric trial designs. Similarly, rare disease research requires access to global patient registries and decentralized trial models to reach widely dispersed populations.

CROs that build domain-specific expertise, forge partnerships with academic and clinical networks, and integrate patient engagement tools stand to benefit from the expanding pipeline of innovative therapies. This strategic positioning will be crucial as pharmaceutical R&D continues to pivot toward precision medicine and biologics.

The clinical segment dominated the market with a revenue share of 76.15% in 2023. Accounting for the largest revenue share due to the sheer complexity, cost, and time associated with conducting Phases I through IV of drug development. These trials involve designing protocols, recruiting participants, conducting site monitoring, collecting data, and ensuring regulatory compliance—services often managed end-to-end by CROs.

Within clinical trials, Phase III trial services generate the highest revenue as they require large-scale patient enrollment, multi-center coordination, and stringent safety monitoring. They also consume the most resources, especially in oncology and chronic disease studies. CROs offering global site networks, advanced analytics, and centralized monitoring are particularly favored by sponsors for these pivotal trials.

Preclinical CRO services are witnessing rapid growth, particularly due to the expanding focus on early-stage drug candidates and biologics. These services include in vitro and in vivo toxicology, pharmacokinetics (PK), pharmacodynamics (PD), and bioanalytical testing—critical steps in identifying promising compounds and submitting Investigational New Drug (IND) applications.

As biopharma companies increasingly prioritize first-in-human studies and look to derisk candidates early, preclinical CROs are becoming strategic partners. The demand for GLP-compliant, integrated preclinical services is rising, and many CROs are investing in advanced platforms for imaging, high-throughput screening, and biomarker development to serve this need.

The small molecule segment dominated the market in 2023. owing to their prevalence in existing pipelines, ease of synthesis, and established regulatory pathways. These compounds make up a significant portion of FDA approvals and remain the preferred modality in areas like infectious diseases, CNS disorders, and cardiovascular conditions.

CROs have extensive experience managing the synthesis, bioanalytical testing, and clinical development of small molecule drugs, and offer streamlined regulatory support for generics and repurposed molecules. Their dominance is also reinforced by global demand for generics and ongoing development of small-molecule oncology and anti-inflammatory drugs.

The large molecule segment is anticipated to register a CAGR of 7.85% during the forecast period. Driven by the rising number of monoclonal antibodies, recombinant proteins, vaccines, and cell/gene therapies in the pharmaceutical pipeline. These complex products require specialized CRO services such as biologics characterization, immunogenicity testing, bioassays, and cold-chain logistics.

CROs are expanding their biologics service portfolios through acquisitions, partnerships with CDMOs, and internal capability development. As the biologics market grows—especially in oncology, autoimmune diseases, and rare disorders—CROs with the infrastructure and expertise to support large molecule development will see accelerated growth.

The clinical monitoring segment dominated the market with the largest revenue share in 2023. As they are critical to ensuring protocol compliance, patient safety, and data integrity during clinical trials. Monitoring services involve on-site visits, centralized data review, and risk-based strategies to track trial conduct and resolve issues in real time.

With the shift toward decentralized and hybrid trials, clinical monitoring is evolving. CROs are integrating remote monitoring, wearable data integration, and centralized dashboards to offer sponsors greater visibility and flexibility. This ongoing innovation sustains the dominance of this service segment.

Patient and site recruitment is growing fastest, reflecting the challenges sponsors face in enrolling eligible patients, especially for rare diseases and personalized therapies. CROs are investing in digital recruitment tools, AI-driven matching algorithms, and patient concierge services to improve enrollment timelines and retention.

As clinical trials become more competitive and targeted, the ability to efficiently recruit and retain patients becomes a key differentiator for CROs. Platforms that incorporate EHR mining, social media outreach, and multilingual engagement strategies are gaining traction in both urban and rural settings.

The oncology segment dominated the market with a revenue share of 30.76% in 2023. Representing over one-third of ongoing clinical trials globally. The explosion of targeted therapies, immuno-oncology agents, and combination treatments has driven CRO demand for oncology trial design, biomarker analysis, and precision recruitment strategies.

CROs with oncology-specific teams, global investigator networks, and regulatory expertise in accelerated approval pathways are particularly successful. With oncology remaining the most invested area in pharma pipelines, this segment will retain its leading position in the near future.

Rare diseases and immunological disorders are rapidly growing, driven by increased regulatory incentives, orphan drug designations, and rising scientific interest in immune modulation. These trials require innovative endpoints, specialized sites, and often global patient searches—all areas where CROs provide critical expertise.

The need for long-term follow-up and registries in these indications further expands the service horizon for CROs, positioning them as long-term partners beyond trial execution.

The following are the leading companies in the pharmaceutical CRO market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical CRO market.

By Type

By Molecule Type

By Services

By Therapeutic Areas

By Region