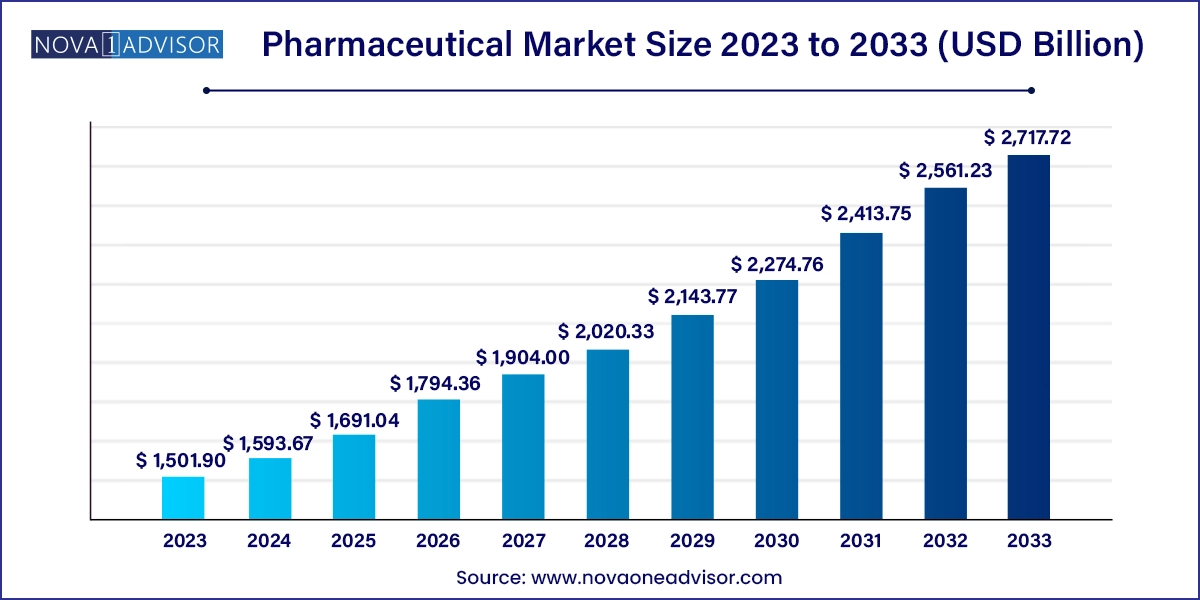

The global pharmaceutical market size was valued at USD 1,501.90 billion in 2023 and is projected to surpass around USD 2,717.72 billion by 2033, registering a CAGR of 6.11% over the forecast period of 2024 to 2033.

Pharmaceutical Market Key Takeaways

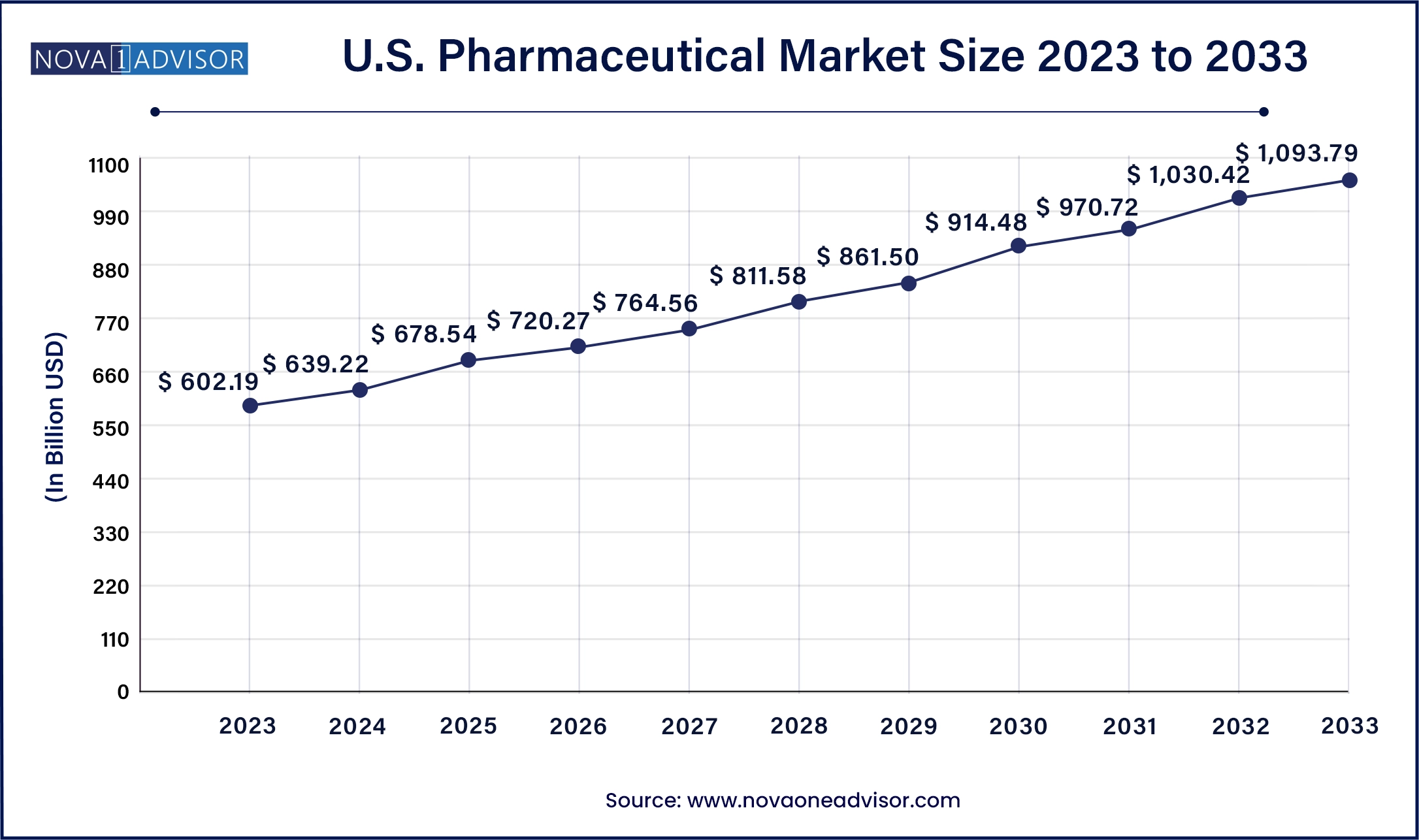

U.S. Pharmaceutical Market Size and Growth 2024 to 2033

The U.S. pharmaceutical market size was exhibited at USD 602.19 billion in 2023 and is projected to be worth around USD 1,093.79 billion by 2033, poised to grow at a CAGR of 6.15% from 2024 to 2033.

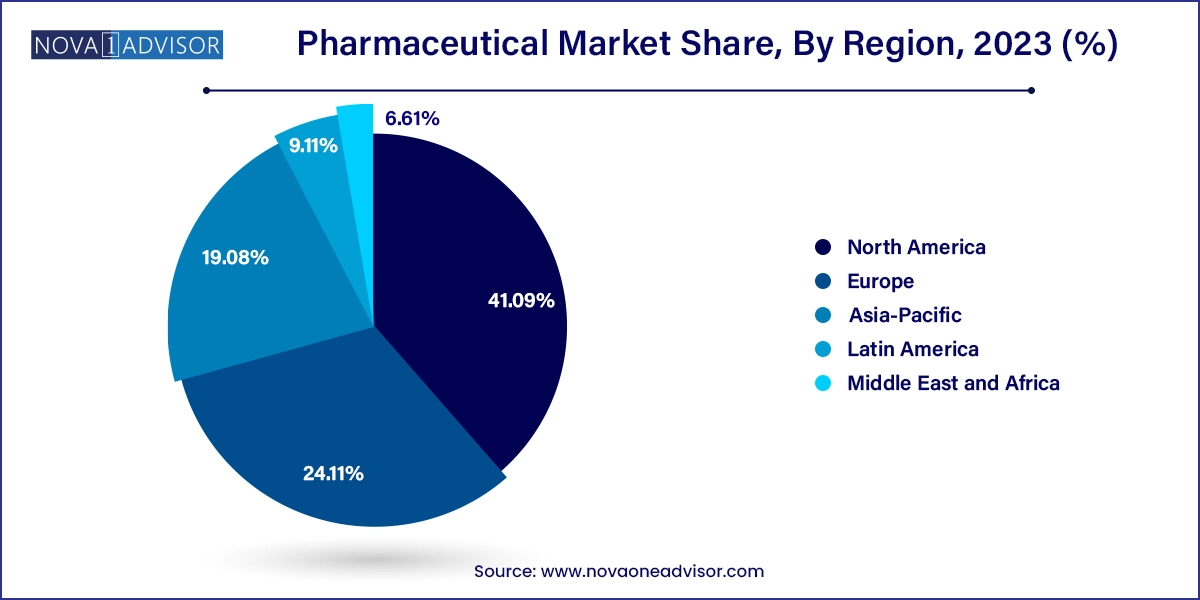

North America held the largest market share of 41.09% in the pharmaceuticals market in 2023 and is expected to maintain a dominant position, in terms of share, throughout the forecast period. Access to high-value medications, extensive healthcare knowledge, high per capita healthcare expenditure, and a strong GDP all contribute to the region's market growth. Moreover, various strategic initiatives developed in the region by established and early-stage pharmaceutical companies is another major factor propelling regional growth.

Asia Pacific is estimated to showcase the fastest growth over the forecast period. The growth of the pharmaceuticals market in the region is attributed to the rising geriatric population, along with an increasing rate of research for the introduction and development of novel therapeutics. The regional demographics are diverse, with the presence of Japan, South Korea, Taiwan, Singapore, and Australia as established countries, while Thailand, Indonesia, Malaysia, Vietnam, Bangladesh, and the Philippines, as well as China and India, present as fast-growing economies.

Pharmaceutical Market Growth

The pharmaceutical industry is witnessing growth due to factors such as the increasing chronic disease prevalence, rising geriatric population, increasing healthcare spending by government organizations globally, and extensive efforts to improvise the affordability of pharmaceuticals. According to an article published in May 2022, U.S. officials are emphasizing prescription drug affordability, as unsustainable high prescription drug prices risk consumer access to proper care.

In 2020, the U.S. spent approximately USD 348.4 billion on prescription medications, translating to USD 1,126 per capita. Additionally, 62% of adults in the country reported that they took at least one prescription medication in 2021, and 29%, or nearly 3 in 10, adults reported that they do not take their medication as prescribed due to their associated costs. As a result, legislators are actively focusing on exploring policy options that can help in lowering pharmaceutical costs, further improving their affordability and access.

The COVID-19 pandemic impacted the pharmaceutical industry’s growth in several ways in 2020. It had an immediate impact on production and demand, altering the supply chain and transportation for medicinal items. The amount of successful R&D activities and clinical trials being conducted in therapy areas such as hypertension, diabetes, and others witnessed a decrease during this period, as the industry altered its focus and prioritized its research on respiratory diseases, infectious diseases, and vaccines.

The COVID-19 pandemic, however, has had a short-term impact on the pharmaceutical industry’s growth. Pharmaceutical firms have recovered from the supply chain and logistics shortfall witnessed during the early pandemic phase by deploying various strategies and plans. The pandemic had a beneficial impact on this market by the end of 2020, with higher sales of pharmaceuticals and vaccines, increased R&D investments, and pipeline portfolios of the market's leading organizations.

A rising chronic disease prevalence, as well as the aging population, are fueling demand for pharmaceuticals. With the rising incidence of chronic diseases such as cancer and diabetes, the requirement for effective treatments is also on the rise. As per WHO’s April 2021 report, noncommunicable diseases (NCDs), also known as chronic diseases, are responsible for around 41 million deaths globally, accounting for 71% of all fatalities. Cardiovascular diseases are the most NCD, followed by cancer, respiratory diseases, and diabetes, with low- and middle-income nations accounting for 77% of all NCD deaths.

Furthermore, according to a December 2023 report from the International Diabetes Federation (IDF), approximately 537 million adults aged between 20-79 years have diabetes. Moreover, the total number of diabetics globally is expected to rise to 743 million by 2033 and 783 million by 2045. These numbers have led some pharmaceutical companies to expand their manufacturing facilities to satisfy rising demand. As a result, the increased burden of chronic diseases is propelling overall market growth.

However, the pharmaceutical industry is gradually and steadily facing some challenges. One threat is the rising expense of drug research. Drug companies are presently spending an estimated USD 212 billion per year on research and development (R&D), with that figure predicted to rise to USD 255 billion by 2026. However, this figure is expanding at a slower rate than the availability of prescription pharmaceuticals on the market. This means that major pharmaceutical corporations such as Pfizer, Merck & Co., and others are confronting rising costs, as their output needs to catch up to customer demand.

Pharmaceutical Market Report Scope

| Report Attribute | |

| Market Size in 2024 | USD 1,593.67 Billion |

| Market Size by 2033 | USD 2,717.72 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.11% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Molecule type, product, type, disease, route of administration, formulation, age group, end market, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd.; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GSK plc; Takeda Pharmaceutical Company Limited |

Molecule Type Insights

Based on molecule type, the market for pharmaceuticals is segmented into biologics & biosimilars (large molecules) and conventional drugs (small molecules). Conventional drugs (small molecules) dominated the market with a revenue share of 57.11% in 2023. The dominance of conventional drugs is due to their well-established manufacturing process, predictable pharmacokinetics, and oral bioavailability.

Additionally, their extensive and proven history of successful clinical use, diverse therapeutic applications, and patent expirations enabling generic competition contribute to their widespread adoption. In addition, small molecules often exhibit better membrane penetration, allowing for targeting intracellular pathways, further solidifying their position in drug development pipelines.

Product Insights

The branded segment dominated the pharmaceutical market with a revenue share of 70.19% in 2023. The dominance of the segment is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising need for the development of novel therapeutics to treat various conditions. Major players operating in the market are constantly focusing on introducing novel pharmaceuticals, further propelling segment growth.

For instance, in June 2023 , AstraZeneca announce the launch of IMJUDO, a revolutionary cancer medication that marks a significant advancement in cancer treatment, for patients in the United Arab Emirates (UAE). However, the patent expiry of branded drugs and entry of generic drugs into the market hampers segment growth. Meanwhile, the generic segment is expected to showcase fastest growth rate over the projected period.

The generic segment's growth is attributed to an increasing number of ANDA approvals and generic drug launches. For instance, in 2021 , the FDA authorized or tentatively approved 776 ANDAs for generic medicines. The COVID-19 pandemic has resulted in a surge in demand for antibiotics and other medications. Furthermore, to increase earnings and expand their market position, leading players are focused on developing specialty generics as well as methods such as first-to-file and first-to-market. Around 106 medications were approved for the first time as generic drugs in the U.S. in 2022.

Type Insights

The prescription segment held a dominant revenue share of 89.23% in 2023 in the market for pharmaceuticals. This dominance is owing to the increasing R&D investments by major players in the market for developing new pharmaceuticals, which are majorly used in the treatment of chronic diseases. With the rising prevalence of such disorders, there has been an increase in patient demand due to unmet clinical needs and a desire for favorable therapeutic outcomes.

A number of these chronic diseases are frequently observed in the patient population, necessitating the use of several recommended therapies. As a result, large pharmaceutical companies are involved in clinical trials for the development and, eventually, approval of new products. Moreover, the rising hospitalization and increasing prescription rates are factors that are further propelling the growth of the overall pharmaceuticals market.

The OTC segment is expected to witness fastest growth, with the high cost of Rx pharmaceuticals causing a shift towards OTC drugs, aided by the rising approval of OTC pharmaceuticals. According to Bloomberg, in July 2022, Americans were expected to spend an yearly average of USD 1,300 per person on prescription medications. In the U.S., the average launch price for a new medicine in 2021 was USD 180,000 for an annual supply. Surging prescription drug prices are fueling the demand for self-medication with OTC pharmaceuticals. As per a Frontiers Media S.A. article published in August 2021, self-medication with OTC drugs is becoming an increasingly widespread global practice.

Disease Insights

Based on disease, the market is segmented into the top 20 prevalent conditions. Cancer led the overall market, accounting for a share of 19.07% in 2023. The dominance of this segment in the pharmaceutical market is aided by several key factors and trends, such as the rising global incidence of various forms of cancer, which has led to an increased demand for innovative & effective treatments, driving significant investment and research in this space. Also, advancements in personalized medicine & targeted therapies have revolutionized cancer treatment, offering higher efficacy and fewer side effects.

Furthermore, collaborations between pharmaceutical companies and research institutions have accelerated the development of novel oncology drugs. Lastly, favorable regulatory pathways & expedited approvals for breakthrough cancer therapies have further propelled the growth of this segment in recent years, solidifying its dominance in the market for pharmaceuticals.

Route of Administration Insights

On the basis of route of administration, the market is segmented into oral, topical, parenteral, inhalations, and other routes of administration. The oral route dominated the market with a revenue share of 60.24% in 2023. This can be attributed to several key factors such as oral medications offering convenience & patient compliance due to their noninvasive nature, leading to higher adherence rates. In addition, the oral route's familiarity & established safety profile further contribute to its dominance, as both patients and healthcare providers prefer this well-understood mode of drug delivery.

Parenteral route of administration is exected to expand at the fastest CAGR over the forecast period. Recent advancements in parenteral drug delivery have transformed the pharmaceutical landscape. For instance, the rise of biologic therapies has led to the development of advanced injectable formulations, enabling the delivery of complex proteins and peptides. Notable examples include monoclonal antibodies used in cancer treatments & novel vaccines.

Formulation Insights

Tablets held the largest market share of 27.95% in 2023 in the pharmaceuticals market. Tablets are the most widely used oral solid dosage form for drug administration, which contributes to their enormous production and sales. This formulation is adopted at a higher rate as compared to capsules for various reasons, including tamper resistance, cost-effectiveness, ease of handling and packing, and high manufacturing efficiency. Tablets are the simplest to produce for a wide range of specializations, including anti-diabetics, anti-inflammatories, antacids, vitamins, and antiallergics.

The sprays segment is expected to show fastest growth over the forecast period. A rising number of approvals for auto-injectors and prefilled syringes fuels segment expansion. Subcutaneous injections have grown in favor in recent years among device makers, medicine developers, and patients. These injections provide a variety of advantages and convenience of use, including self-administration, dependability, precision, fixed doses in prefilled syringes, compliance, compact form, and high patient comfort. The introduction of subcutaneous injections is expected to boost the expansion of the injectable category.

End Market Insights

On the basis of end market, the market is segmented into hospitals, clinics, and others. The hospitals segment dominated the pharmaceuticals market, with a revenue share of 56.31% in 2023. This dominance is underscored by escalating healthcare demands due to the aging population, increased prevalence of chronic illnesses, and advancements in medical treatments. Their pivotal role as centralized care providers enables efficient procurement and distribution of pharmaceuticals, solidifying hospitals as a prominent end market in the industry.

Clinics are estimated to expand at the fastest CAGR over the forecast period. This segment plays a crucial role in preventive care, early diagnosis, and managing common illnesses. For instance, clinics are often the first point of contact for individuals seeking medical attention, allowing for timely intervention & reducing the burden on hospitals. Clinics play an essential role in treating various conditions, from minor infections and injuries to chronic diseases such as diabetes, hypertension, & respiratory disorders.

Age Group Insights

The adults segment held the largest share of 68.0% in the pharmaceuticals market in 2023 and is further expected to advance at the fastest growth rate over the forecast period. The adult population aged between 15-64 years holds the largest share in the global population and is the major consumer of prescription medicines. As per the CDC, in the U.S., around 69.0%, and in Canada, around 65.5% (nearly 7 in 10 persons) aged 40-79 years used at least one prescription drug. The most commonly used drugs among the adult population include lipid-lowering drugs, ACE inhibitors, analgesics, and antidepressants.

The children & adolescent segment is expected to witness strong growth over the forecast period. This growth is due to the rising number of medication approvals for the pediatric population. For instance, in June 2023, Pfizer Inc., in collaboration with OPKO Health Inc., received FDA approval for NGENLA, a human growth hormone medication used to treat pediatric patients. It is expected to be available for prescription in August 2023. A rising prevalence of various disorders in this population, including respiratory conditions, infectious diseases, and rare conditions, is further anticipated to fuel segment growth.

Pharmaceutical Market Top Key Companies:

Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical market.

By Pharmaceutical Molecule Type

By Pharmaceutical Product

By Pharmaceutical Type

By Pharmaceutical Disease

By Pharmaceutical Route of Administration

By Pharmaceutical Formulation

By Pharmaceutical Age Group

By Pharmaceutical End Market

By Region