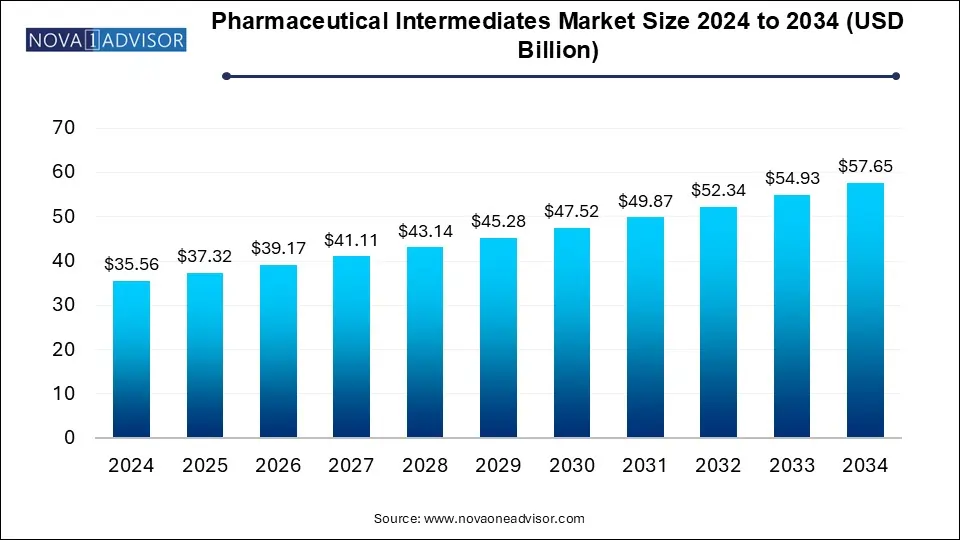

The pharmaceutical intermediates market size was exhibited at USD 35.56 billion in 2024 and is projected to hit around USD 57.65 billion by 2034, growing at a CAGR of 4.95% during the forecast period 2025 to 2034.

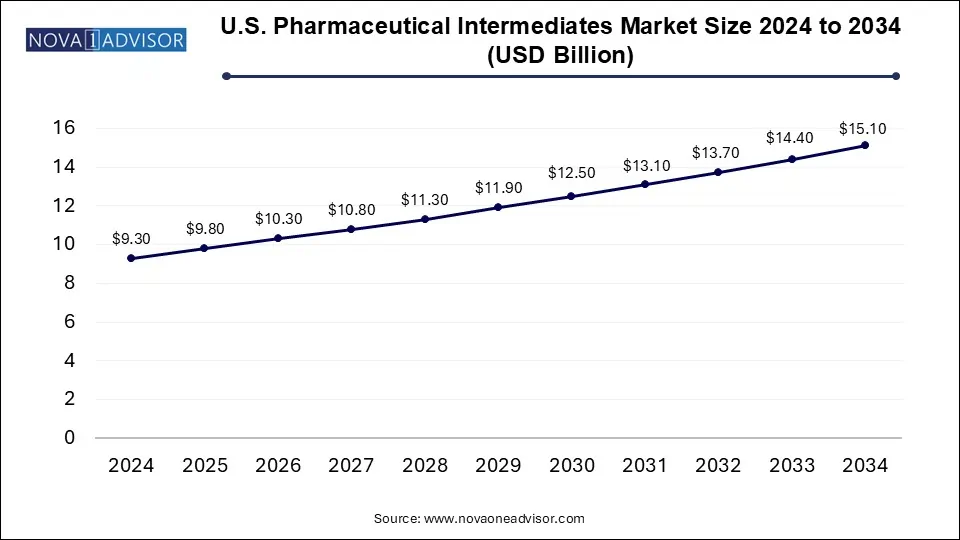

The U.S. pharmaceutical intermediates market size reached USD 9.3 billion in 2024 and is anticipated to be worth around USD 15.1 billion by 2034, poised to grow at a CAGR of 4.5% from 2025 to 2034.

Based on region, the North America dominated the global pharmaceutical intermediates market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is dominating market due to the presence of numerous pharmaceutical companies, research centers and laboratories, and rapidly growing CMOs & CROs in the US and Canada. Further, rising investments by the government and private players to boost the growth of the biopharmaceutical industry is expected to sustain the dominating position of North America throughout the forecast period.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. The rising investments by the market players to set up manufacturing facilities in the nations like China, India, Japan, South Korea, and Singapore owing to the easy and cheap availability of factors of production and favorable government policies is boosting the growth of the pharmaceutical intermediates market during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 37.32 Billion |

| Market Size by 2034 | USD 57.65 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 4.95% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, and End User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | The major players operating in the pharmaceutical intermediates market are BASF SE, Aceto Corporation, Sanofi SAIS, Chiracon GmbH, Yin-sheng Bio-tech Co. Ltd., Dishman Group, Green Vision Life Sciences, Midas Pharma GmbH, Vertellus Holdings LLC., Lonza Group. |

Based on product, the bulk drug intermediates segment accounted largest revenue share in 2024. Bulk drug intermediates are extensively used for making active pharmaceutical ingredient (API). API is the key ingredient used in the manufacturing of drugs that gives the desired therapeutic effect. Moreover, government initiatives to promote and develop bulk drug parks is estimated to drive the growth of this segment. For instance, the Department of Pharmaceuticals prioritizes a list of 56 APIs under Make-in-India initiative.

On the other hand, the custom intermediates is expected to be the fastest-growing segment during the forecast period. Custom drug intermediates means customization of specific molecule up to a certain scale to get the desired therapeutic affect or results. This segment is slowly gaining traction in the market.

Based on application, the analgesics segment accounted for around 31.0% of the global pharmaceutical intermediates market and is expected to sustain its dominance in near future. Analgesics are extensively used for the pain relief. The rising prevalence of chronic ailments such as arthritis, cancer, and cardiovascular diseases is boosting the growth of this segment.

On the other hand, the anti cancer drugs is expected to grow at a rapid rate during the forecast period. This is owing to the rising prevalence of cancer among the global population. According to the International Agency for Research on Cancer, in 2020, around 19.3 million new cancer cases and 10 million cancer deaths were reported across the globe. Therefore, this segment is estimated to be the fastest-growing segment.

Based on end user, the CROs/CMOs segment lead the global pharmaceutical intermediates market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The rising penetration and rapid growth of the contract manufacturing organizations and contract research organizations have significantly boosted the demand for the pharmaceutical intermediates for the production and research purposes of drugs.

On the other hand, research laboratories are expected to grow at a rapid rate during the forecast period. The rising private investments in the research activities in the pharmaceutical industry for the development of new drugs is estimated to drive the growth of this segment.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical Intermediates Market

By Product

By Application

By End User

By Regional